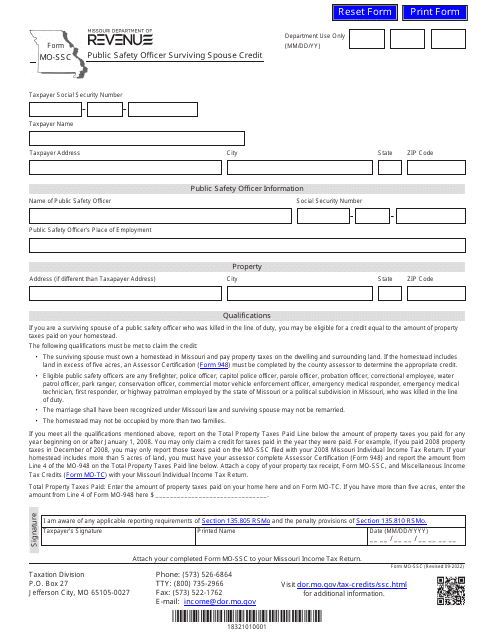

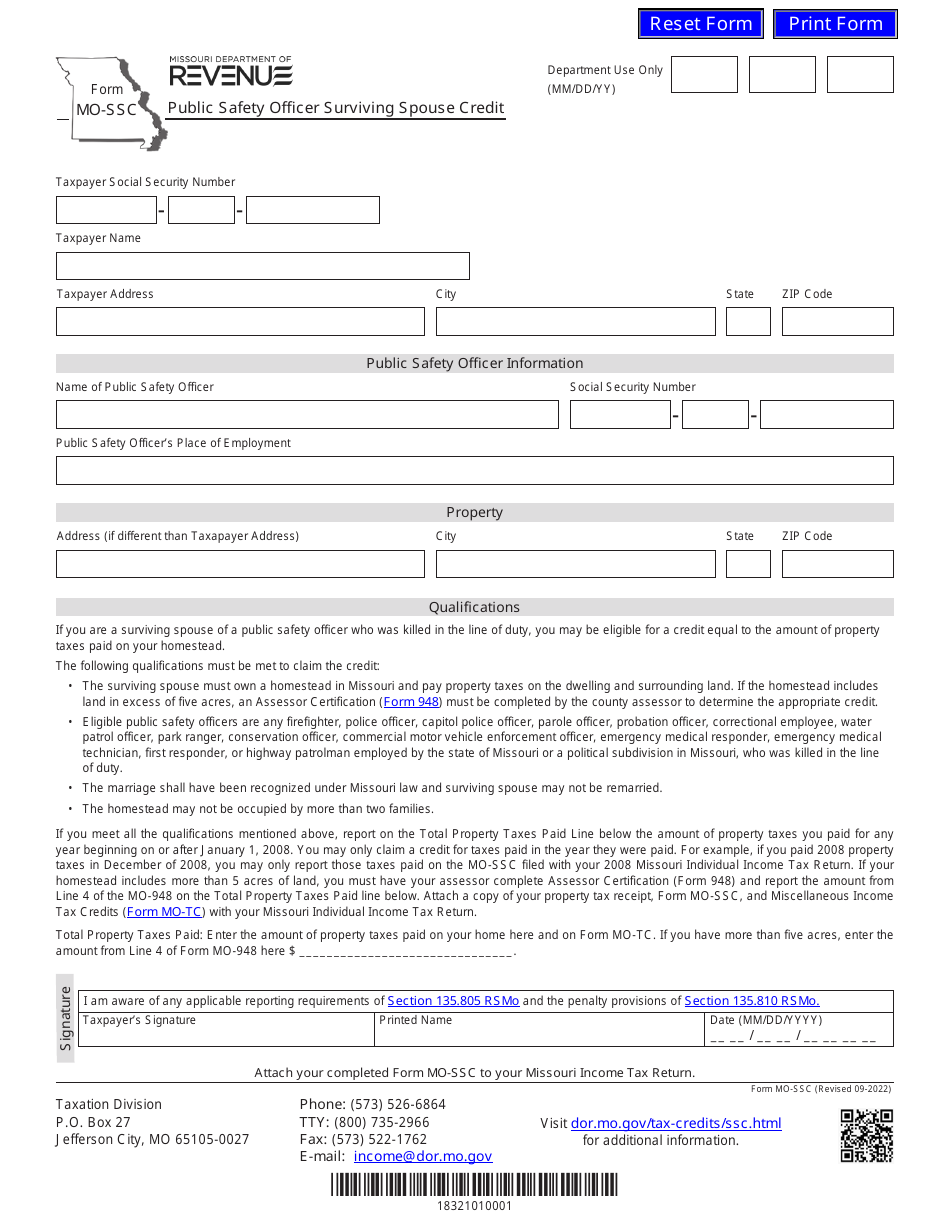

Form MO-SSC Public Safety Officer Surviving Spouse Credit - Missouri

What Is Form MO-SSC?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-SSC Public Safety Officer Surviving Spouse Credit?

A: The MO-SSC Public Safety Officer Surviving Spouse Credit is a tax credit available for surviving spouses of public safety officers in Missouri.

Q: Who is eligible for the MO-SSC Public Safety Officer Surviving Spouse Credit?

A: Surviving spouses of public safety officers who died in the line of duty are generally eligible for the credit.

Q: How much is the MO-SSC Public Safety Officer Surviving Spouse Credit?

A: The credit amount is up to $1,200 per year.

Q: How do I claim the MO-SSC Public Safety Officer Surviving Spouse Credit?

A: To claim the credit, you must file the Missouri Form MO-SSC with your state tax return.

Q: Is there a deadline to claim the MO-SSC Public Safety Officer Surviving Spouse Credit?

A: Yes, the credit must be claimed within three years from the date of the officer's death.

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-SSC by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.