This version of the form is not currently in use and is provided for reference only. Download this version of

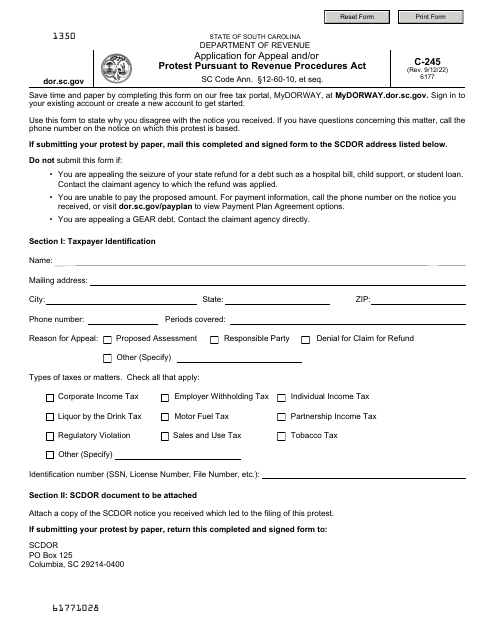

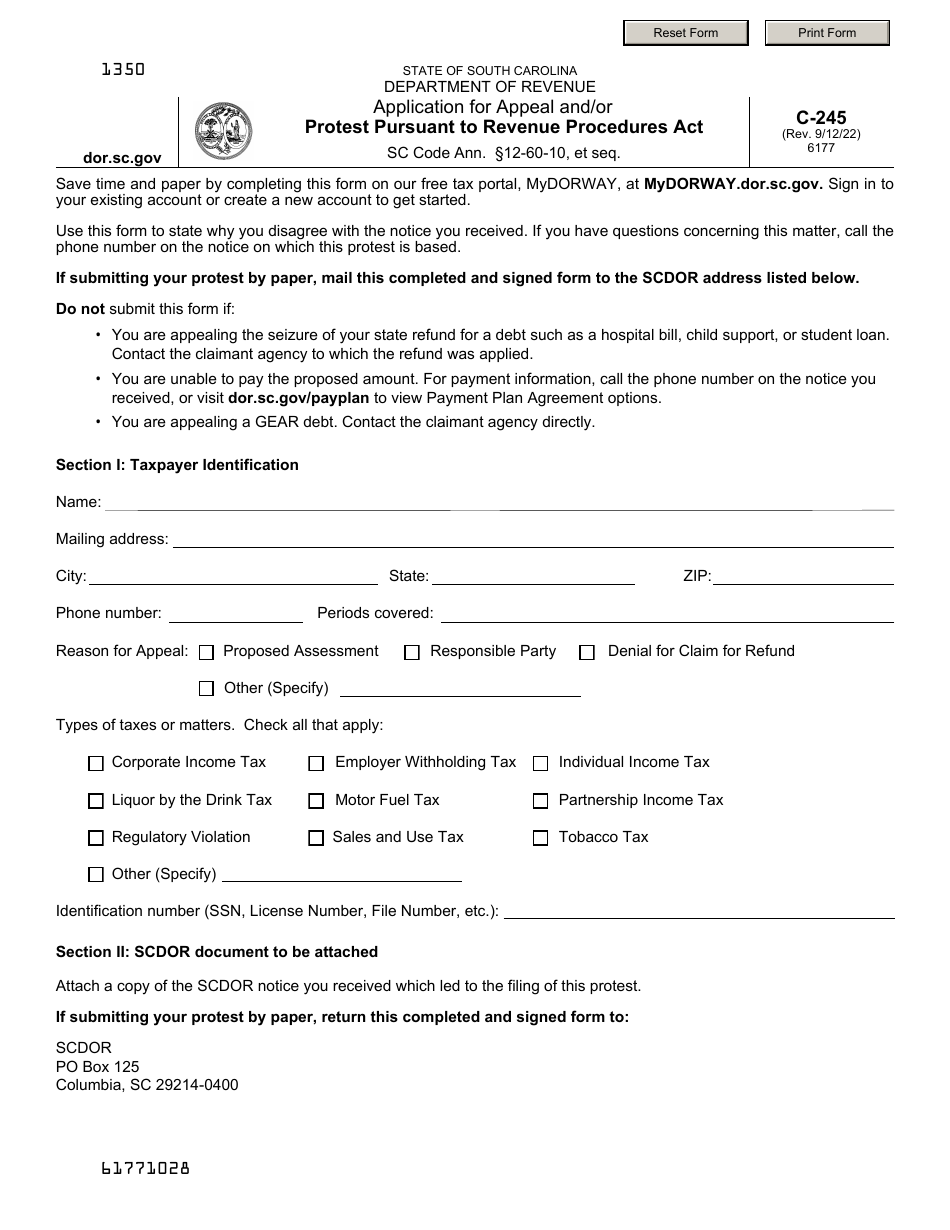

Form C-245

for the current year.

Form C-245 Application for Appeal and / or Protest Pursuant to Revenue Procedures Act - South Carolina

What Is Form C-245?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-245?

A: Form C-245 is an application for appeal and/or protest in South Carolina.

Q: What is the Revenue Procedures Act?

A: The Revenue Procedures Act is a law that governs the process of appealing or protesting tax-related decisions in South Carolina.

Q: What can I use Form C-245 for?

A: You can use Form C-245 to appeal or protest a tax-related decision in South Carolina.

Q: Is there a deadline to submit Form C-245?

A: Yes, there is a deadline to submit Form C-245. The specific deadline will be provided by the South Carolina Department of Revenue.

Q: Can I submit Form C-245 electronically?

A: Yes, you can submit Form C-245 electronically. Check with the South Carolina Department of Revenue for specific instructions on how to do so.

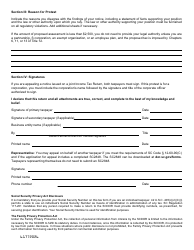

Q: What should I include with my Form C-245?

A: You should include any relevant supporting documentation and a clear explanation of the basis for your appeal or protest.

Q: What happens after I submit Form C-245?

A: After you submit Form C-245, the South Carolina Department of Revenue will review your application and make a decision regarding your appeal or protest.

Q: Can I appeal the decision made by the South Carolina Department of Revenue?

A: Yes, if you disagree with the decision made by the South Carolina Department of Revenue, you may have the option to further appeal.

Form Details:

- Released on September 12, 2022;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-245 by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.