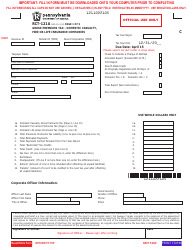

This version of the form is not currently in use and is provided for reference only. Download this version of

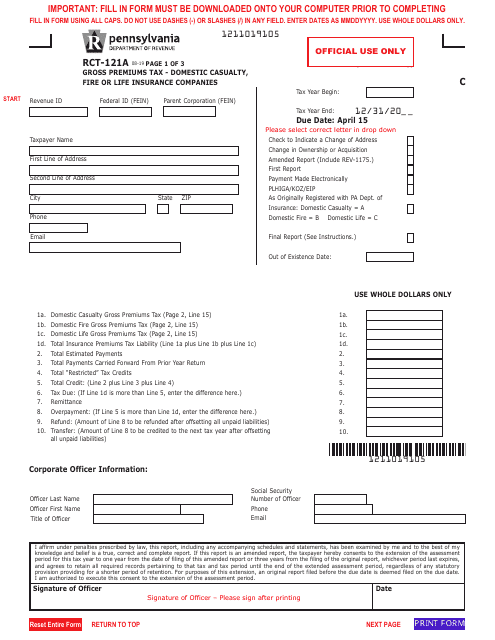

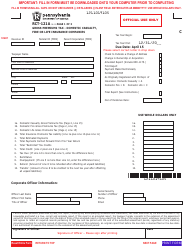

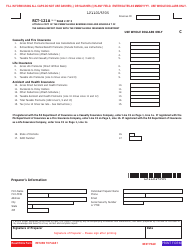

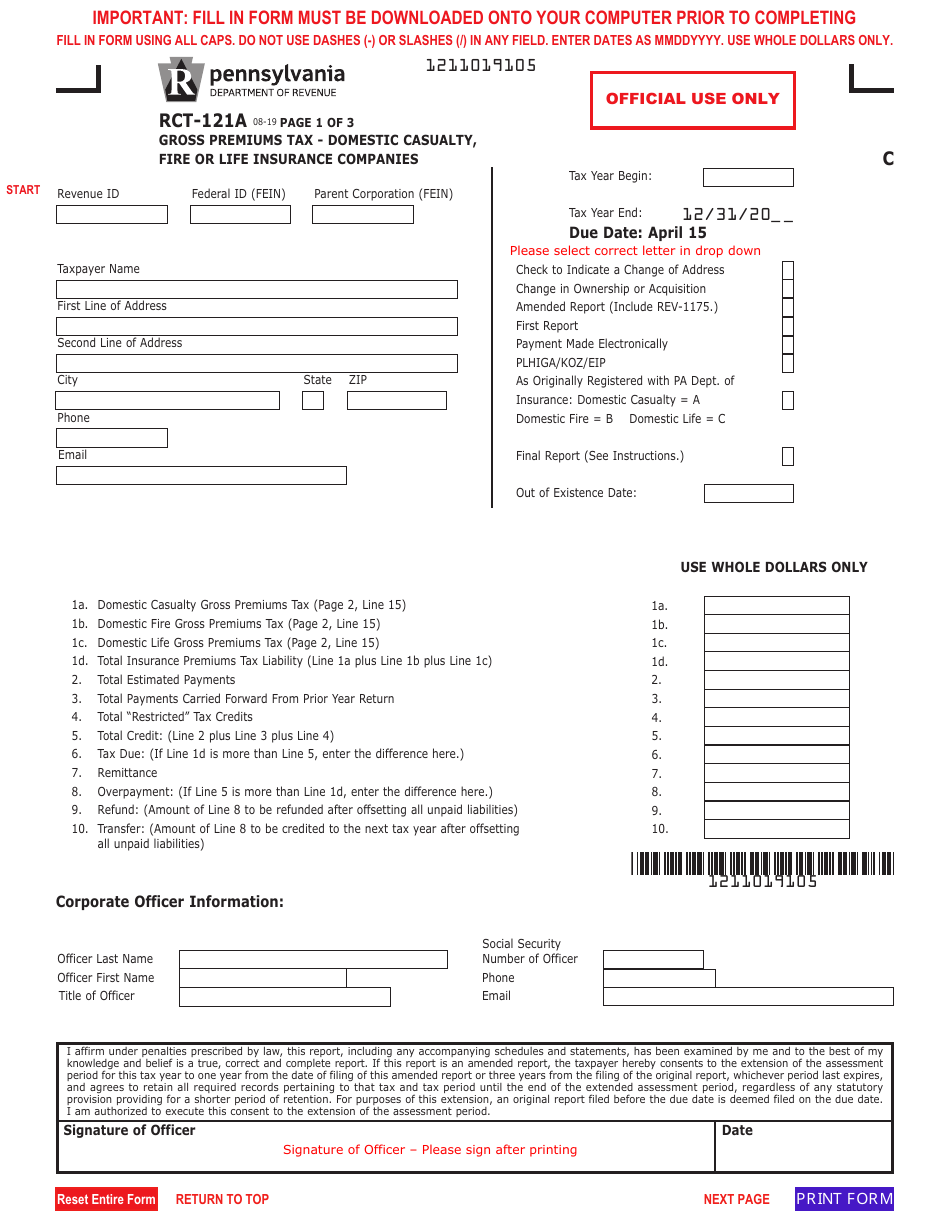

Form RCT-121A

for the current year.

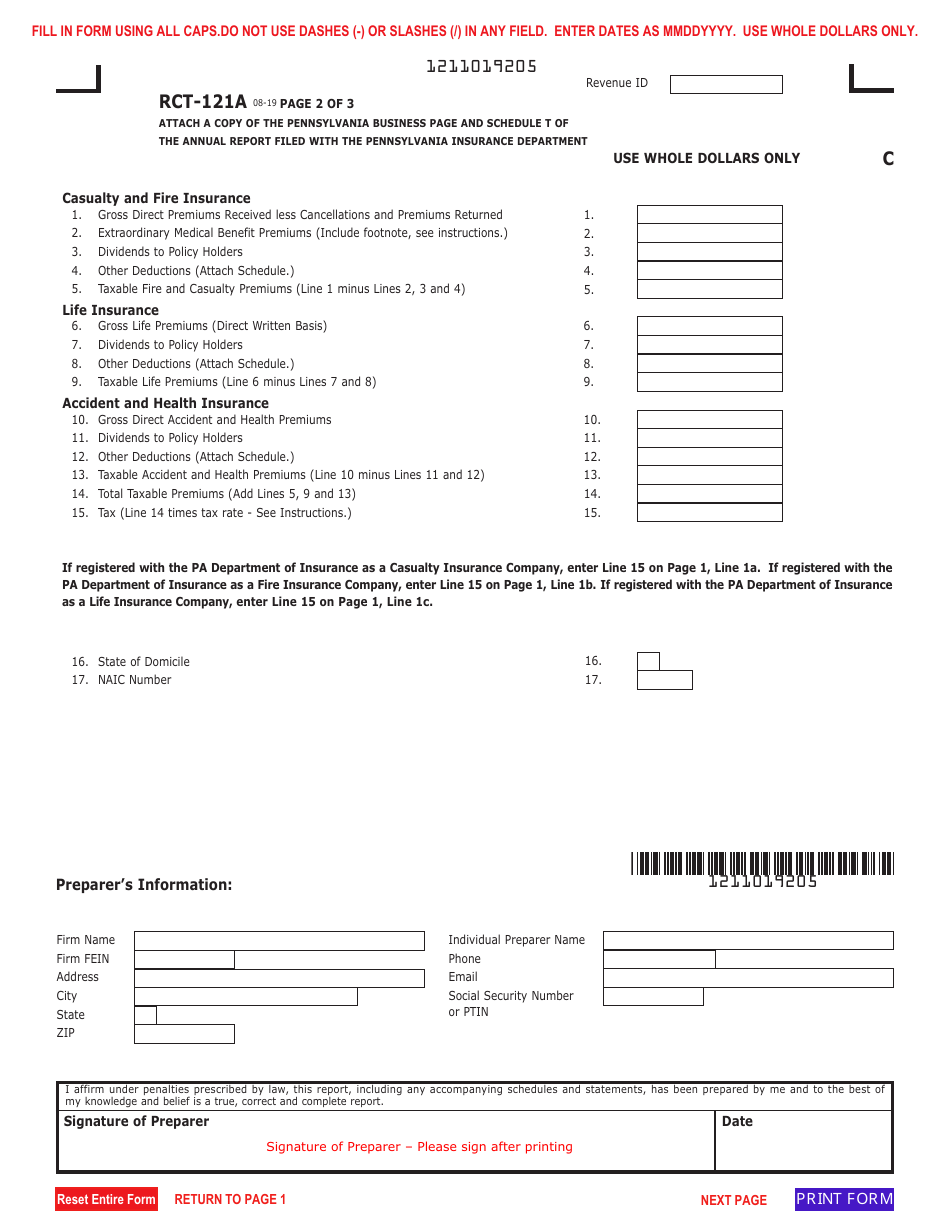

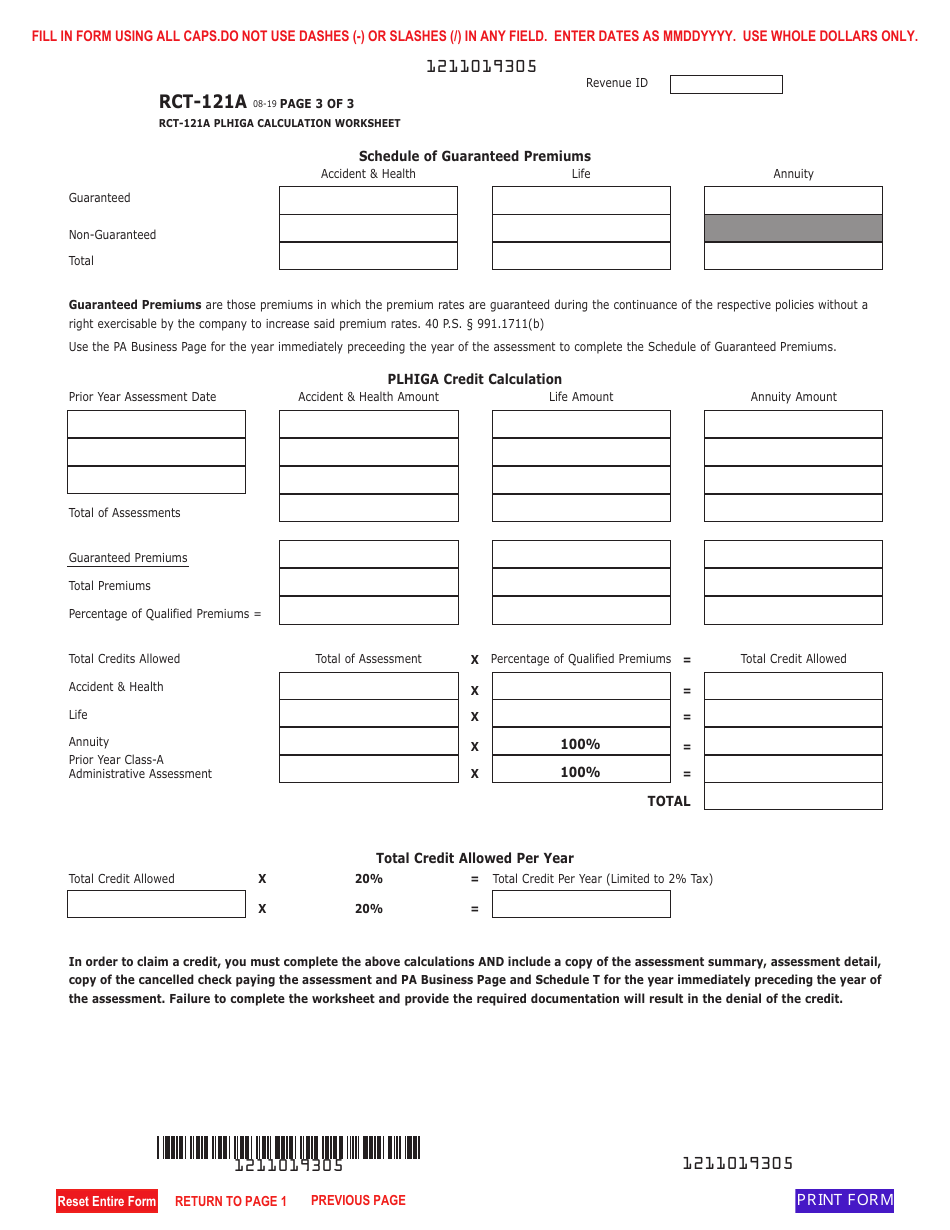

Form RCT-121A Gross Premiums Tax - Domestic Casualty, Fire or Life Insurance Companies - Pennsylvania

What Is Form RCT-121A?

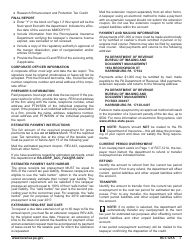

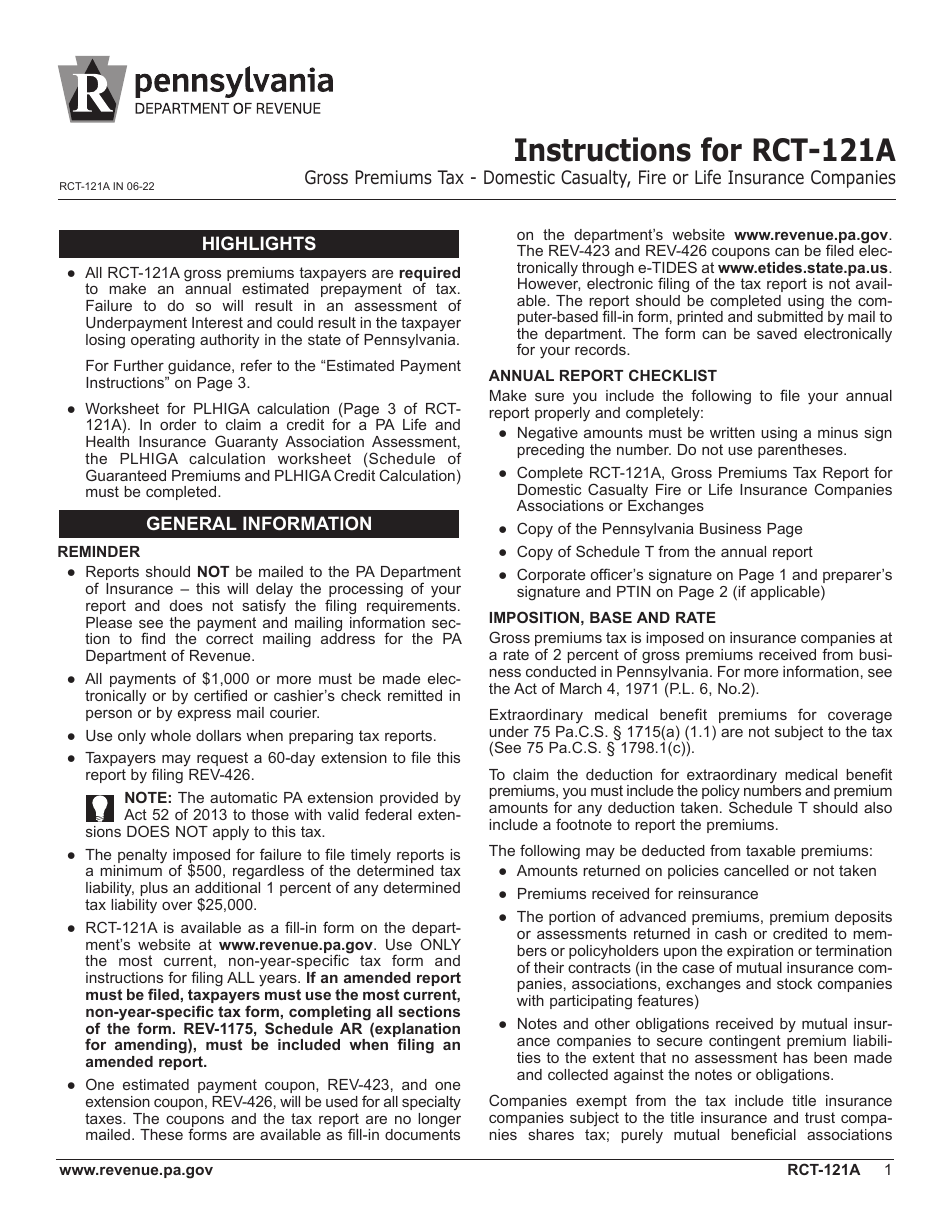

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

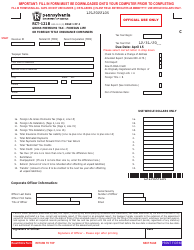

Q: What is RCT-121A?

A: RCT-121A is a form used in Pennsylvania to report gross premiums tax for domestic casualty, fire, or life insurance companies.

Q: Who needs to file RCT-121A?

A: Domestic casualty, fire, or life insurance companies in Pennsylvania are required to file RCT-121A.

Q: What is the purpose of RCT-121A?

A: The purpose of RCT-121A is to report and pay the gross premiums tax in Pennsylvania.

Q: When is RCT-121A due?

A: RCT-121A is typically due on or before March 1st of each year.

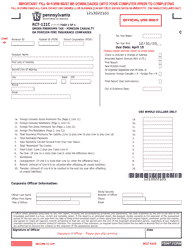

Q: Are there any penalties for late or non-filing of RCT-121A?

A: Yes, there may be penalties for late or non-filing of RCT-121A, including interest charges and potential legal consequences. It is important to file on time to avoid these penalties.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.