This version of the form is not currently in use and is provided for reference only. Download this version of

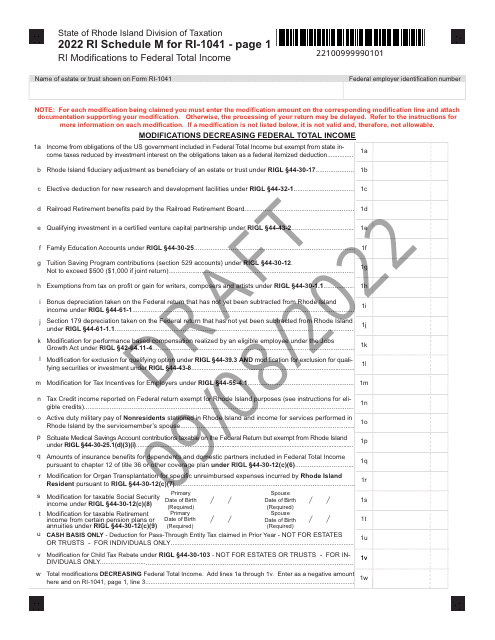

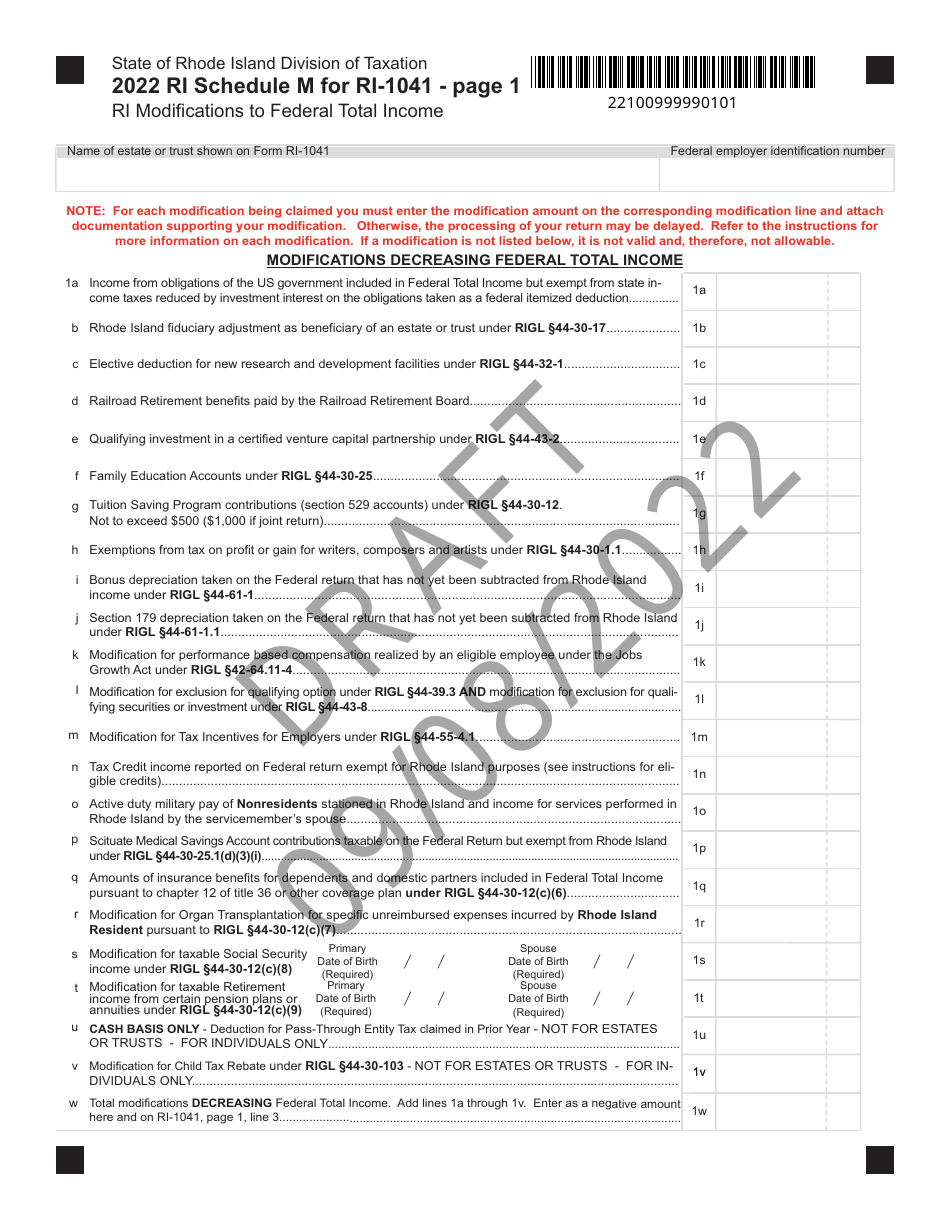

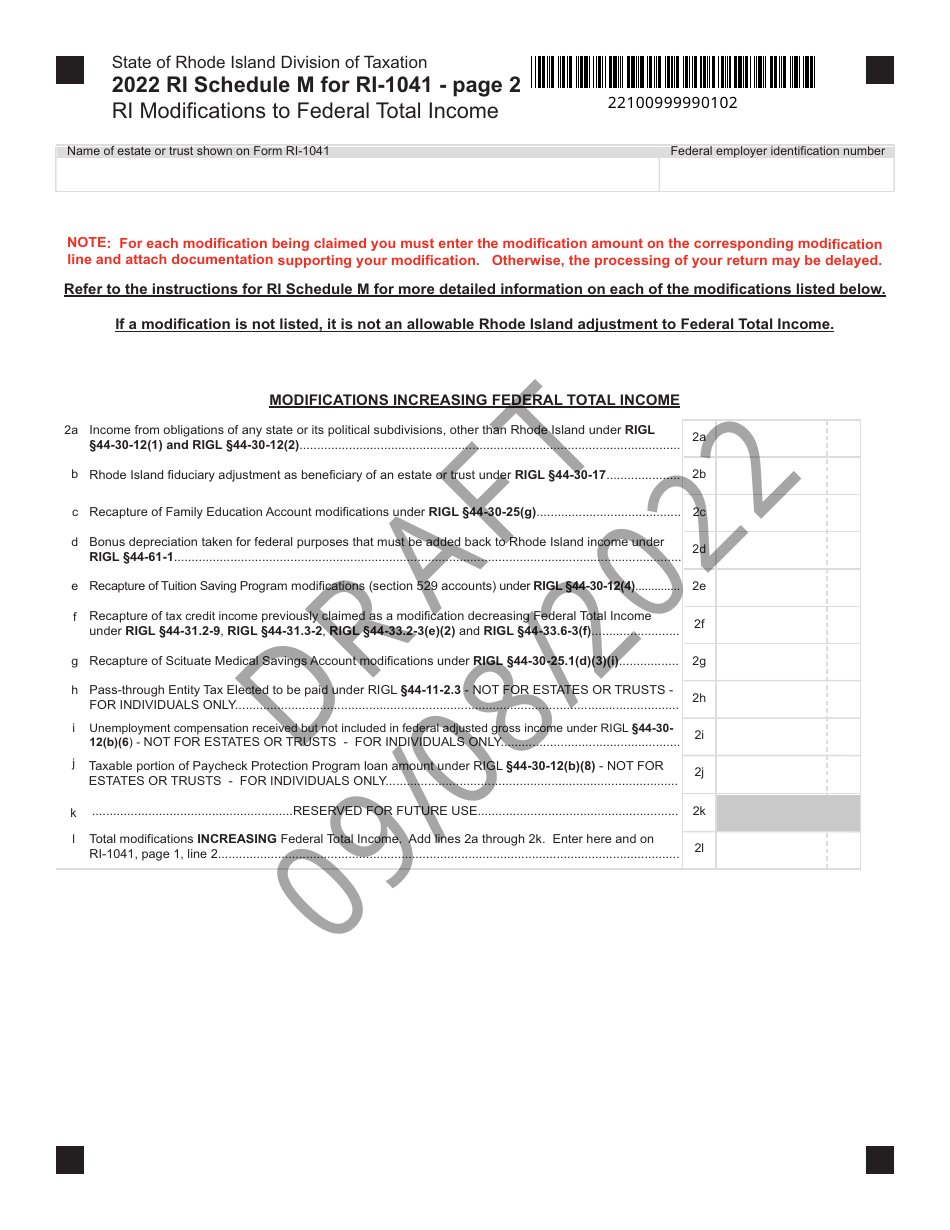

Form RI-1041 Schedule M

for the current year.

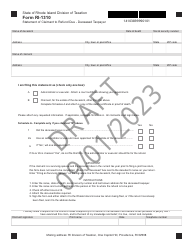

Form RI-1041 Schedule M Ri(modifications to Federal Total Income - Draft - Rhode Island

What Is Form RI-1041 Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1041, Fiduciary Income Tax Return - Draft. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

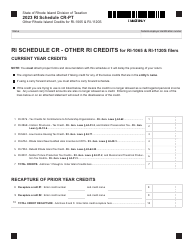

Q: What is RI-1041 Schedule M RI?

A: RI-1041 Schedule M RI is a modification form specific to Rhode Island that is used to adjust the federal total income for tax purposes.

Q: What does RI-1041 Schedule M RI allow for?

A: RI-1041 Schedule M RI allows for modifications to be made to the federal total income, which can impact the taxpayer's Rhode Island tax liability.

Q: Why would someone need to use RI-1041 Schedule M RI?

A: Someone may need to use RI-1041 Schedule M RI if they have certain income or deductions that are specific to Rhode Island and need to adjust their federal total income accordingly.

Q: Who is required to file RI-1041 Schedule M RI?

A: Individuals or businesses that have Rhode Island-specific modifications to their federal total income are required to file RI-1041 Schedule M RI with their Rhode Island tax return.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1041 Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.