This version of the form is not currently in use and is provided for reference only. Download this version of

Form AO213P

for the current year.

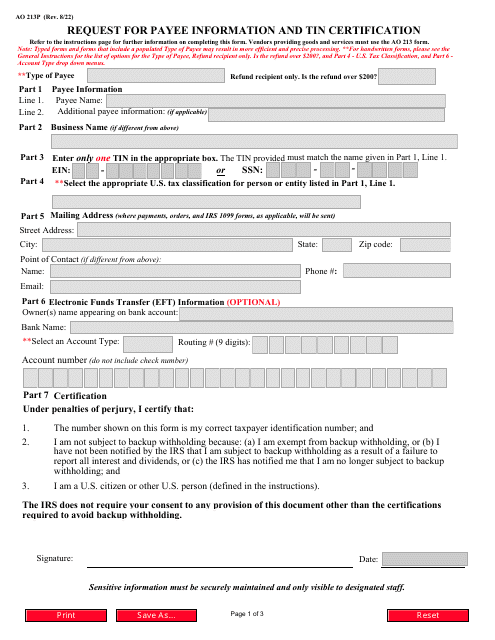

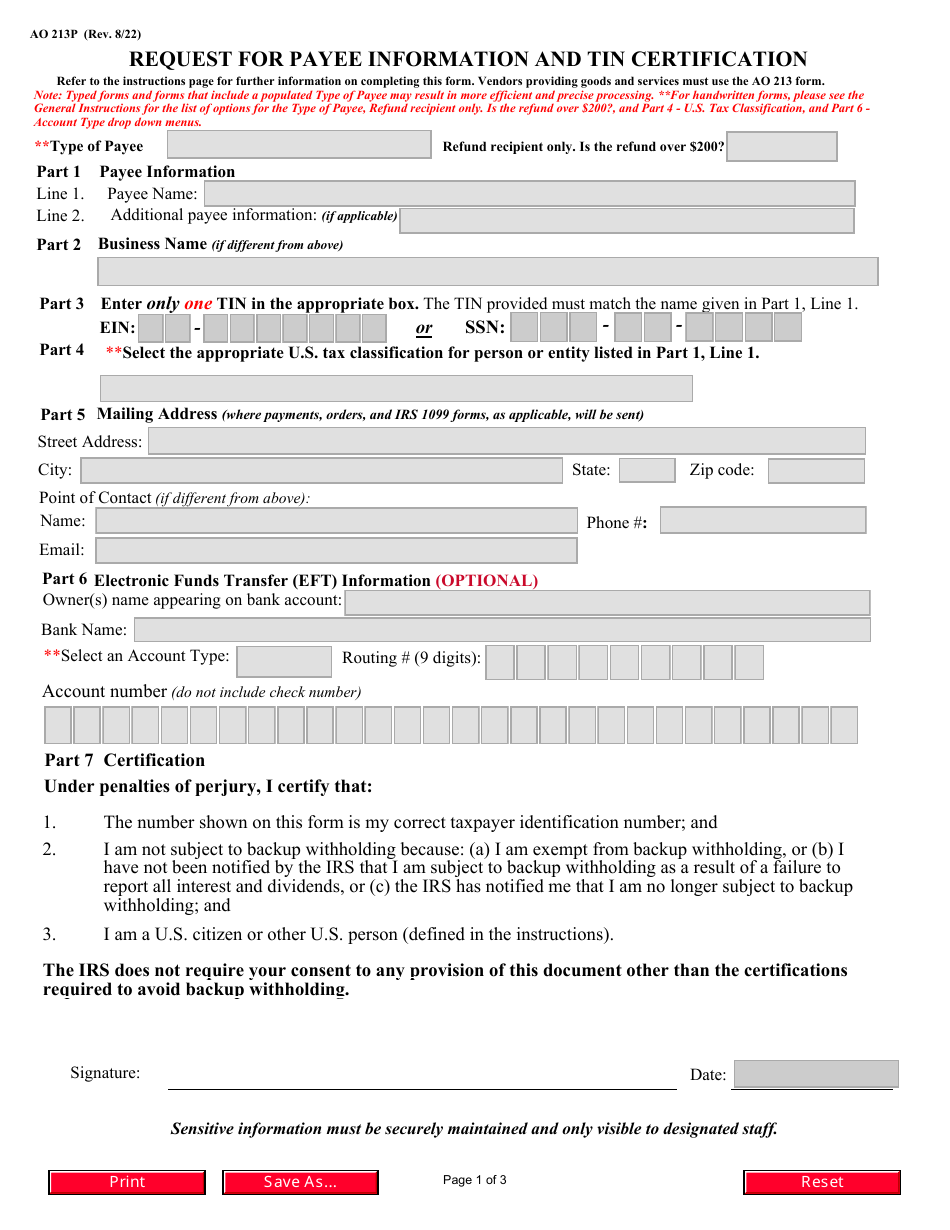

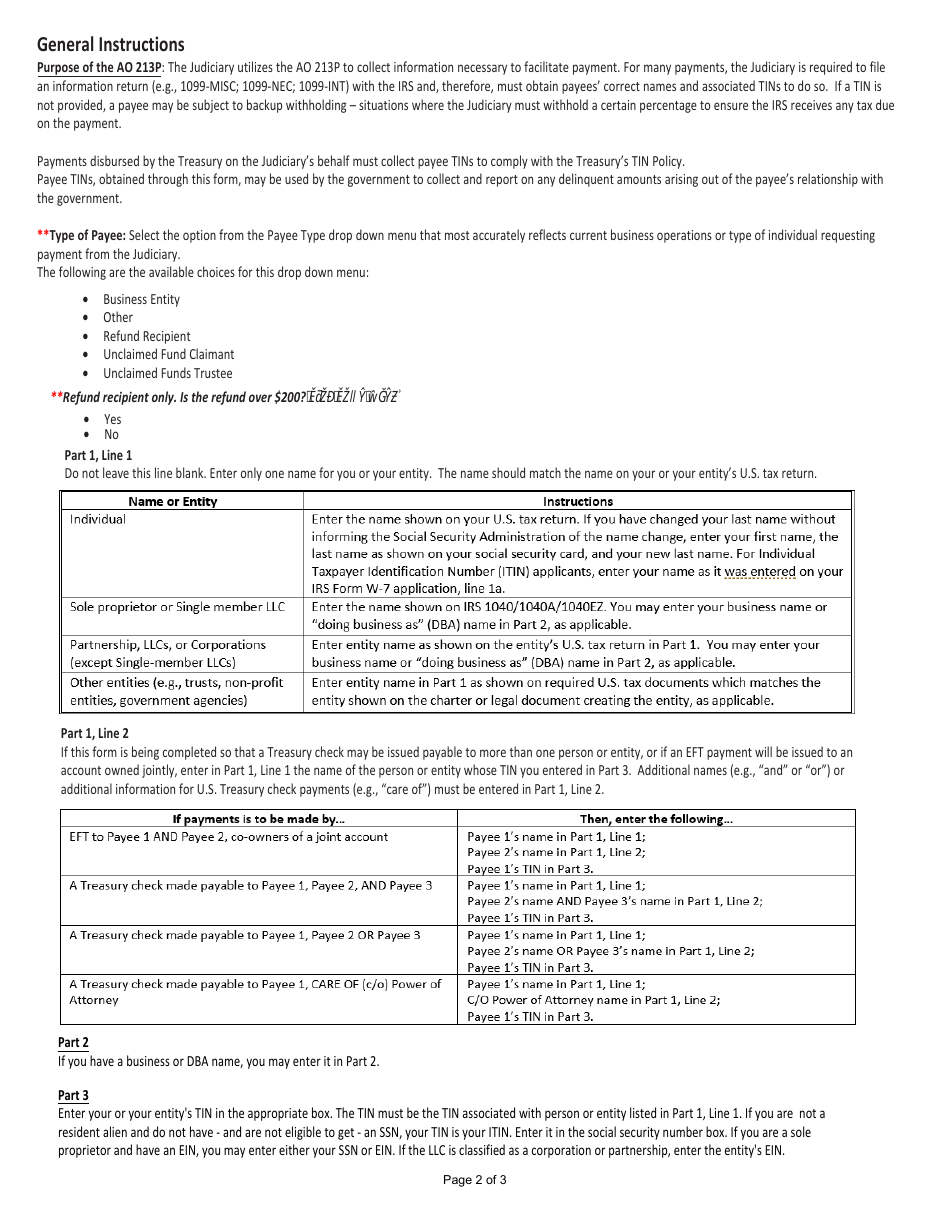

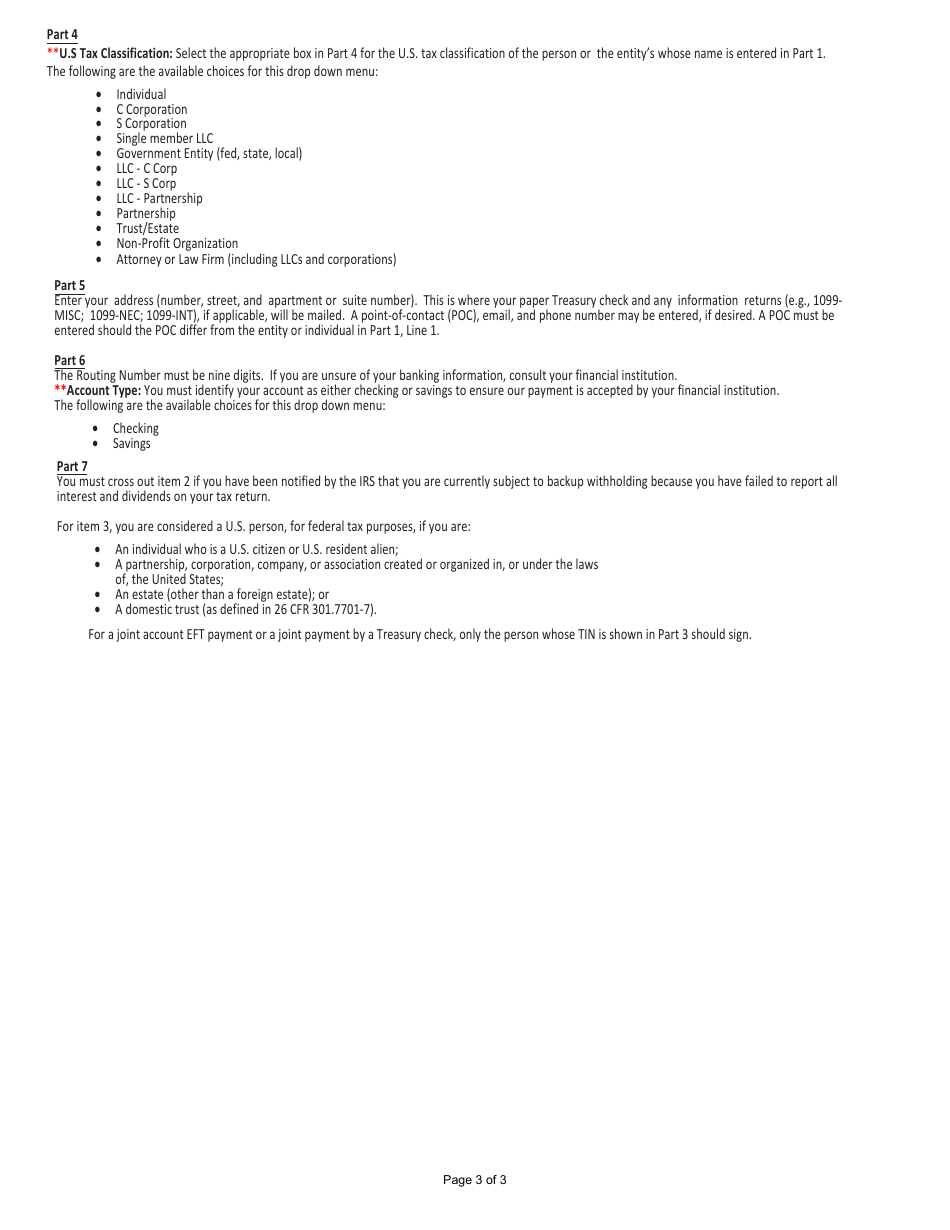

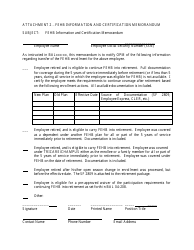

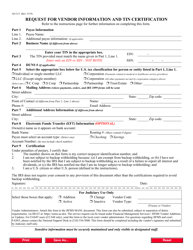

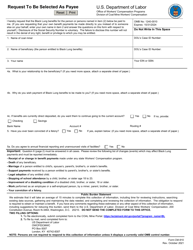

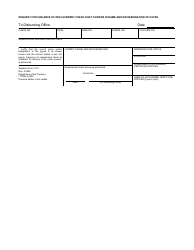

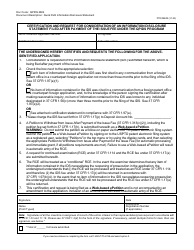

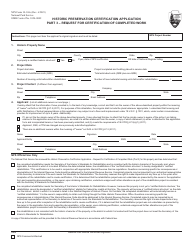

Form AO213P Request for Payee Information and Tin Certification

What Is Form AO213P?

This is a legal form that was released by the United States Courts on August 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AO213P?

A: Form AO213P is a Request for Payee Information and Tin Certification.

Q: What is the purpose of Form AO213P?

A: The purpose of Form AO213P is to collect payee information and to certify the Taxpayer Identification Number (TIN).

Q: Who needs to fill out Form AO213P?

A: Form AO213P needs to be filled out by individuals or entities who are required to provide payee information and certify their TIN.

Q: What information is required on Form AO213P?

A: Form AO213P requires information such as name, address, and TIN of the payee.

Q: How do I submit Form AO213P?

A: You can submit Form AO213P by mail or electronically, depending on the instructions provided.

Q: Are there any penalties for not filing Form AO213P?

A: Yes, failing to provide payee information or certify the TIN can result in penalties imposed by the IRS.

Form Details:

- Released on August 1, 2022;

- The latest available edition released by the United States Courts;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AO213P by clicking the link below or browse more documents and templates provided by the United States Courts.