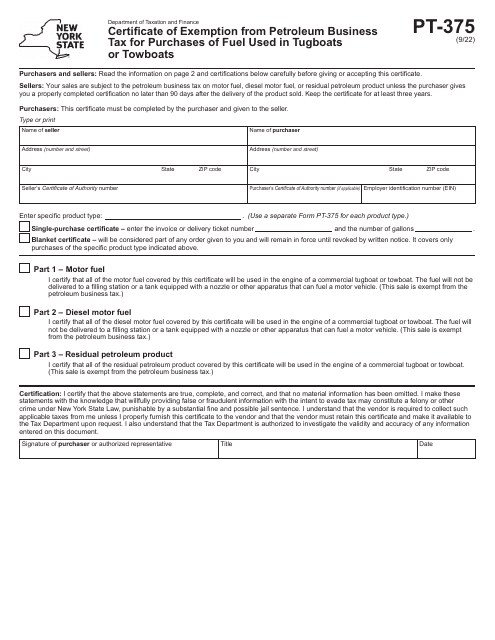

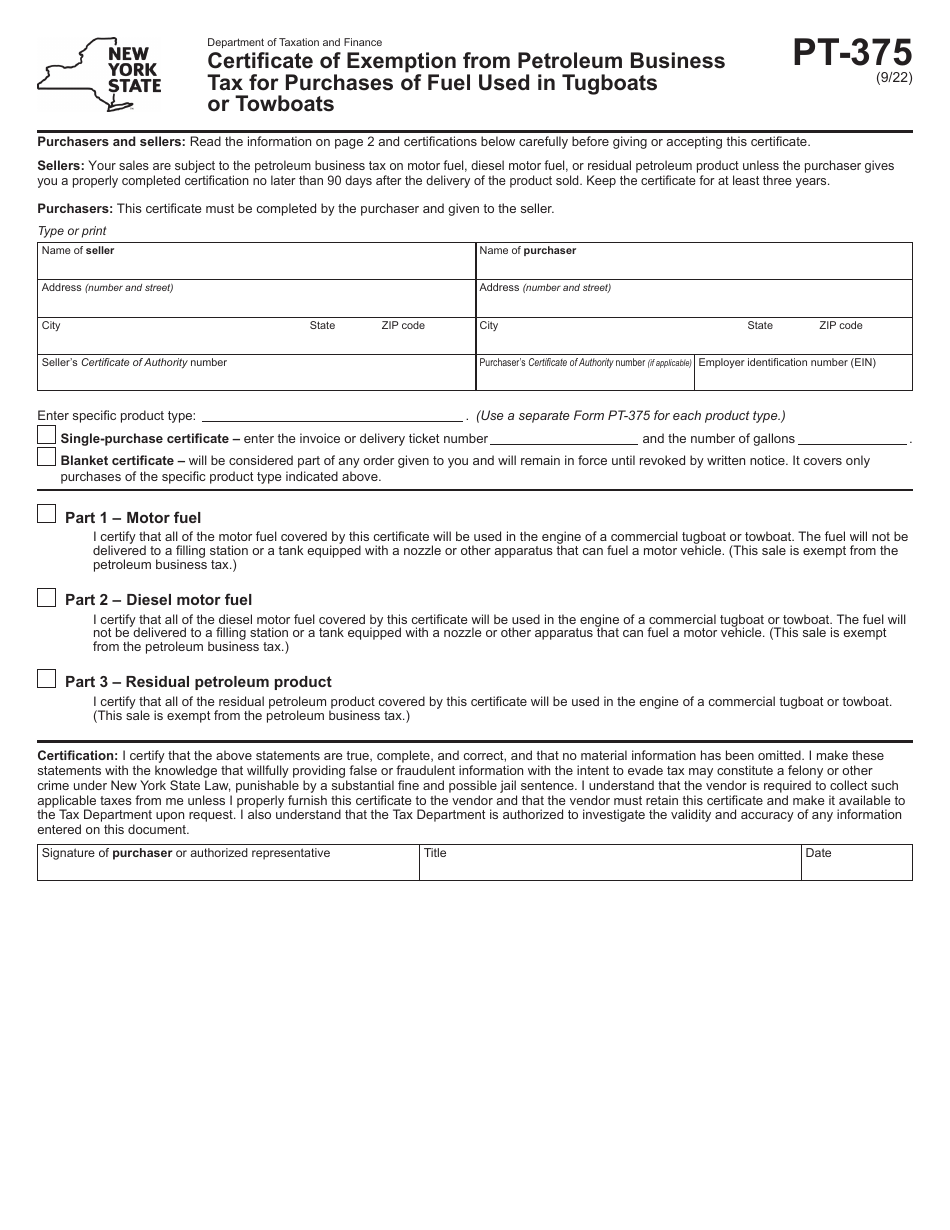

Form PT-375 Certificate of Exemption From Petroleum Business Tax for Purchases of Fuel Used in Tugboats or Towboats - New York

What Is Form PT-375?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PT-375?

A: Form PT-375 is the Certificate of Exemption From Petroleum Business Tax for Purchases of Fuel Used in Tugboats or Towboats.

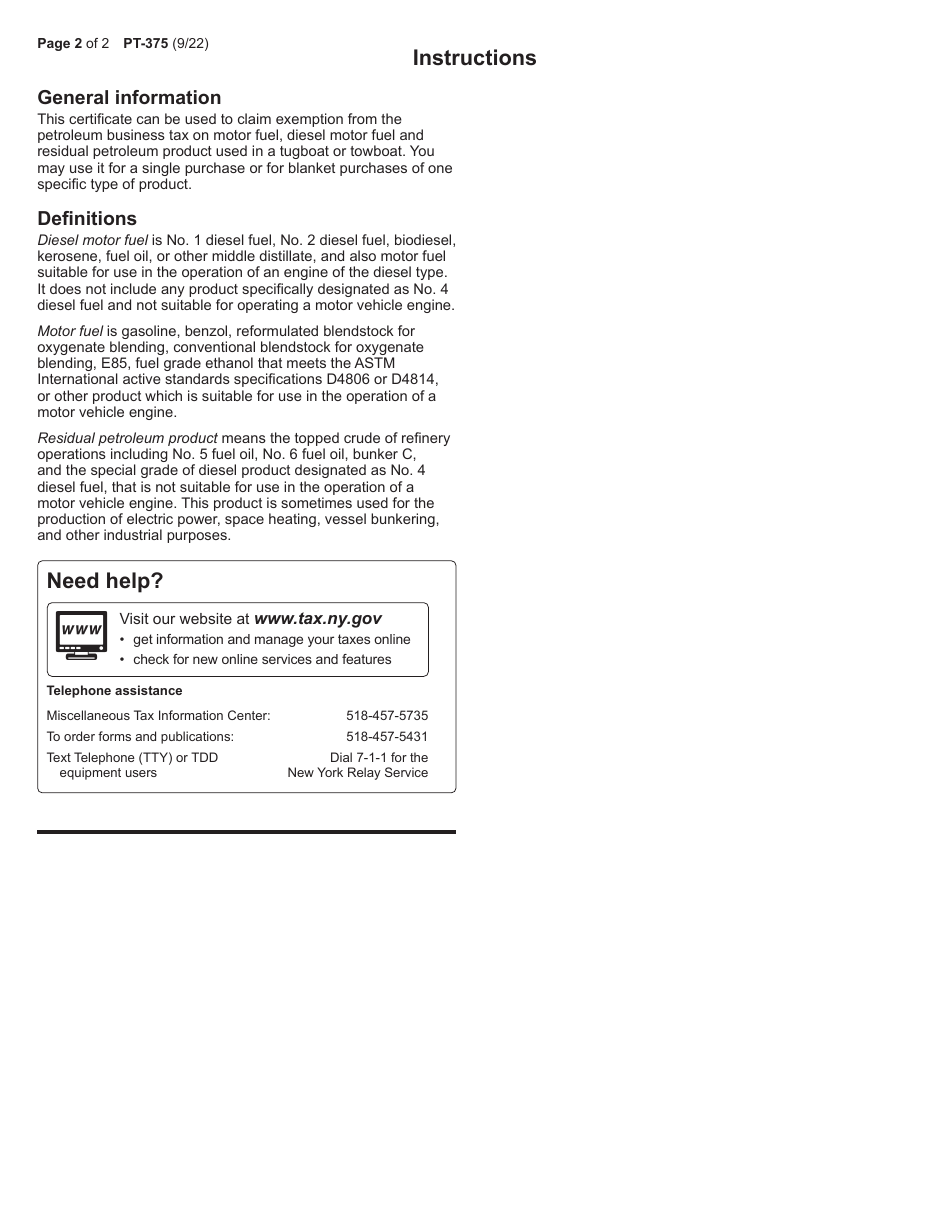

Q: What is the purpose of Form PT-375?

A: The purpose of Form PT-375 is to claim an exemption from the Petroleum Business Tax when purchasing fuel for use in tugboats or towboats.

Q: Who is eligible to use Form PT-375?

A: Owners or operators of tugboats or towboats in New York may be eligible to use Form PT-375.

Q: What is the benefit of using Form PT-375?

A: Using Form PT-375 allows for an exemption from the Petroleum Business Tax, resulting in potential cost savings for purchasing fuel for tugboats or towboats.

Q: Are there any requirements or conditions for using Form PT-375?

A: Yes, there are specific requirements and conditions that must be met in order to use Form PT-375. These include providing accurate information about the tugboat or towboat, the type of fuel being purchased, and the intended use of the fuel.

Q: Is there a deadline for submitting Form PT-375?

A: There is no specific deadline for submitting Form PT-375, but it is recommended to submit the form as soon as possible to ensure the exemption is applied to eligible fuel purchases.

Q: What should I do if I have questions or need assistance with Form PT-375?

A: If you have questions or need assistance with Form PT-375, you can reach out to the New York State Department of Taxation and Finance for guidance.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PT-375 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.