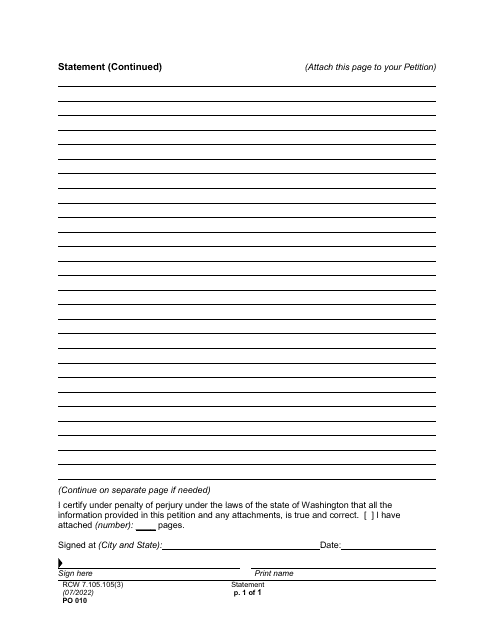

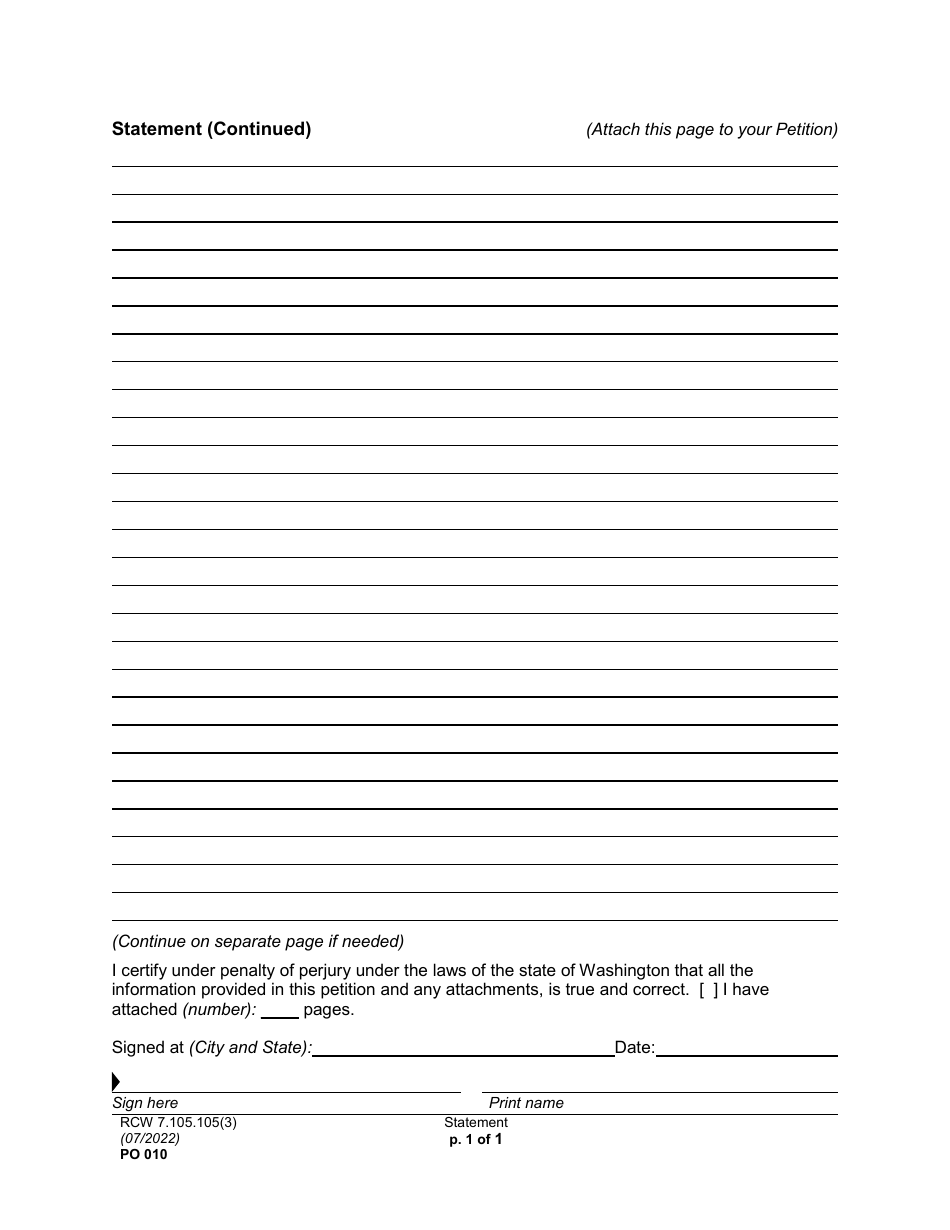

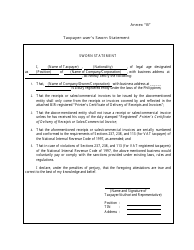

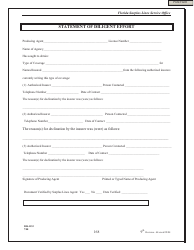

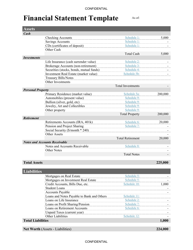

Form PO010 Statement - Washington

What Is Form PO010?

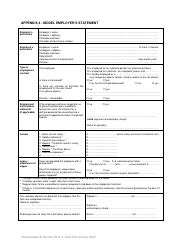

This is a legal form that was released by the Washington State Courts - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PO010 Statement?

A: Form PO010 Statement is a document related to tax filings in the state of Washington.

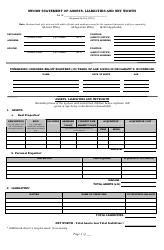

Q: What does Form PO010 Statement cover?

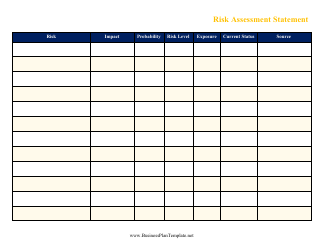

A: Form PO010 Statement covers a variety of tax-related information for businesses.

Q: Who needs to file Form PO010 Statement?

A: Businesses operating in Washington may need to file Form PO010 Statement.

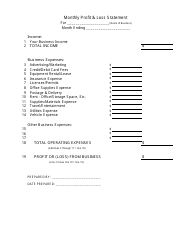

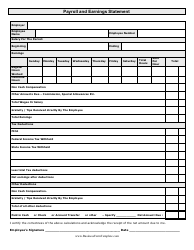

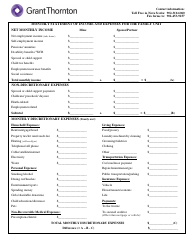

Q: What information does Form PO010 Statement require?

A: Form PO010 Statement requires information such as gross income, deductions, and tax credits.

Q: When is the deadline to file Form PO010 Statement?

A: The deadline to file Form PO010 Statement varies depending on the reporting period. It is typically due on a monthly or quarterly basis.

Q: What are the consequences of not filing Form PO010 Statement?

A: Failure to file Form PO010 Statement may result in penalties and interest.

Q: Is Form PO010 Statement the same as federal tax forms?

A: No, Form PO010 Statement is specific to Washington state tax requirements and is separate from federal tax forms.

Q: Are there any exemptions or credits available on Form PO010 Statement?

A: Yes, there may be exemptions and credits available on Form PO010 Statement. Consult the instructions or a tax professional for more information.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Washington State Courts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PO010 by clicking the link below or browse more documents and templates provided by the Washington State Courts.