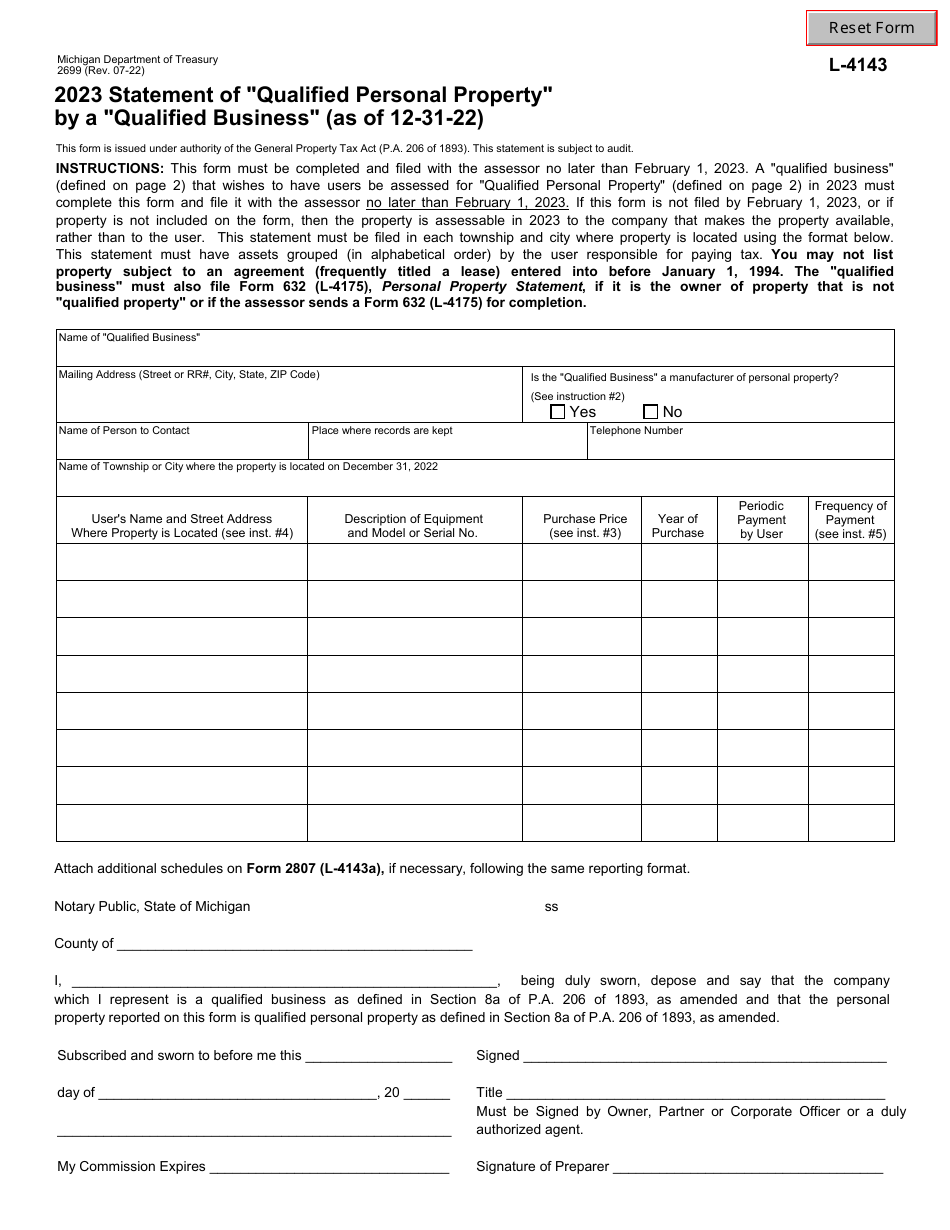

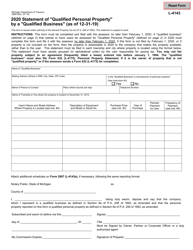

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 2699 (L-4143)

for the current year.

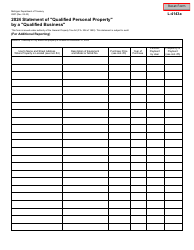

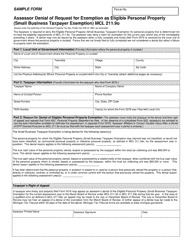

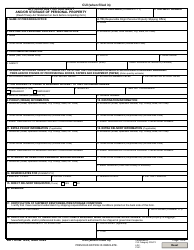

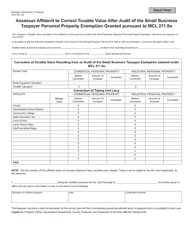

Form 2699 (L-4143) Statement of "qualified Personal Property" by a "qualified Business" - Michigan

What Is Form 2699 (L-4143)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 2699?

A: Form 2699 is the Statement of Qualified Personal Property by a Qualified Business.

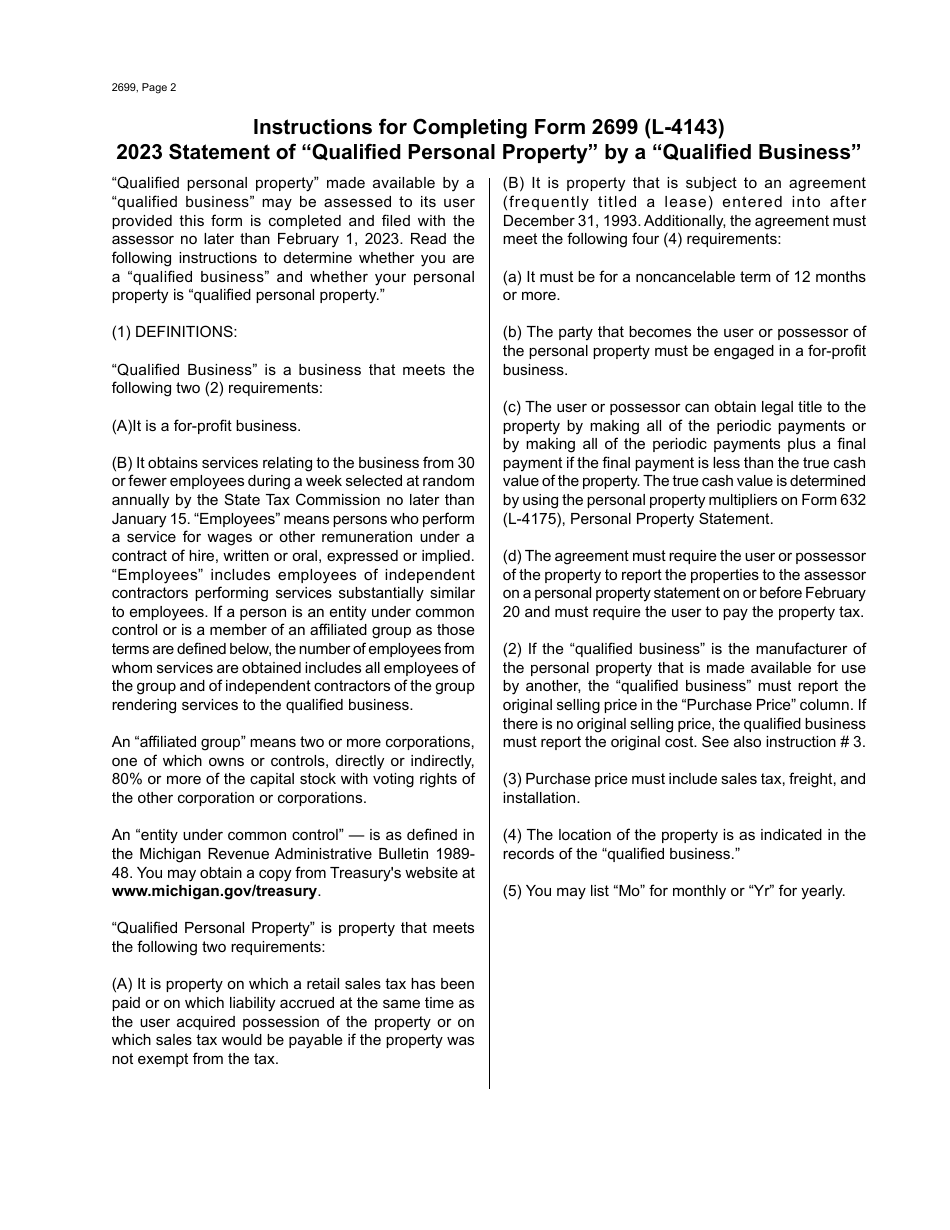

Q: What is qualified personal property?

A: Qualified personal property refers to tangible property owned, leased, or used in a trade or business.

Q: What is a qualified business?

A: A qualified business is a business that meets certain criteria set by the state of Michigan.

Q: What is the purpose of Form 2699?

A: The purpose of Form 2699 is to report the qualified personal property of a qualified business for taxation purposes.

Q: Who needs to file Form 2699?

A: Qualified businesses in Michigan that own or lease tangible personal property used in their trade or business need to file Form 2699.

Q: When is the deadline to file Form 2699?

A: The deadline to file Form 2699 is February 20th of each year.

Q: Is there a fee for filing Form 2699?

A: No, there is no fee for filing Form 2699.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 2699 (L-4143) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.