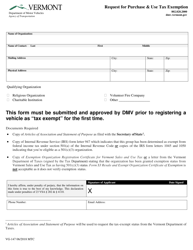

This version of the form is not currently in use and is provided for reference only. Download this version of

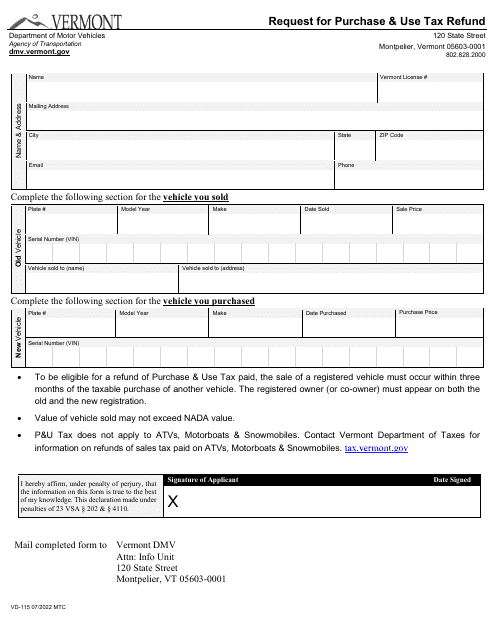

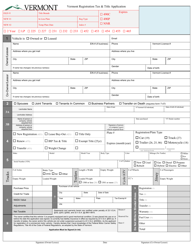

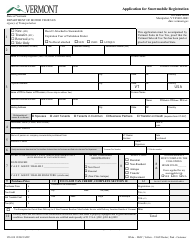

Form VD-115

for the current year.

Form VD-115 Request for Purchase & Use Tax Refund - Vermont

What Is Form VD-115?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VD-115?

A: Form VD-115 is the Request for Purchase & Use Tax Refund form in Vermont.

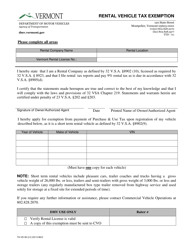

Q: What is the purpose of Form VD-115?

A: The purpose of Form VD-115 is to request a refund on Vermont purchase & use taxes.

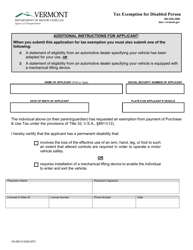

Q: Who is eligible to use Form VD-115?

A: Any individual or business who has paid Vermont purchase & use taxes may be eligible to use Form VD-115 to request a refund.

Q: What information is required on Form VD-115?

A: Some of the information required on Form VD-115 includes your name, address, tax account number, and details of the purchases for which you are requesting a refund.

Q: Is there a deadline for submitting Form VD-115?

A: Yes, Form VD-115 must be submitted within three years from the due date of the original tax return for the period in which the tax was paid.

Q: How long does it take to receive a refund after submitting Form VD-115?

A: The processing time for refunds can vary, but it generally takes several weeks to process a refund request on Form VD-115.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VD-115 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.