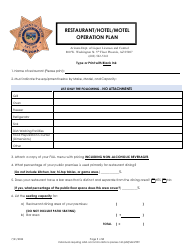

Records Required for Audit - Restaurant / Hotel / Motel - Arizona

Records Required for Audit - Restaurant/Hotel/Motel is a legal document that was released by the Arizona Department of Liquor Licenses and Control - a government authority operating within Arizona.

FAQ

Q: What records are typically required for an audit of a restaurant, hotel, or motel in Arizona?

A: The records typically required for an audit of a restaurant, hotel, or motel in Arizona may include financial statements, sales and purchase invoices, payroll records, bank statements, general ledger, tax returns, and any other relevant financial documentation.

Q: Why are financial statements important for an audit of a restaurant, hotel, or motel?

A: Financial statements provide an overview of a business's financial performance and position, which is crucial for the audit process. They help auditors assess the accuracy and completeness of financial records and ensure compliance with accounting standards and regulations.

Q: What is the importance of sales and purchase invoices in an audit?

A: Sales and purchase invoices are important documents as they provide evidence of transactions, including sales revenue, expenses, and purchases. Auditors use these invoices to verify the accuracy of recorded sales and expenses, ensuring proper reporting and compliance.

Q: How do payroll records contribute to the audit process?

A: Payroll records are essential for auditing employee wages, benefits, and taxes. Auditors will review these records to ensure accurate payment calculations, proper withholding, compliance with employment laws, and the proper classification of workers.

Q: Why are bank statements necessary for an audit of a restaurant, hotel, or motel?

A: Bank statements are crucial documents in an audit as they provide a verification of financial transactions and cash flows. Auditors compare these statements with the business's accounting records to ensure that all transactions are accurately recorded and there are no irregularities.

Q: What is the role of the general ledger in an audit?

A: The general ledger is a central accounting record that summarizes all financial transactions of a business. During an audit, auditors examine the general ledger to ensure that it accurately reflects all financial activities, providing a complete and accurate picture of the business's financial position.

Q: Why are tax returns required for an audit of a restaurant, hotel, or motel?

A: Tax returns are important documents that provide auditors with insights into a business's tax compliance. Auditors use tax returns to verify reported income, deductions, and credits, ensuring that the business has complied with all relevant tax laws and regulations.

Form Details:

- Released on July 21, 2022;

- The latest edition currently provided by the Arizona Department of Liquor Licenses and Control;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Liquor Licenses and Control.