This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

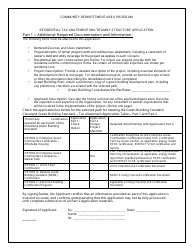

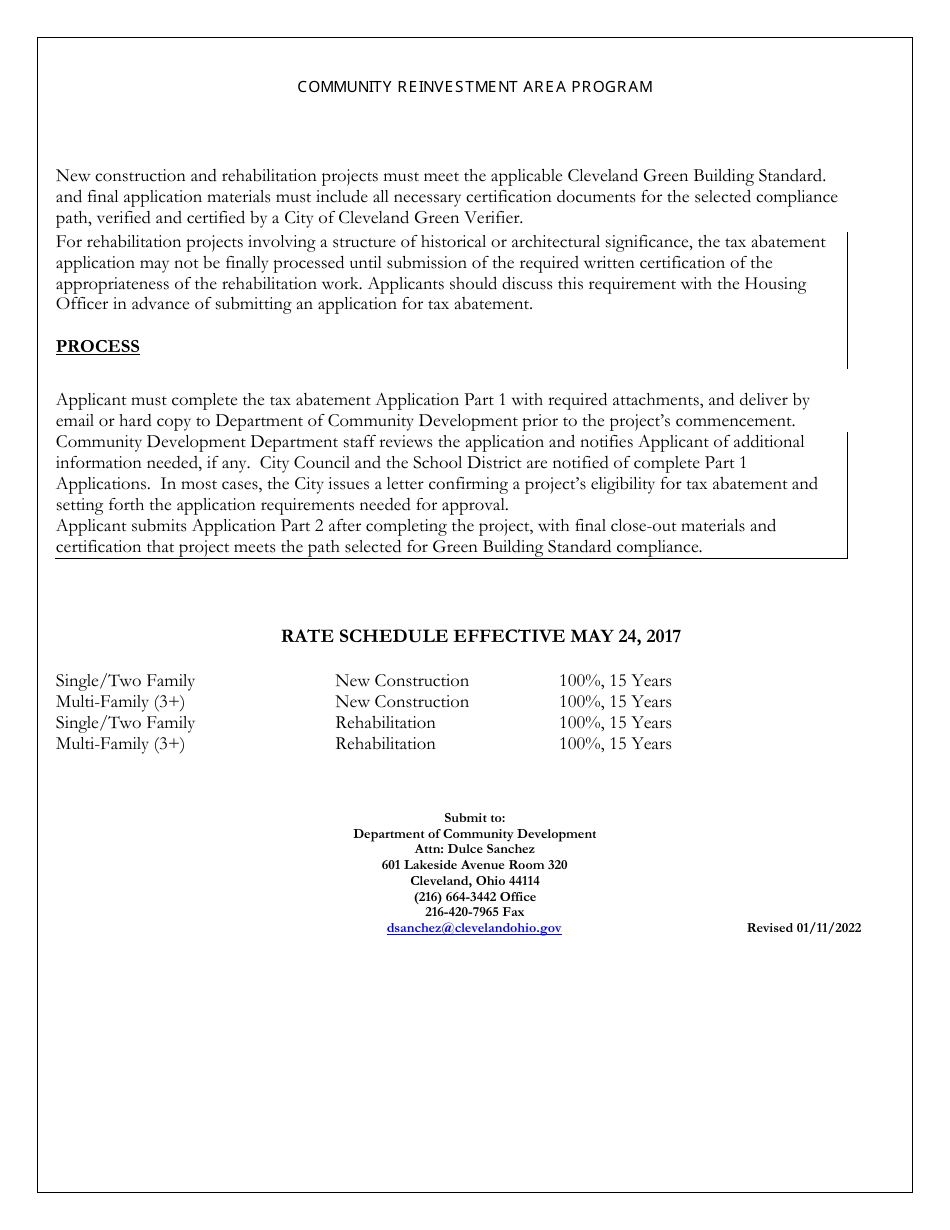

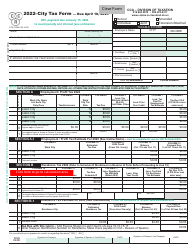

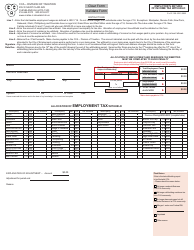

Residential Tax Abatement Multifamily Structure Application - City of Cleveland, Ohio

Residential Tax Abatement Multifamily Structure Application is a legal document that was released by the Department of Community Development - City of Cleveland, Ohio - a government authority operating within Ohio. The form may be used strictly within City of Cleveland.

FAQ

Q: What is a Residential Tax Abatement Multifamily Structure Application?

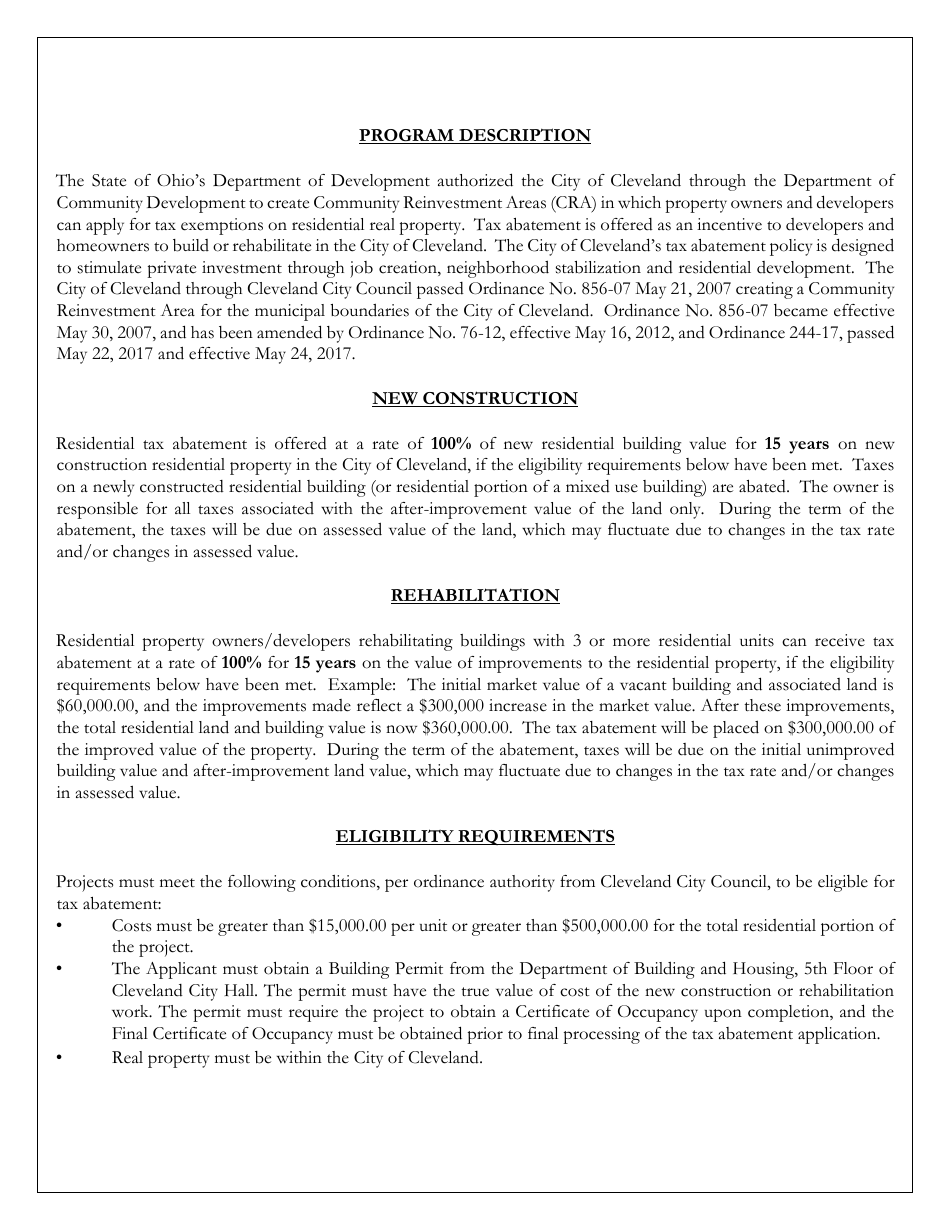

A: A Residential Tax Abatement Multifamily Structure Application is a form used to apply for tax abatement for multifamily residential properties in the City of Cleveland, Ohio.

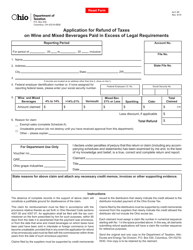

Q: What is tax abatement?

A: Tax abatement is a reduction or exemption from property taxes provided by the government to encourage development or improvements of certain properties.

Q: Who can apply for the Residential Tax Abatement Multifamily Structure Application?

A: Owners or developers of multifamily residential properties in the City of Cleveland, Ohio can apply for the Residential Tax Abatement Multifamily Structure Application.

Q: What are the benefits of tax abatement?

A: Tax abatement can provide financial incentives for property owners by reducing or eliminating property taxes for a certain period of time, which can help promote investment and development in the community.

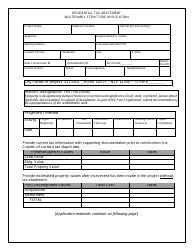

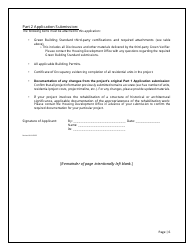

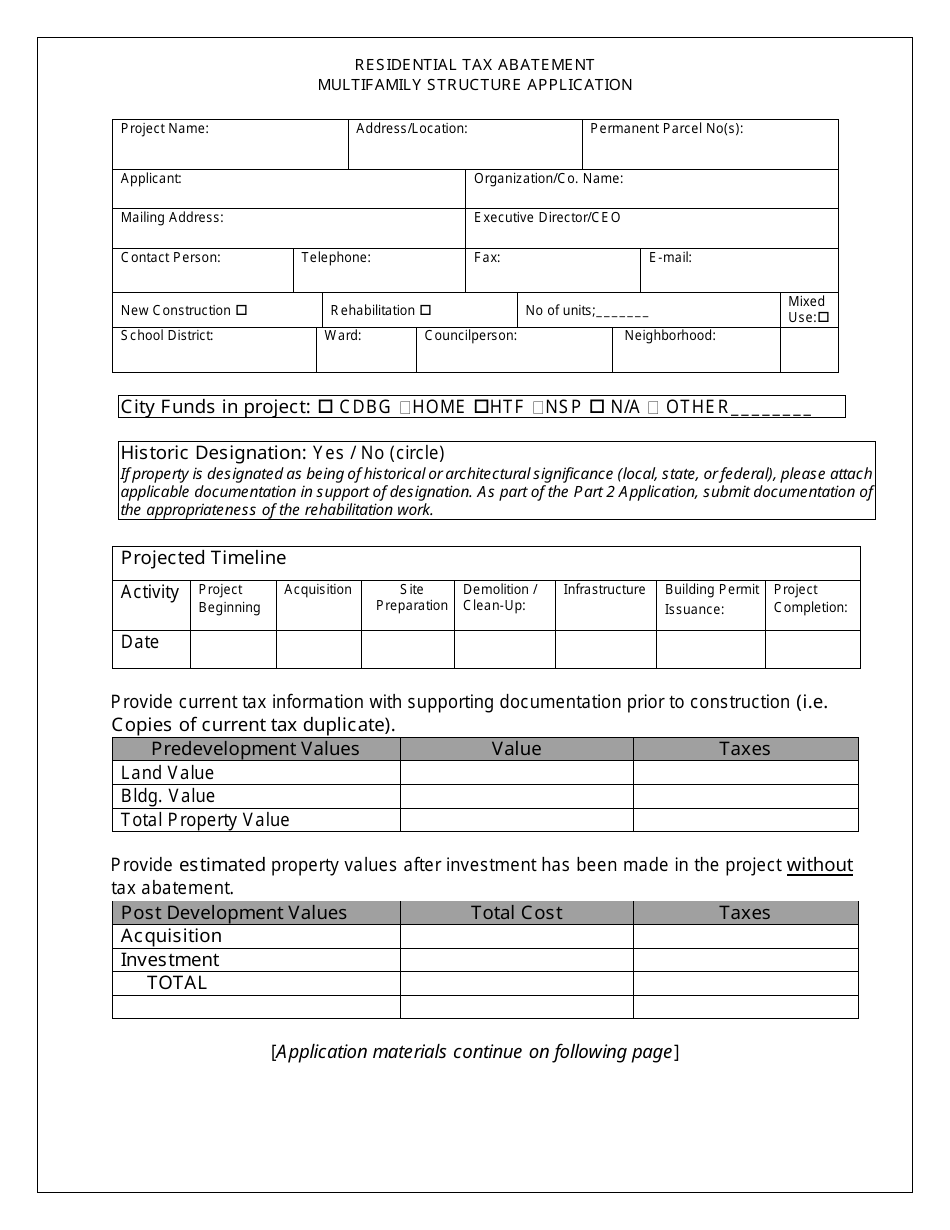

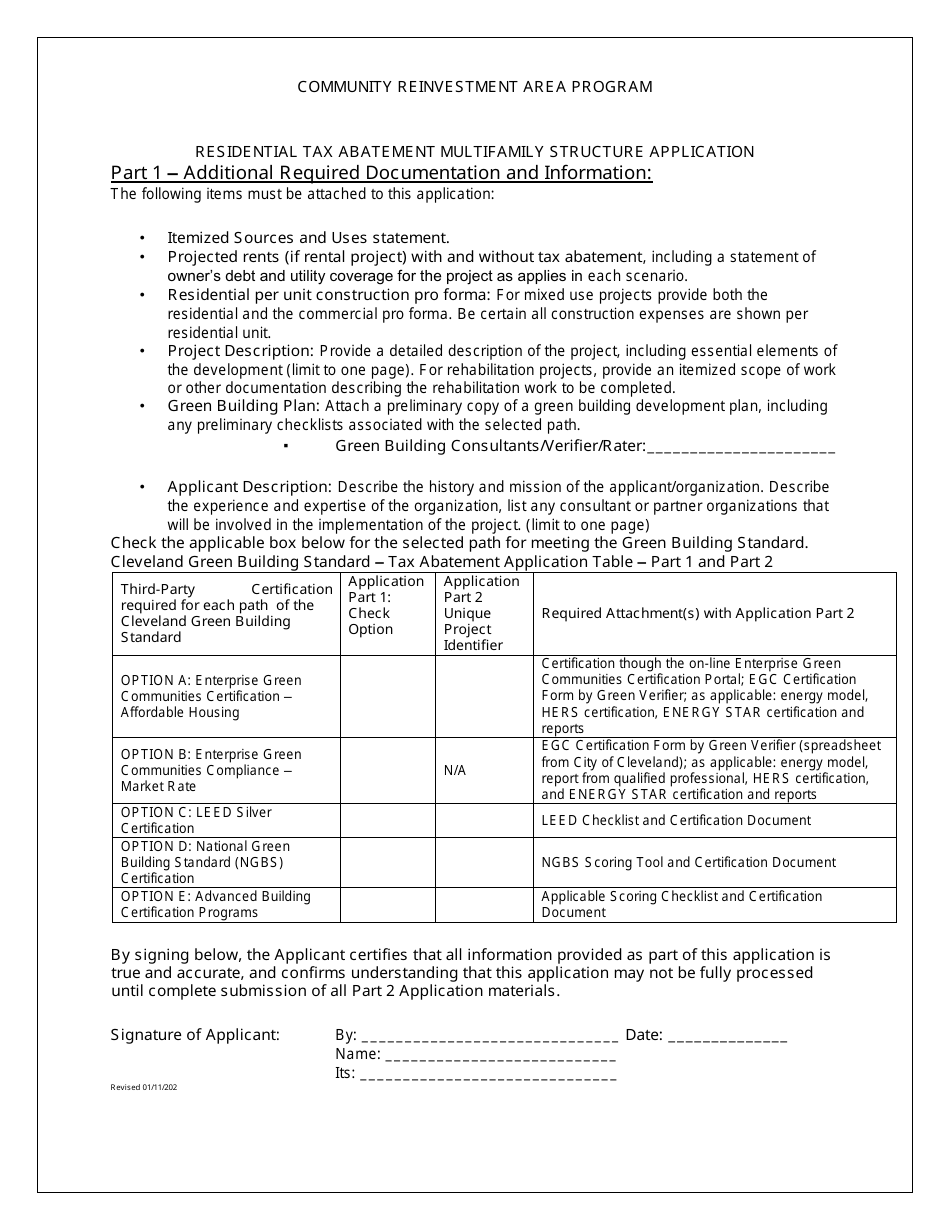

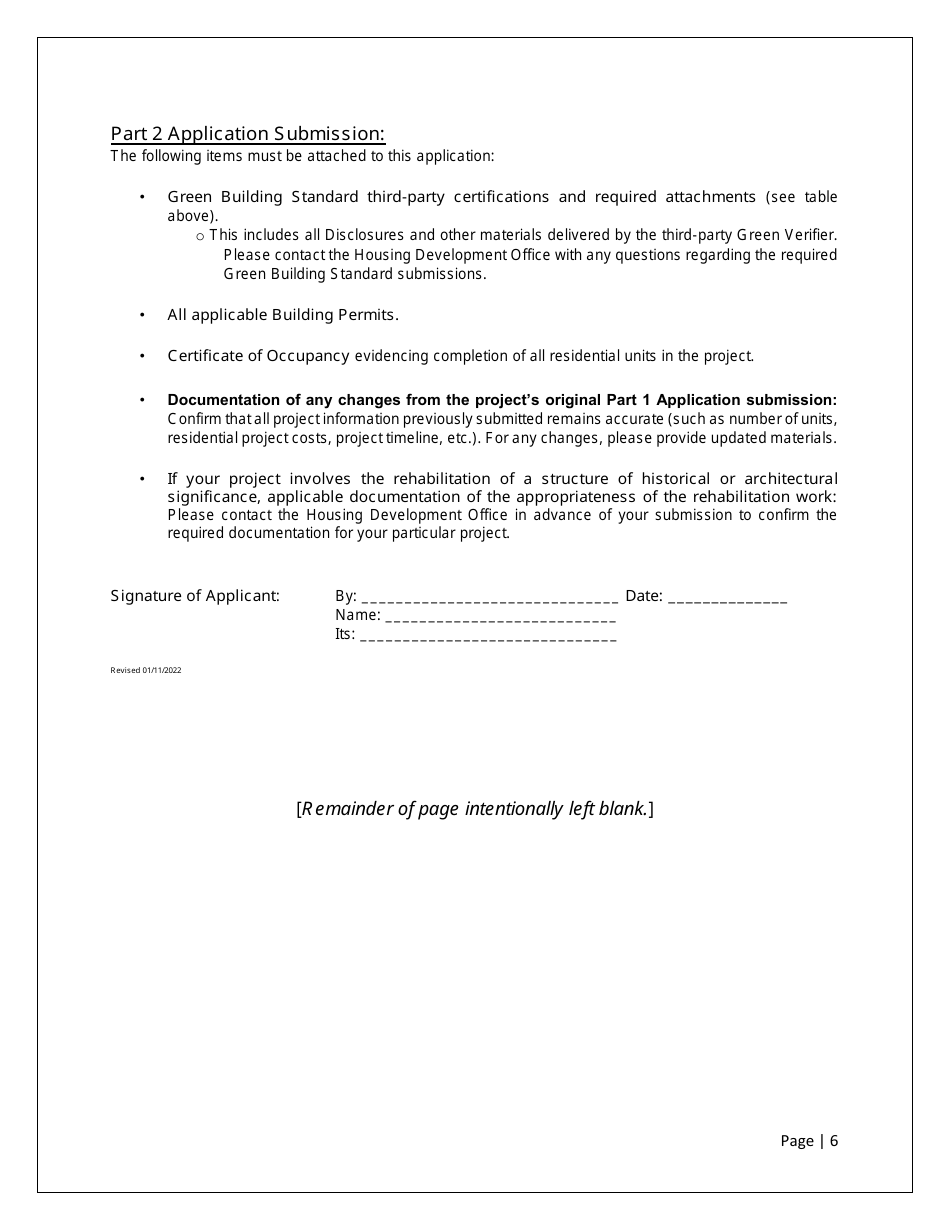

Q: What should be included in the application?

A: The application should include information about the property, such as the address, number of units, and estimated construction costs, as well as any supporting documentation required by the City of Cleveland, Ohio.

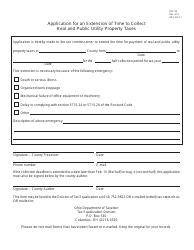

Q: How long does the tax abatement last?

A: The duration of the tax abatement period can vary depending on the specific program and the property's location, but it is typically for a certain number of years, such as 10 or 15 years.

Q: Are there any restrictions or requirements for tax abatement?

A: Yes, there are typically certain restrictions and requirements for tax abatement, such as minimum investment thresholds, compliance with building codes or regulations, and the creation of affordable housing units.

Q: Can existing multifamily properties be eligible for tax abatement?

A: Yes, existing multifamily properties may be eligible for tax abatement if they meet the requirements set by the City of Cleveland, Ohio.

Q: Who should I contact for more information about the Residential Tax Abatement Multifamily Structure Application?

A: For more information about the Residential Tax Abatement Multifamily Structure Application, you should contact the City of Cleveland, Ohio's Department of Economic Development or the local government offices.

Form Details:

- Released on January 11, 2022;

- The latest edition currently provided by the Department of Community Development - City of Cleveland, Ohio;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Community Development - City of Cleveland, Ohio.