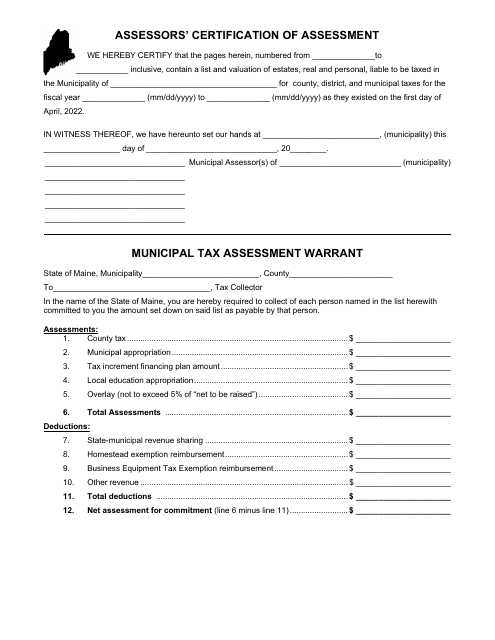

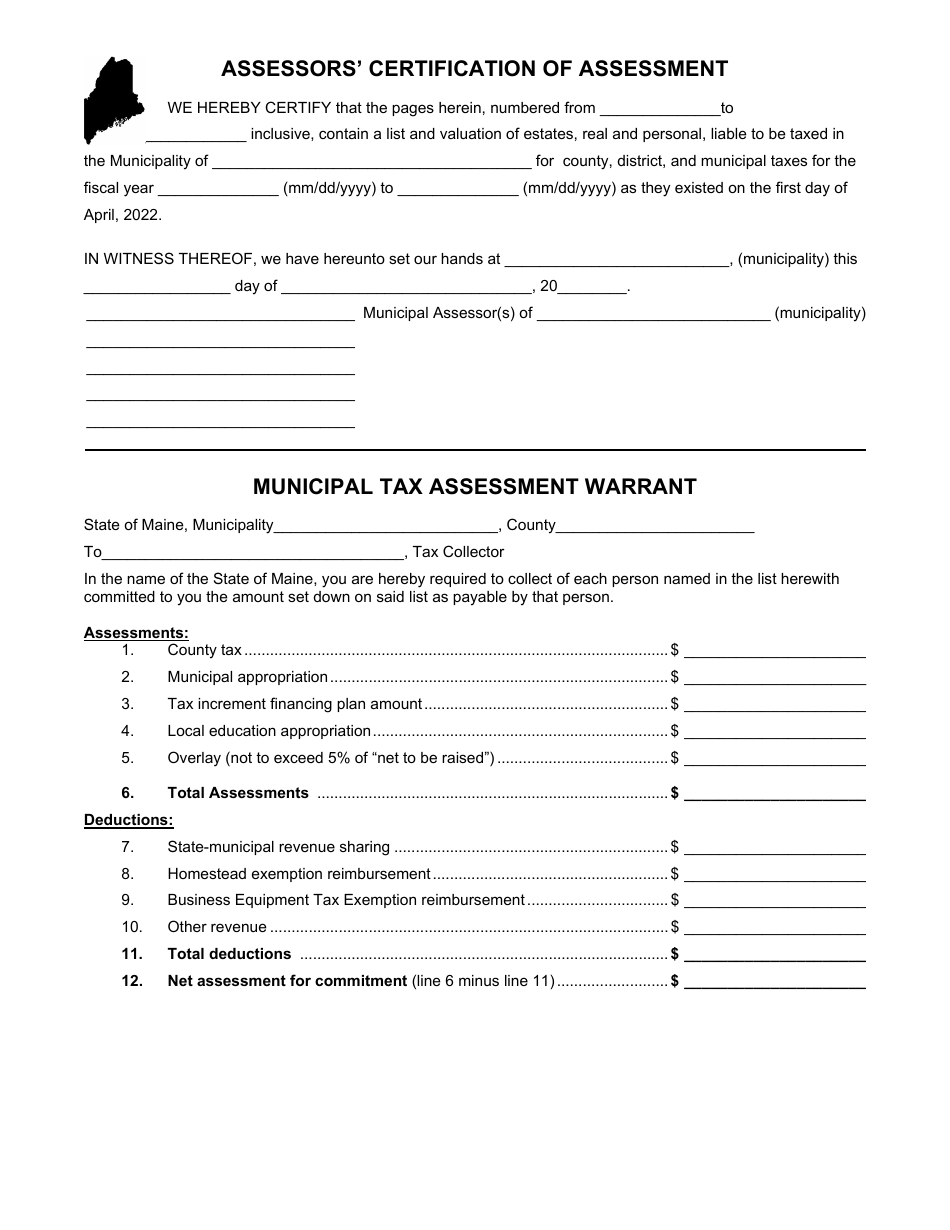

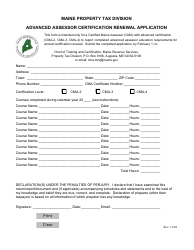

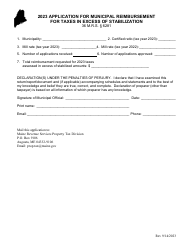

Assessors' Certification of Assessment and Municipal Tax Assessment Warrant - Maine

Assessors' Certification of Assessment and Municipal Tax Assessment Warrant is a legal document that was released by the Maine Revenue Services - a government authority operating within Maine.

FAQ

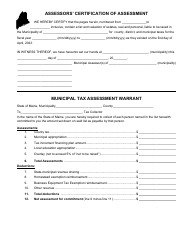

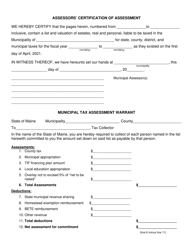

Q: What is the Assessors' Certification of Assessment?

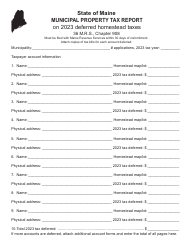

A: The Assessors' Certification of Assessment is a document that certifies the assessed value of a property for tax purposes.

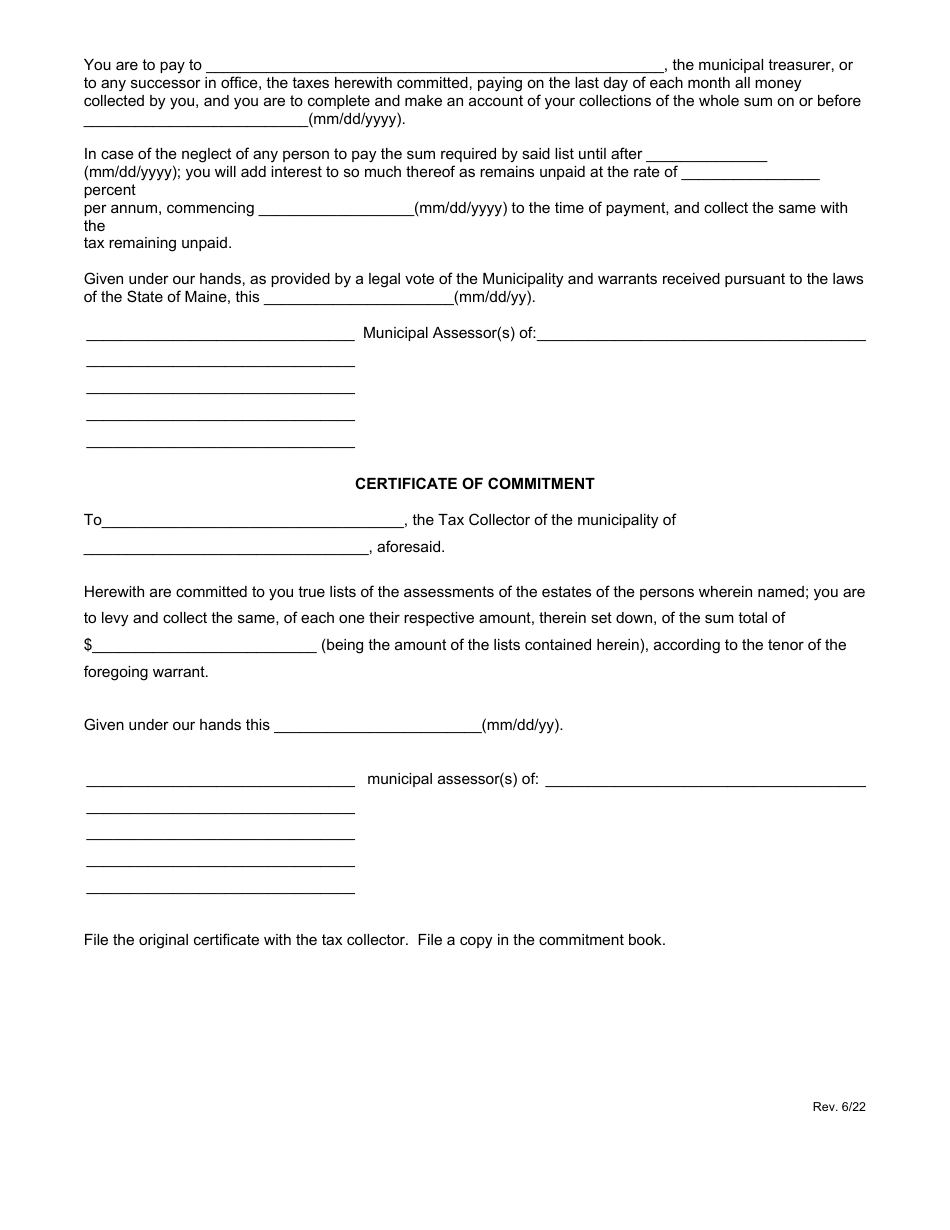

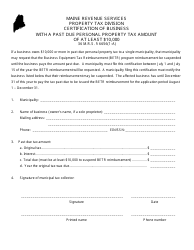

Q: What is the Municipal Tax Assessment Warrant?

A: The Municipal Tax Assessment Warrant is a document that authorizes the collection of property taxes by the municipal government.

Q: Who issues the Assessors' Certification of Assessment?

A: The Assessors' Certification of Assessment is issued by the local tax assessor's office.

Q: What does the Assessors' Certification of Assessment include?

A: The Assessors' Certification of Assessment includes the assessed value of the property, any exemptions or deductions, and the name of the property owner.

Q: What is the purpose of the Municipal Tax Assessment Warrant?

A: The purpose of the Municipal Tax Assessment Warrant is to authorize the collection of property taxes to fund municipal services and operations.

Q: Who is responsible for collecting property taxes?

A: The municipal government is responsible for collecting property taxes.

Q: What happens if property taxes are not paid?

A: If property taxes are not paid, the municipality may initiate legal proceedings to collect the unpaid taxes, which can result in penalties, interest, or even the sale of the property.

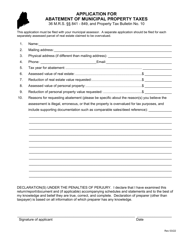

Q: Can property tax assessments be appealed?

A: Yes, property tax assessments can be appealed. Property owners have the right to challenge the assessed value of their property if they believe it is inaccurate or unfair.

Q: How can property owners appeal a tax assessment?

A: Property owners can typically appeal a tax assessment by filing an appeal with the local tax assessor's office or the local board of assessment review.

Q: Is there a deadline to file a tax assessment appeal?

A: Yes, there is usually a deadline to file a tax assessment appeal. Property owners should check with their local tax assessor's office for the specific deadline.

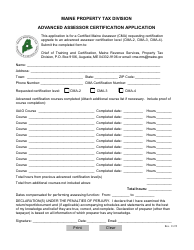

Form Details:

- Released on June 1, 2022;

- The latest edition currently provided by the Maine Revenue Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Revenue Services.