This version of the form is not currently in use and is provided for reference only. Download this version of

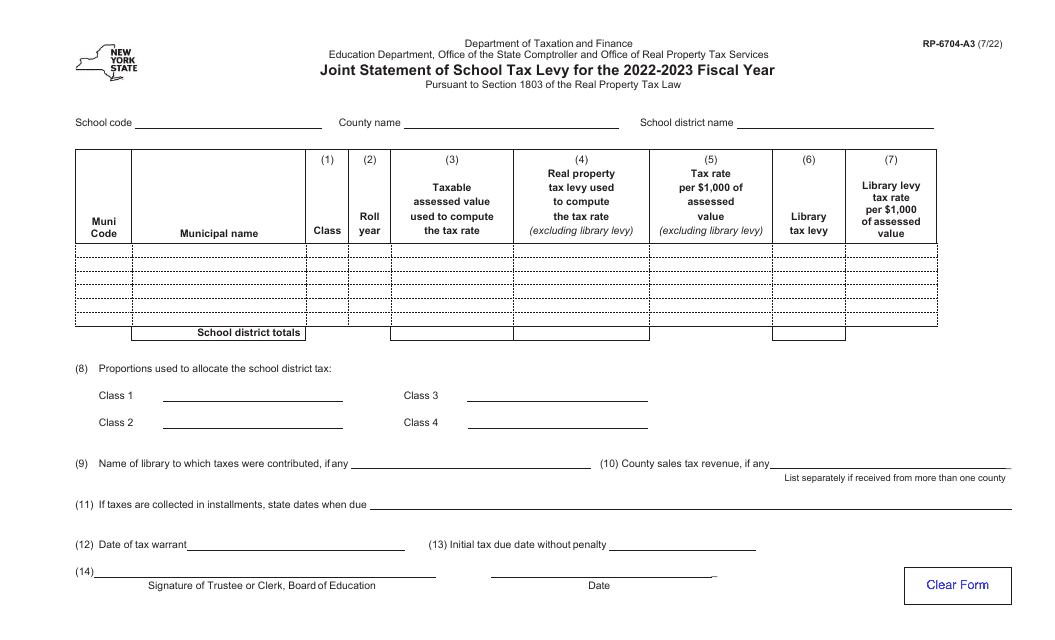

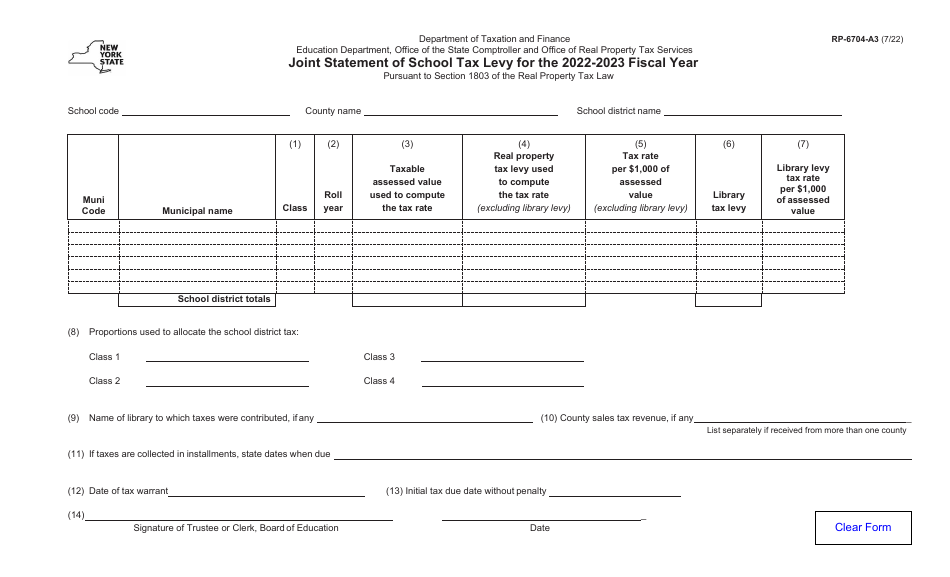

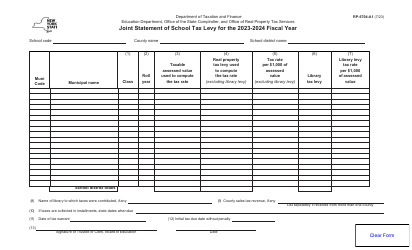

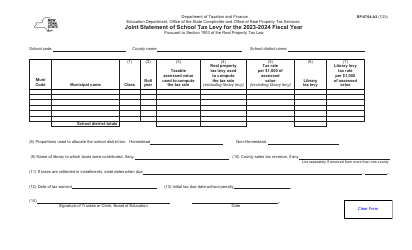

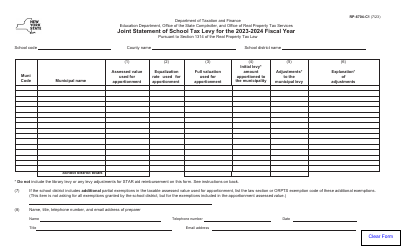

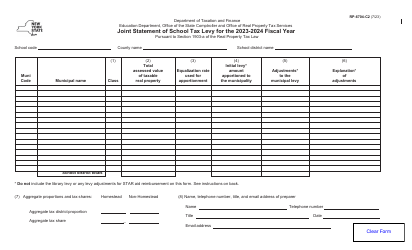

Form RP-6704-A3

for the current year.

Form RP-6704-A3 Joint Statement of School Tax Levy - New York

What Is Form RP-6704-A3?

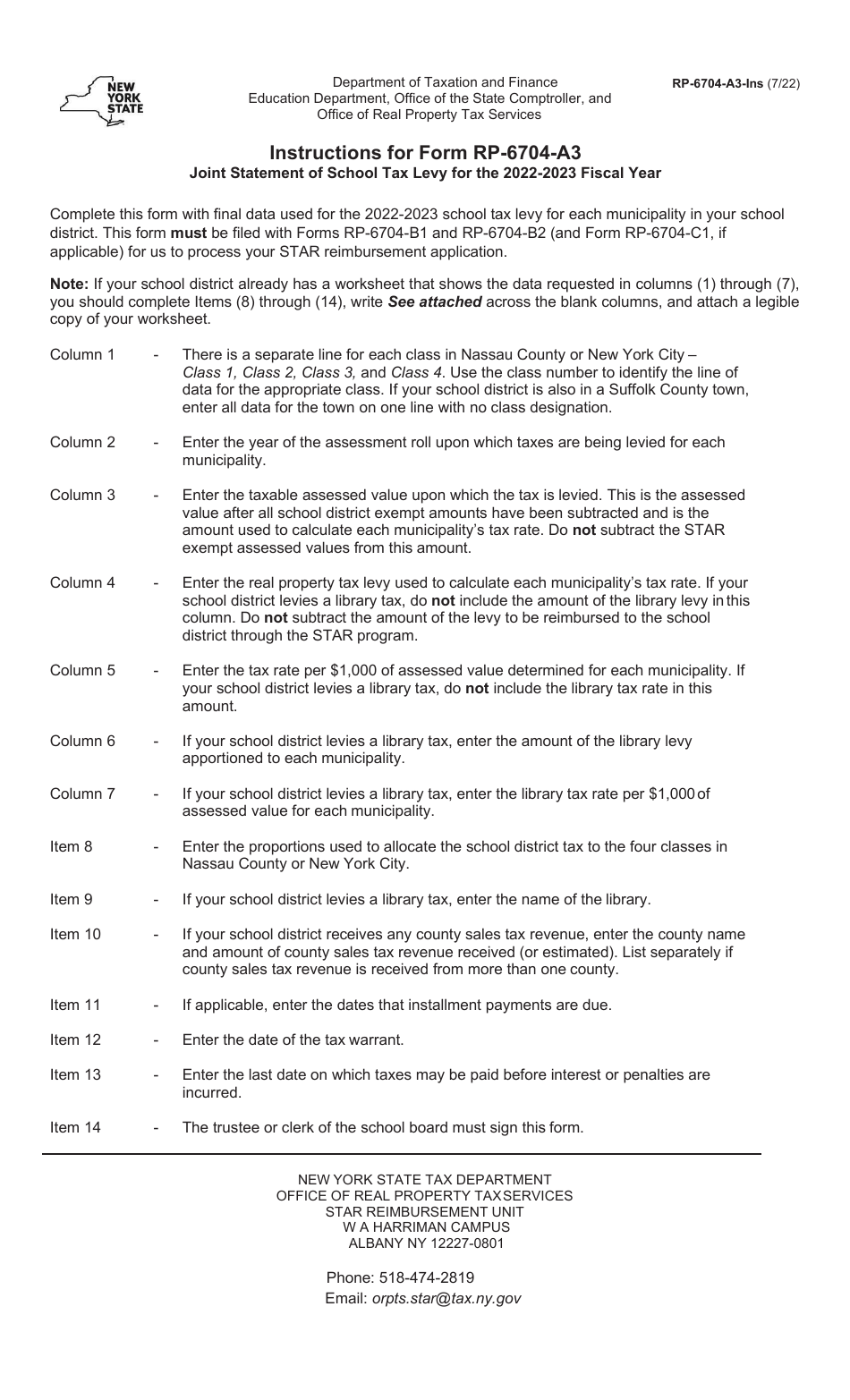

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-6704-A3?

A: Form RP-6704-A3 is the Joint Statement of School Tax Levy for properties in New York.

Q: Who needs to file Form RP-6704-A3?

A: Property owners in New York who are subject to school tax levy need to file Form RP-6704-A3.

Q: What is the purpose of Form RP-6704-A3?

A: The purpose of Form RP-6704-A3 is to report the school tax levy and distribute it among the taxing jurisdictions.

Q: When is Form RP-6704-A3 due?

A: Form RP-6704-A3 is typically due on or before the 30th day after the date the tax roll was filed or the date of final approval of the roll.

Q: Are there any penalties for not filing Form RP-6704-A3?

A: Yes, there may be penalties for late or non-filing of Form RP-6704-A3. It is important to file the form on time to avoid any penalties or interest charges.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-6704-A3 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.