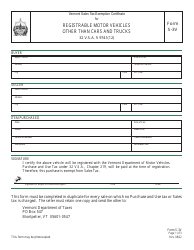

This version of the form is not currently in use and is provided for reference only. Download this version of

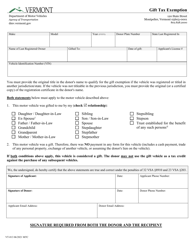

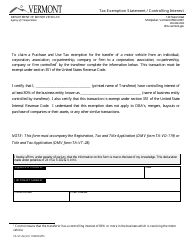

Form VT-014

for the current year.

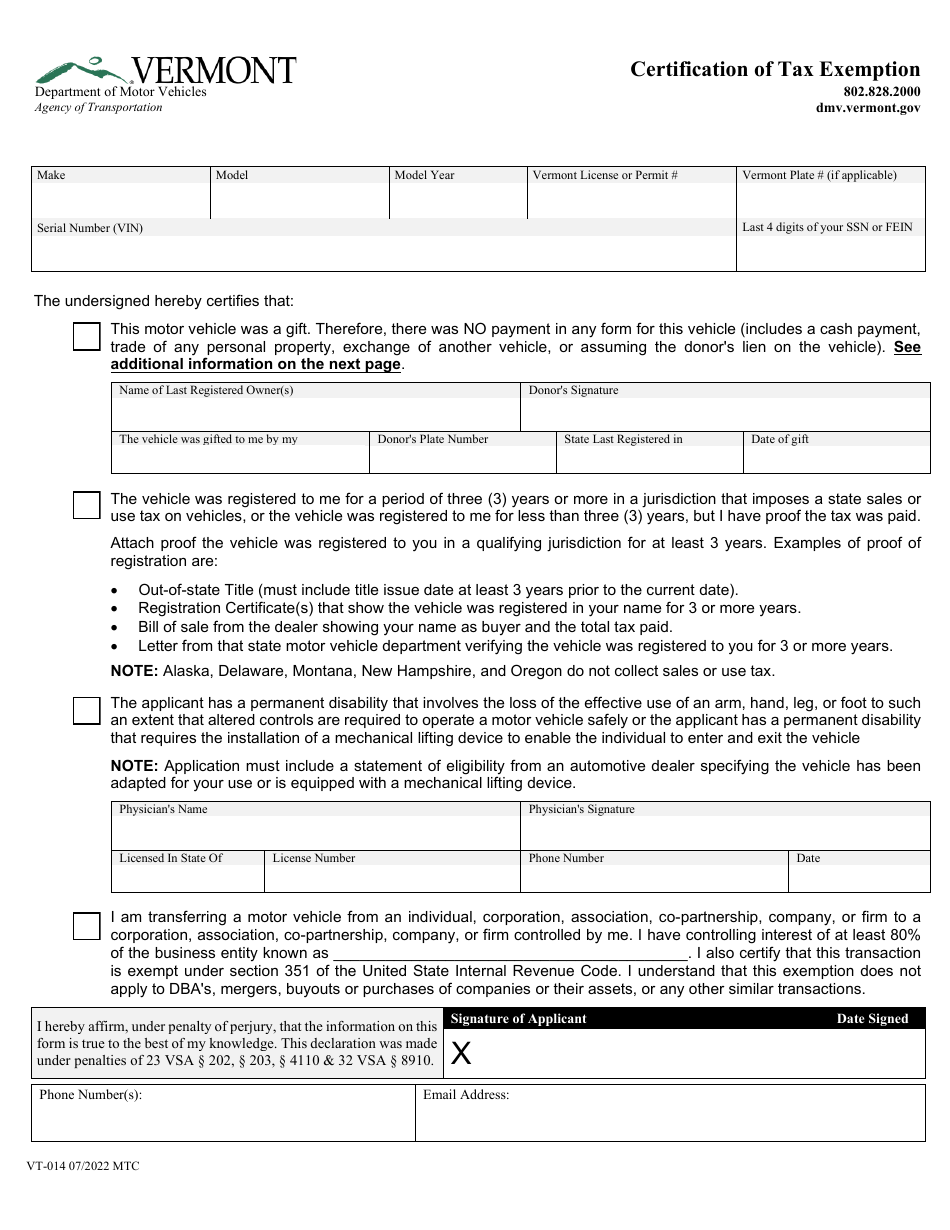

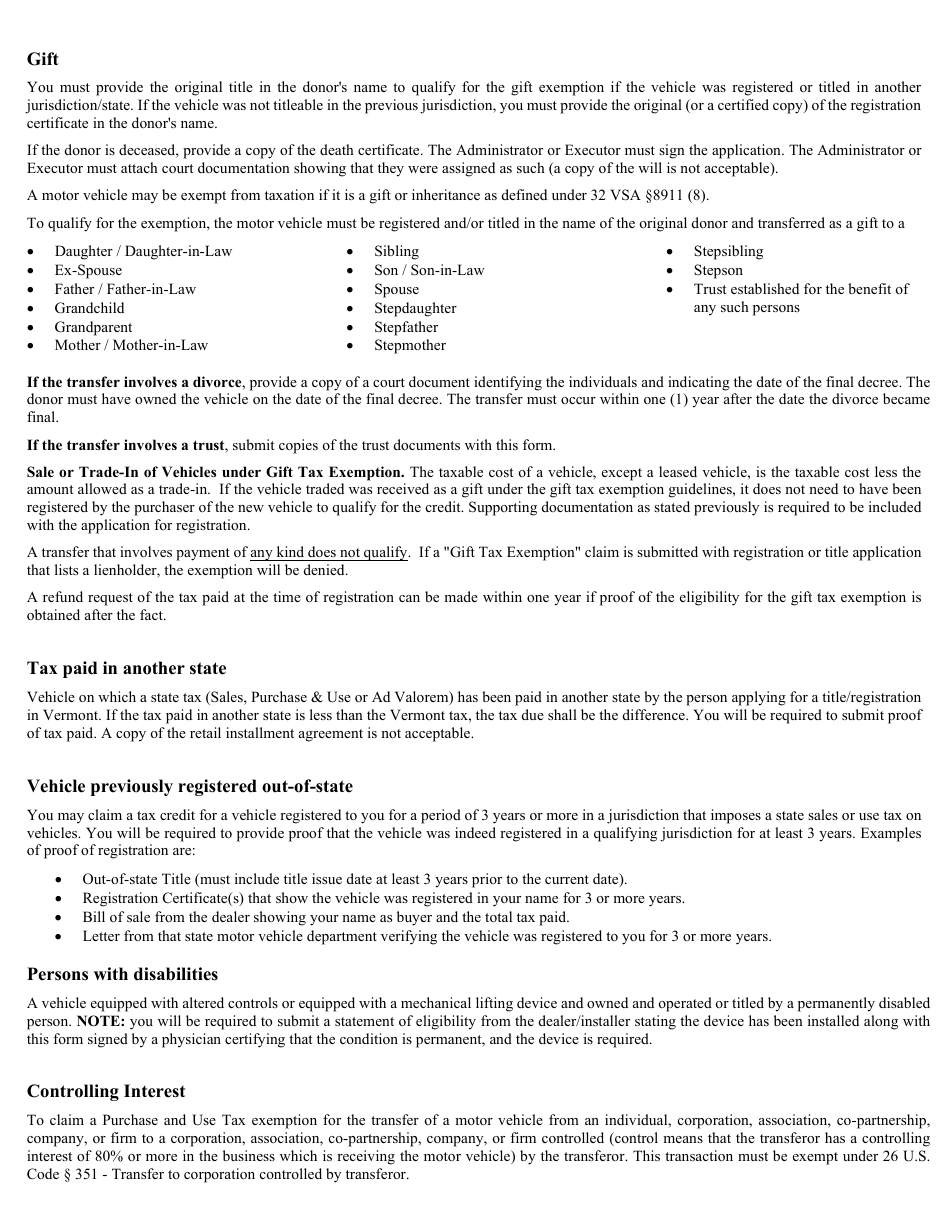

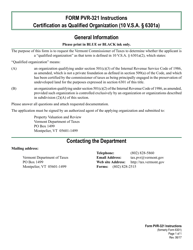

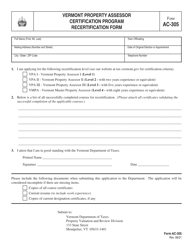

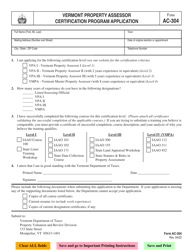

Form VT-014 Certification of Tax Exemption - Vermont

What Is Form VT-014?

This is a legal form that was released by the Vermont Department of Motor Vehicles - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form VT-014?

A: Form VT-014 is the Certification of Tax Exemption form used in Vermont.

Q: What is the purpose of Form VT-014?

A: The purpose of Form VT-014 is to certify that an organization qualifies for tax exemption in Vermont.

Q: Who is required to file Form VT-014?

A: Nonprofit organizations that seek tax exemption in Vermont are required to file Form VT-014.

Q: What information is required on Form VT-014?

A: Form VT-014 requires information about the organization, its activities, and its qualifications for tax exemption.

Q: Are there any filing fees for Form VT-014?

A: No, there are no filing fees for Form VT-014.

Q: How often do I need to file Form VT-014?

A: Form VT-014 needs to be filed initially to apply for tax exemption, and then every five years to maintain the tax-exempt status.

Q: Is Form VT-014 confidential?

A: No, Form VT-014 is considered public record and may be subject to public disclosure.

Q: What should I do if there are changes to the organization's tax-exempt status?

A: If there are changes to the organization's tax-exempt status, a new Form VT-014 must be filed to update the information.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Vermont Department of Motor Vehicles;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form VT-014 by clicking the link below or browse more documents and templates provided by the Vermont Department of Motor Vehicles.