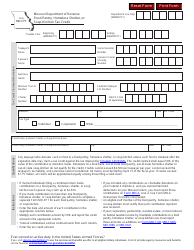

This version of the form is not currently in use and is provided for reference only. Download this version of

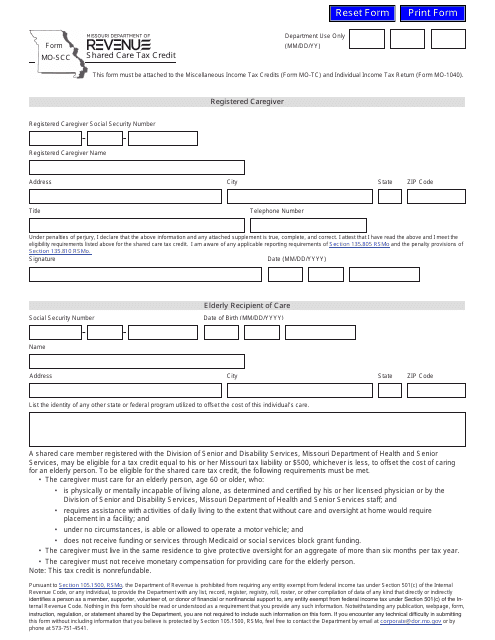

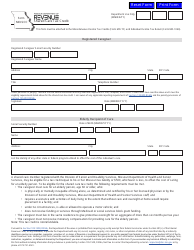

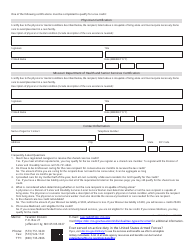

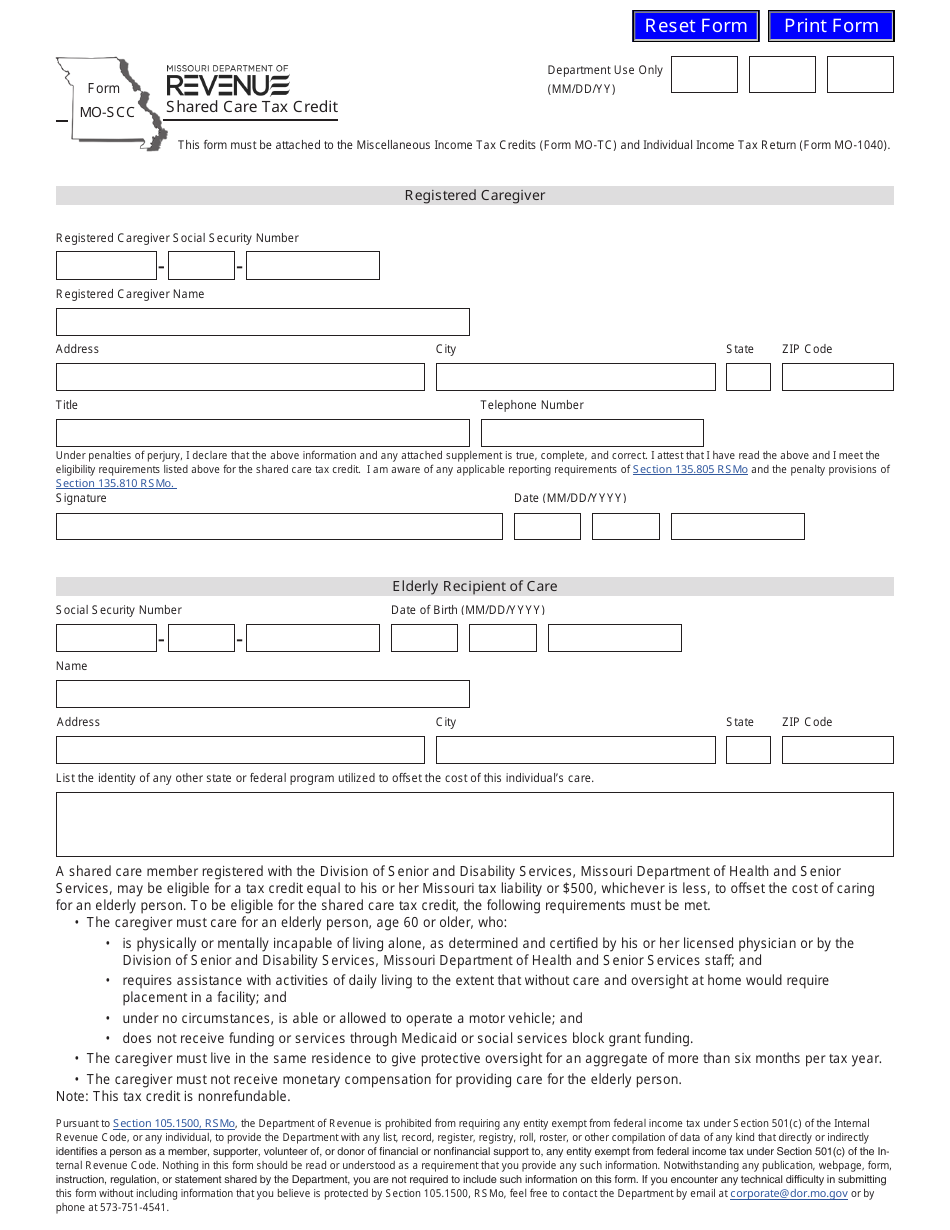

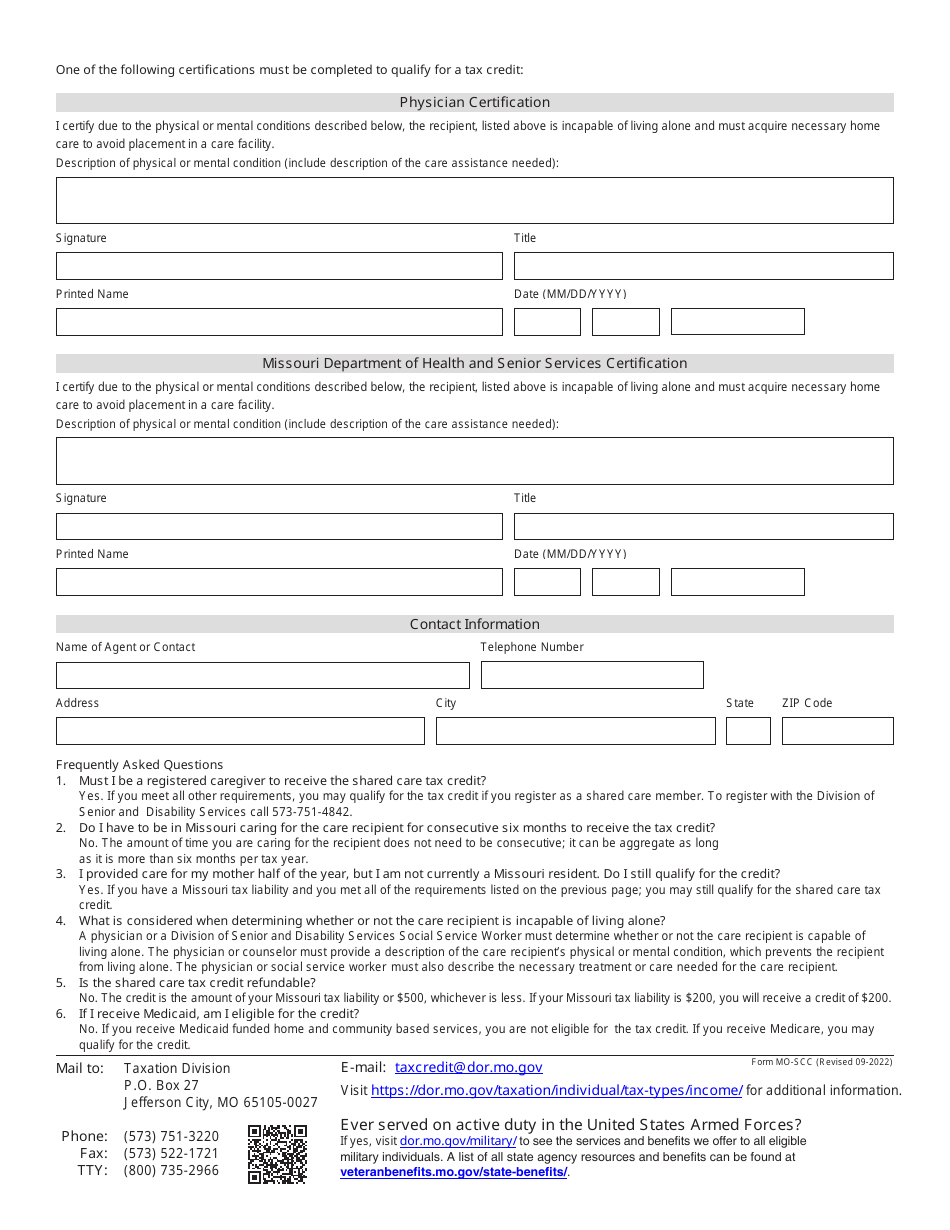

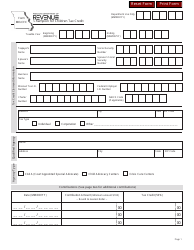

Form MO-SCC

for the current year.

Form MO-SCC Shared Care Tax Credit - Missouri

What Is Form MO-SCC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

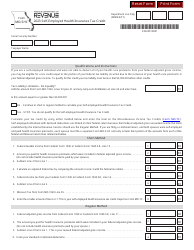

Q: What is Form MO-SCC?

A: Form MO-SCC, also known as the Shared Care Tax Credit form, is a tax form used in the state of Missouri to claim the Shared Care Tax Credit.

Q: What is the Shared Care Tax Credit?

A: The Shared Care Tax Credit is a tax credit offered by the state of Missouri to taxpayers who contribute to a shared care facility that provides care for children or adults with disabilities.

Q: Who is eligible for the Shared Care Tax Credit?

A: To be eligible for the Shared Care Tax Credit, you must have made a monetary contribution to a shared care facility that provides care for children or adults with disabilities.

Q: How much is the Shared Care Tax Credit?

A: The amount of the Shared Care Tax Credit is equal to 50% of the contributions made to a shared care facility, up to a maximum credit of $1,000.

Q: How do I claim the Shared Care Tax Credit?

A: To claim the Shared Care Tax Credit, you need to fill out Form MO-SCC and include it with your Missouri state tax return.

Q: Is there a deadline to file Form MO-SCC?

A: Yes, Form MO-SCC must be filed along with your Missouri state tax return by the tax filing deadline, which is usually April 15th.

Q: Are there any other requirements to qualify for the Shared Care Tax Credit?

A: In addition to making monetary contributions to a shared care facility, you must also meet certain income requirements to qualify for the Shared Care Tax Credit.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-SCC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.