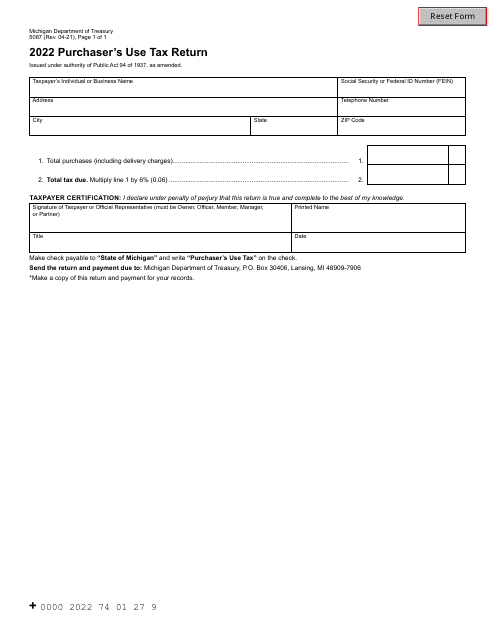

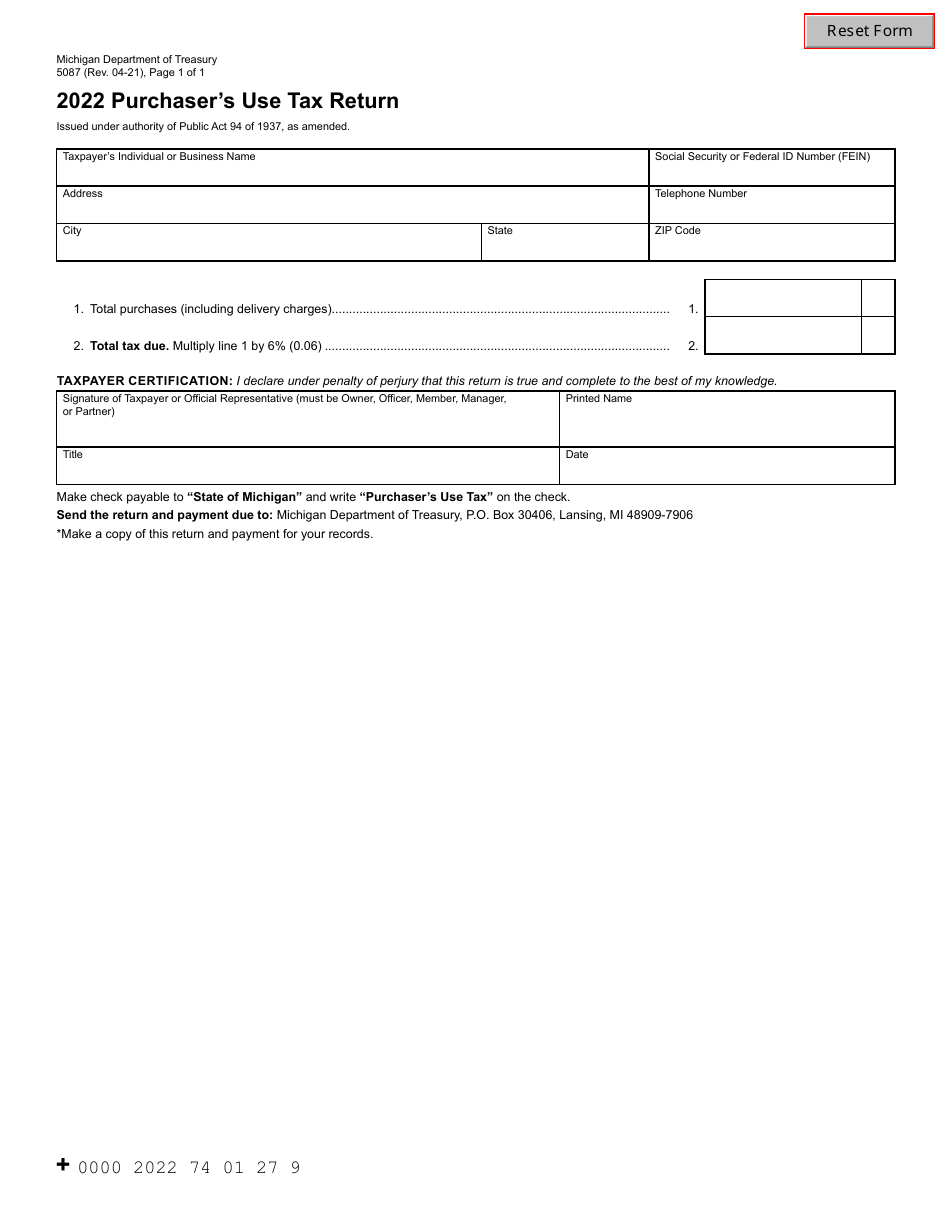

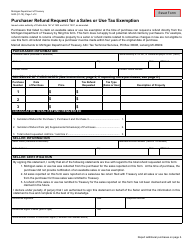

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5087

for the current year.

Form 5087 Purchaser's Use Tax Return - Michigan

What Is Form 5087?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5087?

A: Form 5087 is the Purchaser's Use Tax Return in Michigan.

Q: Who should file Form 5087?

A: Any purchaser in Michigan who has not paid the appropriate sales or use tax at the time of purchase should file Form 5087.

Q: What is use tax?

A: Use tax is a tax on goods purchased for use in Michigan, on which sales tax has not been paid.

Q: When is Form 5087 due?

A: Form 5087 is due on the 20th day of the month following the month in which the purchase was made.

Q: What happens if I don't file a Form 5087?

A: If you do not file a Form 5087 and pay the use tax owed, you may be subject to penalties and interest.

Q: Do I need to keep a copy of Form 5087 for my records?

A: Yes, it is recommended to keep a copy of Form 5087 and any supporting documentation for at least four years.

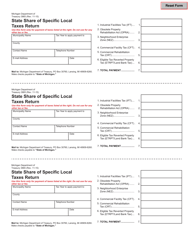

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5087 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.