This version of the form is not currently in use and is provided for reference only. Download this version of

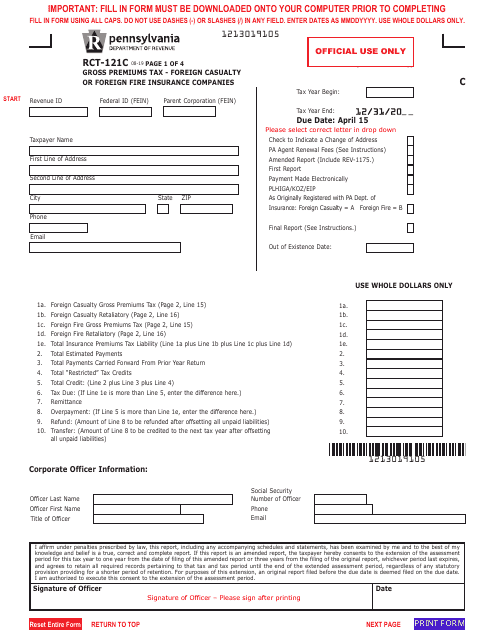

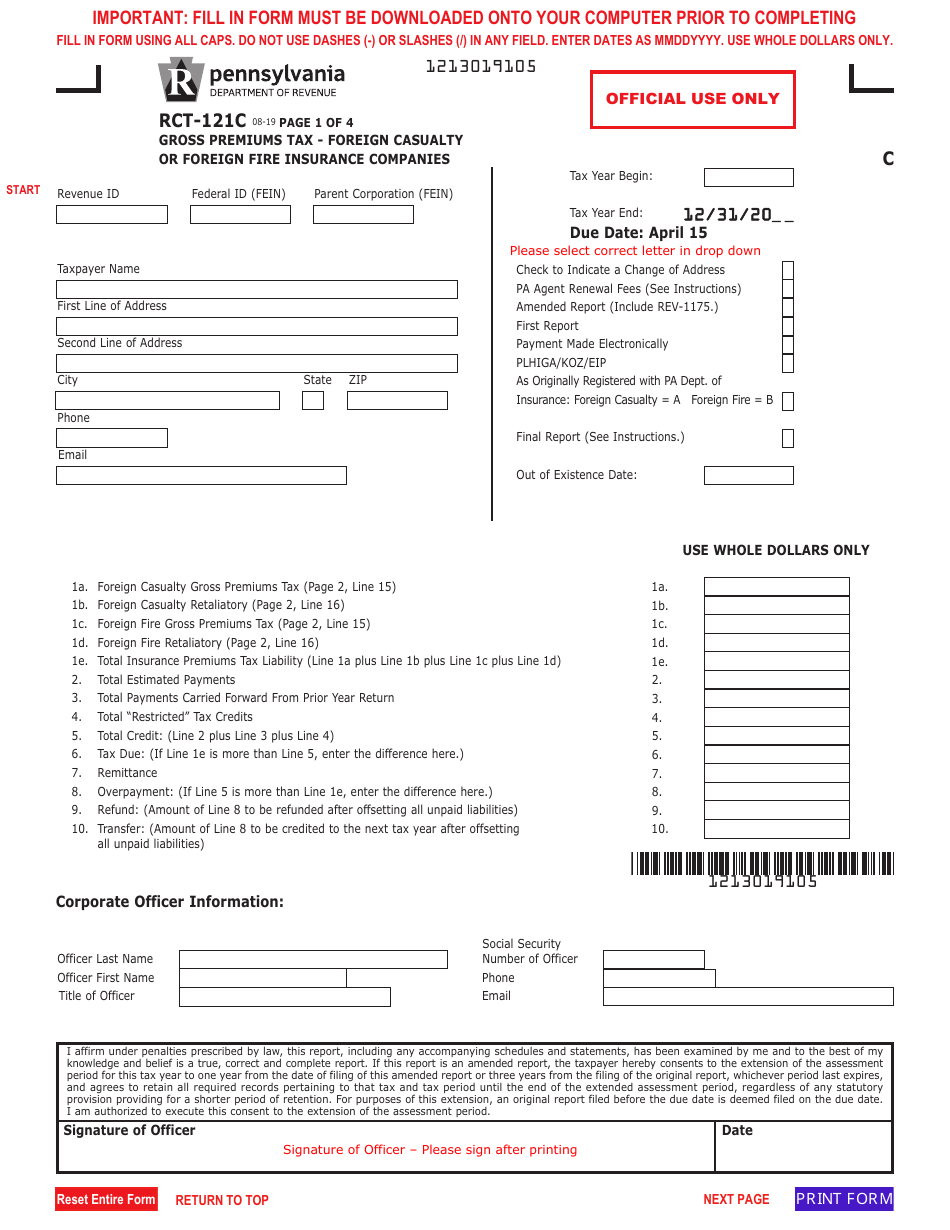

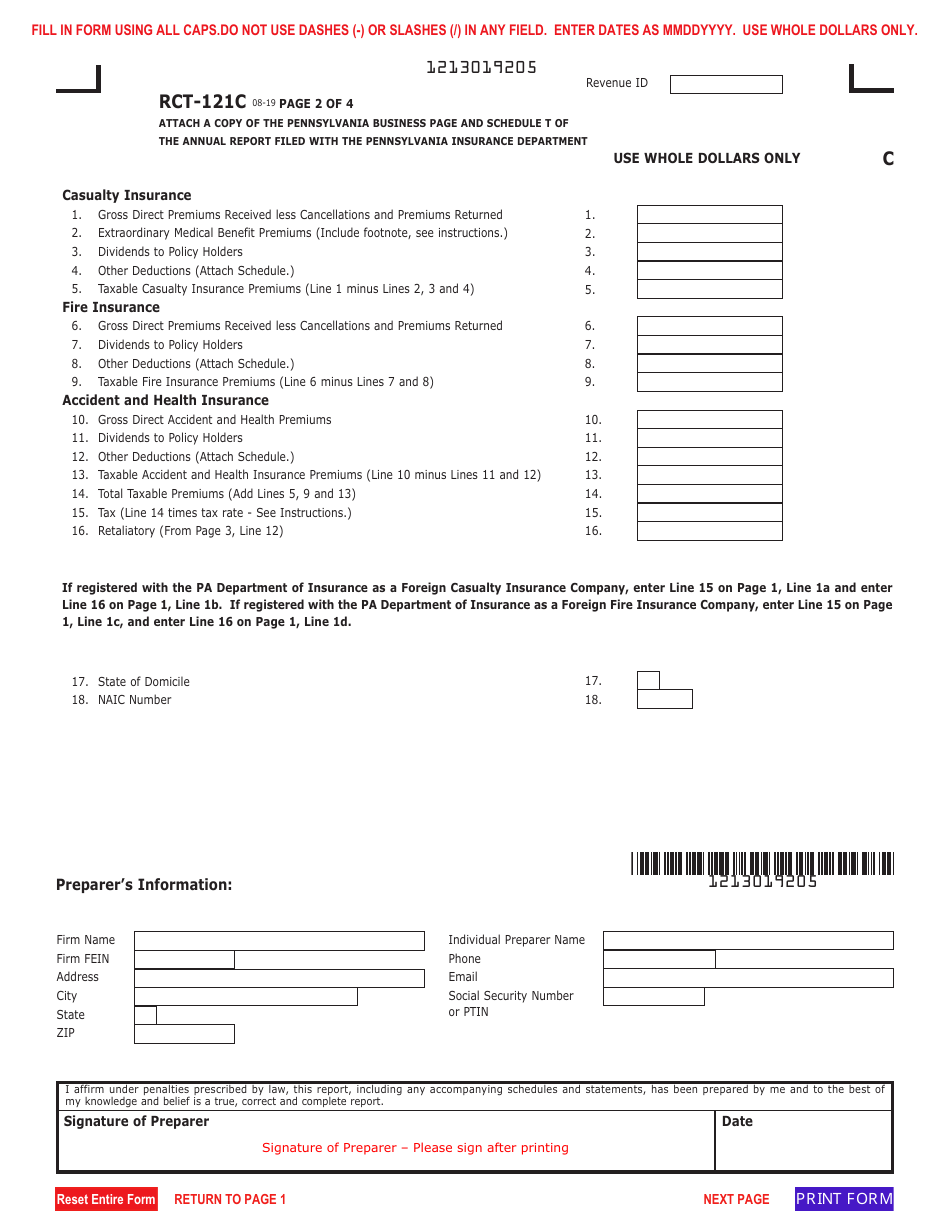

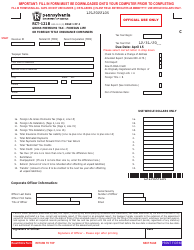

Form RCT-121C

for the current year.

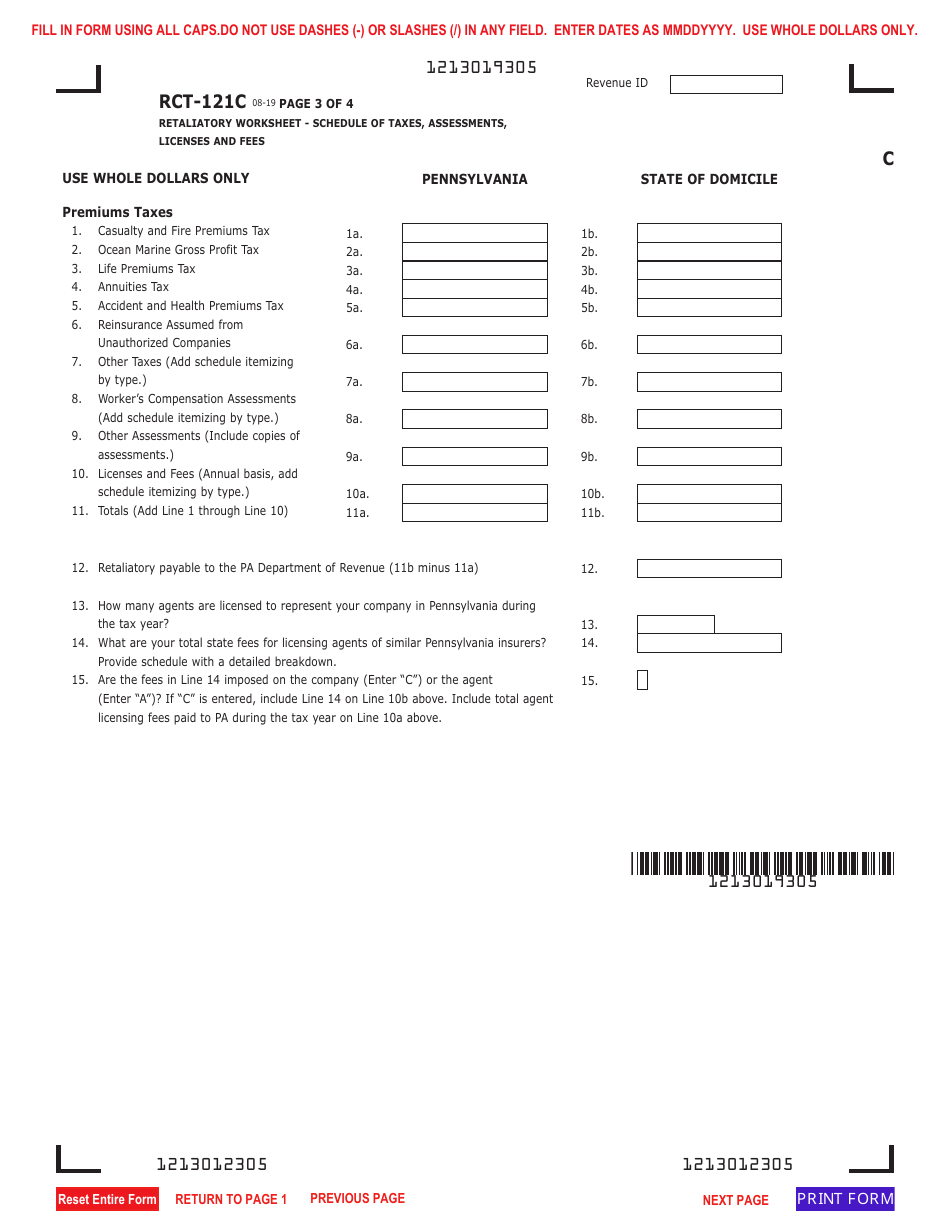

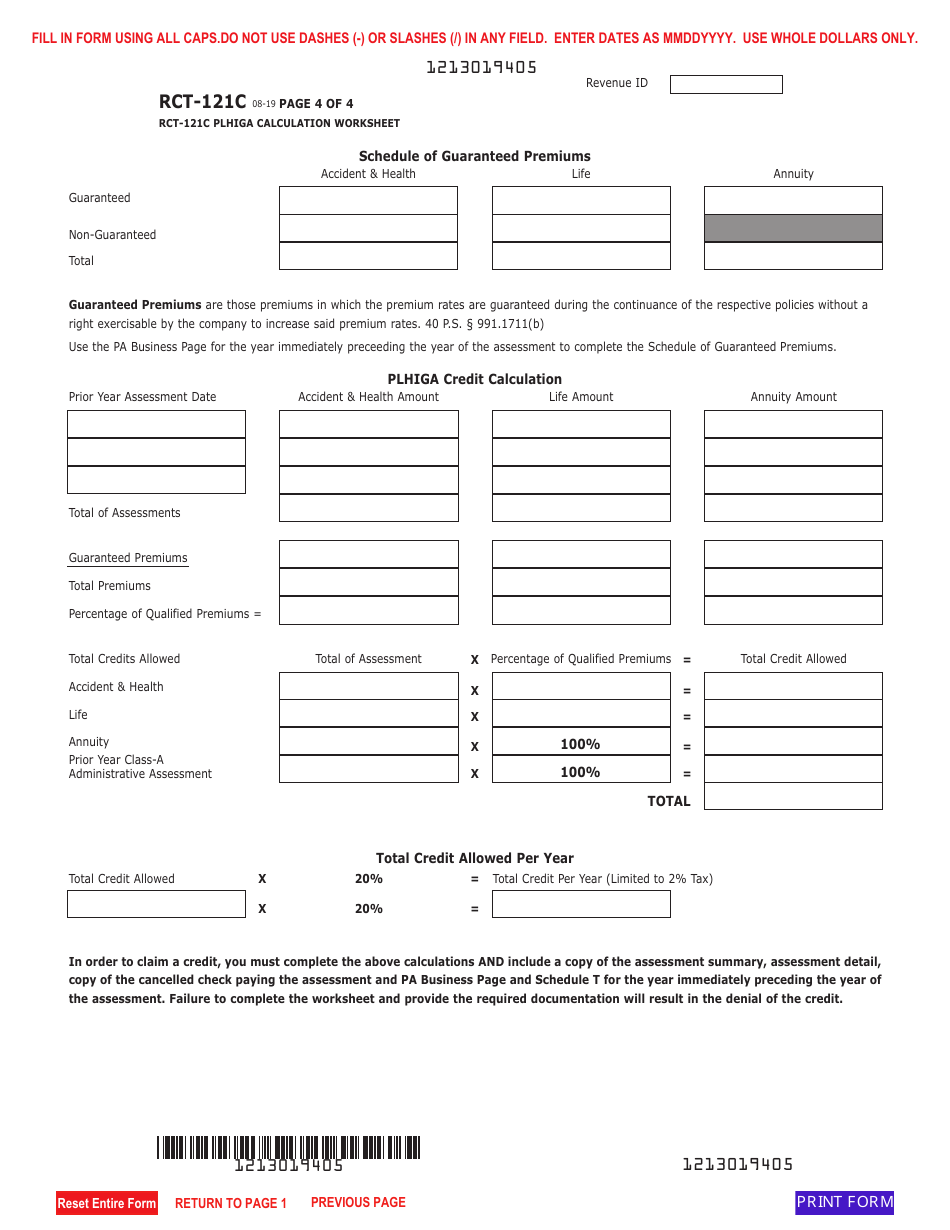

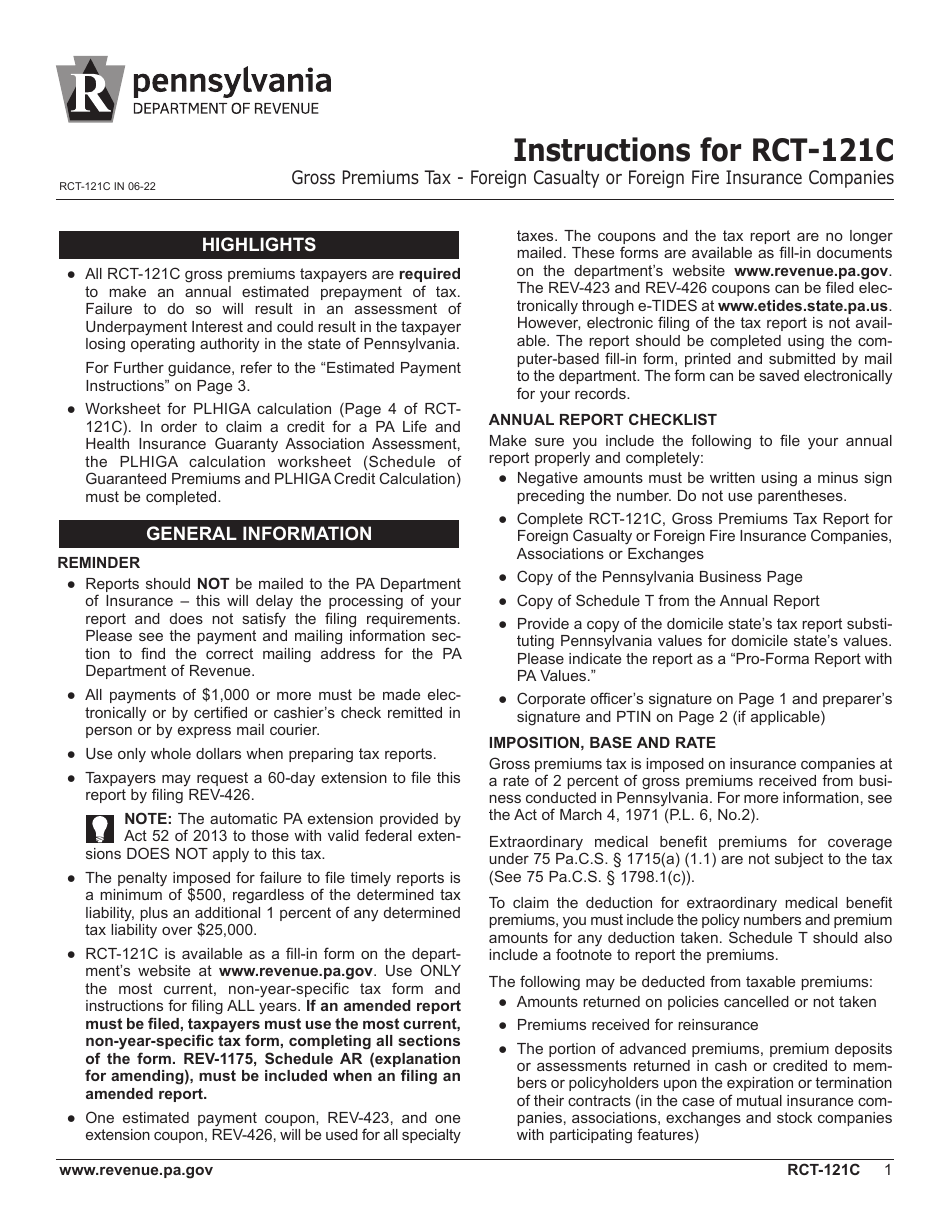

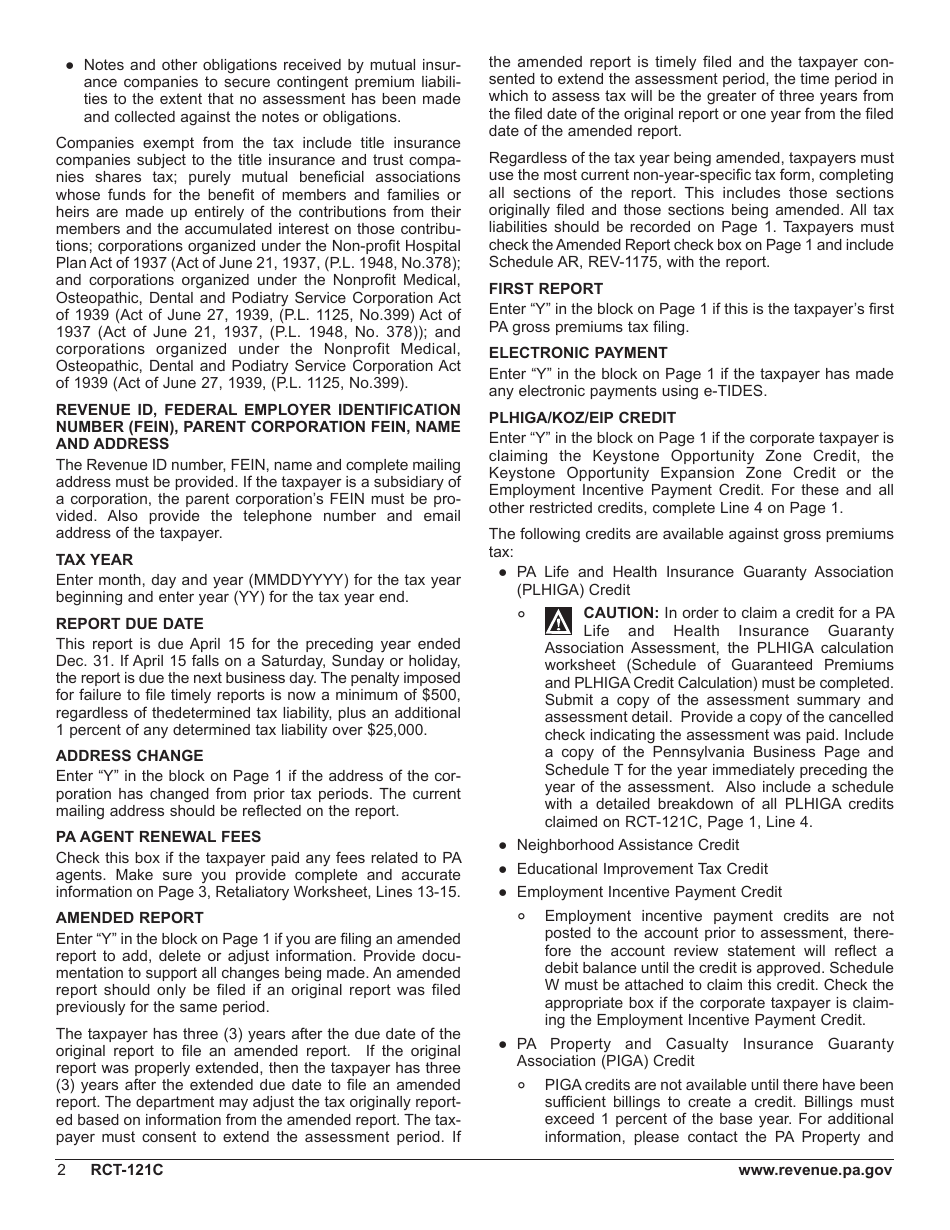

Form RCT-121C Gross Premiums Tax - Foreign Casualty or Foreign Fire Insurance Companies - Pennsylvania

What Is Form RCT-121C?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

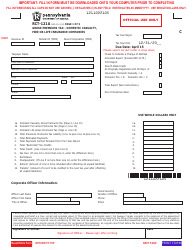

Q: What is Form RCT-121C?

A: Form RCT-121C is a tax form used by foreign casualty or foreign fire insurance companies operating in Pennsylvania.

Q: What is the purpose of Form RCT-121C?

A: The purpose of Form RCT-121C is to report and pay the Gross Premiums Tax for foreign casualty or foreign fire insurance companies.

Q: Who needs to file Form RCT-121C?

A: Foreign casualty or foreign fire insurance companies operating in Pennsylvania need to file Form RCT-121C.

Q: When is Form RCT-121C due?

A: Form RCT-121C is due on or before March 1st of each year.

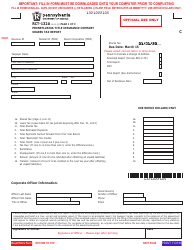

Q: Are there any penalties for not filing or paying the Gross Premiums Tax on time?

A: Yes, there are penalties for late filing or late payment of the Gross Premiums Tax. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.