This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

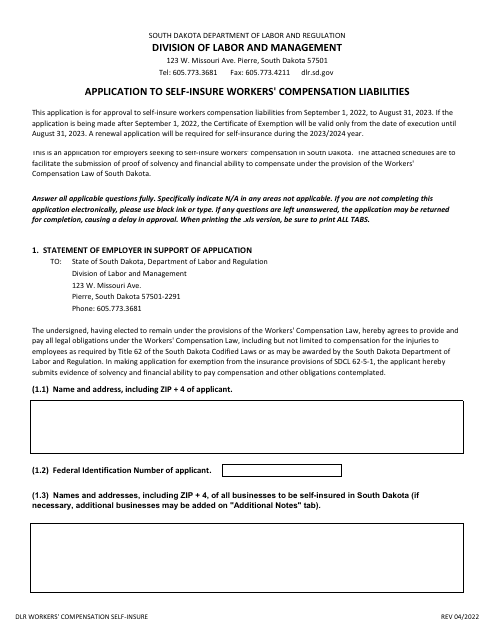

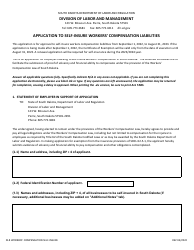

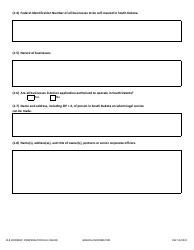

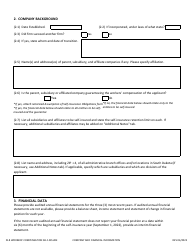

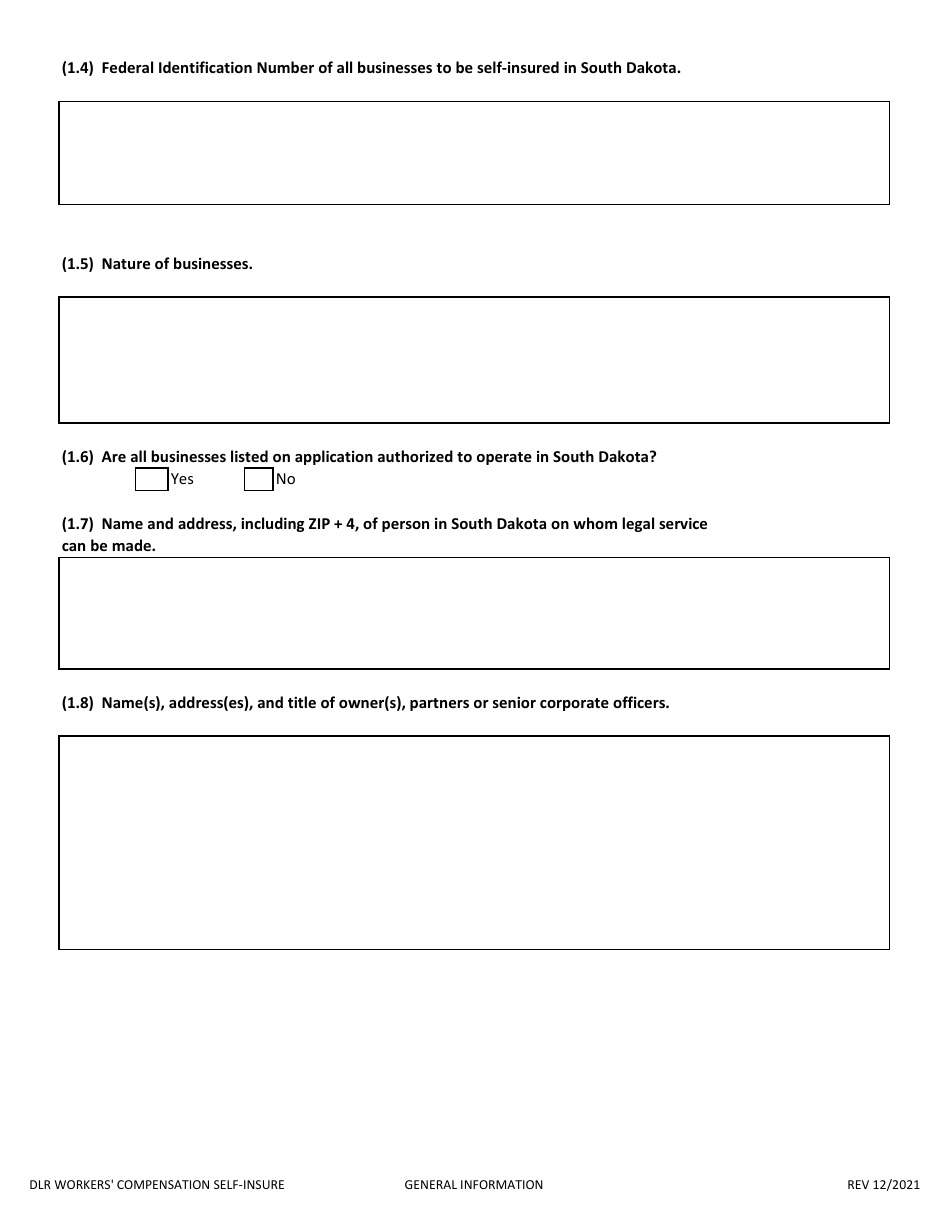

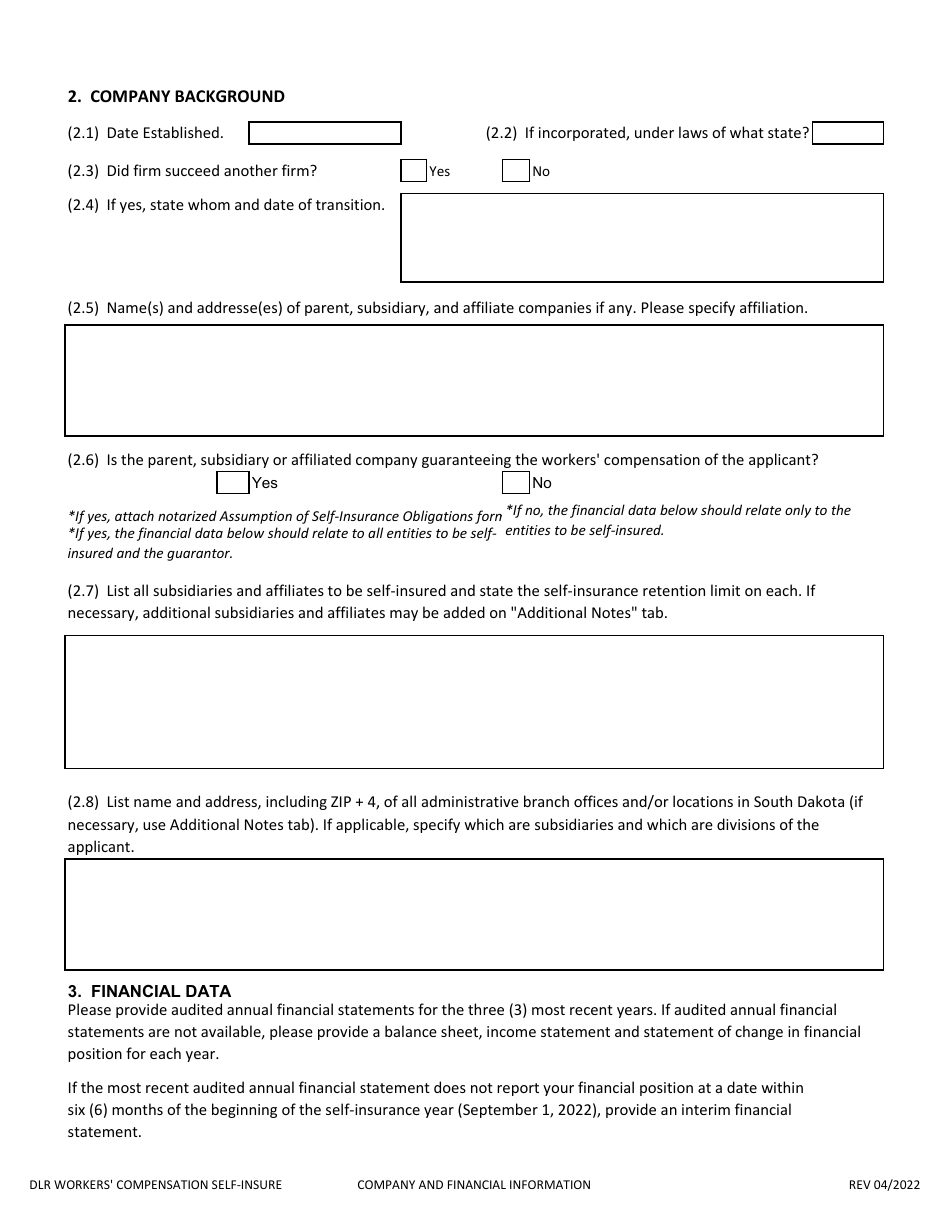

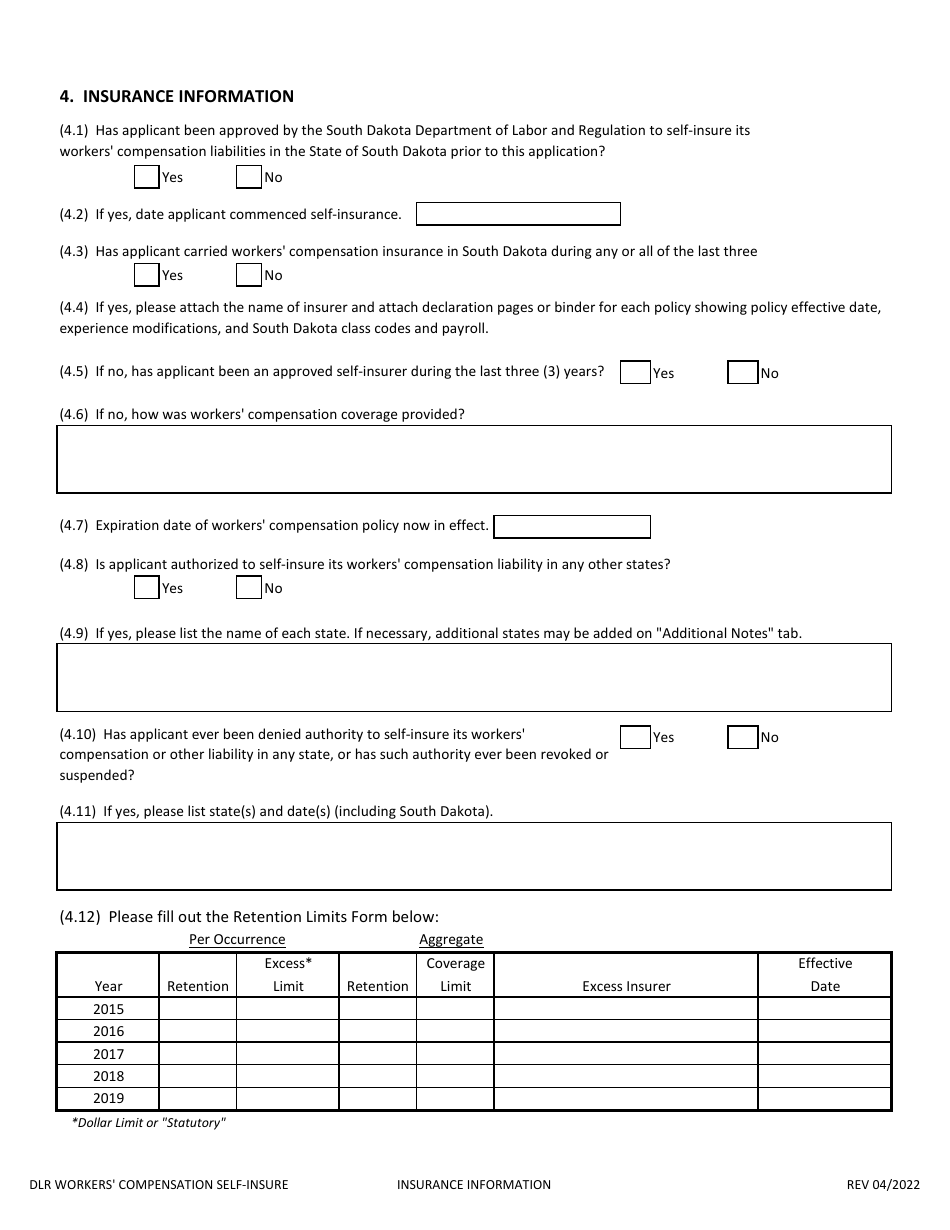

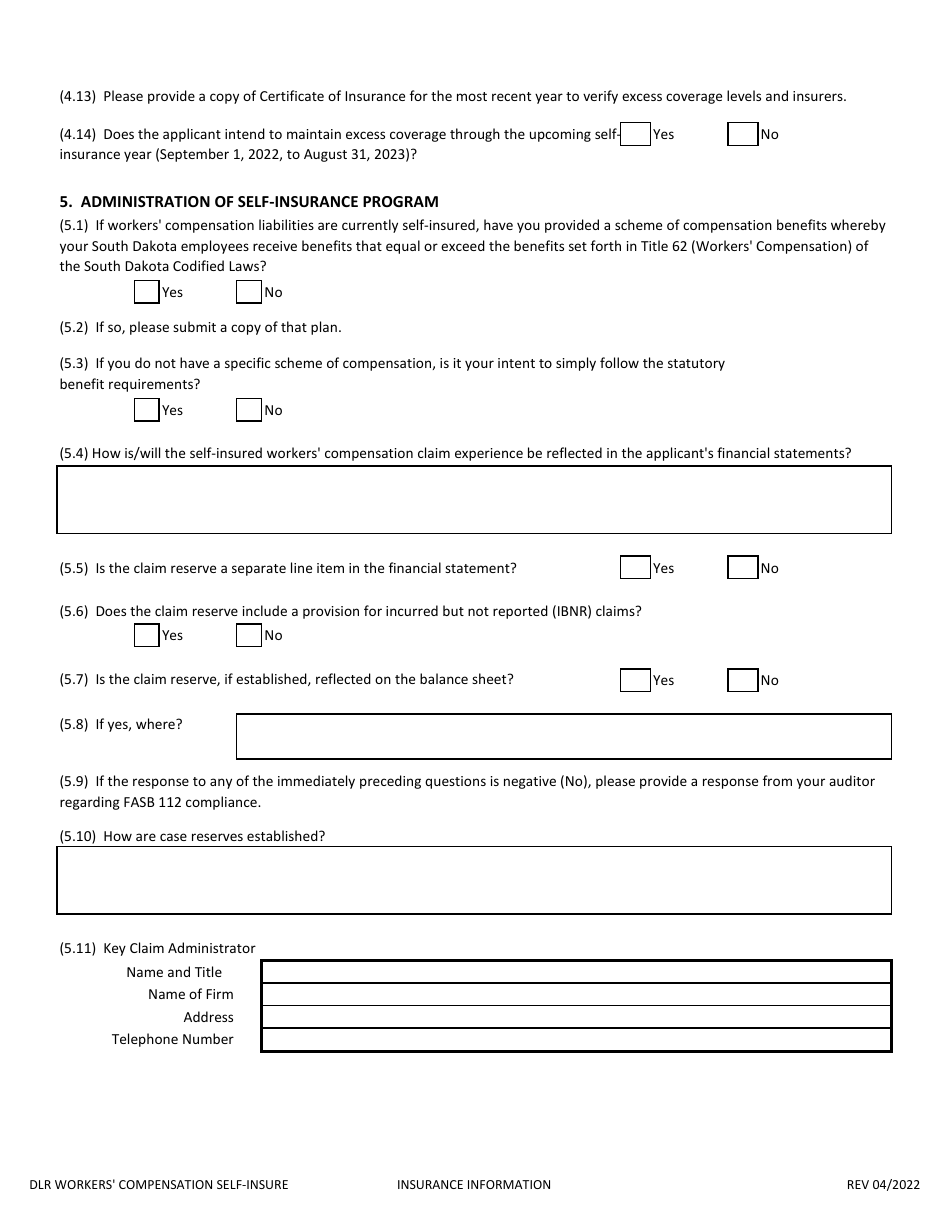

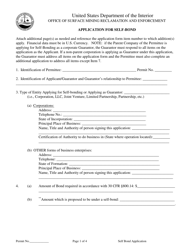

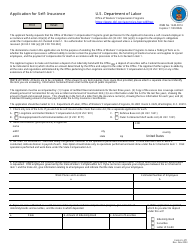

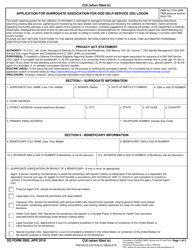

Application to Self-insure Workers' Compensation Liabilities - South Dakota

Application to Self-insure Workers' Compensation Liabilities is a legal document that was released by the South Dakota Department of Labor & Regulation - a government authority operating within South Dakota.

FAQ

Q: What is a self-insurance application?

A: A self-insurance application is the process by which a company seeks approval to self-insure its workers' compensation liabilities.

Q: What is workers' compensation?

A: Workers' compensation is a form of insurance that provides medical benefits and wage replacement to employees who are injured or become ill as a result of their job.

Q: Why would a company want to self-insure its workers' compensation liabilities?

A: Companies may choose to self-insure their workers' compensation liabilities to have more control over claims management, potentially reduce costs, and ensure prompt payment of benefits.

Q: How does the self-insurance application process work?

A: The self-insurance application process typically involves submitting an application to the appropriate regulatory authority, providing financial documentation, and demonstrating the ability to meet ongoing financial obligations.

Q: What are the requirements for self-insurance in South Dakota?

A: The specific requirements for self-insurance in South Dakota can vary, but generally include financial stability, sufficient reserves, and a demonstrated ability to manage claims effectively.

Q: How long does it take to get approval for self-insurance?

A: The timeframe for approval of a self-insurance application can vary depending on the complexity of the application and the regulatory authority's review process.

Q: Are there any drawbacks to self-insuring workers' compensation liabilities?

A: Self-insuring workers' compensation liabilities comes with certain risks, including potential financial losses if claim costs exceed projections and the need to have adequate reserves to cover claims.

Q: Can a company switch from self-insurance to traditional workers' compensation insurance?

A: Yes, a company that self-insures its workers' compensation liabilities can switch to traditional insurance if desired, although there may be certain requirements or processes to follow.

Q: Are there any resources available to help companies with the self-insurance application process?

A: Yes, companies can typically seek assistance and guidance from the appropriate regulatory authority or seek professional advice from insurance consultants or attorneys who specialize in workers' compensation self-insurance.

Q: Is self-insurance the right option for every company?

A: Self-insurance may be a viable option for some companies, but it is not suitable for every company. Each company should carefully consider their specific circumstances, financial capabilities, and risk tolerance before deciding to self-insure.

Form Details:

- Released on April 1, 2022;

- The latest edition currently provided by the South Dakota Department of Labor & Regulation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the South Dakota Department of Labor & Regulation.