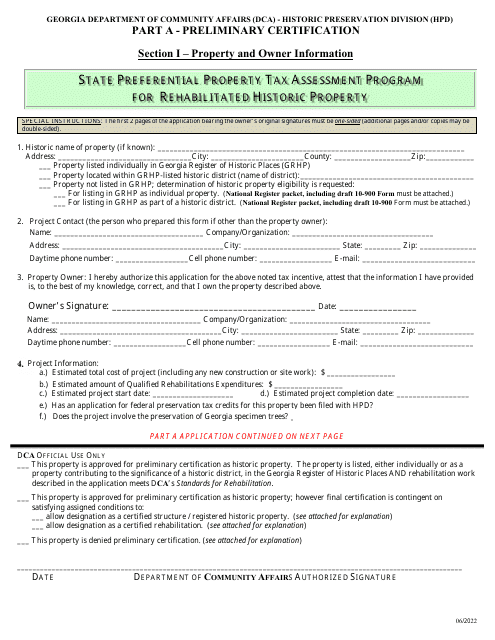

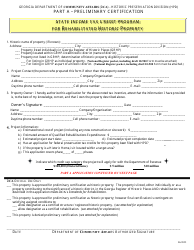

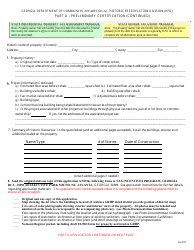

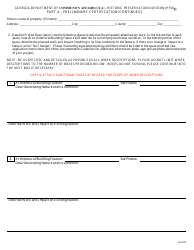

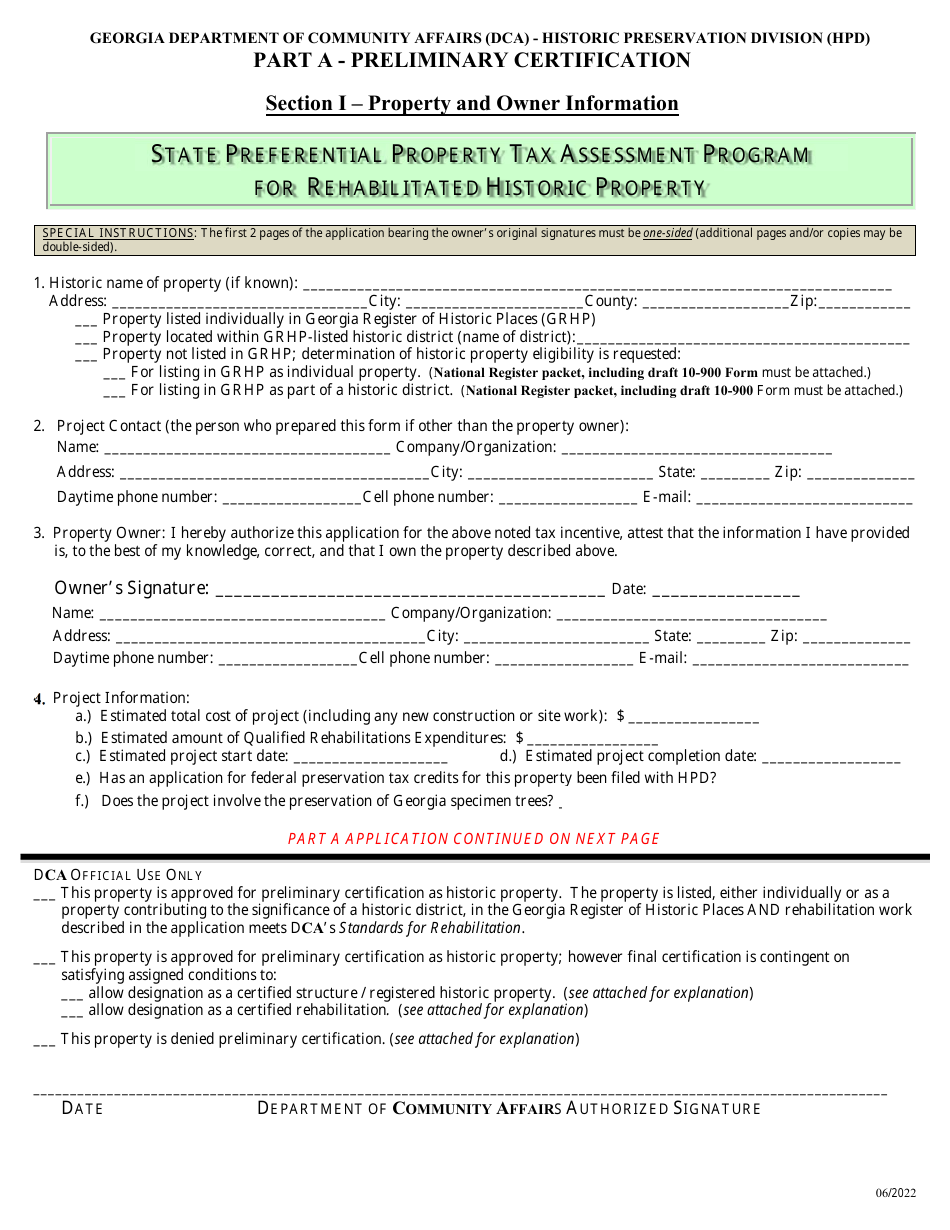

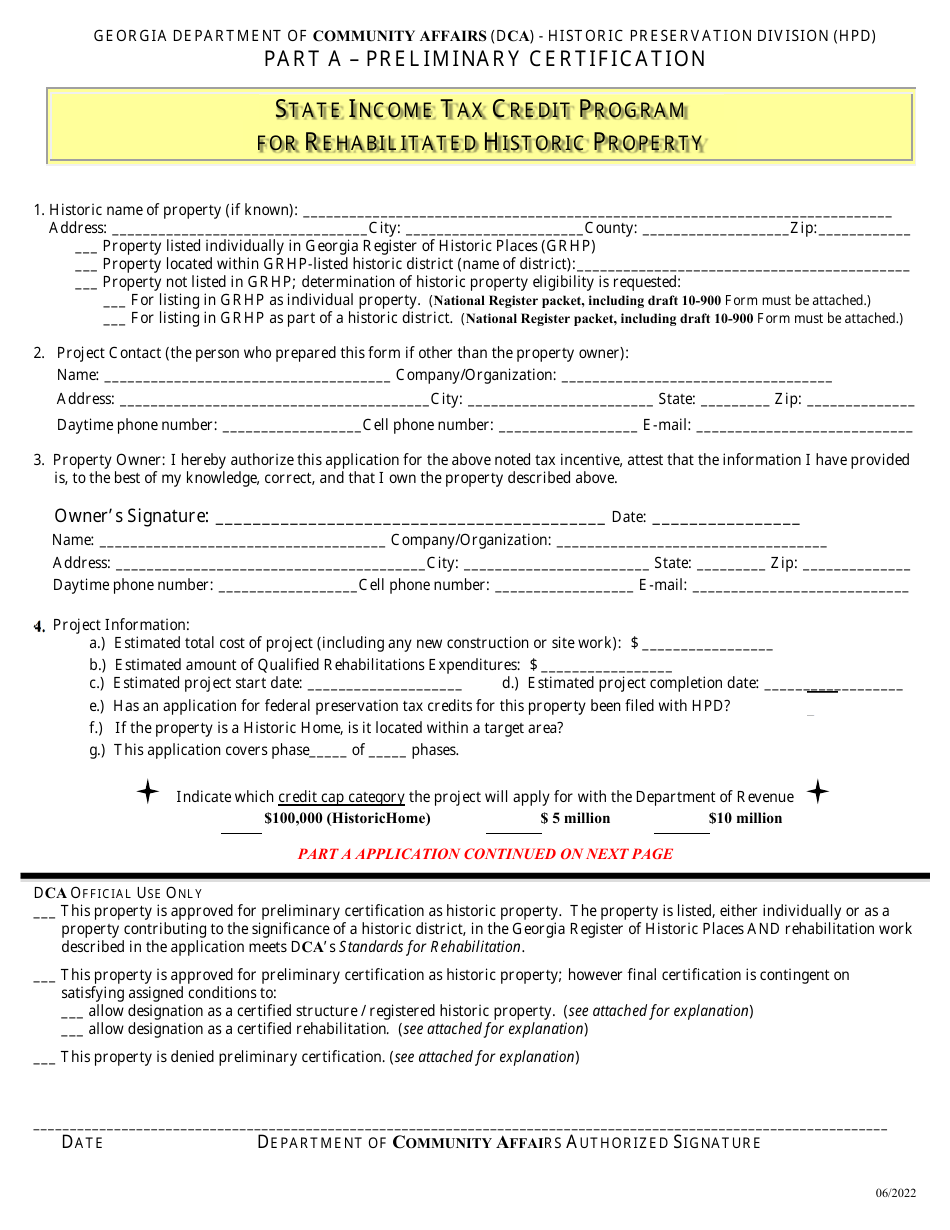

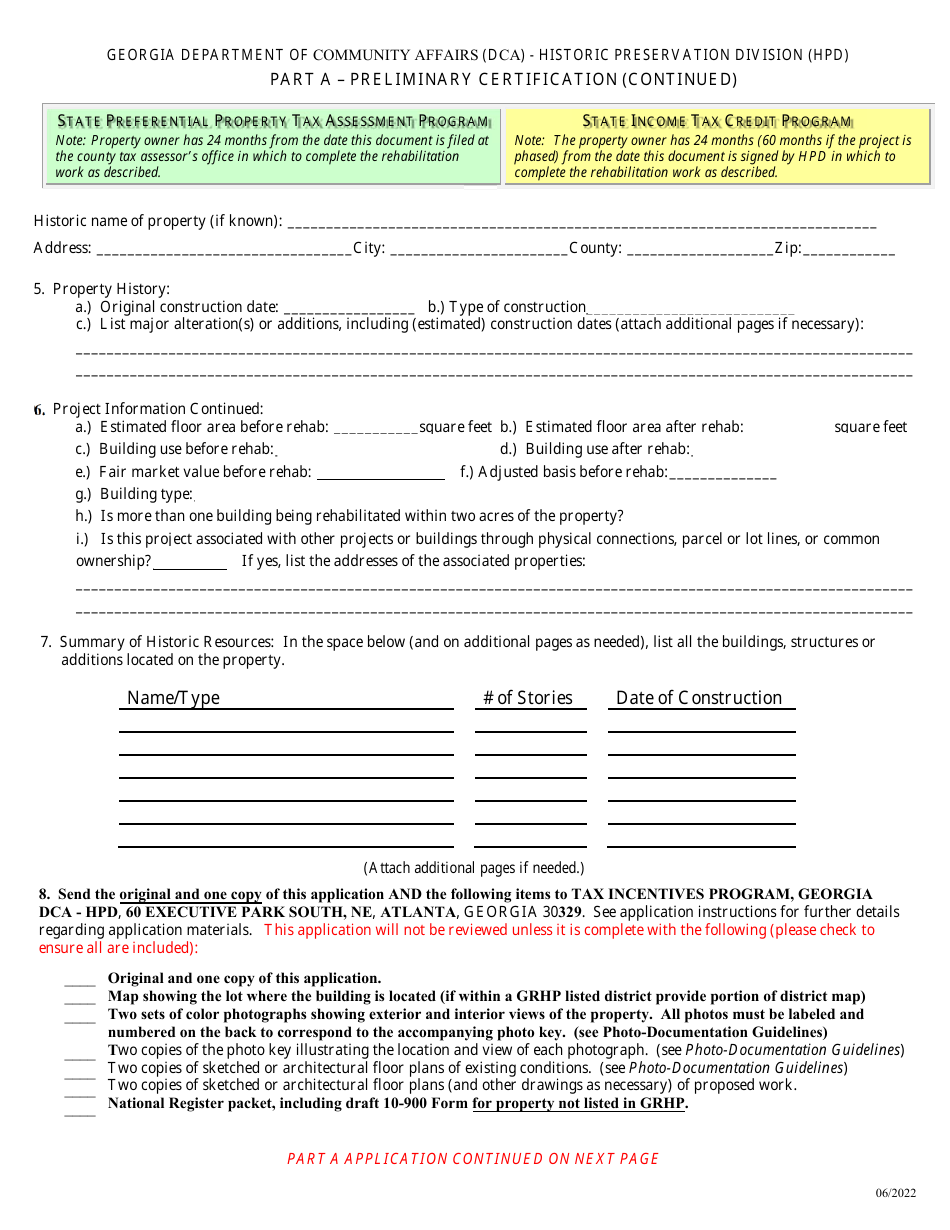

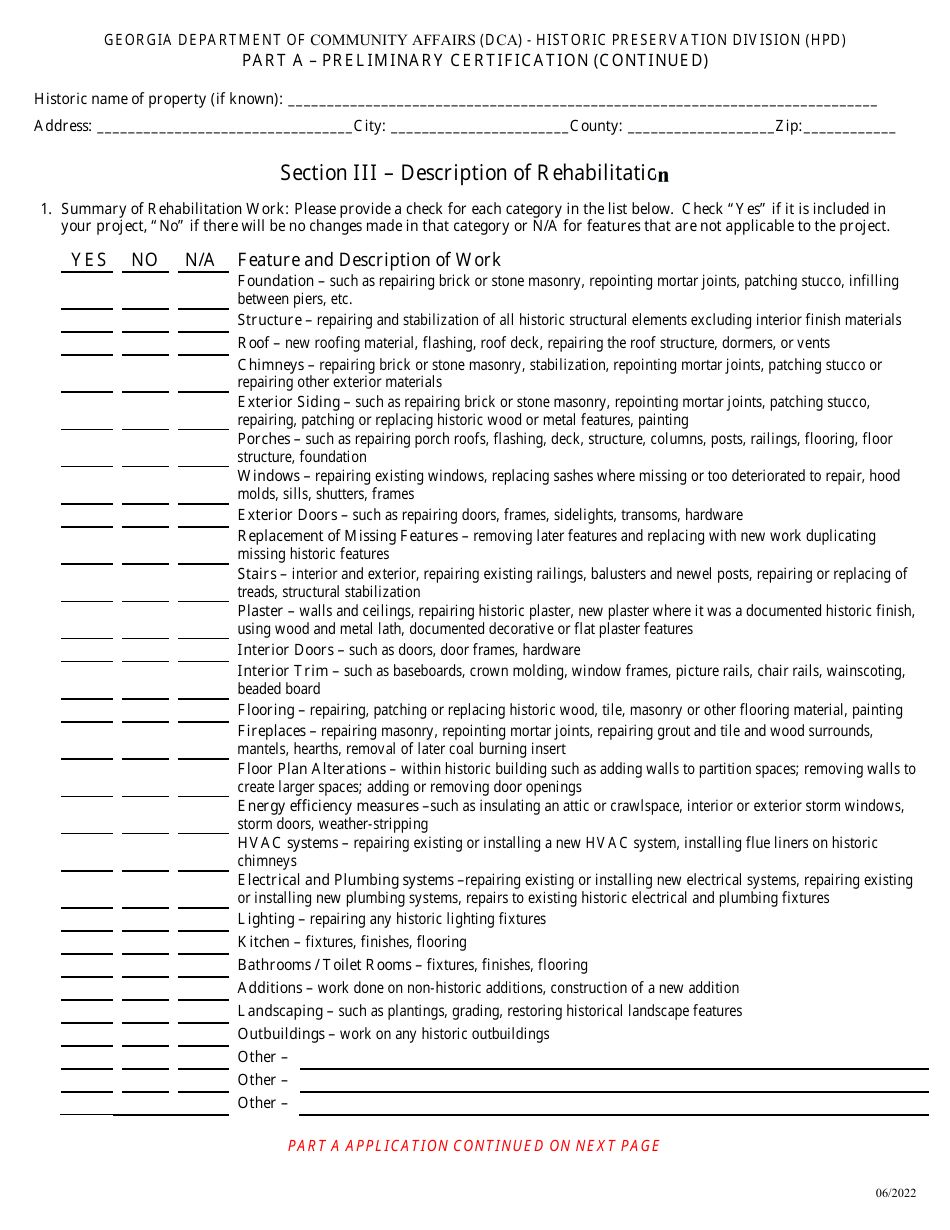

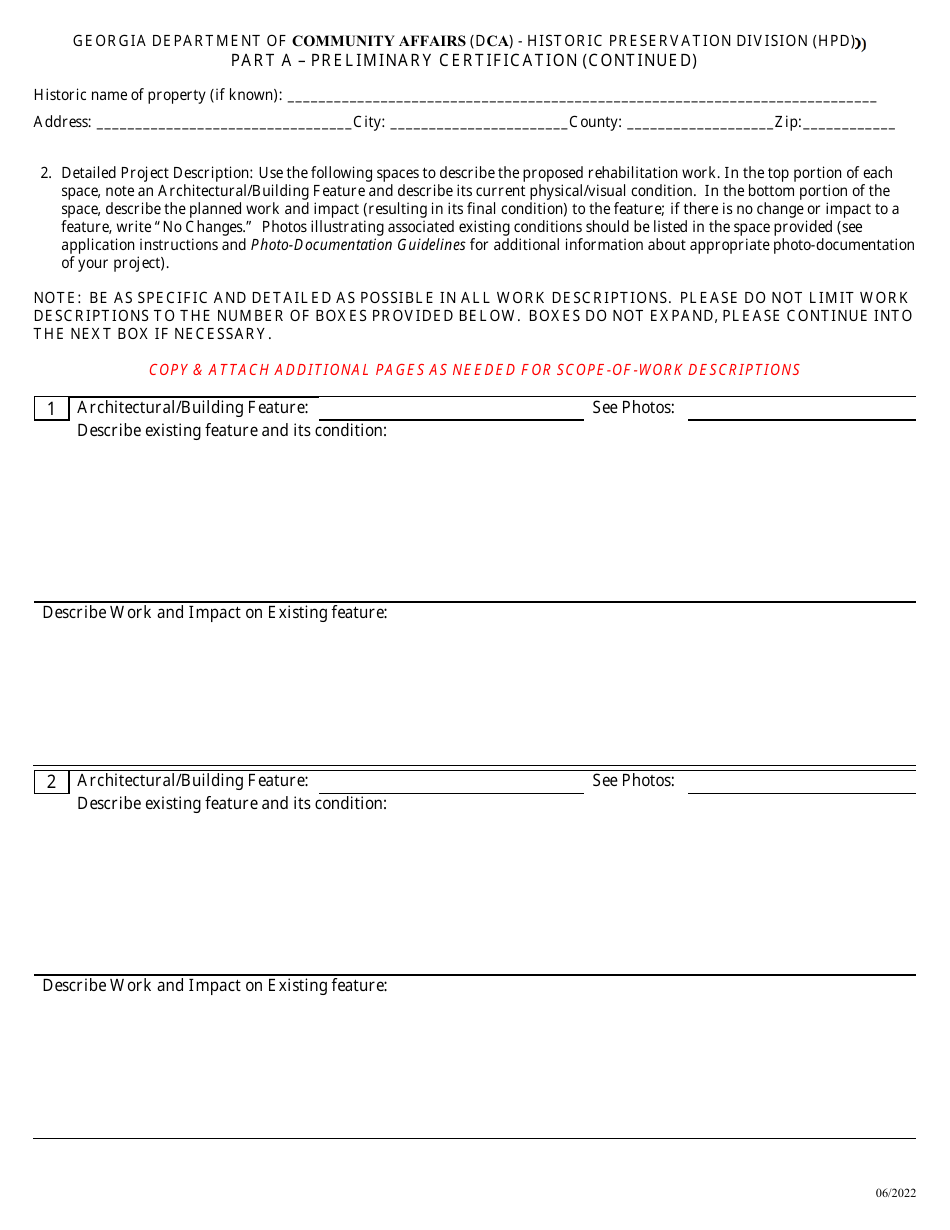

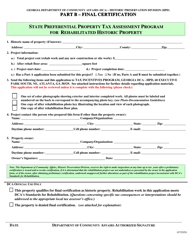

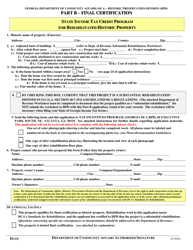

Part A Preliminary Certification - State Preferential Property Tax Assessment Program for Rehabilitated Historic Property - Georgia (United States)

What Is Part A?

This is a legal form that was released by the Georgia Department of Community Affairs - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Part A Preliminary Certification?

A: Part A Preliminary Certification is a state preferential property tax assessment program for rehabilitated historic property in Georgia.

Q: What is the purpose of the program?

A: The program aims to encourage the rehabilitation and preservation of historic properties by offering tax incentives.

Q: Who is eligible for Part A Preliminary Certification?

A: Owners of historic properties in Georgia who intend to rehabilitate them are eligible for Part A Preliminary Certification.

Q: What are the benefits of Part A Preliminary Certification?

A: The benefits include preferential property tax assessments, which can result in significant tax savings for property owners.

Q: How does the program work?

A: Owners of historic properties must apply for Part A Preliminary Certification before starting the rehabilitation work. Once certified, they can benefit from property tax incentives.

Q: What is a preferential property tax assessment?

A: A preferential property tax assessment is a reduced valuation placed on a property for tax purposes, resulting in lower property tax payments.

Q: Is there a specific time limit for completing the rehabilitation work?

A: Yes, owners must complete the rehabilitation work within a specified period of time to maintain the tax incentives.

Q: Can the property owner sell the property after obtaining Part A Preliminary Certification?

A: Yes, the property owner can sell the property, but the new owner must continue the rehabilitation work and meet the program requirements to maintain the tax incentives.

Q: Are there any fees associated with the Part A Preliminary Certification?

A: Yes, there are application and processing fees associated with the certification process.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Georgia Department of Community Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part A by clicking the link below or browse more documents and templates provided by the Georgia Department of Community Affairs.