This version of the form is not currently in use and is provided for reference only. Download this version of

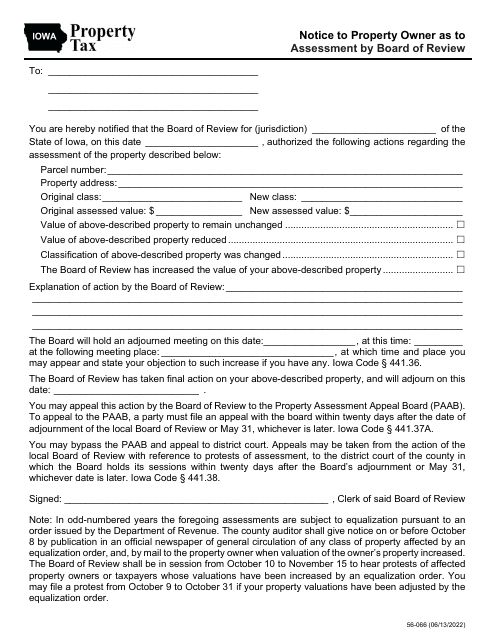

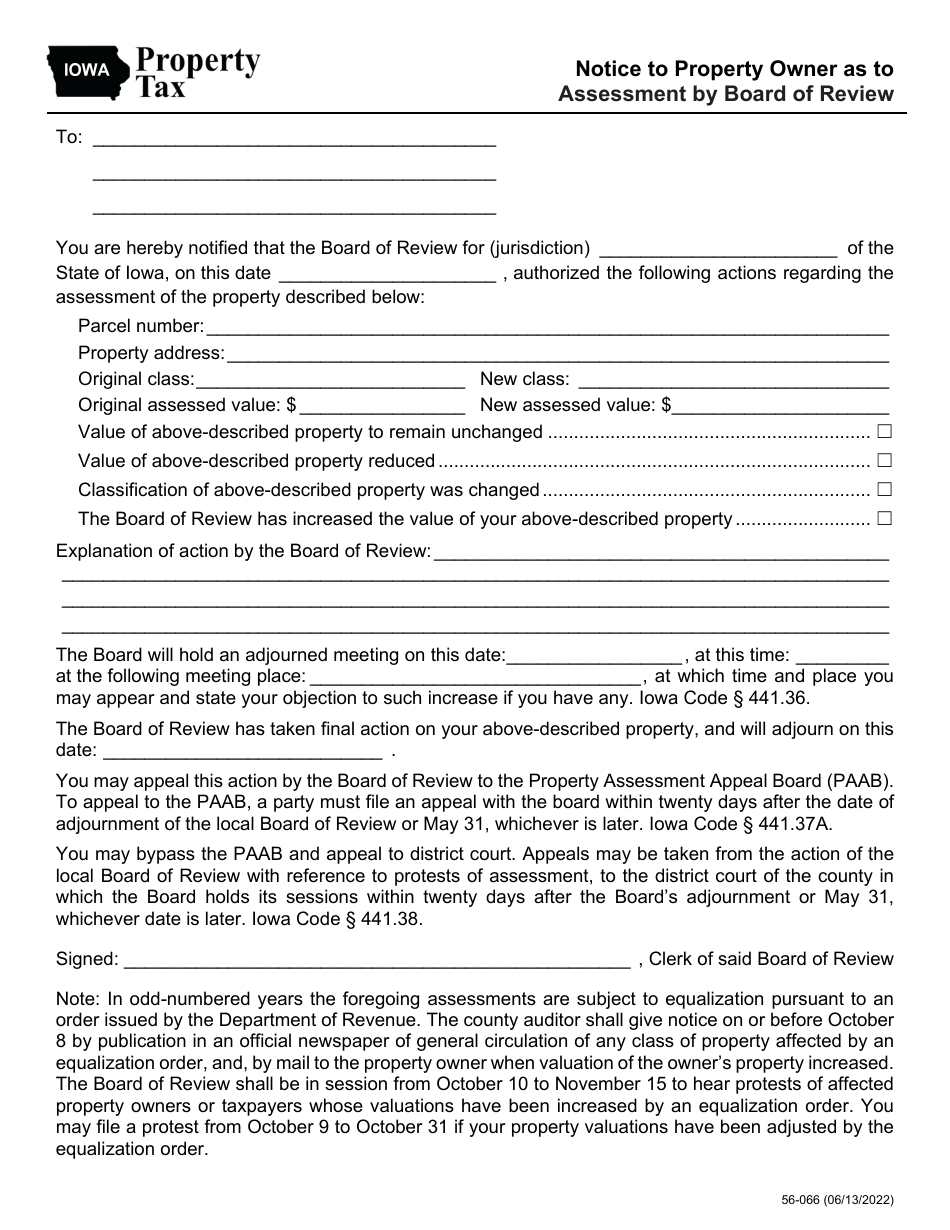

Form 56-066

for the current year.

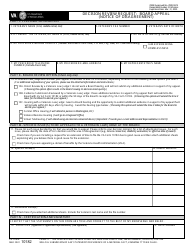

Form 56-066 Notice to Property Owner as to Assessment by Board of Review - Iowa

What Is Form 56-066?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56-066?

A: Form 56-066 is a notice to property owner as to assessment by Board of Review in Iowa.

Q: What does Form 56-066 do?

A: Form 56-066 notifies property owners about the assessment made by the Board of Review.

Q: Who is the intended recipient of Form 56-066?

A: The intended recipient of Form 56-066 is the property owner.

Q: What information does Form 56-066 provide to the property owner?

A: Form 56-066 provides information about the assessment made by the Board of Review, including the assessed value of the property.

Q: Is Form 56-066 mandatory?

A: Yes, property owners are required to receive Form 56-066 to be informed about the assessment made by the Board of Review.

Q: What should a property owner do after receiving Form 56-066?

A: After receiving Form 56-066, a property owner should review the assessment and contact the Board of Review if they have any questions or concerns.

Q: Are there any deadlines associated with Form 56-066?

A: Yes, there may be deadlines for filing an appeal or requesting a review of the assessment. Property owners should pay attention to any deadlines mentioned in Form 56-066.

Q: Can a property owner appeal the assessment mentioned in Form 56-066?

A: Yes, a property owner has the right to appeal the assessment made by the Board of Review. They should follow the procedures outlined in Form 56-066 or contact the Board of Review for more information.

Q: What happens if a property owner does not receive Form 56-066?

A: If a property owner does not receive Form 56-066, they may still be responsible for the assessment made by the Board of Review. It is advisable to contact the relevant authorities to ensure proper communication and assessment review.

Form Details:

- Released on June 13, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 56-066 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.