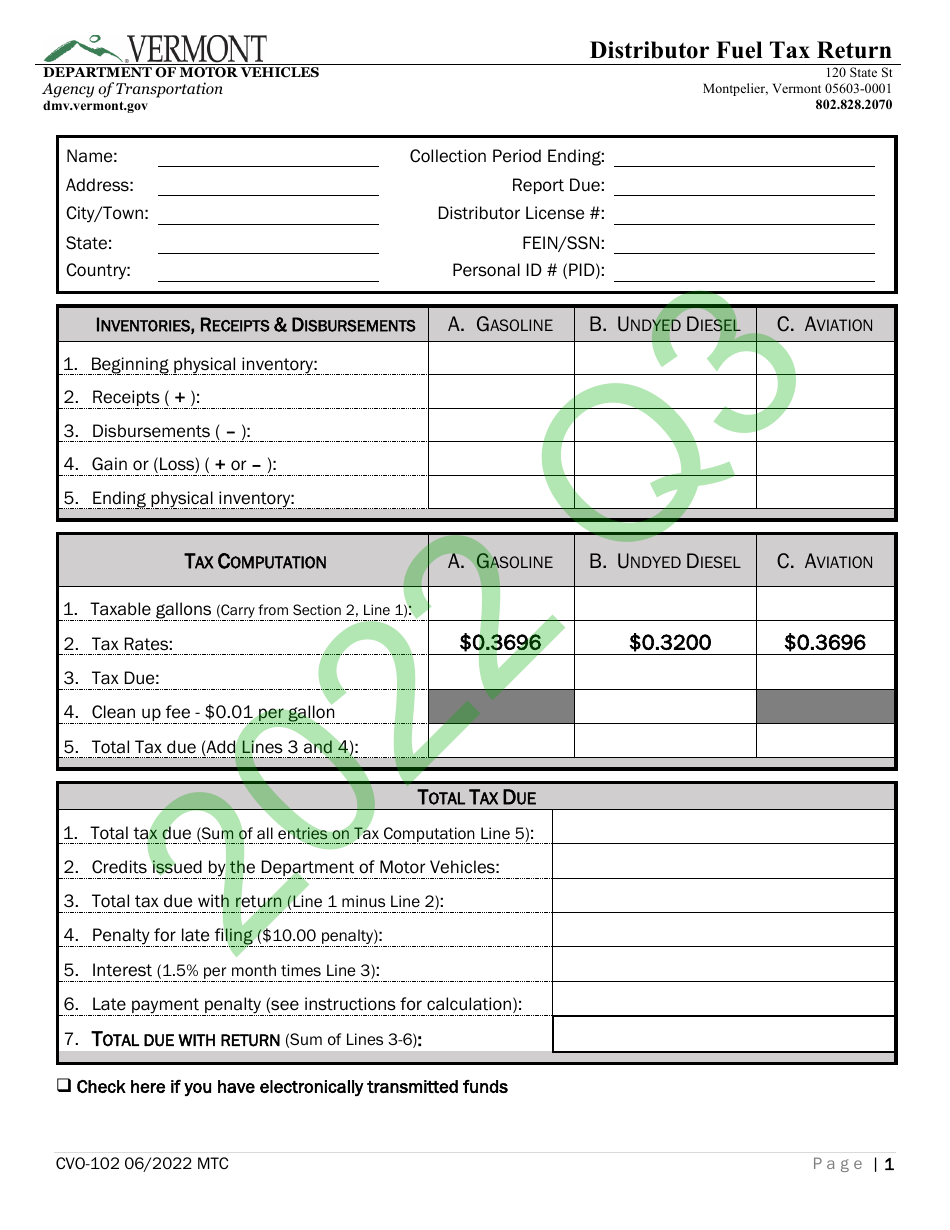

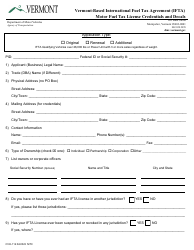

This version of the form is not currently in use and is provided for reference only. Download this version of

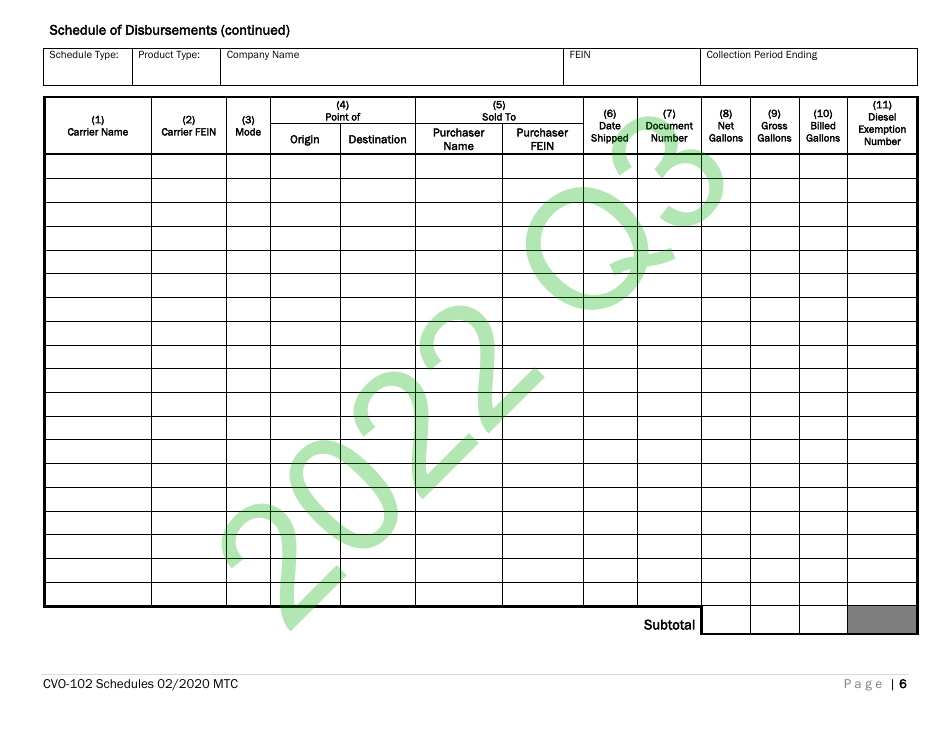

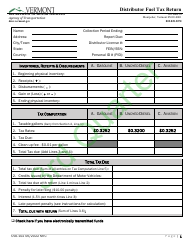

Form CVO-102

for the current year.

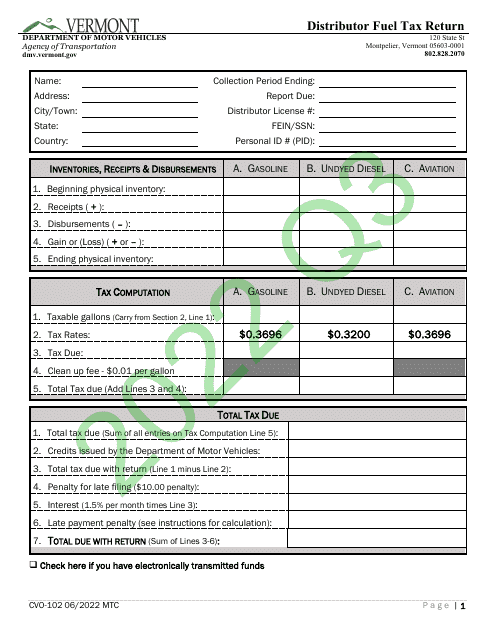

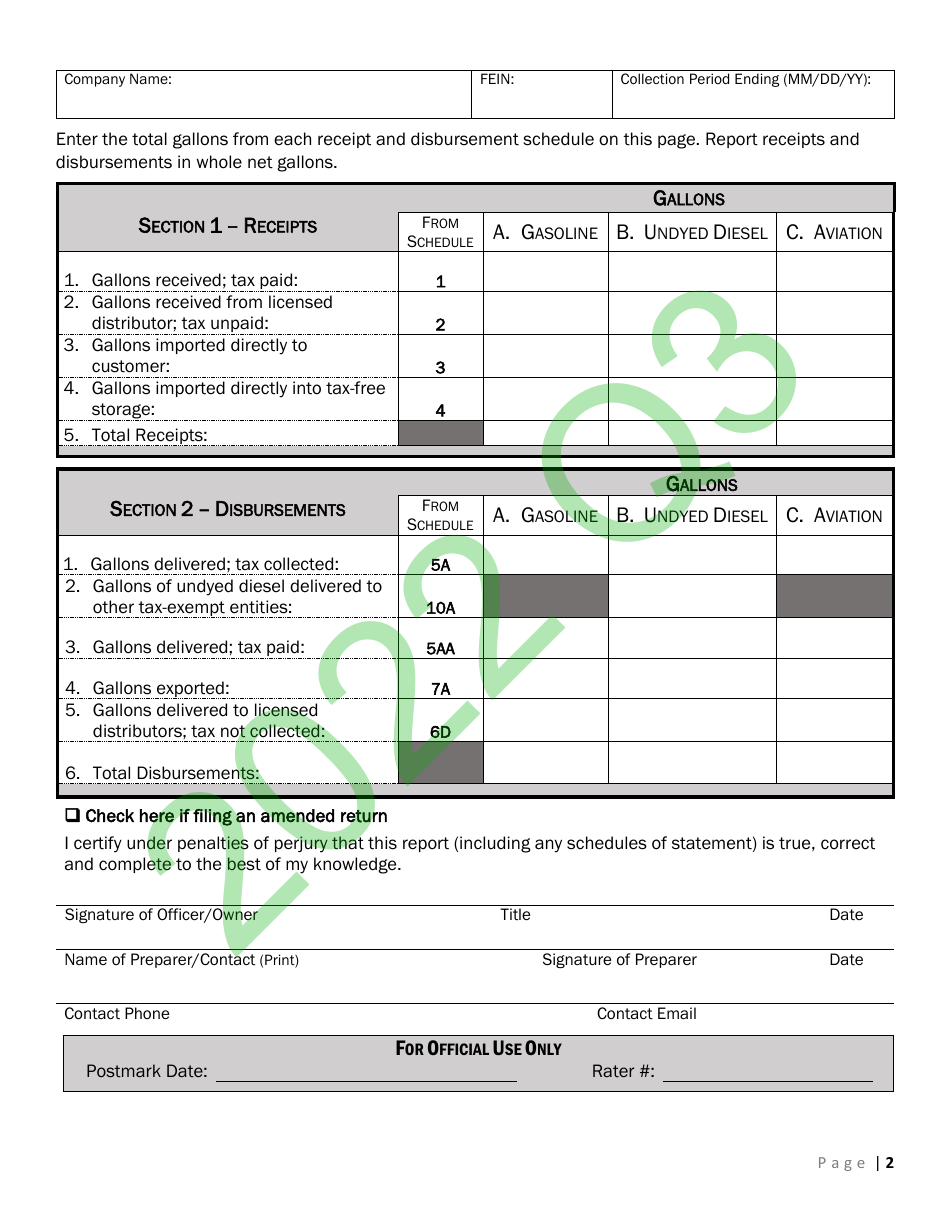

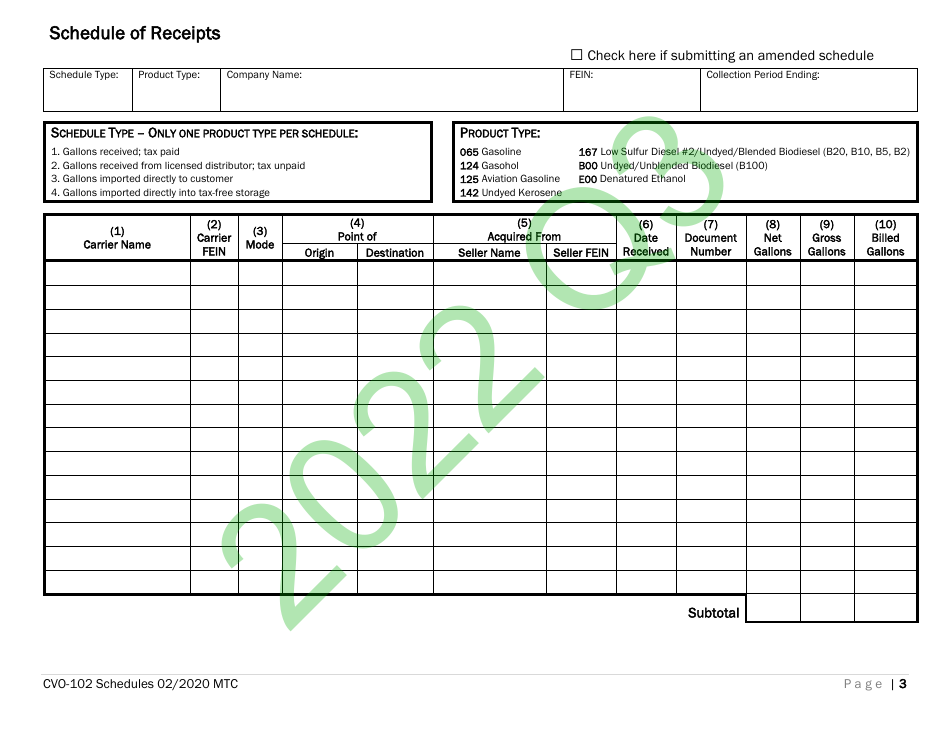

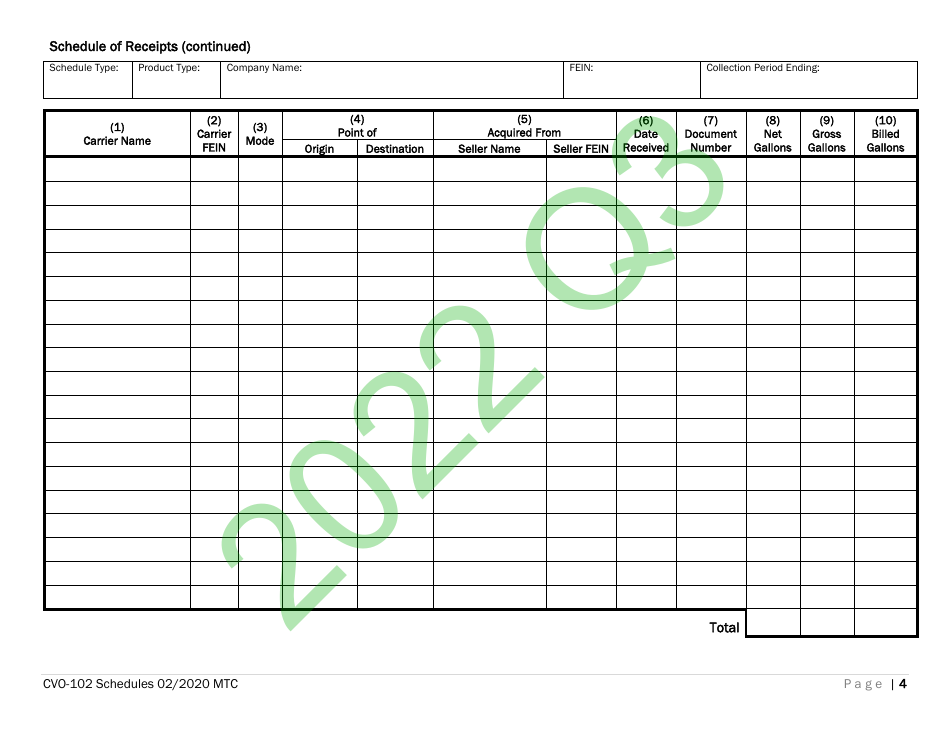

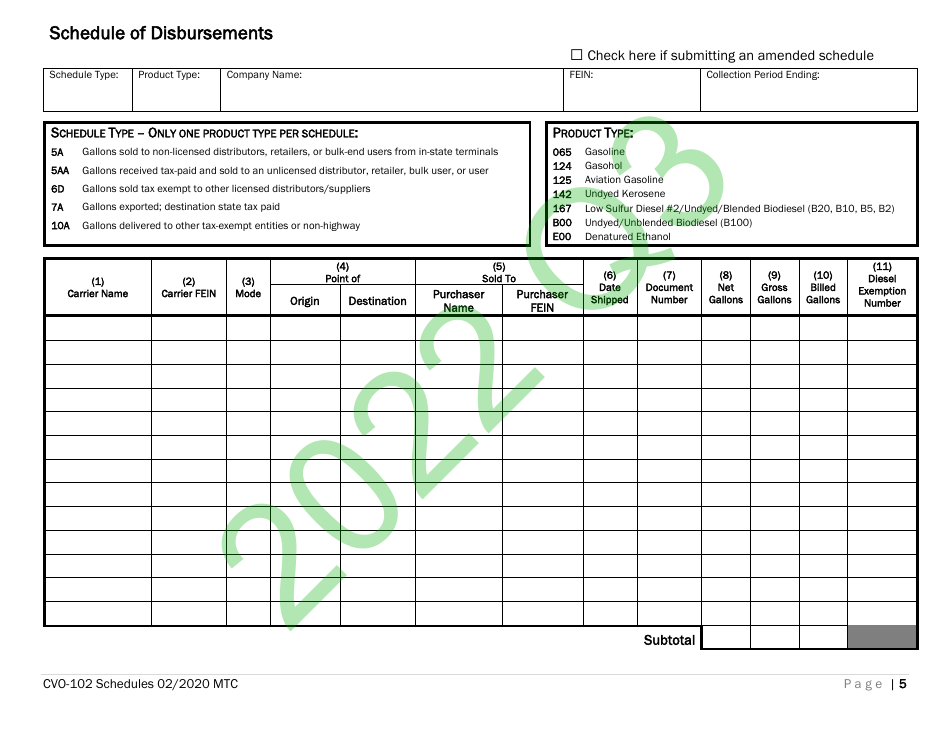

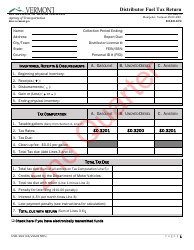

Form CVO-102 Distributor Fuel Tax Return (Q3) - Vermont

What Is Form CVO-102?

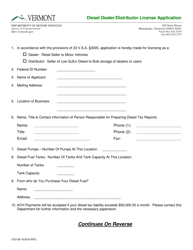

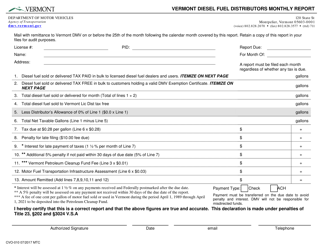

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CVO-102?

A: Form CVO-102 is the Distributor Fuel Tax Return for Vermont.

Q: What does Q3 mean?

A: Q3 refers to the third quarter of the year.

Q: Who needs to file Form CVO-102?

A: Distributors of fuel in Vermont need to file Form CVO-102.

Q: What is the purpose of Form CVO-102?

A: The purpose of Form CVO-102 is to report and pay the distributor fuel tax to the state of Vermont.

Q: When is the deadline to file Form CVO-102 (Q3) in Vermont?

A: The deadline to file Form CVO-102 for Q3 in Vermont is typically the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance. It is important to adhere to the filing deadlines and requirements set by the state of Vermont.

Q: What should I do if I have questions about Form CVO-102?

A: If you have questions about Form CVO-102, you can contact the Vermont Department of Motor Vehicles or consult with a tax professional for assistance.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CVO-102 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.