This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5560

for the current year.

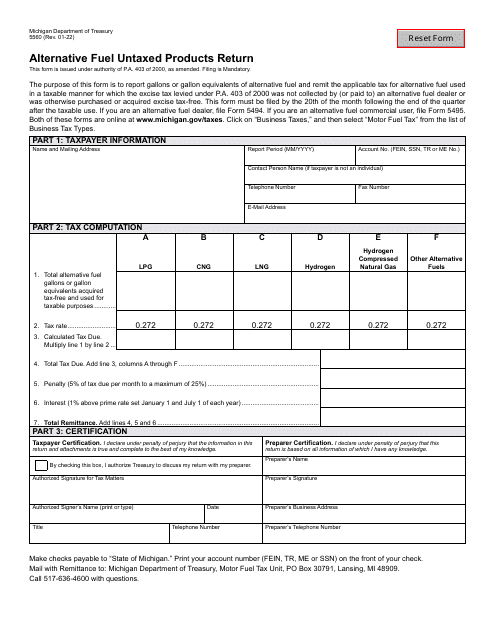

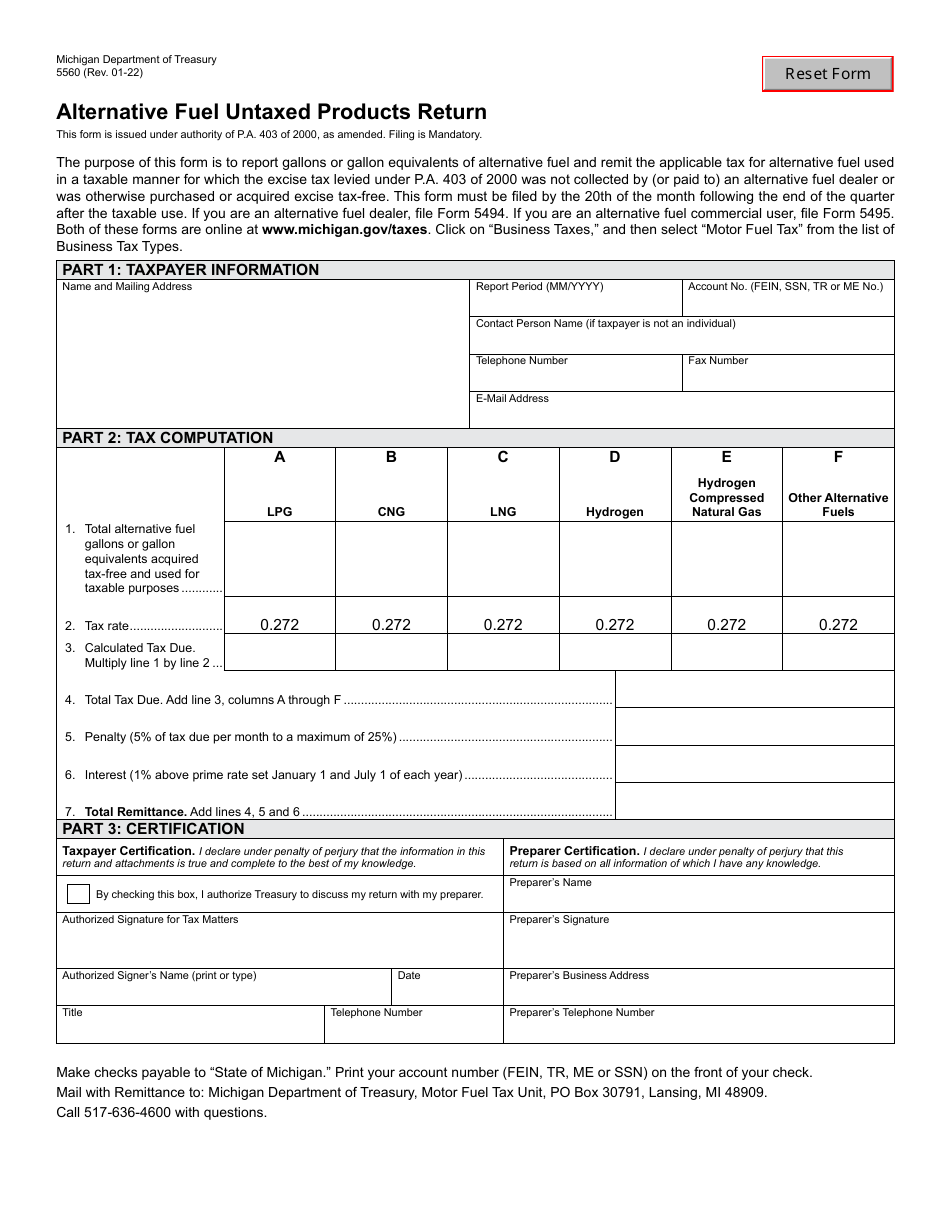

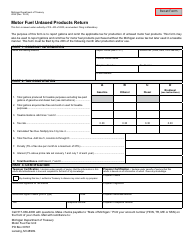

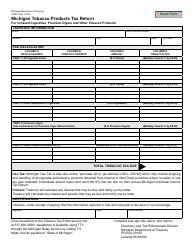

Form 5560 Alternative Fuel Untaxed Products Return - Michigan

What Is Form 5560?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5560?

A: Form 5560 is the Alternative Fuel Untaxed Products Return for the state of Michigan.

Q: Who needs to file Form 5560?

A: Any person or entity that sells, transfers, or delivers alternative fuel products in Michigan needs to file Form 5560.

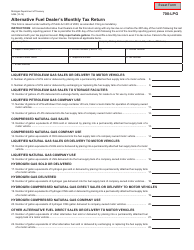

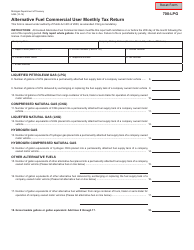

Q: What are alternative fuel products?

A: Alternative fuel products include liquids or gases that are suitable for powering internal combustion engines and are not subject to motor fuel taxes.

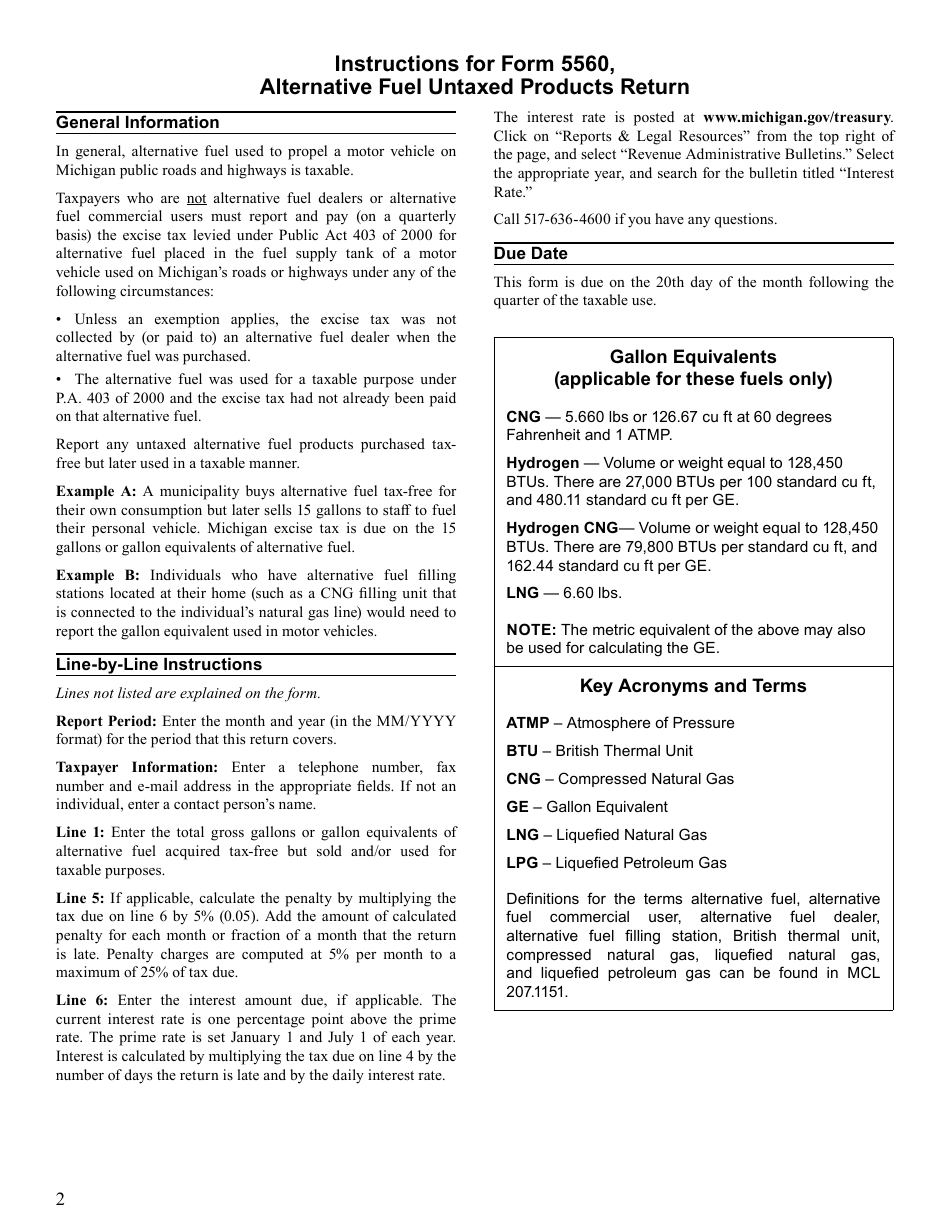

Q: When is Form 5560 due?

A: Form 5560 is due on a monthly basis, with the due date falling on or before the 20th day of the month following the reporting period.

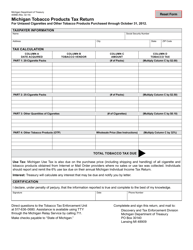

Q: Are there any penalties for late or incorrect filing of Form 5560?

A: Yes, there are penalties for late or incorrect filing of Form 5560. It is important to file on time and accurately to avoid these penalties.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5560 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.