This version of the form is not currently in use and is provided for reference only. Download this version of

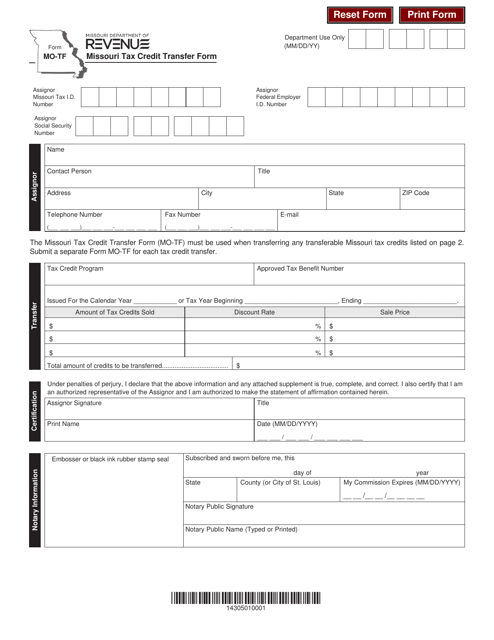

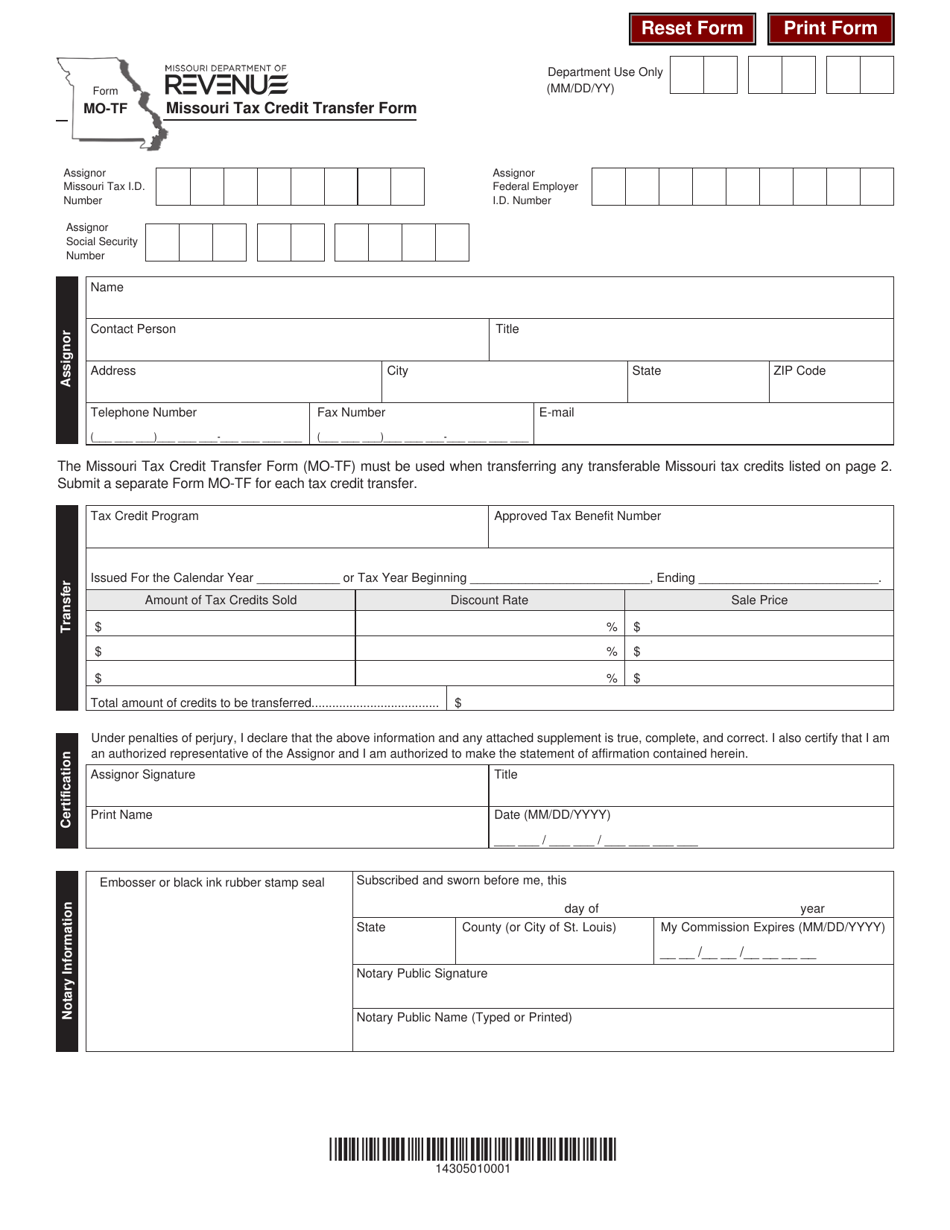

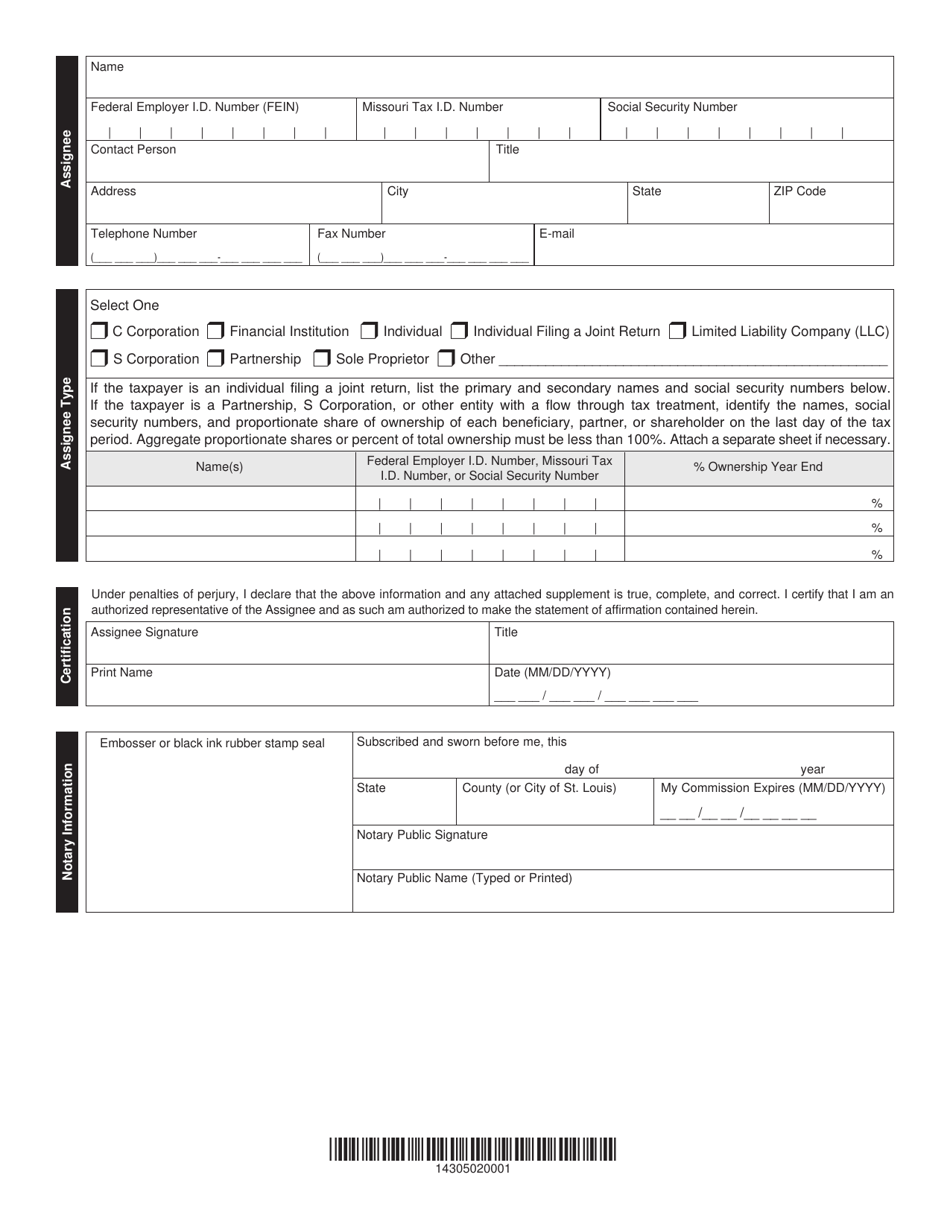

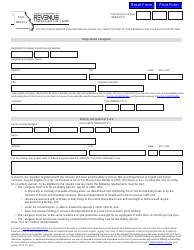

Form MO-TF

for the current year.

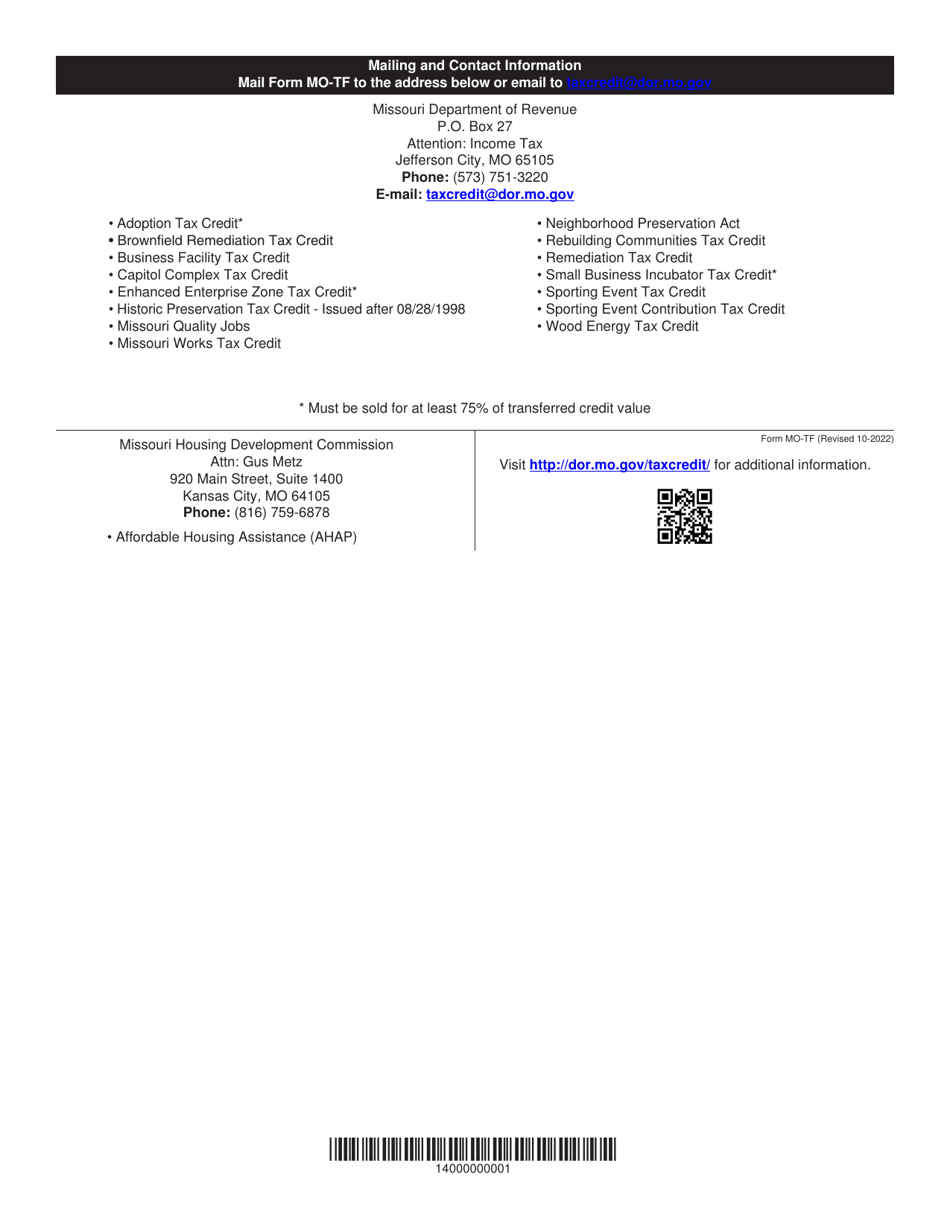

Form MO-TF Missouri Tax Credit Transfer Form - Missouri

What Is Form MO-TF?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-TF?

A: Form MO-TF is the Missouri Tax Credit Transfer Form.

Q: What is a tax credit transfer?

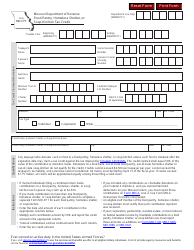

A: A tax credit transfer is a process where the tax credits earned by one individual or entity can be transferred to another individual or entity.

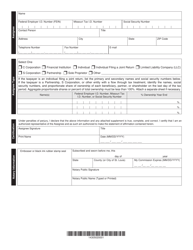

Q: Who needs to use Form MO-TF?

A: Form MO-TF needs to be used by individuals or entities who want to transfer their Missouri tax credits to another individual or entity.

Q: Why would someone want to transfer their tax credits?

A: Someone would want to transfer their tax credits if they are unable to use them and would like to sell or transfer them to someone who can benefit from them.

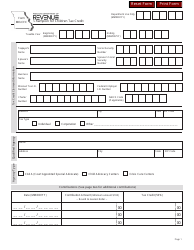

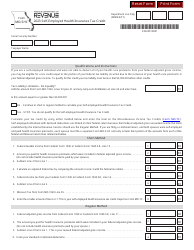

Q: How do I fill out Form MO-TF?

A: You need to provide the necessary information on the form, including details about the tax credits being transferred and the parties involved in the transfer.

Q: Are there any fees for transferring tax credits?

A: There may be fees associated with transferring tax credits, such as processing fees or fees charged by tax professionals or brokers.

Q: Is there a deadline for filing Form MO-TF?

A: Yes, Form MO-TF must be filed by the due date of the tax return for which the credits are being transferred.

Q: Can I transfer tax credits from a previous year?

A: No, tax credits can only be transferred for the current tax year.

Q: What happens after I submit Form MO-TF?

A: After you submit Form MO-TF, the Missouri Department of Revenue will review the form and process the transfer of tax credits to the designated party.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-TF by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.