This version of the form is not currently in use and is provided for reference only. Download this version of

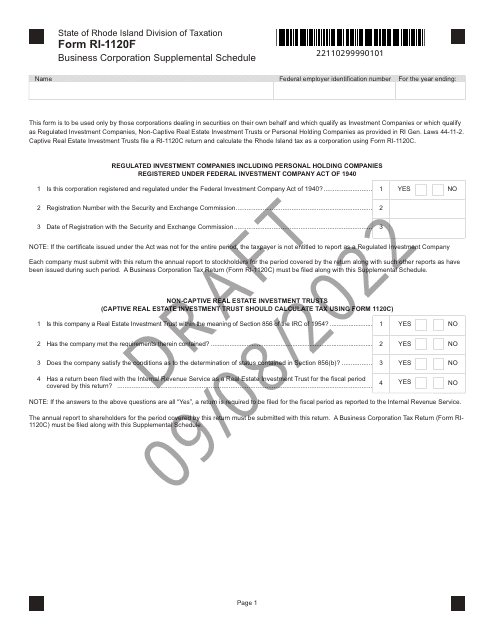

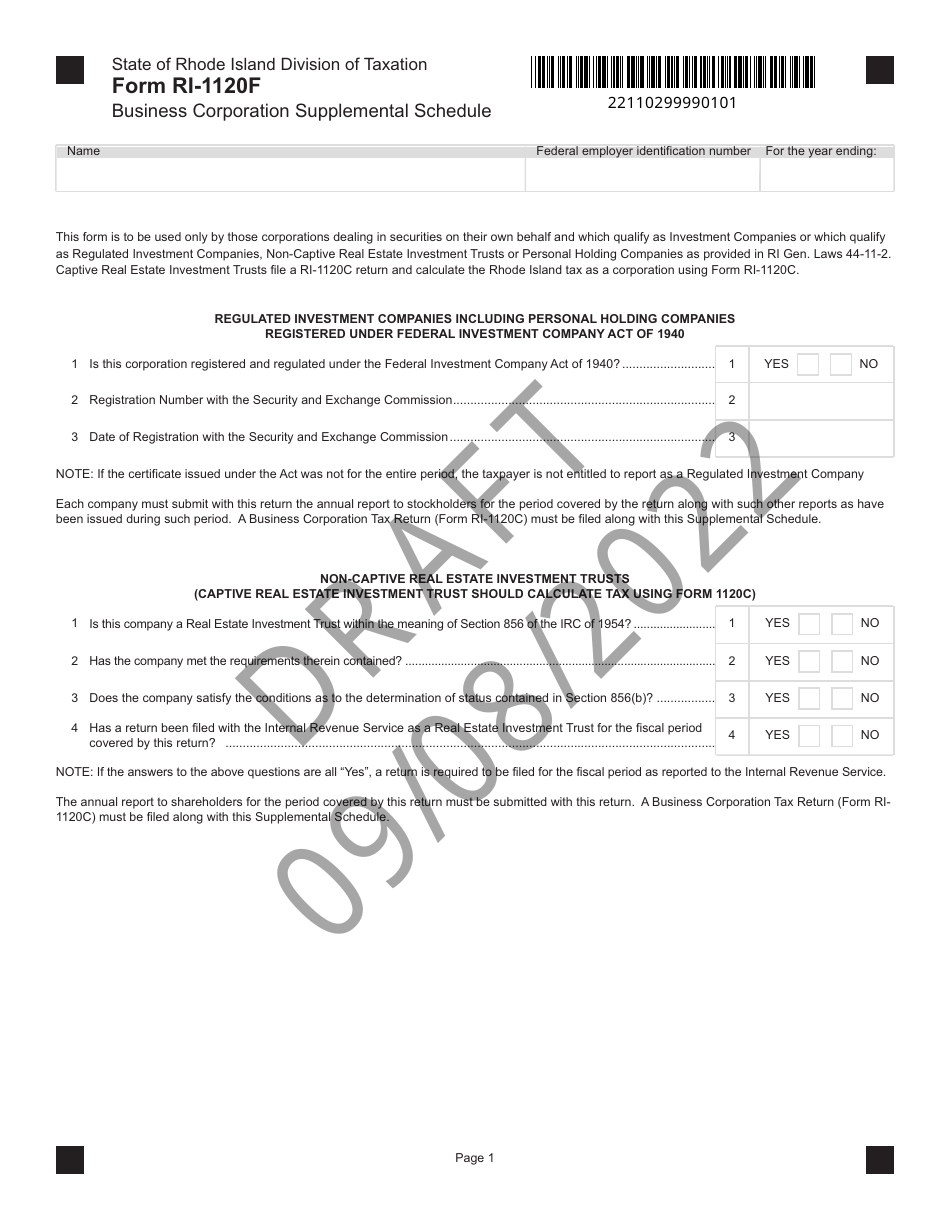

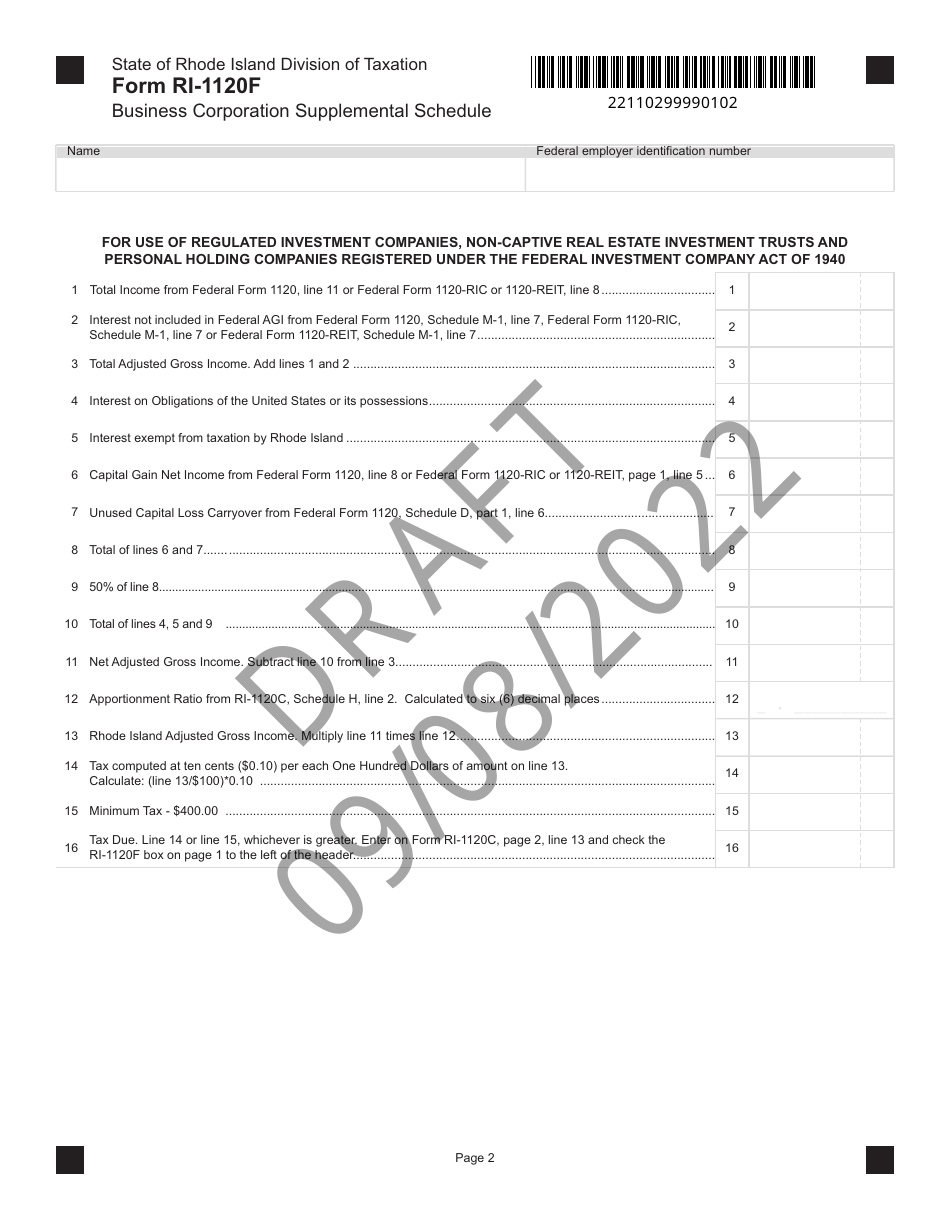

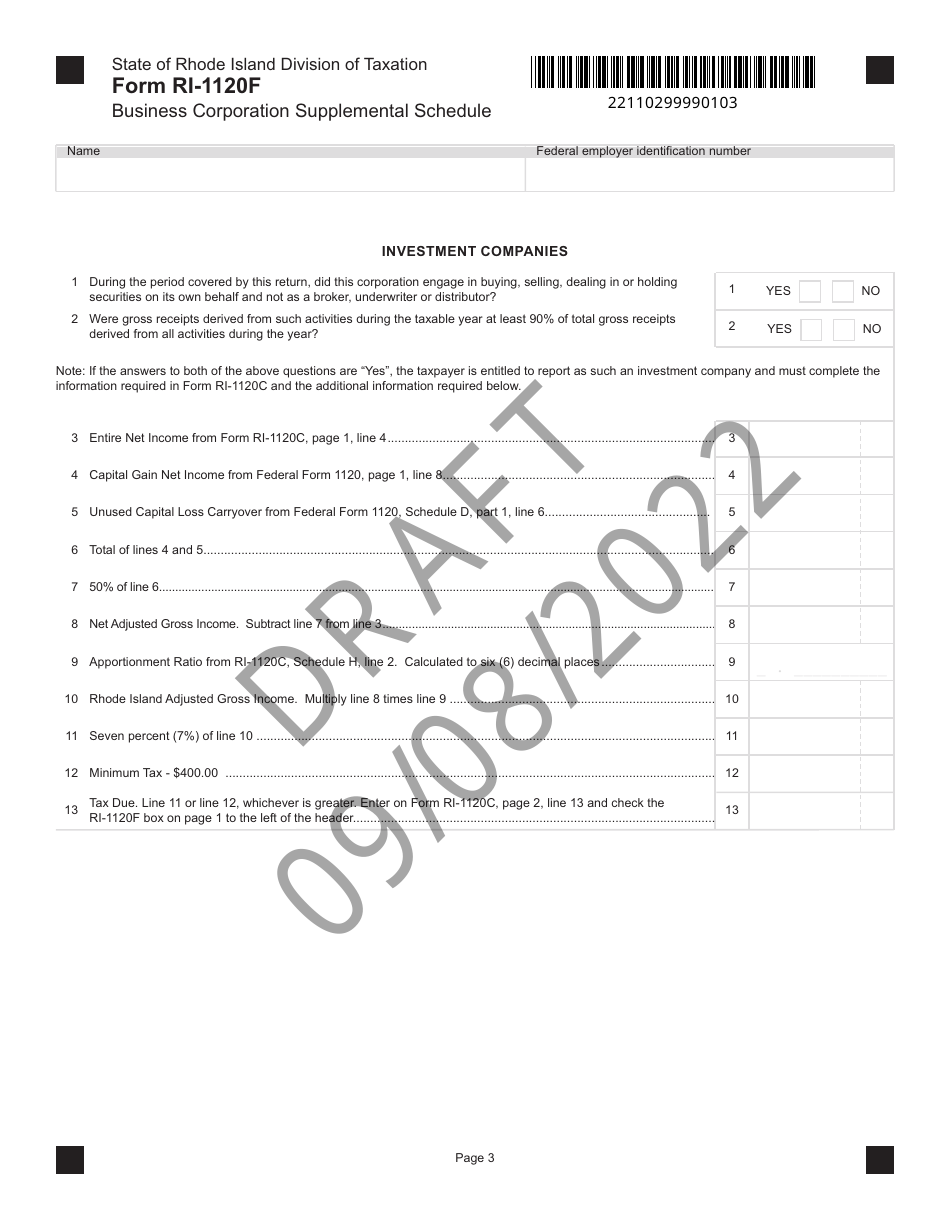

Form RI-1120F

for the current year.

Form RI-1120F Business Corporation Supplemental Schedule - Draft - Rhode Island

What Is Form RI-1120F?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form RI-1120F?

A: Form RI-1120F is the Business CorporationSupplemental Schedule for the state of Rhode Island.

Q: Who is required to file form RI-1120F?

A: Business corporations operating in Rhode Island are required to file form RI-1120F.

Q: What information is required on form RI-1120F?

A: Form RI-1120F requires detailed information about the corporation's income, deductions, and credits in Rhode Island.

Q: When is form RI-1120F due?

A: Form RI-1120F is typically due on the same date as the corporation's federal income tax return, which is usually March 15th.

Q: Are there any penalties for late filing of form RI-1120F?

A: Yes, there may be penalties for late filing or failure to file form RI-1120F, so it is important to submit it on time.

Q: Can I file form RI-1120F electronically?

A: Yes, the Rhode Island Division of Taxation accepts electronic filing of form RI-1120F.

Q: Can I amend my form RI-1120F if I made an error?

A: Yes, you can file an amended form RI-1120F to correct any errors or omissions.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1120F by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.