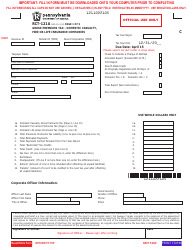

This version of the form is not currently in use and is provided for reference only. Download this version of

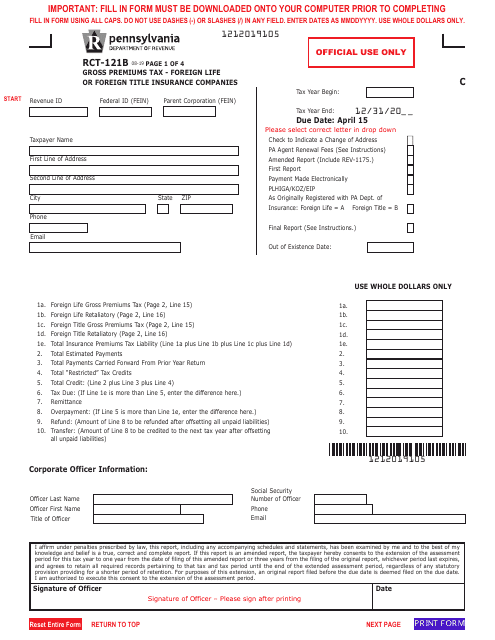

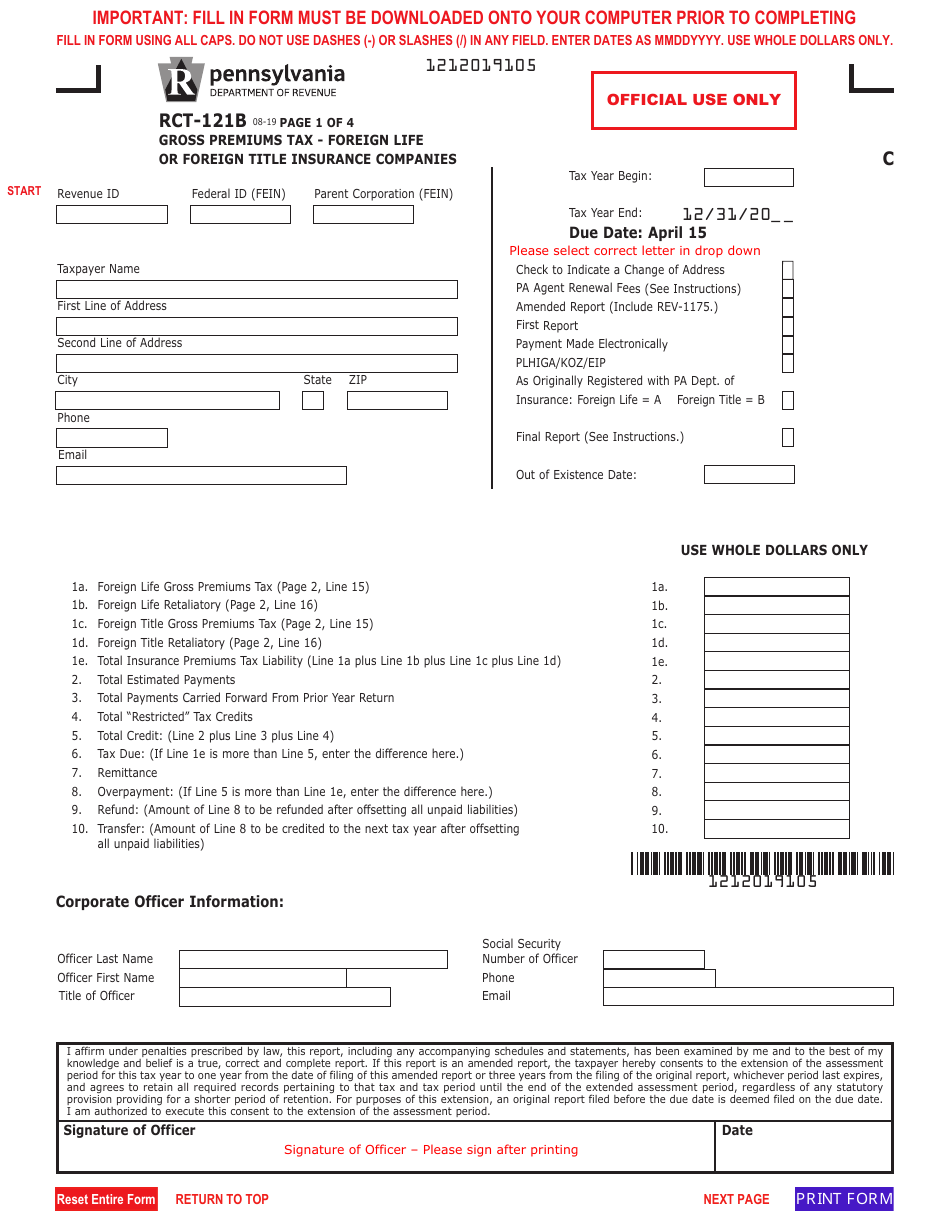

Form RCT-121B

for the current year.

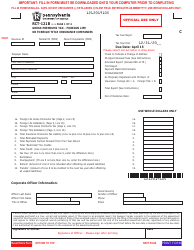

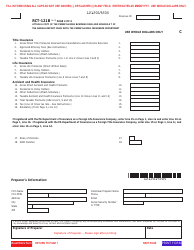

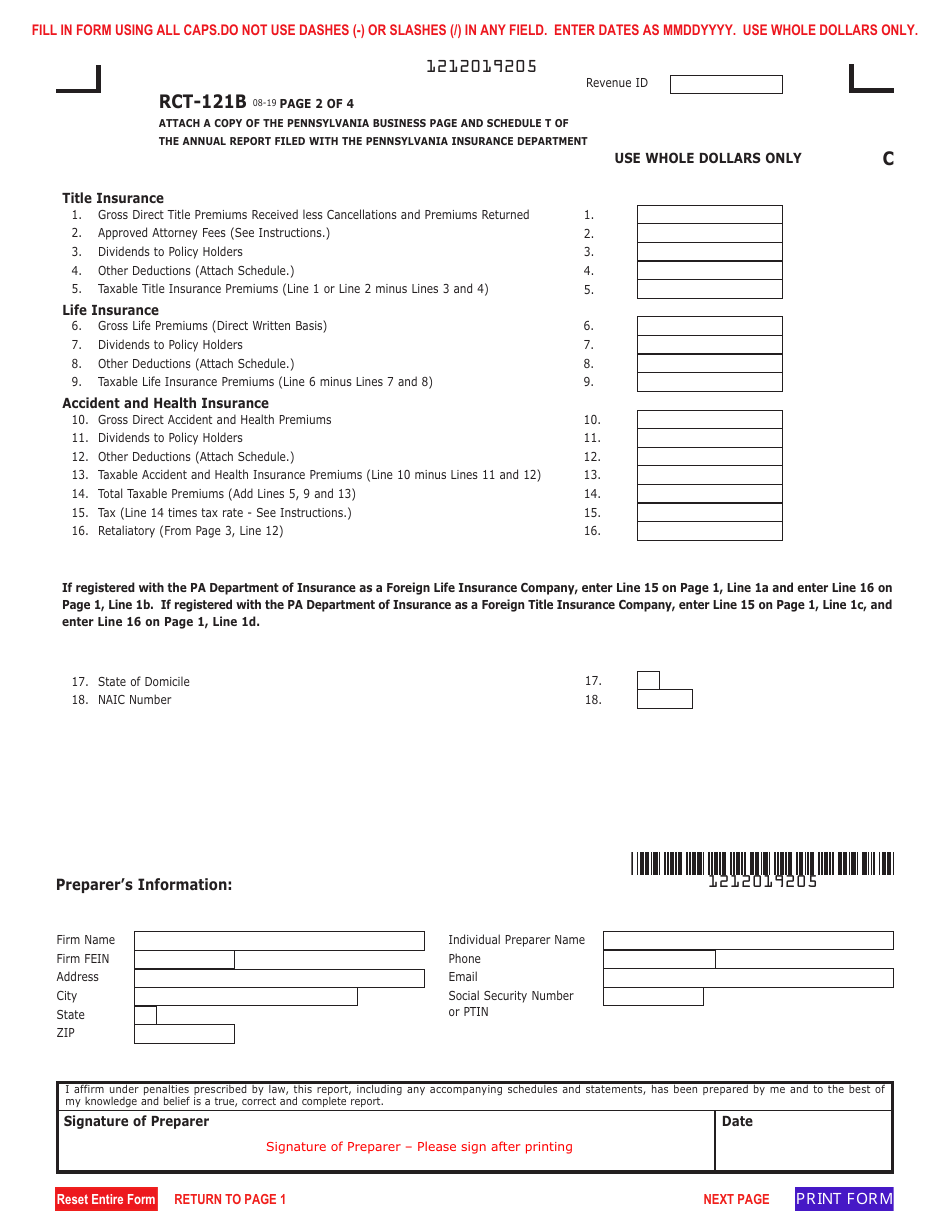

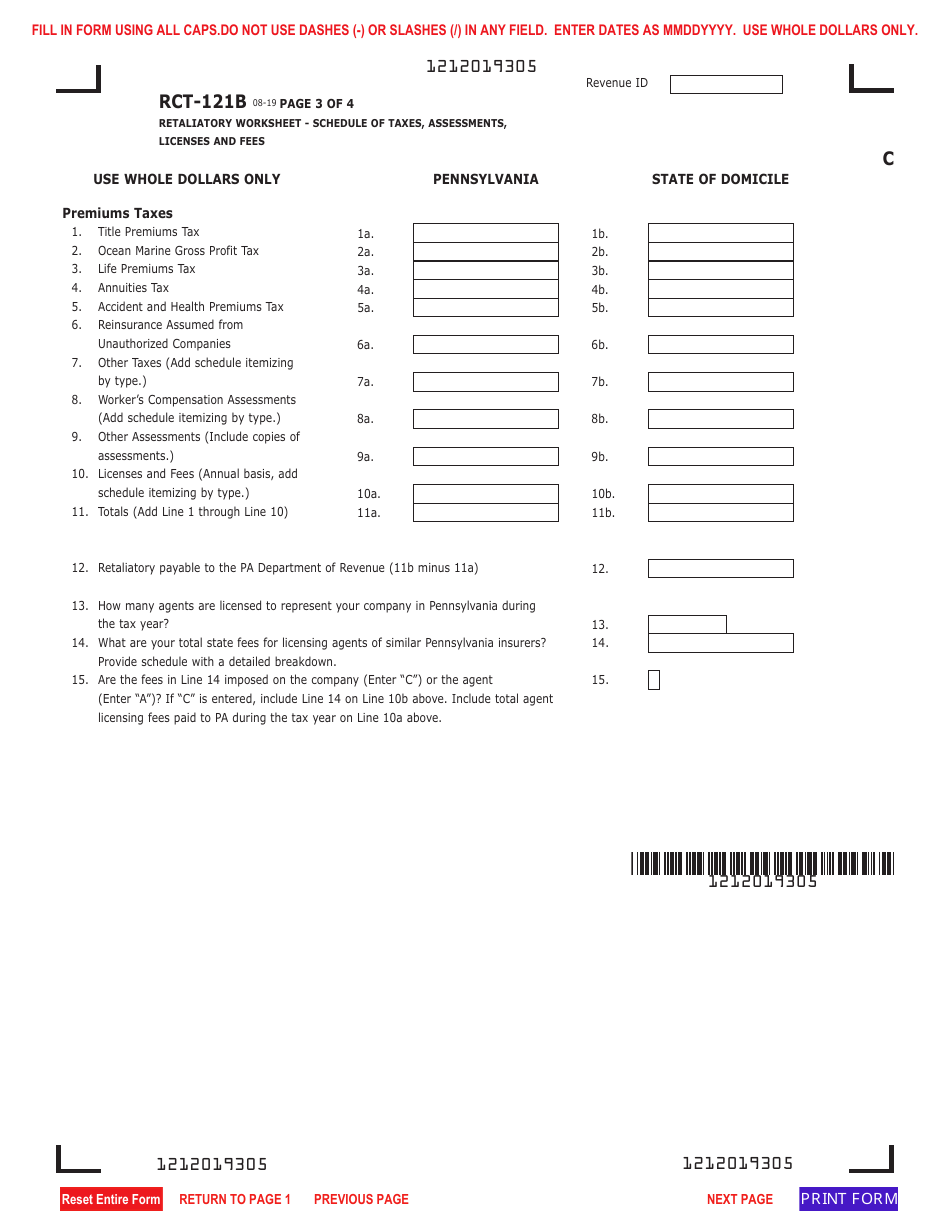

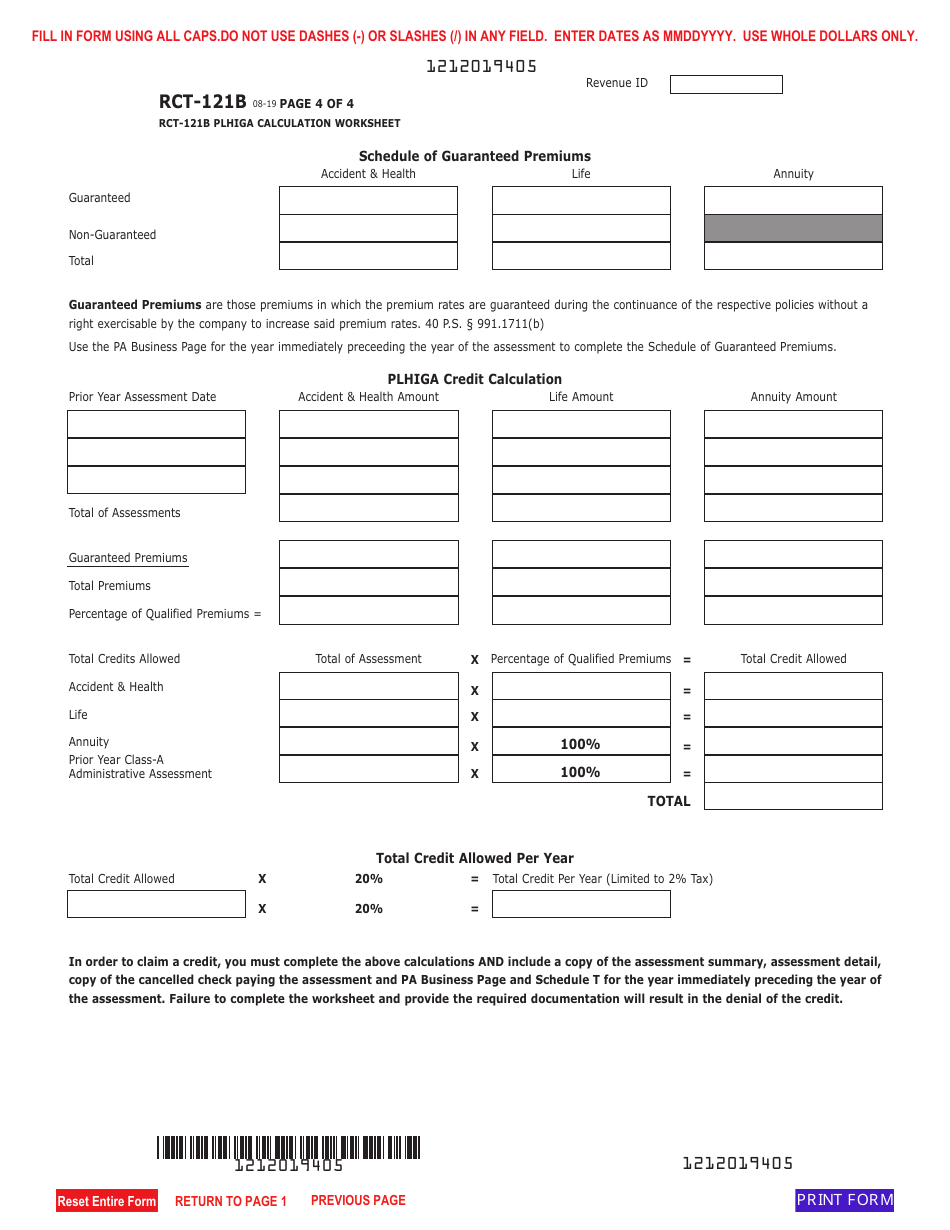

Form RCT-121B Gross Premiums Tax - Foreign Life or Foreign Title Insurance Companies - Pennsylvania

What Is Form RCT-121B?

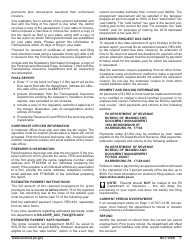

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

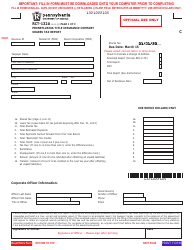

Q: What is Form RCT-121B?

A: Form RCT-121B is a tax form used by foreign life or foreign title insurance companies in Pennsylvania.

Q: Who needs to file Form RCT-121B?

A: Foreign life insurance companies or foreign title insurance companies operating in Pennsylvania need to file Form RCT-121B.

Q: What is the purpose of Form RCT-121B?

A: Form RCT-121B is used to report and pay the Gross Premiums Tax by foreign life or foreign title insurance companies in Pennsylvania.

Q: What is the Gross Premiums Tax?

A: The Gross Premiums Tax is a tax imposed on the gross premiums received by foreign life or foreign title insurance companies operating in Pennsylvania.

Q: When is Form RCT-121B due?

A: Form RCT-121B is due on or before April 15th of each year.

Q: Are there any penalties for late filing or non-filing of Form RCT-121B?

A: Yes, there are penalties for late filing or non-filing of Form RCT-121B, including interest charges and potential legal action.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.