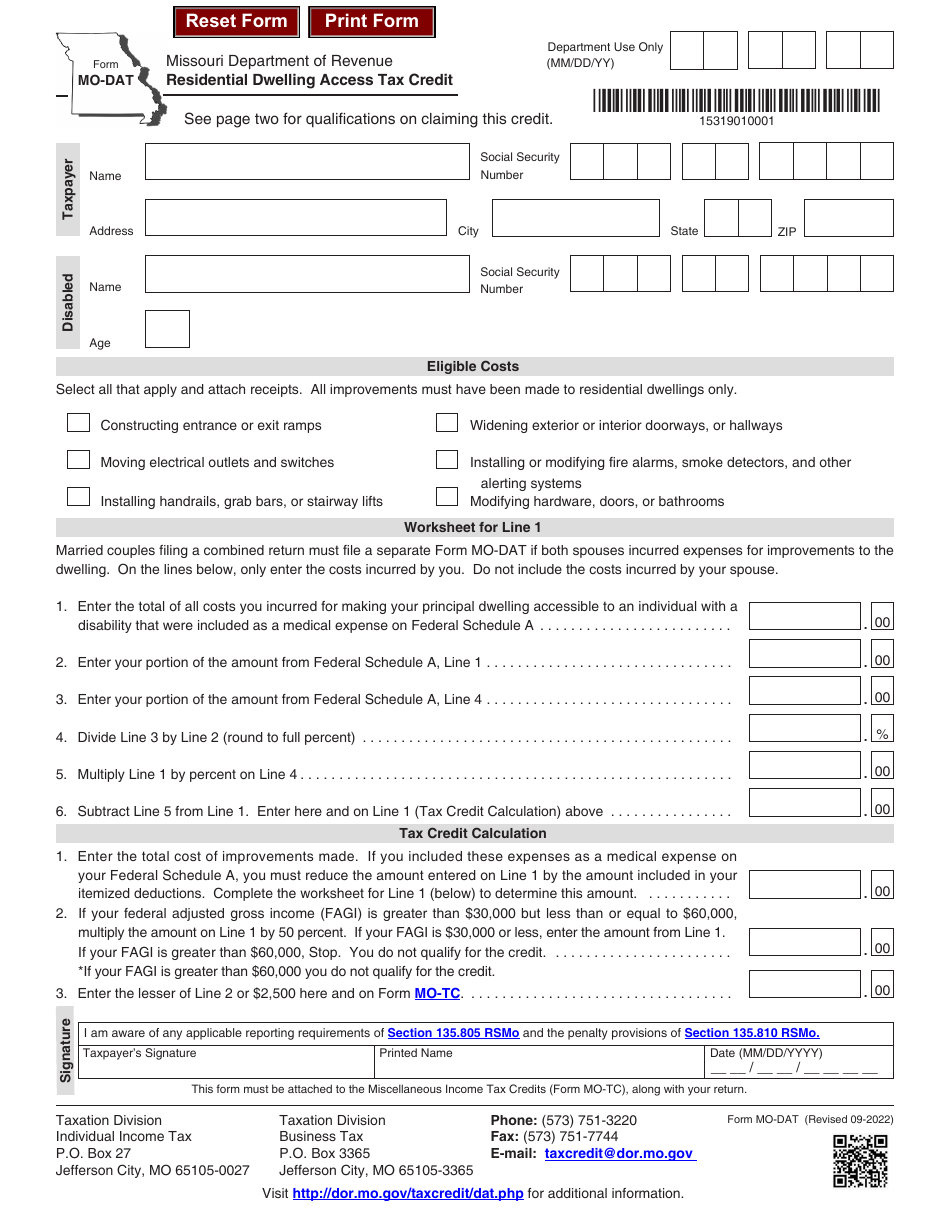

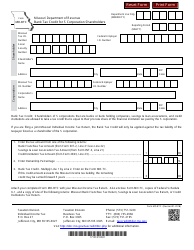

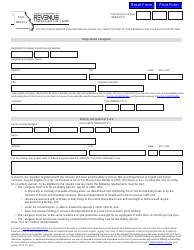

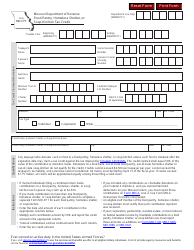

Form MO-DAT Residential Dwelling Access Tax Credit - Missouri

What Is Form MO-DAT?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-DAT Residential Dwelling Access Tax Credit?

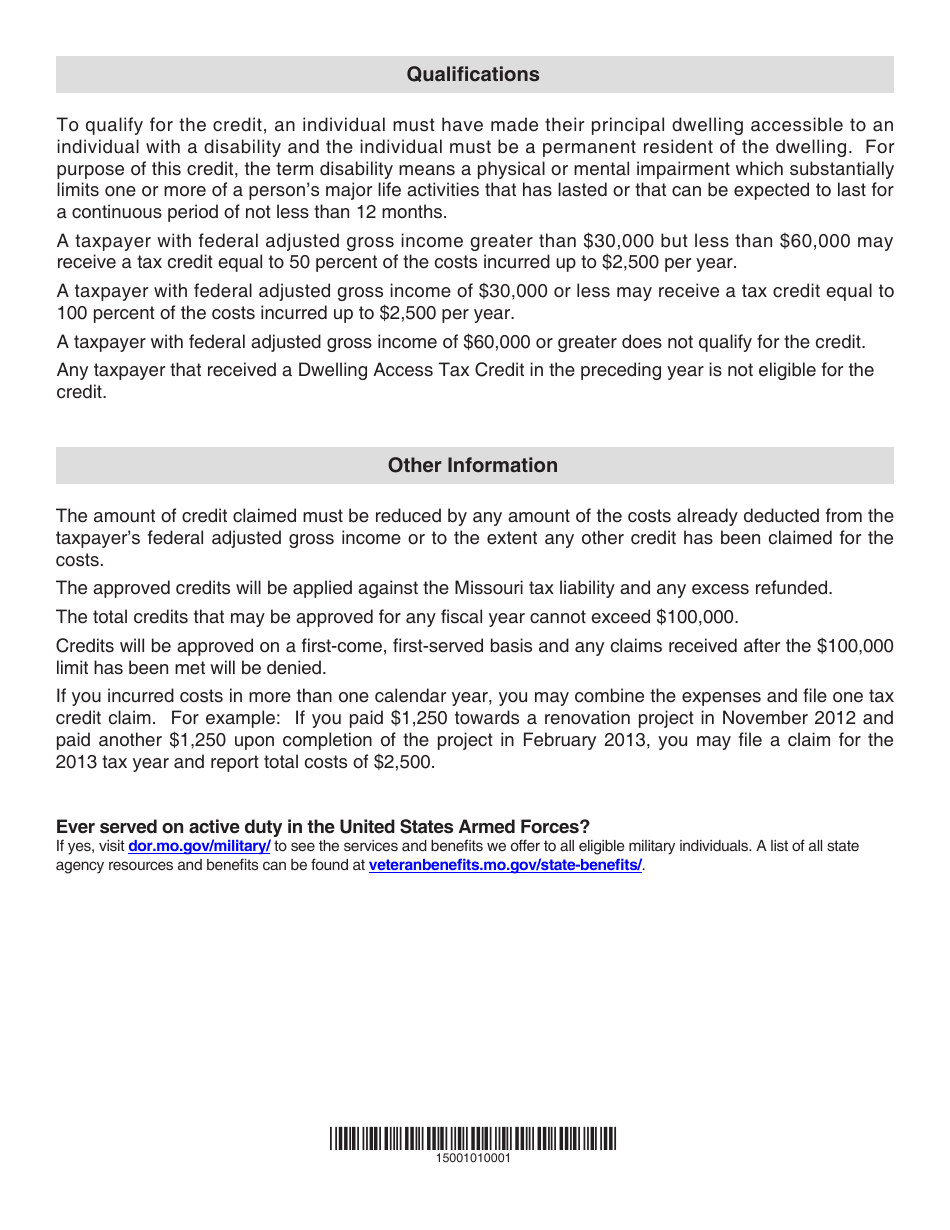

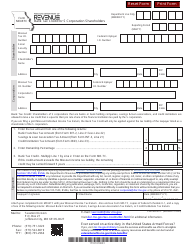

A: The MO-DAT Residential Dwelling Access Tax Credit is a tax credit available in Missouri that provides financial assistance to individuals who make their homes accessible for disabled individuals.

Q: Who is eligible for the MO-DAT Residential Dwelling Access Tax Credit?

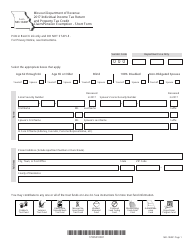

A: Individuals who are residents of Missouri and have made modifications to their homes to make them accessible for disabled residents may be eligible for the tax credit.

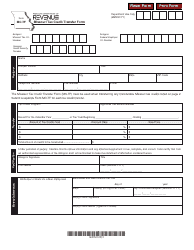

Q: What types of modifications qualify for the MO-DAT Residential Dwelling Access Tax Credit?

A: Modifications such as installing ramps, widening doorways, adding accessible bathrooms, and making other accessibility enhancements may qualify for the tax credit.

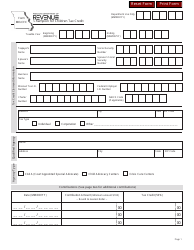

Q: How much is the MO-DAT Residential Dwelling Access Tax Credit?

A: The tax credit is equal to 50% of the cost of eligible modifications, up to a maximum credit of $1,500 per year.

Q: How do I apply for the MO-DAT Residential Dwelling Access Tax Credit?

A: To apply for the tax credit, you will need to complete Form MO-DAT and submit it with your state income tax return. The form can be obtained from the Missouri Department of Revenue.

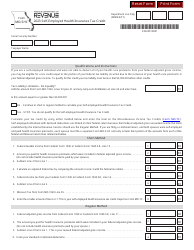

Q: Are there any limitations or restrictions for the MO-DAT Residential Dwelling Access Tax Credit?

A: Yes, there are some limitations and restrictions for the tax credit. The modifications must be completed by a licensed contractor, and the credit cannot be claimed for work done on rental properties or for modifications that have already received funding from other sources.

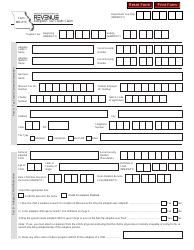

Form Details:

- Released on September 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-DAT by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.