This version of the form is not currently in use and is provided for reference only. Download this version of

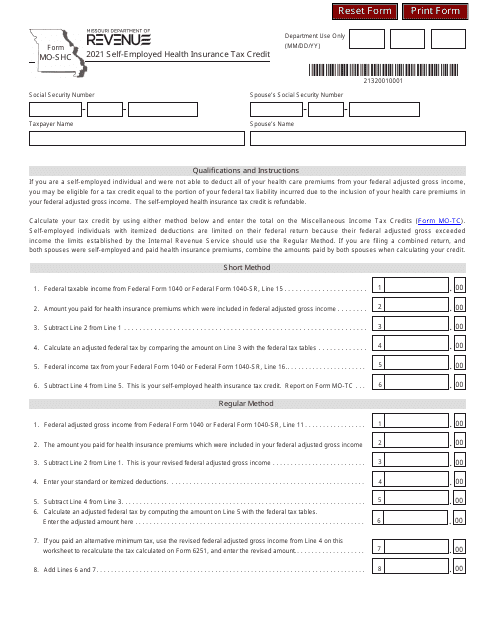

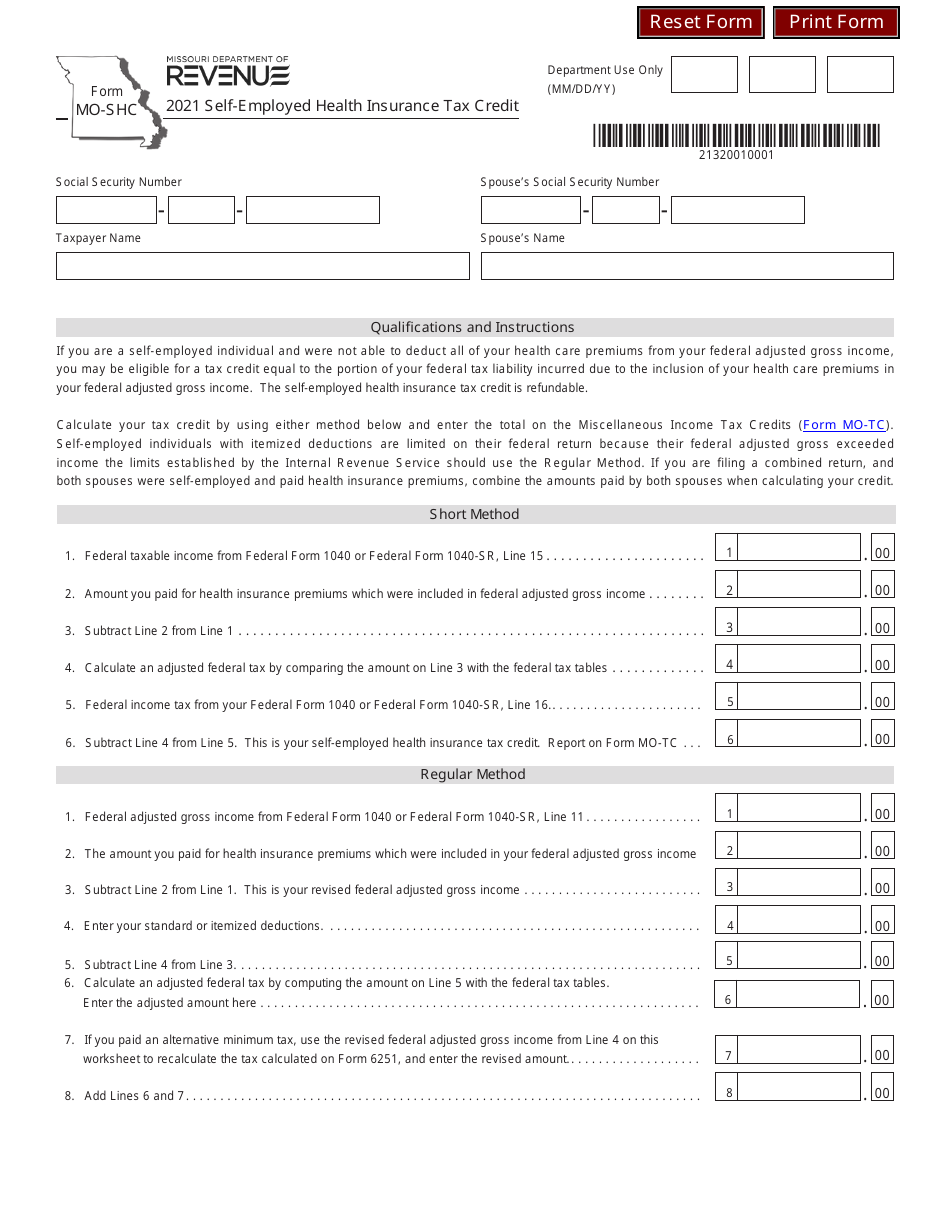

Form MO-SHC

for the current year.

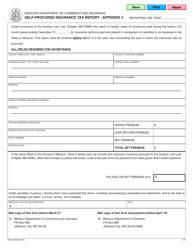

Form MO-SHC Self-employed Health Insurance Tax Credit - Missouri

What Is Form MO-SHC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-SHC Self-employed Health Insurance Tax Credit?

A: The MO-SHC Self-employed Health Insurance Tax Credit is a program in Missouri that provides a tax credit to self-employed individuals who purchase health insurance.

Q: Who is eligible for the MO-SHC Self-employed Health Insurance Tax Credit?

A: Self-employed individuals in Missouri who meet certain income and health insurance coverage requirements may be eligible for the tax credit.

Q: How do I apply for the MO-SHC Self-employed Health Insurance Tax Credit?

A: To apply for the tax credit, you need to complete and submit the MO-SHC Self-employed Health Insurance Tax Credit form to the Missouri Department of Revenue.

Q: What are the income and health insurance coverage requirements for the MO-SHC Self-employed Health Insurance Tax Credit?

A: The specific income and health insurance coverage requirements can vary each year. It is recommended to review the instructions and requirements on the MO-SHC form or consult with a tax professional.

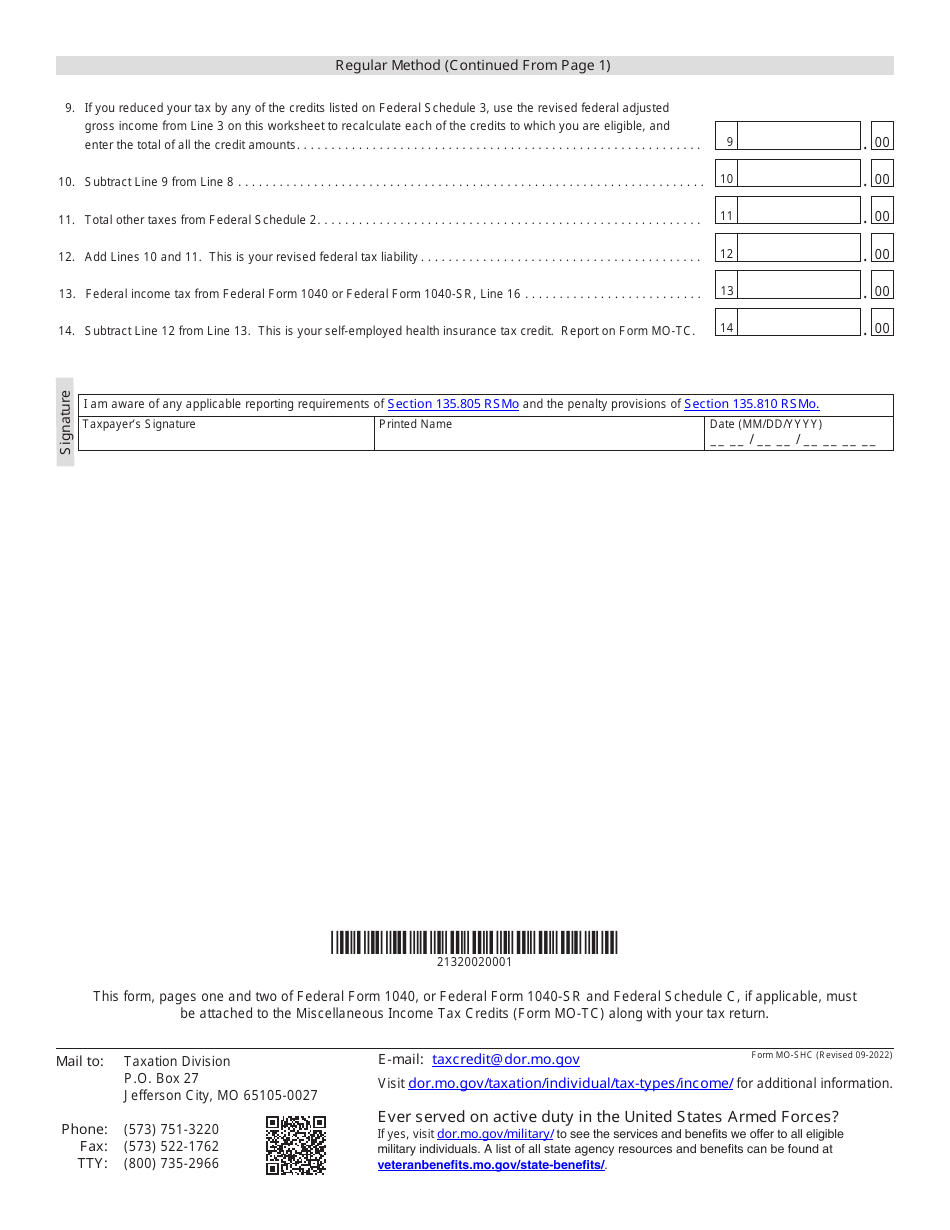

Q: What documents do I need to submit with the MO-SHC Self-employed Health Insurance Tax Credit form?

A: You will need to provide documentation of your health insurance coverage and proof of payment for the premiums.

Q: How much tax credit can I receive through the MO-SHC Self-employed Health Insurance Tax Credit?

A: The amount of the tax credit can vary depending on your qualifying health insurance premiums and your income. It is best to consult the instructions on the MO-SHC form or speak with a tax professional for more information.

Q: When is the deadline to submit the MO-SHC Self-employed Health Insurance Tax Credit form?

A: The deadline to submit the MO-SHC Self-employed Health Insurance Tax Credit form is typically April 15th of each year, coinciding with the individual incometax deadline.

Q: Can I claim the MO-SHC Self-employed Health Insurance Tax Credit if I receive health insurance through an employer?

A: No, the MO-SHC Self-employed Health Insurance Tax Credit is specifically for self-employed individuals who purchase their own health insurance.

Q: Is the MO-SHC Self-employed Health Insurance Tax Credit refundable?

A: No, the MO-SHC Self-employed Health Insurance Tax Credit is non-refundable. It can only be used to offset your tax liability.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-SHC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.