This version of the form is not currently in use and is provided for reference only. Download this version of

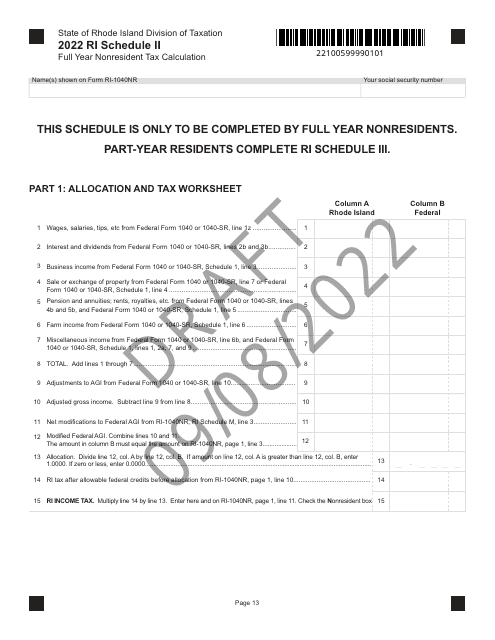

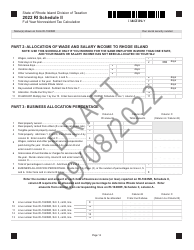

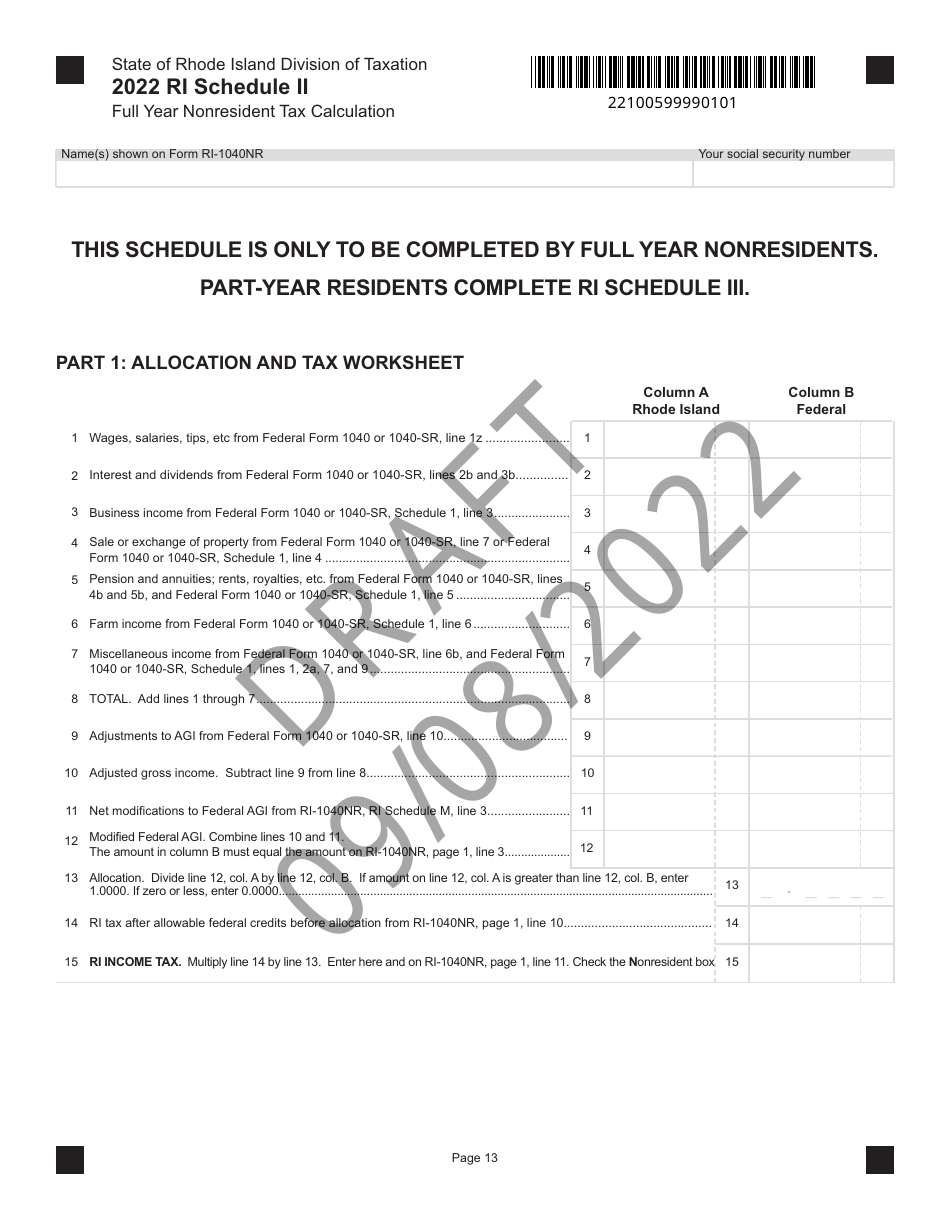

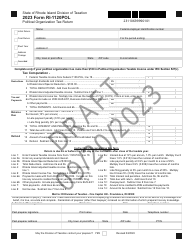

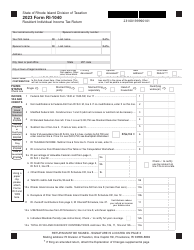

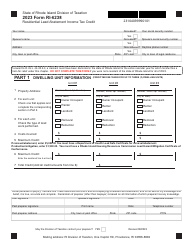

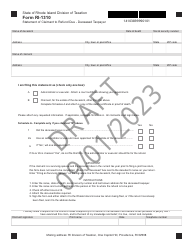

Form RI-1040NR Schedule II

for the current year.

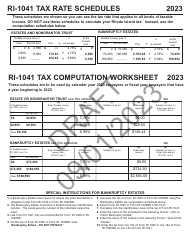

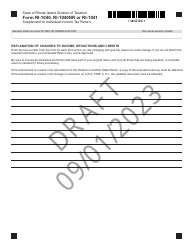

Form RI-1040NR Schedule II Full Year Nonresident Tax Calculation - Draft - Rhode Island

What Is Form RI-1040NR Schedule II?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.The document is a supplement to Form RI-1040NR, Nonresident Individual Income Tax Return - Draft. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

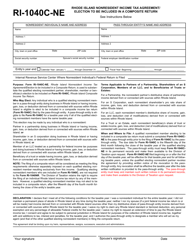

Q: Who needs to file the RI-1040NR Schedule II form?

A: Nonresidents who earned income in Rhode Island and need to calculate their state taxes.

Q: Do I need to attach the RI-1040NR Schedule II form to my tax return?

A: Yes, if you are a nonresident and earned income in Rhode Island, you must complete and attach this form to your tax return.

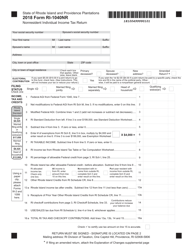

Q: What information do I need to complete the RI-1040NR Schedule II form?

A: You will need to provide details about your income earned in Rhode Island, deductions, exemptions, and tax credits.

Q: How do I calculate my Rhode Island nonresident taxes using this form?

A: The form provides instructions and worksheets to help you calculate your tax liability based on your income and other factors.

Q: Can I e-file the RI-1040NR Schedule II form?

A: No, this specific form must be filed by mail. It cannot be e-filed.

Q: Are there any specific deadlines for filing the RI-1040NR Schedule II form?

A: The form must be filed by the same deadline as your federal tax return, which is usually April 15th or the next business day if the 15th falls on a weekend or holiday.

Form Details:

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1040NR Schedule II by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.