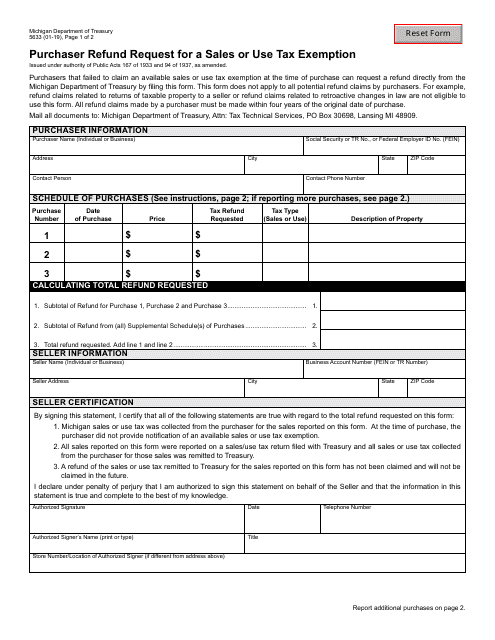

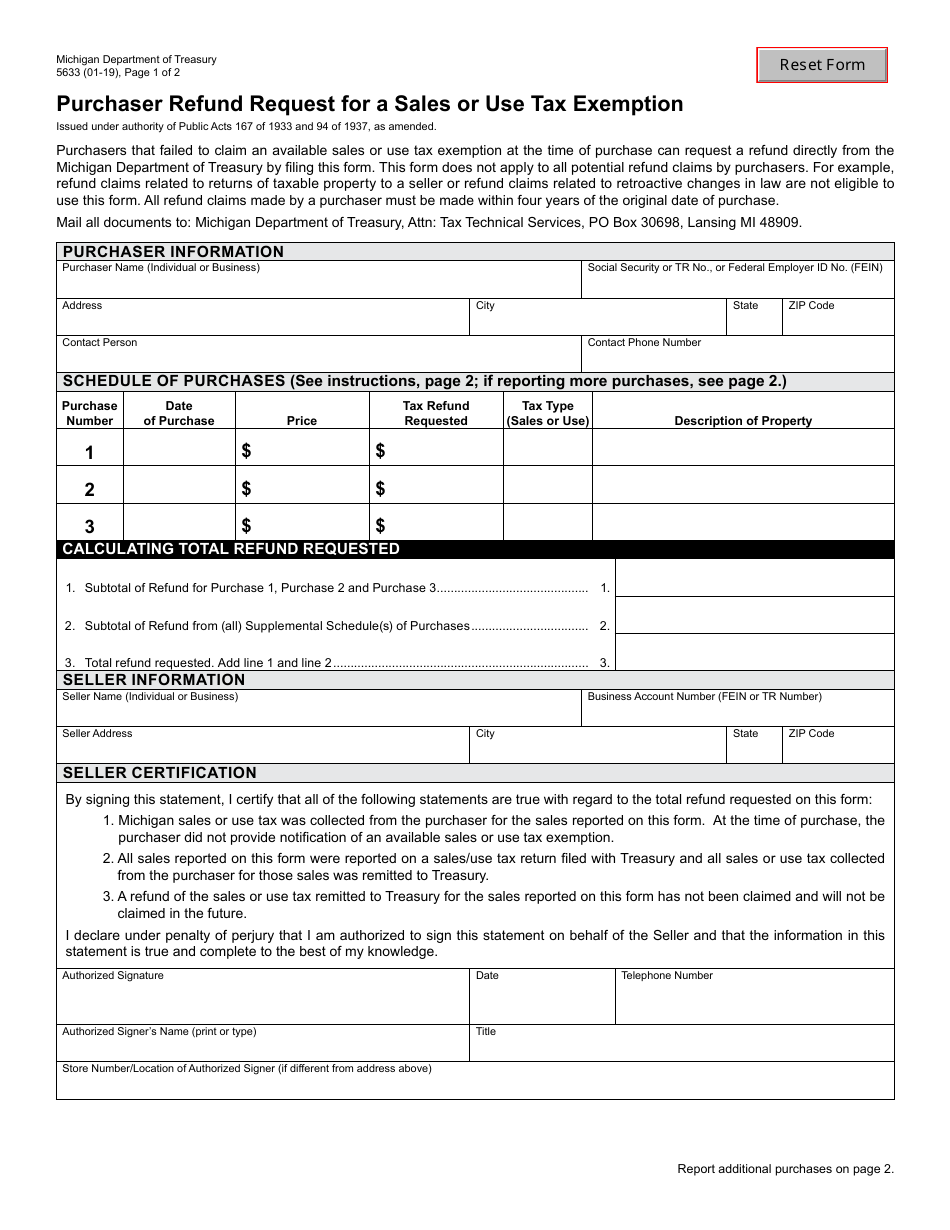

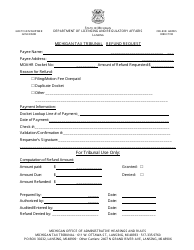

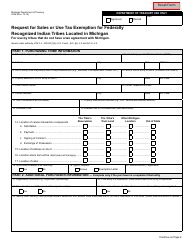

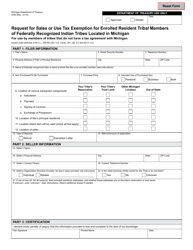

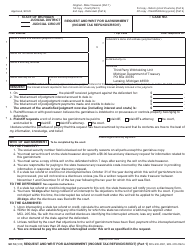

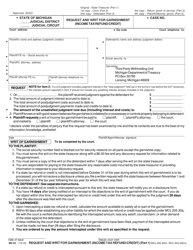

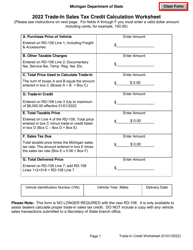

Form 5633 Purchaser Refund Request for a Sales or Use Tax Exemption - Michigan

What Is Form 5633?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5633?

A: Form 5633 is the Purchaser Refund Request for a Sales or Use Tax Exemption in Michigan.

Q: Who uses Form 5633?

A: Purchasers who are seeking a refund for sales or use tax exemption in Michigan use Form 5633.

Q: What is the purpose of Form 5633?

A: The purpose of Form 5633 is to request a refund for sales or use tax exemption in Michigan.

Q: Are there any eligibility requirements for using Form 5633?

A: Yes, there are eligibility requirements for using Form 5633. You must meet certain criteria to qualify for a sales or use tax exemption refund in Michigan.

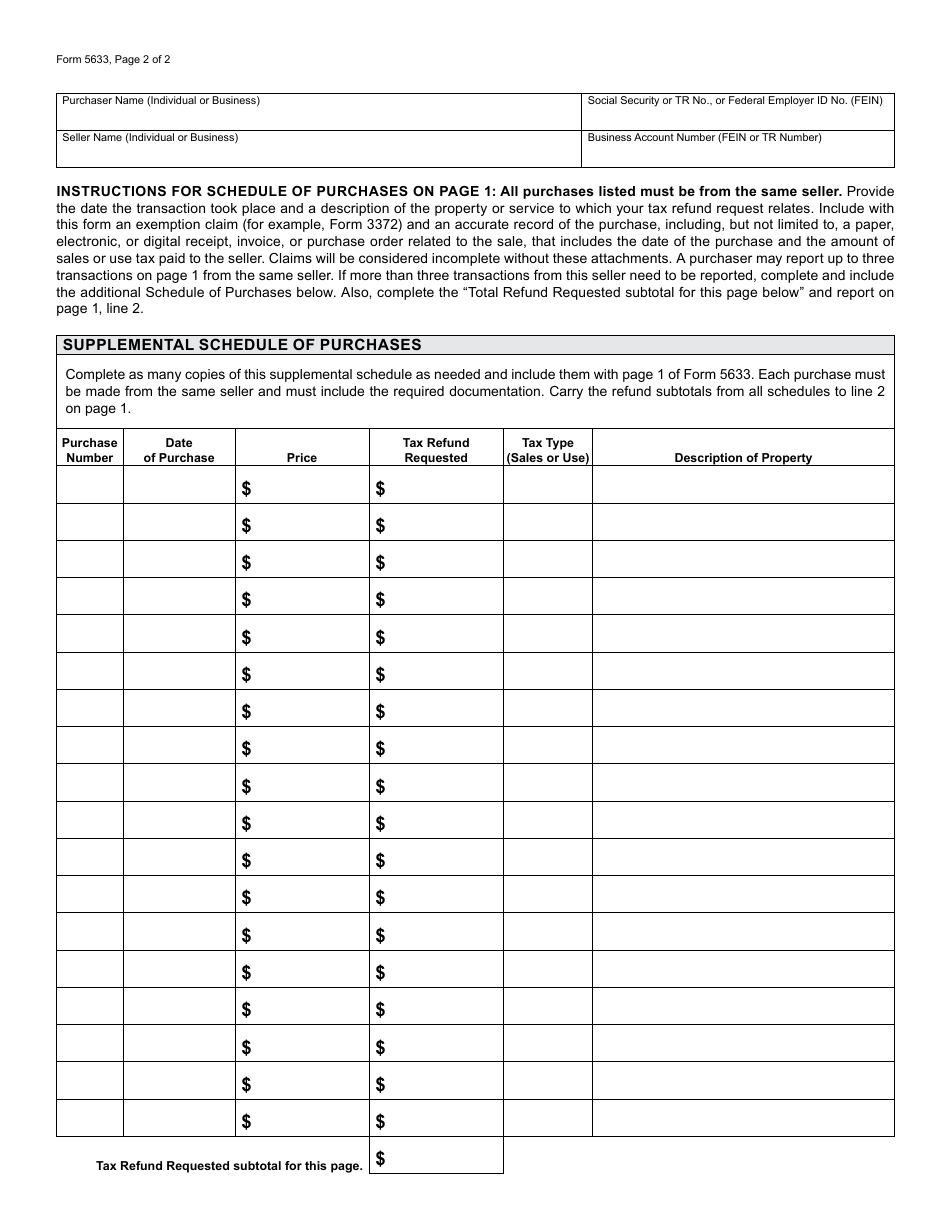

Q: How do I fill out Form 5633?

A: To fill out Form 5633, you need to provide the necessary information and supporting documentation, including the reason for the refund request and proof of eligibility for sales or use tax exemption in Michigan.

Q: What should I do with the completed Form 5633?

A: Once you have completed Form 5633, you should submit it to the Michigan Department of Treasury along with any required documentation and supporting evidence.

Q: How long does it take to process a refund request using Form 5633?

A: The processing time for a refund request using Form 5633 may vary. It is recommended to contact the Michigan Department of Treasury for information regarding processing times.

Q: Is there a deadline for submitting Form 5633?

A: Yes, there is a deadline for submitting Form 5633. It is important to submit the form within the specified timeframe to be eligible for a refund of sales or use tax exemption in Michigan.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5633 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.