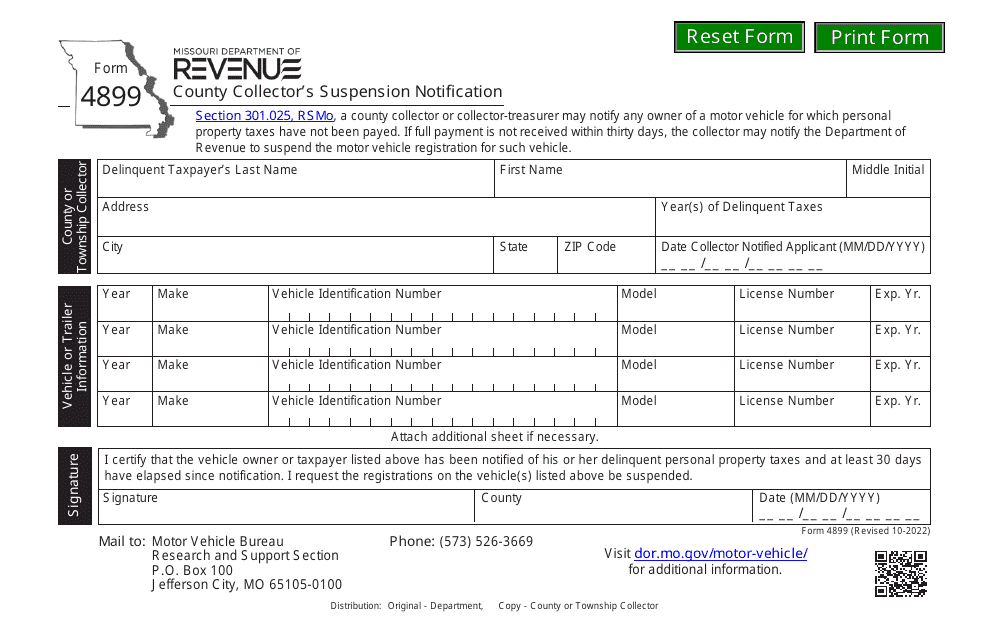

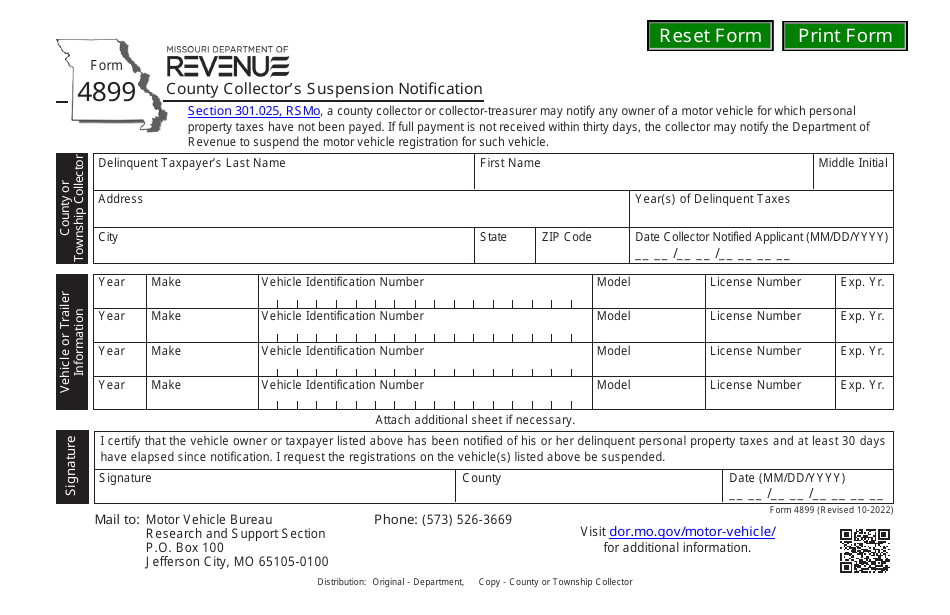

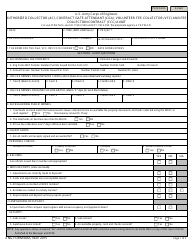

Form 4899 County Collector's Suspension Notification - Missouri

What Is Form 4899?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4899 County Collector's Suspension Notification?

A: Form 4899 County Collector's Suspension Notification is a document used in Missouri to notify a county collector of the suspension of their duties.

Q: What is the purpose of Form 4899?

A: The purpose of Form 4899 is to inform a county collector in Missouri that their duties have been suspended.

Q: Who uses Form 4899?

A: Form 4899 is used by the appropriate authorities in Missouri to notify a county collector of their suspension.

Q: How does Form 4899 work?

A: Form 4899 is completed by the appropriate authorities and sent to the county collector to notify them of their suspension.

Q: Is Form 4899 specific to a certain county in Missouri?

A: No, Form 4899 is a general form used throughout Missouri to notify county collectors.

Q: What happens after a county collector receives Form 4899?

A: After receiving Form 4899, the county collector's duties are suspended until further notice or until the issue is resolved.

Q: Is there a deadline for responding to Form 4899?

A: The document does not specify a deadline for responding to Form 4899, but it is important for the county collector to take prompt action.

Q: What should the county collector do if they receive Form 4899?

A: If a county collector receives Form 4899, they should follow the instructions provided and take appropriate action to resolve the issue.

Q: Can the county collector appeal the suspension?

A: Yes, the county collector has the right to appeal the suspension and should follow the appeal process outlined in the document.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4899 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.