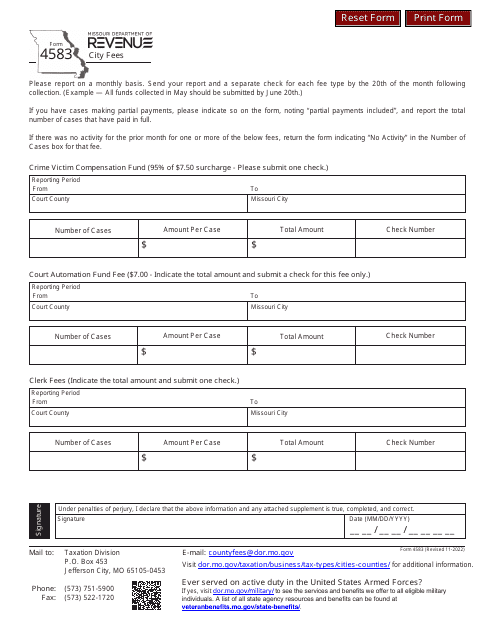

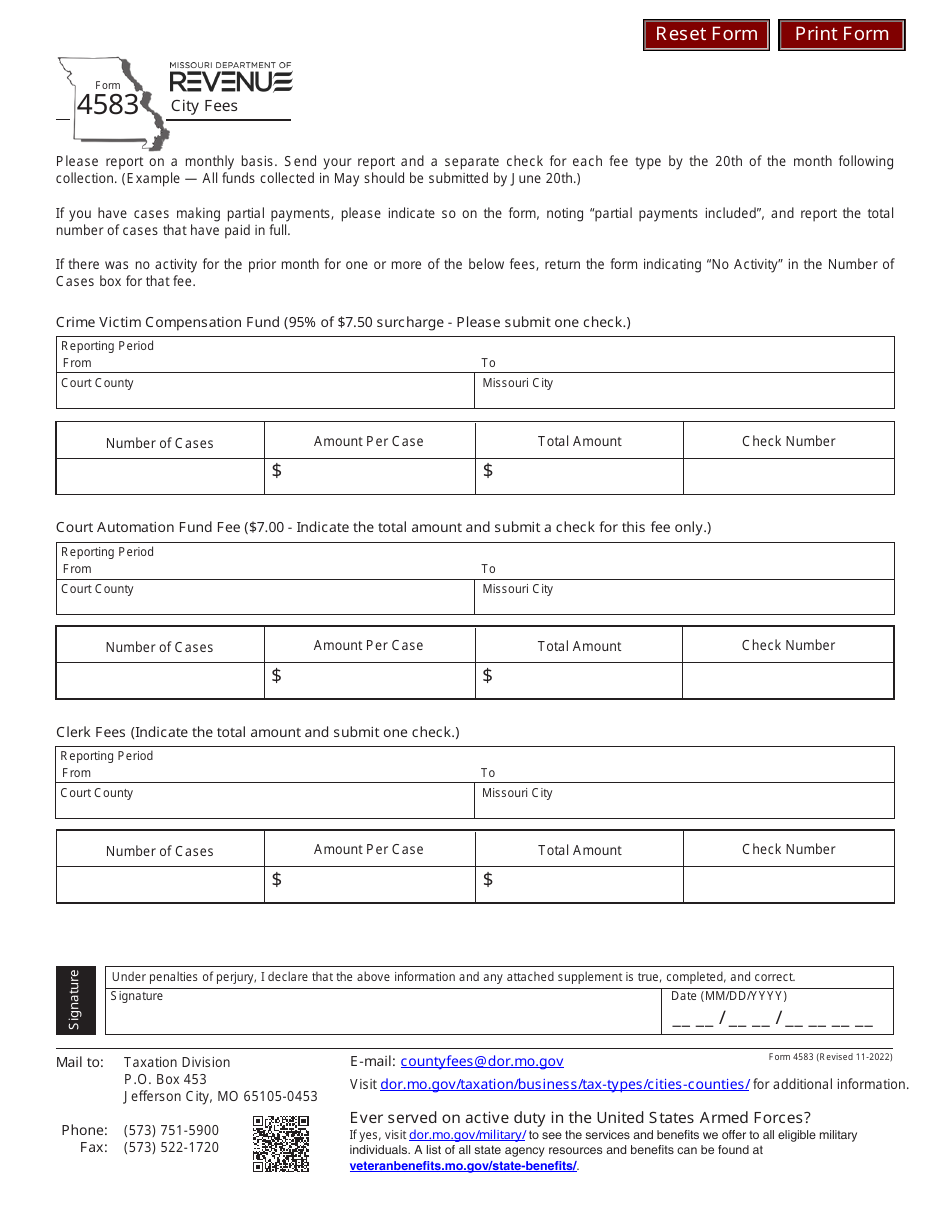

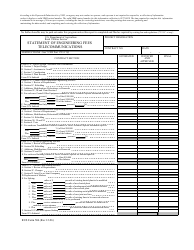

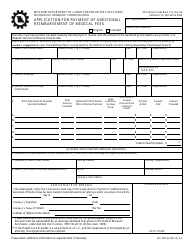

Form 4583 City Fees - Missouri

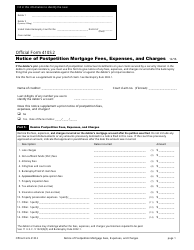

What Is Form 4583?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

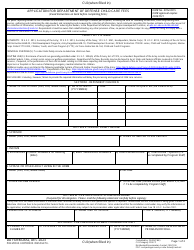

Q: What is Form 4583?

A: Form 4583 is a document used to report city fees in Missouri.

Q: Who needs to file Form 4583?

A: Businesses operating in Missouri that are required to pay city fees must file Form 4583.

Q: What are city fees in Missouri?

A: City fees in Missouri are local taxes or fees imposed by cities for various purposes, such as licensing or permits.

Q: Are all businesses required to pay city fees in Missouri?

A: No, only businesses operating in cities that have imposed such fees are required to pay them.

Q: How often do businesses need to file Form 4583?

A: Businesses need to file Form 4583 annually.

Q: Is there a deadline for filing Form 4583?

A: Yes, businesses must file Form 4583 by the due date specified by the Missouri Department of Revenue.

Q: What happens if a business fails to file Form 4583?

A: Failure to file Form 4583 or pay the required city fees may result in penalties or legal consequences.

Q: Can businesses claim exemptions or deductions on Form 4583?

A: Yes, businesses may be eligible for certain exemptions or deductions on Form 4583. It is important to review the instructions and guidelines provided with the form.

Q: Who can businesses contact for assistance with Form 4583?

A: Businesses can contact the Missouri Department of Revenue or their local city offices for assistance with Form 4583.

Form Details:

- Released on November 1, 2022;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4583 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.