This version of the form is not currently in use and is provided for reference only. Download this version of

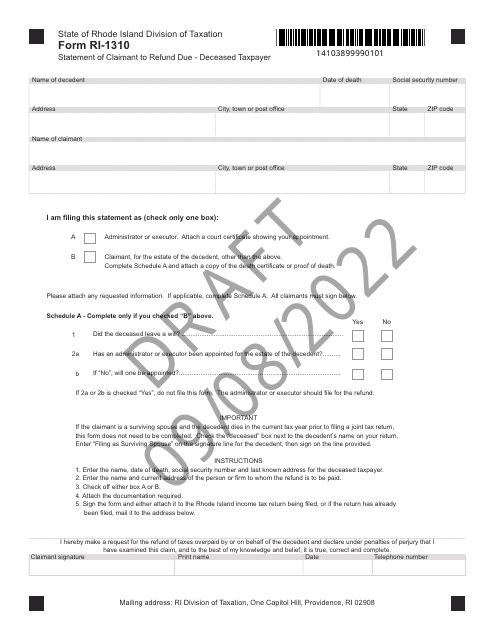

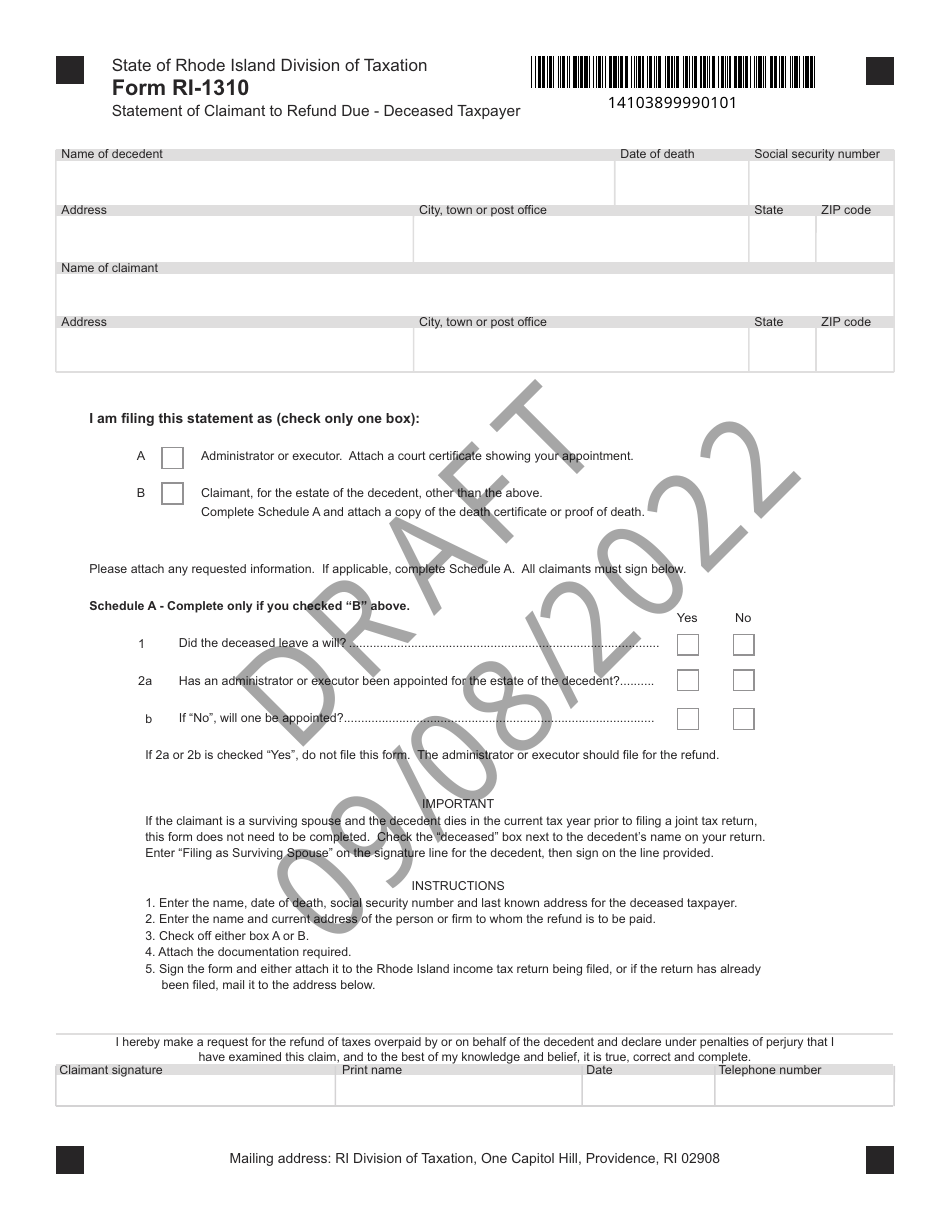

Form RI-1310

for the current year.

Form RI-1310 Statement of Claimant to Refund Due - Deceased Taxpayer - Draft - Rhode Island

What Is Form RI-1310?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-1310?

A: The Form RI-1310 is a Statement of Claimant to Refund Due for a deceased taxpayer in Rhode Island.

Q: Who can file Form RI-1310?

A: The executor, administrator, or personal representative of the deceased taxpayer's estate can file Form RI-1310.

Q: What is the purpose of Form RI-1310?

A: The purpose of Form RI-1310 is to claim a refund on behalf of a deceased taxpayer in Rhode Island.

Q: What information is required to complete Form RI-1310?

A: You will need to provide the deceased taxpayer's personal information, refund amount, and your relationship to the deceased.

Q: Is there a deadline to file Form RI-1310?

A: Yes, Form RI-1310 must be filed within 3 years from the due date of the original tax return or within 2 years from the date of the tax payment, whichever is later.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1310 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.