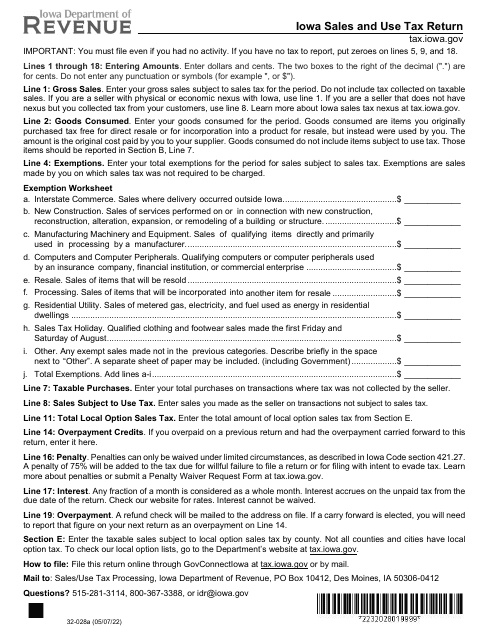

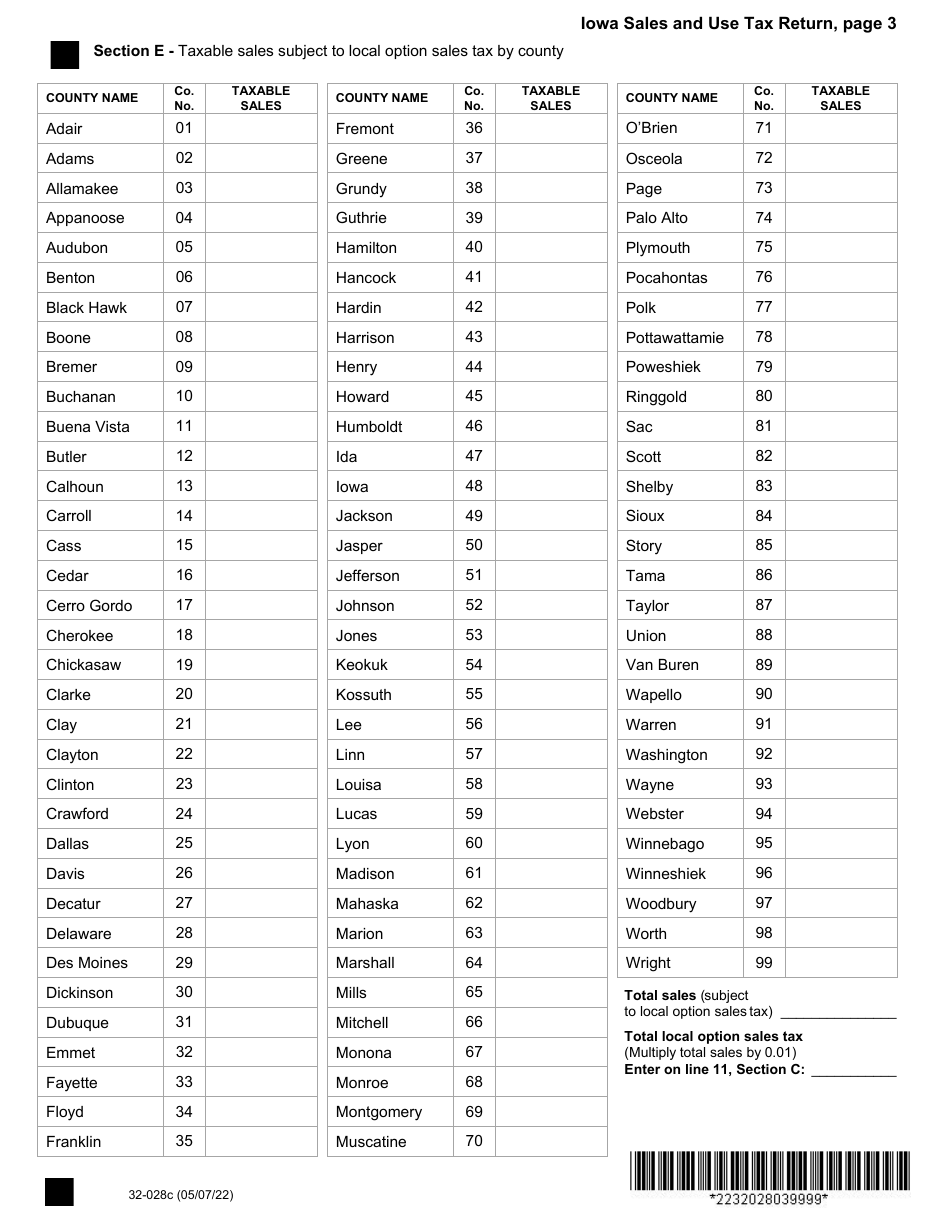

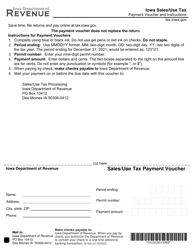

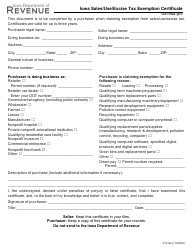

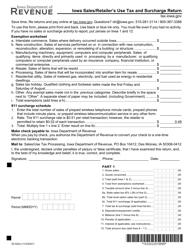

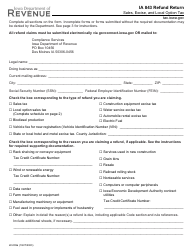

Form 32-028 Iowa Sales and Use Tax Return - Iowa

What Is Form 32-028?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 32-028?

A: Form 32-028 is the Iowa Sales and Use Tax Return.

Q: Who needs to file Form 32-028?

A: Anyone who conducts business in Iowa and is responsible for collecting and remitting sales or use tax.

Q: What is the purpose of Form 32-028?

A: The purpose of Form 32-028 is to report and pay sales and use tax collected from customers in Iowa.

Q: How often should Form 32-028 be filed?

A: Form 32-028 is generally filed monthly, but some taxpayers may be eligible to file quarterly or annually.

Q: Are there any exemptions from filing Form 32-028?

A: Certain taxpayers may be eligible for exemptions or reduced filing frequency. Consult the Iowa Department of Revenue for more information.

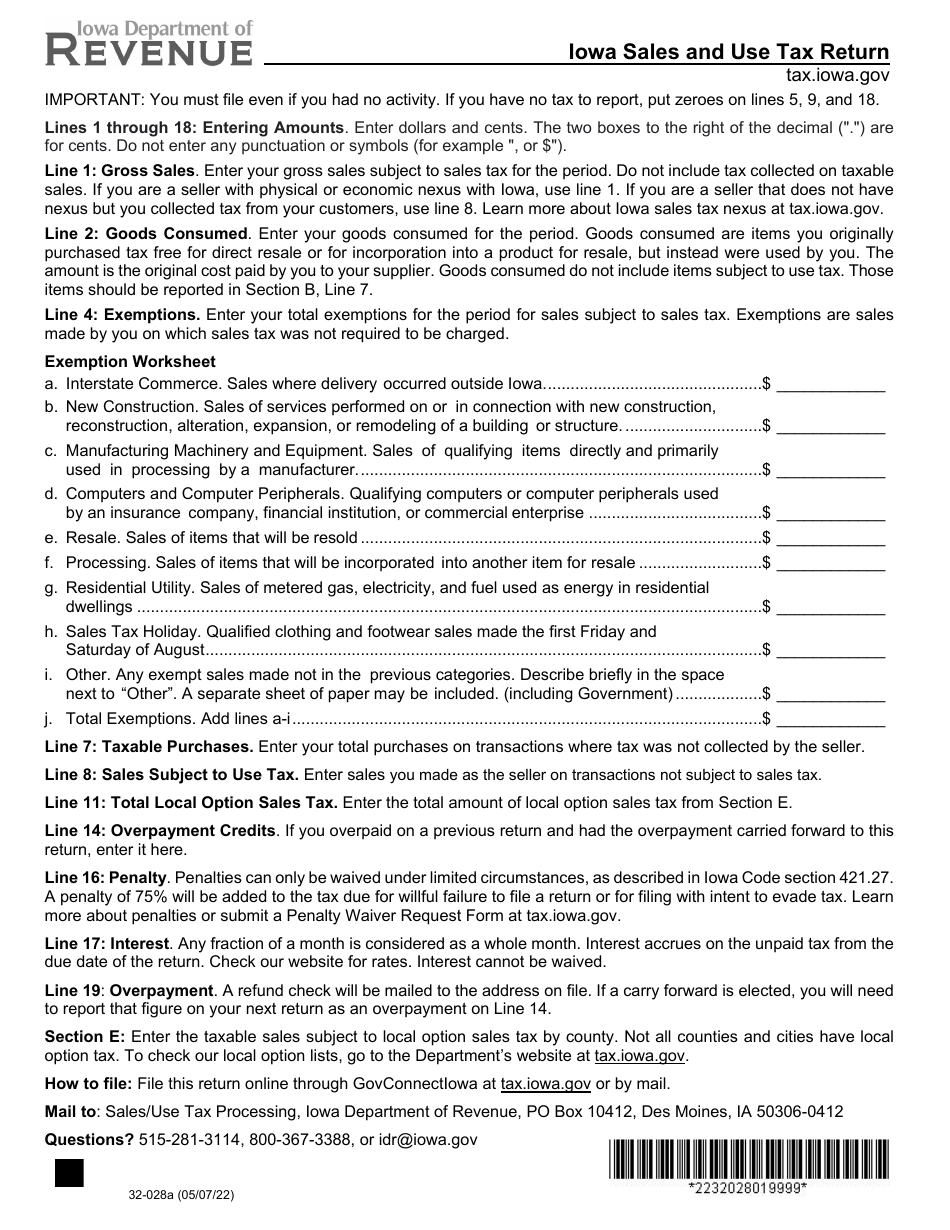

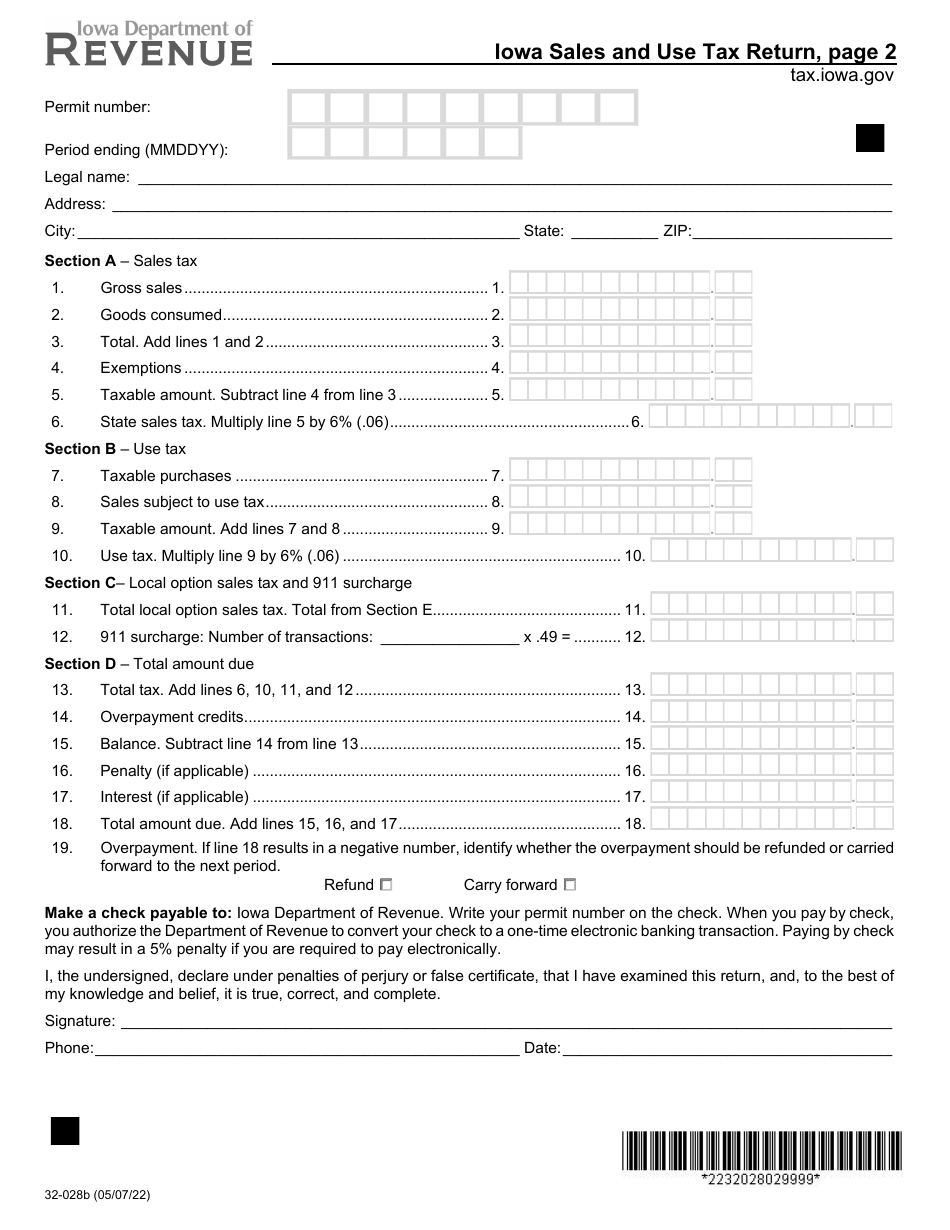

Q: What information is required to complete Form 32-028?

A: You will need to provide your business information, total sales or use tax collected, and any credits or deductions you are eligible for.

Q: When is the deadline for filing Form 32-028?

A: Form 32-028 must be filed and paid by the 20th day of the month following the reporting period.

Form Details:

- Released on May 7, 2022;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 32-028 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.