This version of the form is not currently in use and is provided for reference only. Download this version of

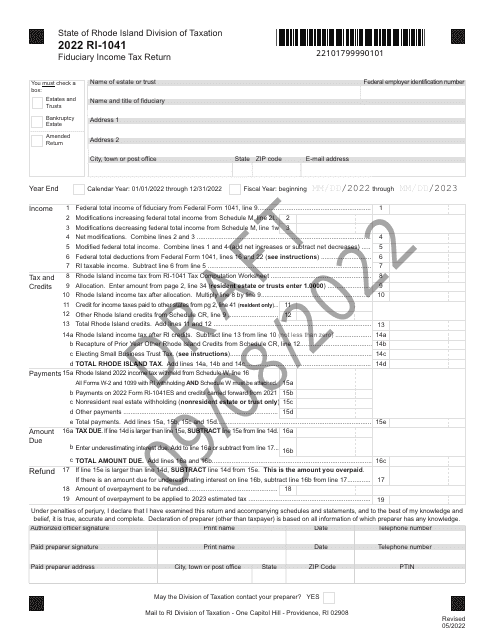

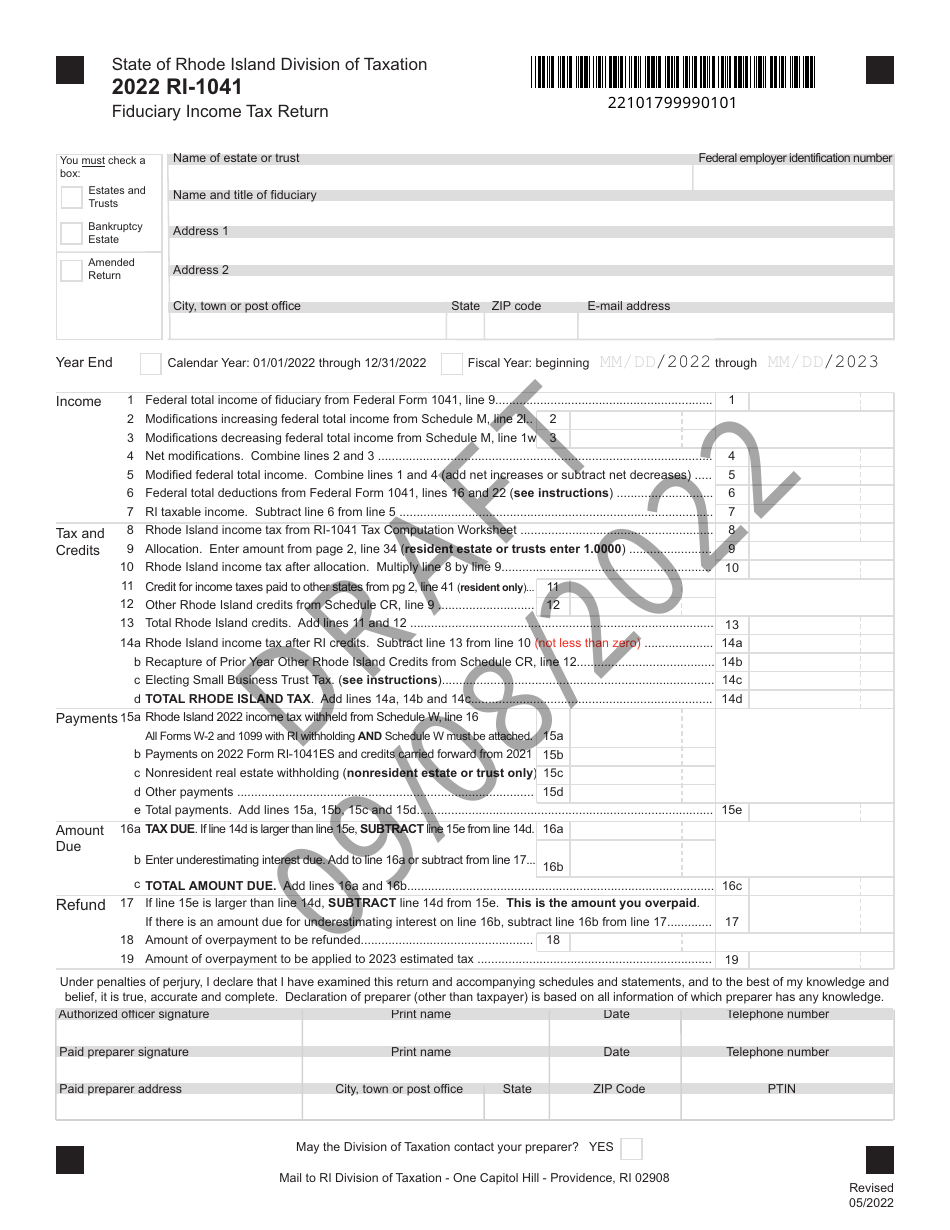

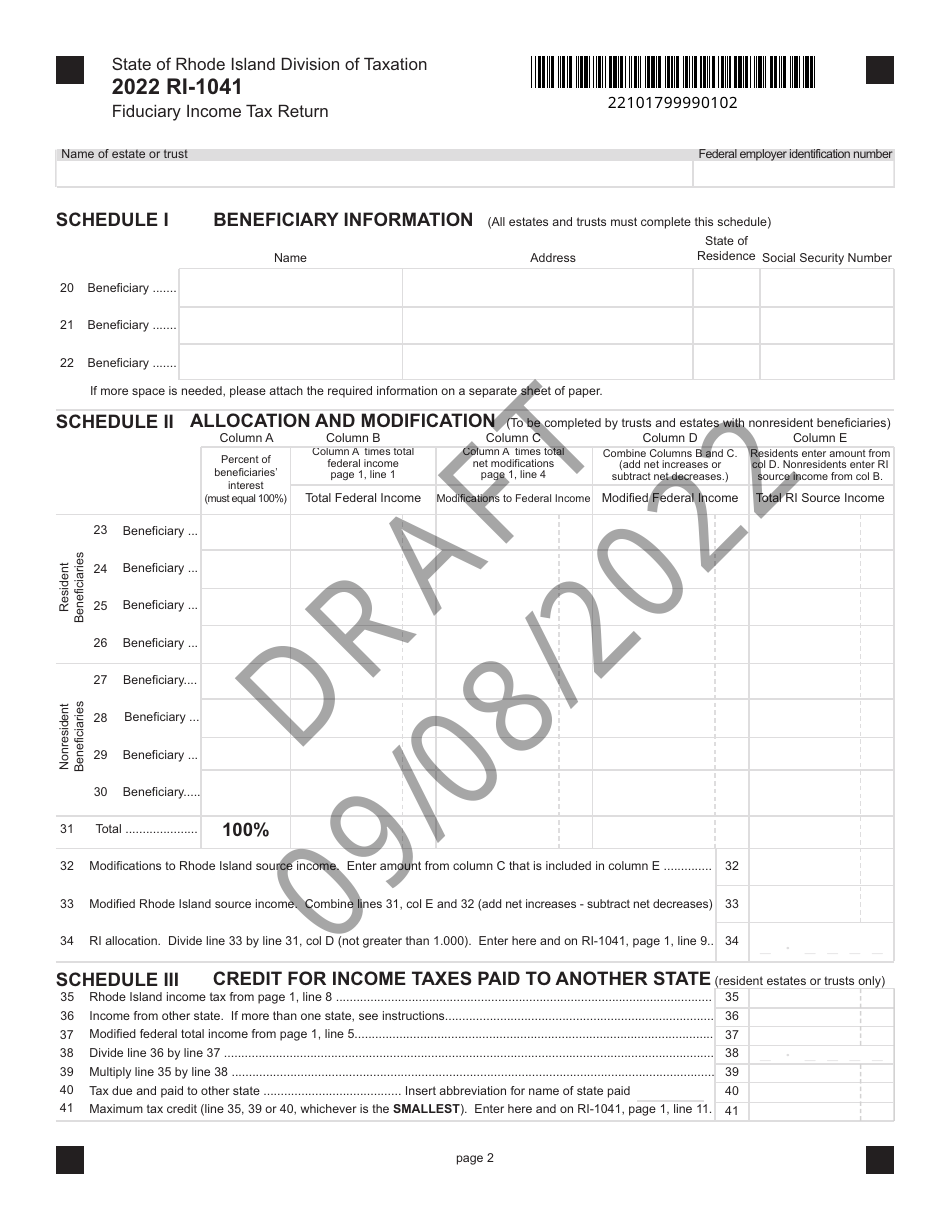

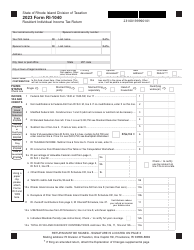

Form RI-1041

for the current year.

Form RI-1041 Fiduciary Income Tax Return - Draft - Rhode Island

What Is Form RI-1041?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RI-1041?

A: Form RI-1041 is the Rhode Island Fiduciary Income Tax Return.

Q: Who needs to file Form RI-1041?

A: Anyone who is the fiduciary (executor, administrator, trustee, etc.) of a Rhode Island estate or trust must file Form RI-1041.

Q: What is the purpose of Form RI-1041?

A: Form RI-1041 is used to report the income, deductions, and tax liability of a Rhode Island estate or trust.

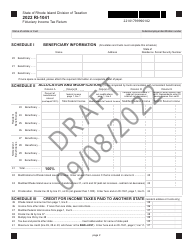

Q: What information is required to complete Form RI-1041?

A: You will need information about the estate or trust's income, deductions, and expenses, as well as information about beneficiaries and distributions.

Q: When is the deadline to file Form RI-1041?

A: The deadline to file Form RI-1041 is the same as the federal income tax deadline, which is usually April 15th.

Q: Are there any penalties for late filing of Form RI-1041?

A: Yes, there may be penalties for late filing or failure to file Form RI-1041. It is important to file the form on time to avoid penalties.

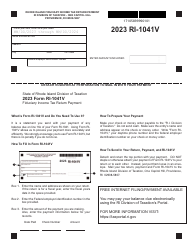

Q: Can Form RI-1041 be filed electronically?

A: Yes, Form RI-1041 can be filed electronically using approved tax software or through a tax professional.

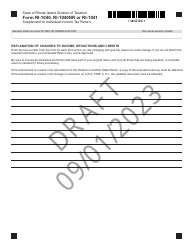

Q: Do I need to include any supporting documents with Form RI-1041?

A: Yes, you may need to include supporting documents such as schedules, statements, or forms that are relevant to the income, deductions, or expenses reported on Form RI-1041.

Q: Can I request an extension to file Form RI-1041?

A: Yes, you can request an extension to file Form RI-1041. However, the extension only extends the deadline to file, not the deadline to pay any taxes owed.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1041 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.