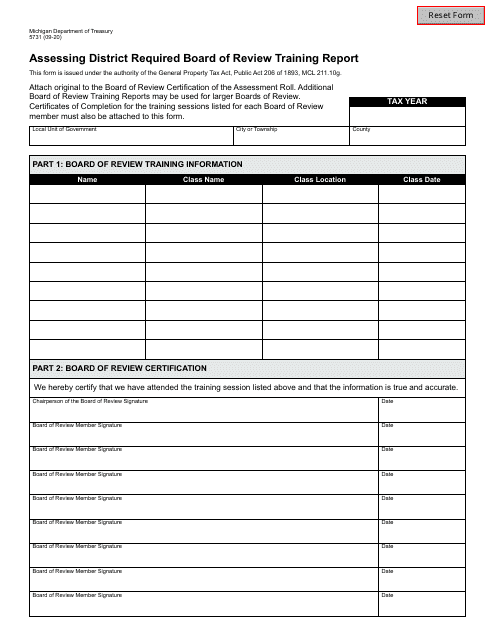

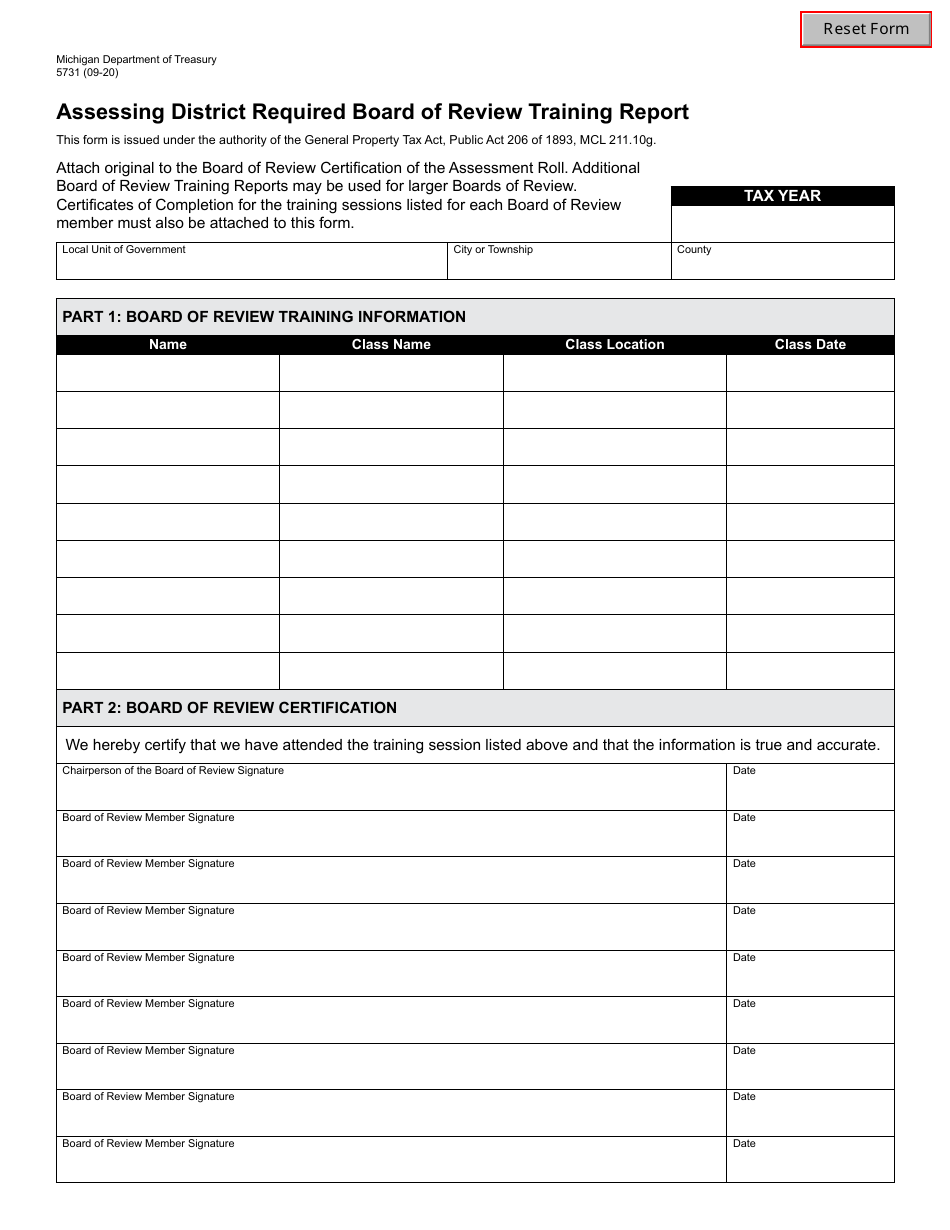

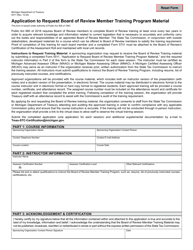

Form 5731 Assessing District Required Board of Review Training Report - Michigan

What Is Form 5731?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5731?

A: Form 5731 is the Assessing District Required Board of Review Training Report in Michigan.

Q: Who is required to submit Form 5731?

A: Assessing districts in Michigan are required to submit Form 5731.

Q: What is the purpose of Form 5731?

A: The purpose of Form 5731 is to report the training completed by the members of the Board of Review in the assessing district.

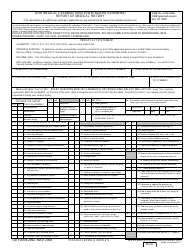

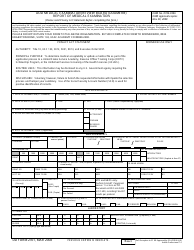

Q: What information is required on Form 5731?

A: Form 5731 requires information about the members of the Board of Review, the training completed, and the date and location of the training.

Q: When is Form 5731 due?

A: Form 5731 is usually due by May 1st of each year.

Q: Is there a penalty for not submitting Form 5731?

A: Failure to submit Form 5731 may result in the assessing district losing its eligibility for certain property tax administrative funding.

Q: Who should I contact for more information about Form 5731?

A: For more information about Form 5731, you should contact the Michigan Department of Treasury.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5731 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.