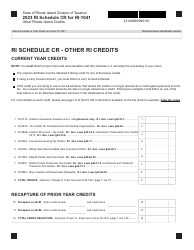

This version of the form is not currently in use and is provided for reference only. Download this version of

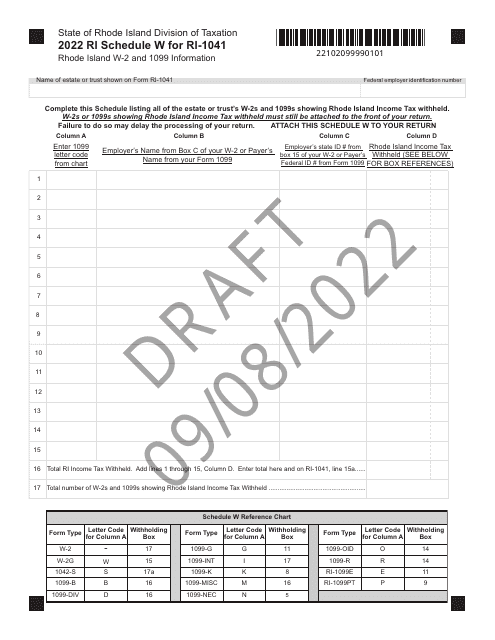

Form RI-1041 Schedule W

for the current year.

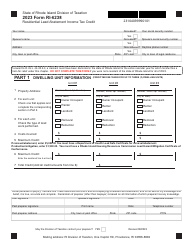

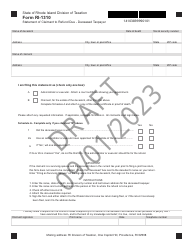

Form RI-1041 Schedule W Rhode Island W-2 and 1099 Information - Draft - Rhode Island

What Is Form RI-1041 Schedule W?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return - Draft. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-1041 Schedule W?

A: Form RI-1041 Schedule W is a document used in Rhode Island to report W-2 and 1099 information for the tax year.

Q: What is the purpose of Form RI-1041 Schedule W?

A: The purpose of Form RI-1041 Schedule W is to provide the Rhode Island Department of Revenue with details of W-2 wages and 1099 income for a taxpayer.

Q: Who needs to file Form RI-1041 Schedule W?

A: Any taxpayer in Rhode Island who has W-2 wages or 1099 income should file Form RI-1041 Schedule W.

Q: When is Form RI-1041 Schedule W due?

A: Form RI-1041 Schedule W is due by the same date as the Rhode Island Form RI-1041, which is typically April 15th of the following year.

Q: Do I need to attach Form RI-1041 Schedule W to my tax return?

A: Yes, you need to attach Form RI-1041 Schedule W to your Rhode Island Form RI-1041 when filing your tax return.

Q: Can I e-file Form RI-1041 Schedule W?

A: No, currently the Rhode Island Department of Revenue does not support e-filing for Form RI-1041 Schedule W. It must be filed by mail.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1041 Schedule W by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.