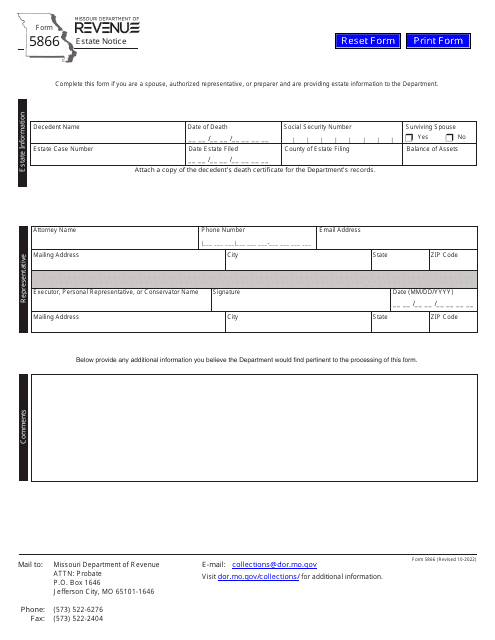

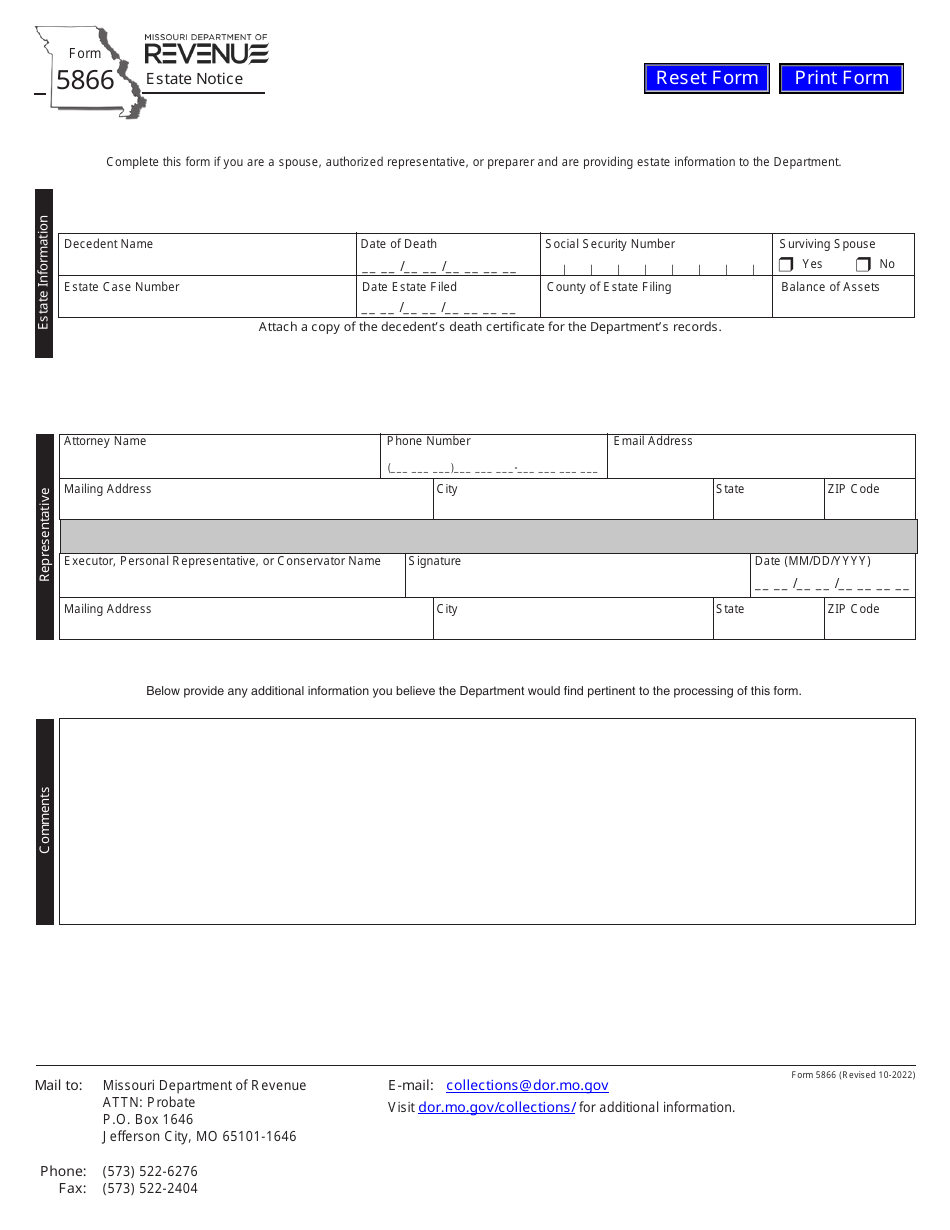

Form 5866 Estate Notice - Missouri

What Is Form 5866?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5866 Estate Notice?

A: Form 5866 Estate Notice is a document used in the state of Missouri to inform creditors and interested parties of a deceased person's estate.

Q: Who files Form 5866 Estate Notice?

A: The personal representative of the deceased person's estate is responsible for filing Form 5866 Estate Notice.

Q: What information is required on Form 5866 Estate Notice?

A: Form 5866 Estate Notice requires information about the deceased person, the personal representative, and a list of known creditors.

Q: Is there a fee for filing Form 5866 Estate Notice?

A: Yes, there is a filing fee for Form 5866 Estate Notice. The fee amount may vary depending on the county.

Q: What is the purpose of filing Form 5866 Estate Notice?

A: The purpose of filing Form 5866 Estate Notice is to provide notice to creditors and interested parties about the deceased person's estate, allowing them to make a claim against the estate if necessary.

Q: When should Form 5866 Estate Notice be filed?

A: Form 5866 Estate Notice should be filed within six months after the date of the first published notice to creditors.

Q: What happens after Form 5866 Estate Notice is filed?

A: After Form 5866 Estate Notice is filed, creditors have a certain period of time to file claims against the estate. The personal representative is responsible for reviewing and resolving any valid claims.

Q: What if I do not file Form 5866 Estate Notice?

A: Failure to file Form 5866 Estate Notice may result in creditors not being properly notified of the deceased person's estate, potentially affecting the distribution of assets.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5866 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.