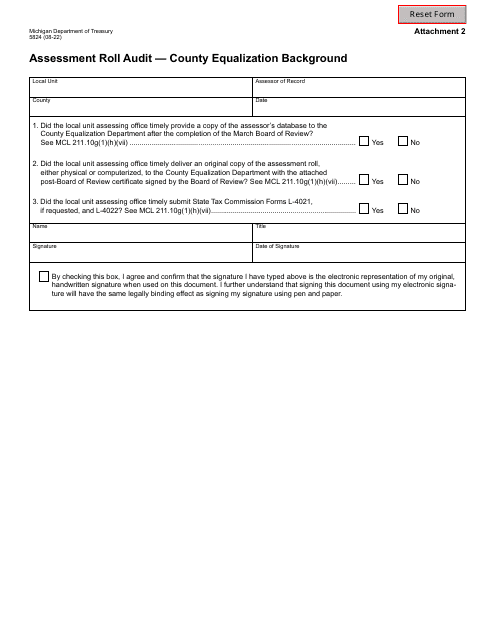

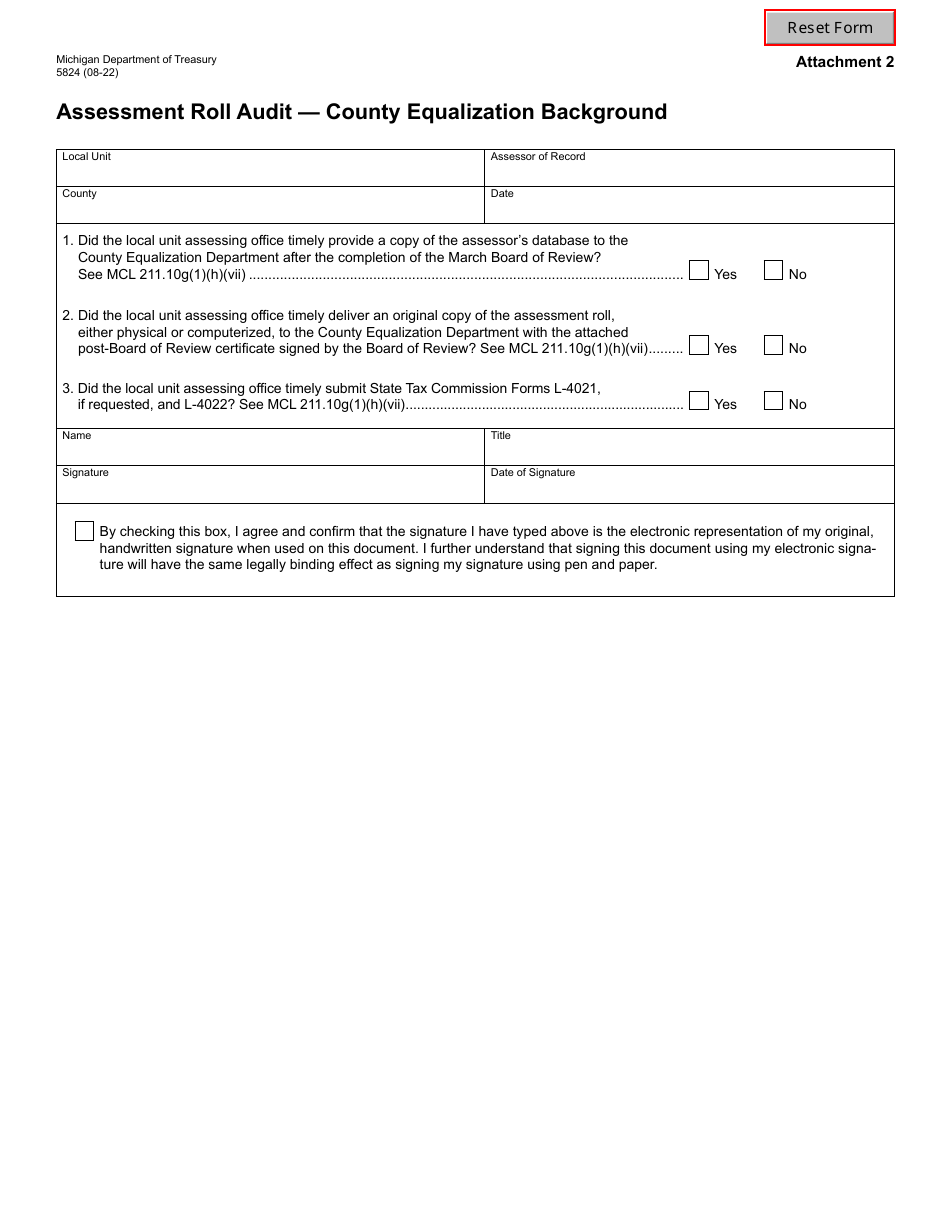

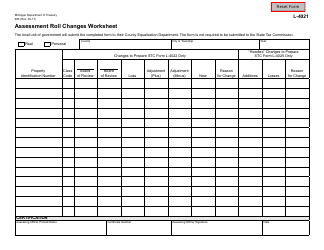

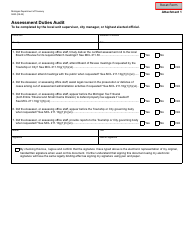

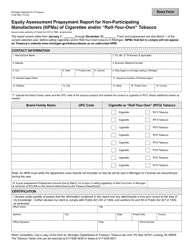

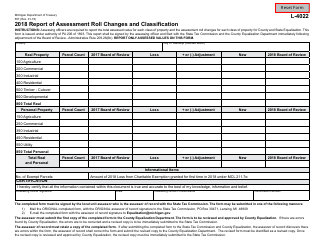

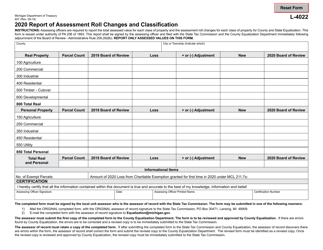

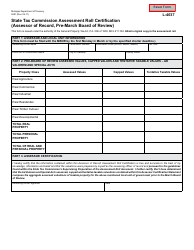

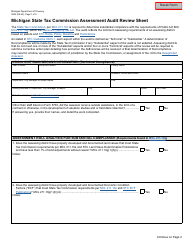

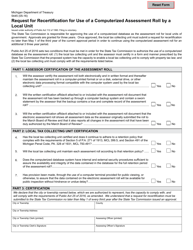

Form 5824 Assessment Roll Audit - County Equalization Background - Michigan

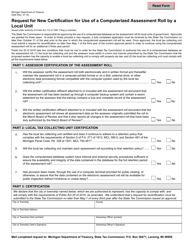

What Is Form 5824?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

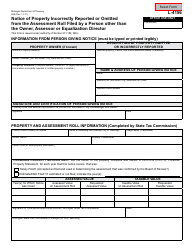

Q: What is Form 5824 Assessment Roll Audit?

A: Form 5824 Assessment Roll Audit is a form used for conducting a property assessment roll audit.

Q: What is the purpose of a property assessment roll audit?

A: The purpose of a property assessment roll audit is to ensure the accuracy and fairness of property assessments for taxation purposes.

Q: Who conducts the property assessment roll audit?

A: The County Equalization Department in Michigan conducts the property assessment roll audit.

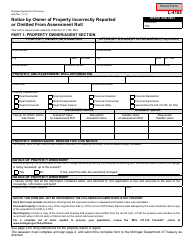

Q: What is the County Equalization Department?

A: The County Equalization Department is responsible for ensuring fair and accurate property assessments for tax purposes in the county.

Q: Why is the County Equalization Department involved in property assessment?

A: The County Equalization Department ensures that property assessments are conducted in a uniform and equitable manner across the county.

Q: What is the background of Form 5824 Assessment Roll Audit in Michigan?

A: Form 5824 Assessment Roll Audit is a document used in Michigan to facilitate the property assessment roll audit process and ensure compliance with state laws.

Q: How can I obtain Form 5824 Assessment Roll Audit?

A: You can obtain Form 5824 Assessment Roll Audit from the County Equalization Department in Michigan.

Q: Is the property assessment roll audit mandatory in Michigan?

A: Yes, property assessment roll audits are mandatory in Michigan to ensure compliance with state laws and maintain fair property assessments.

Q: What are the consequences of inaccurate property assessments?

A: Inaccurate property assessments can result in unfair taxation, unequal distribution of tax burden, and legal disputes.

Q: Can property owners dispute their assessments?

A: Yes, property owners can dispute their assessments through an appeal process if they believe their assessment is inaccurate or unfair.

Form Details:

- Released on August 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5824 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.