This version of the form is not currently in use and is provided for reference only. Download this version of

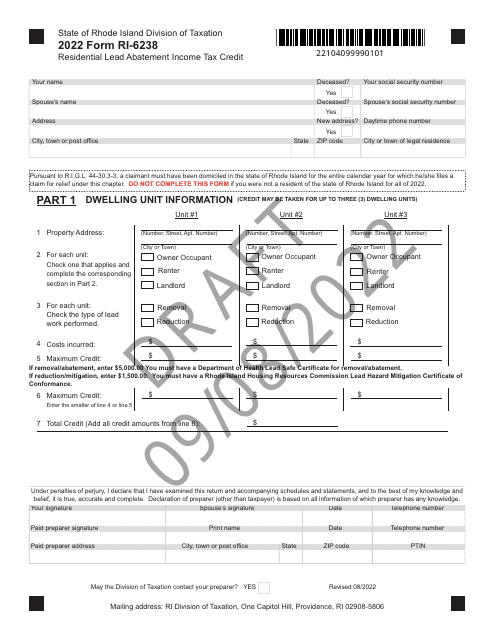

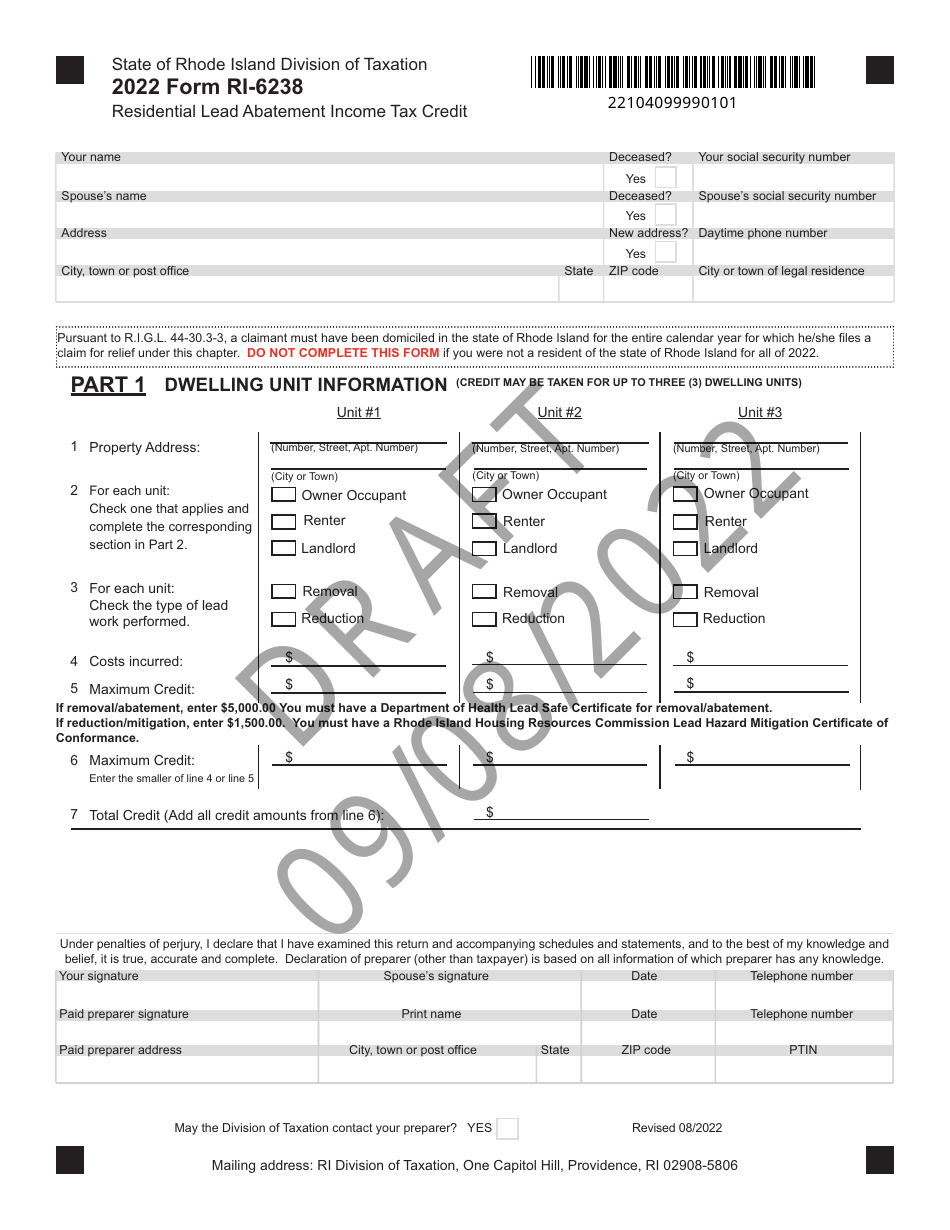

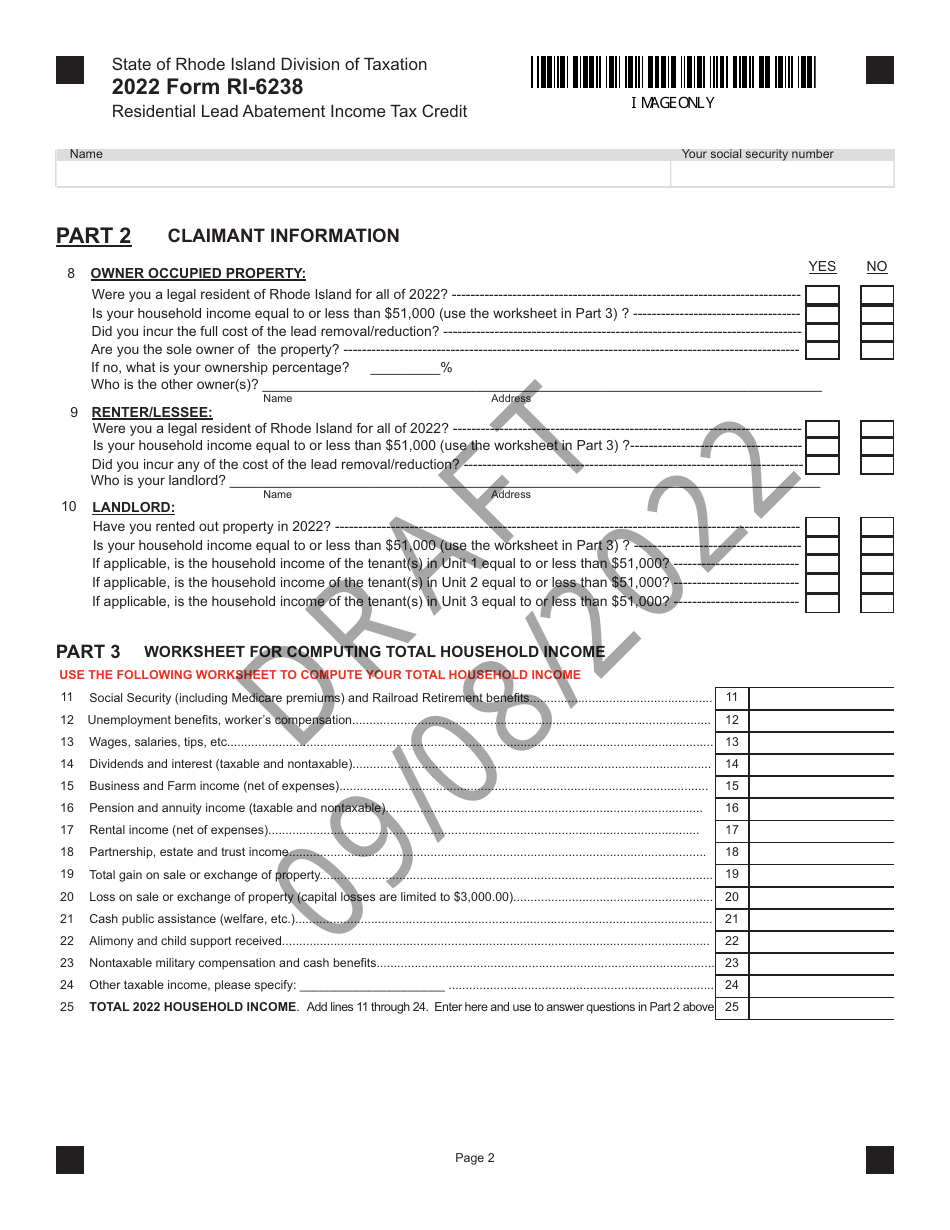

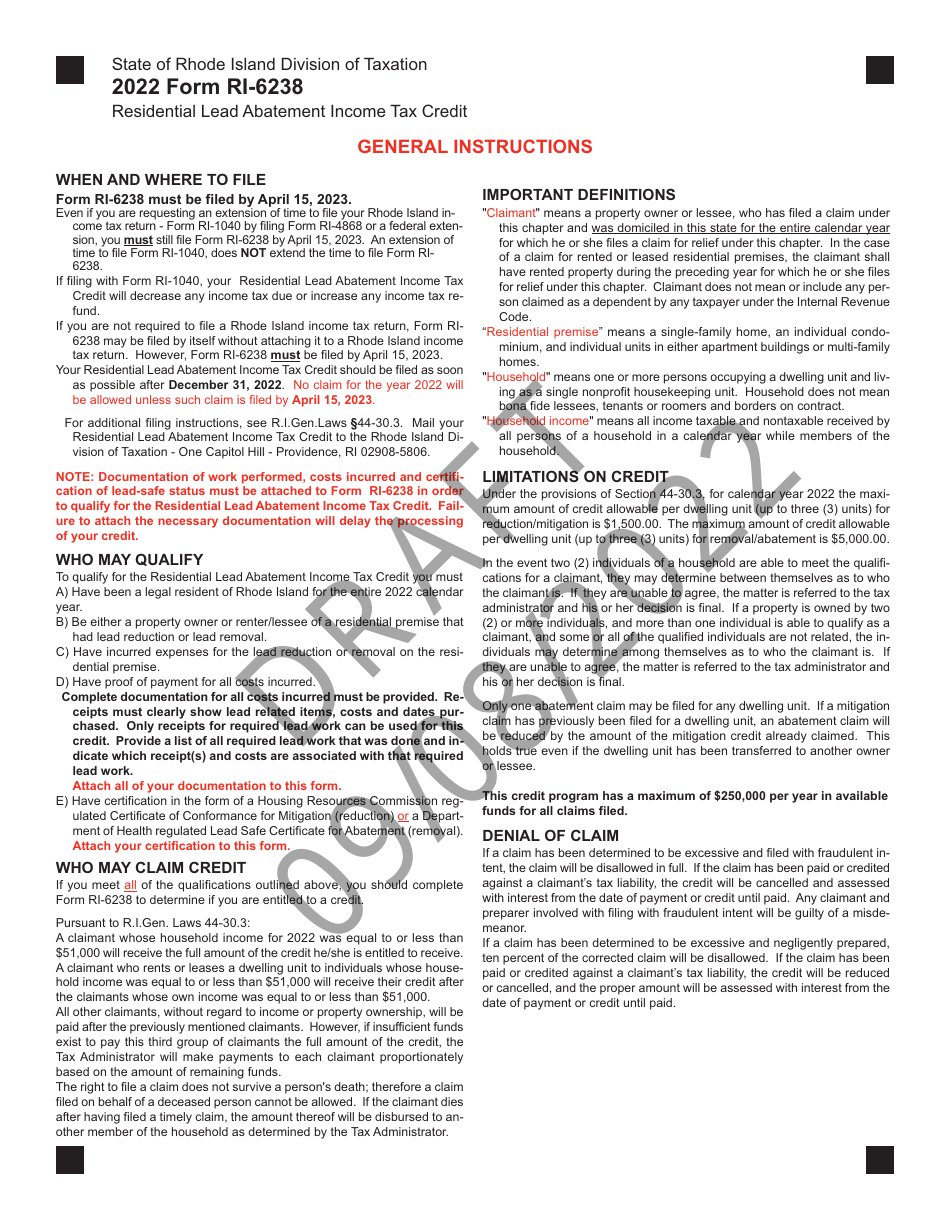

Form RI-6238

for the current year.

Form RI-6238 Residential Lead Abatement Income Tax Credit - Draft - Rhode Island

What Is Form RI-6238?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form RI-6238?

A: Form RI-6238 is the Residential Lead Abatement Income Tax Credit form.

Q: What is the purpose of Form RI-6238?

A: The purpose of Form RI-6238 is to claim the Residential Lead Abatement Income Tax Credit in Rhode Island.

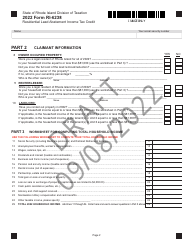

Q: Who is eligible to claim the Residential Lead Abatement Income Tax Credit?

A: Homeowners, landlords, and tenants in Rhode Island who have incurred expenses related to lead abatement are eligible to claim the credit.

Q: How can I claim the Residential Lead Abatement Income Tax Credit?

A: To claim the credit, you must complete Form RI-6238 and attach it to your Rhode Island state tax return.

Q: What expenses are eligible for the Residential Lead Abatement Income Tax Credit?

A: Expenses related to the abatement of lead hazards in residential properties, including labor, materials, and contractor fees, may be eligible for the credit.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-6238 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.