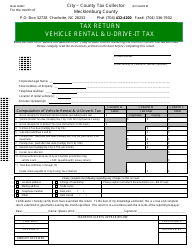

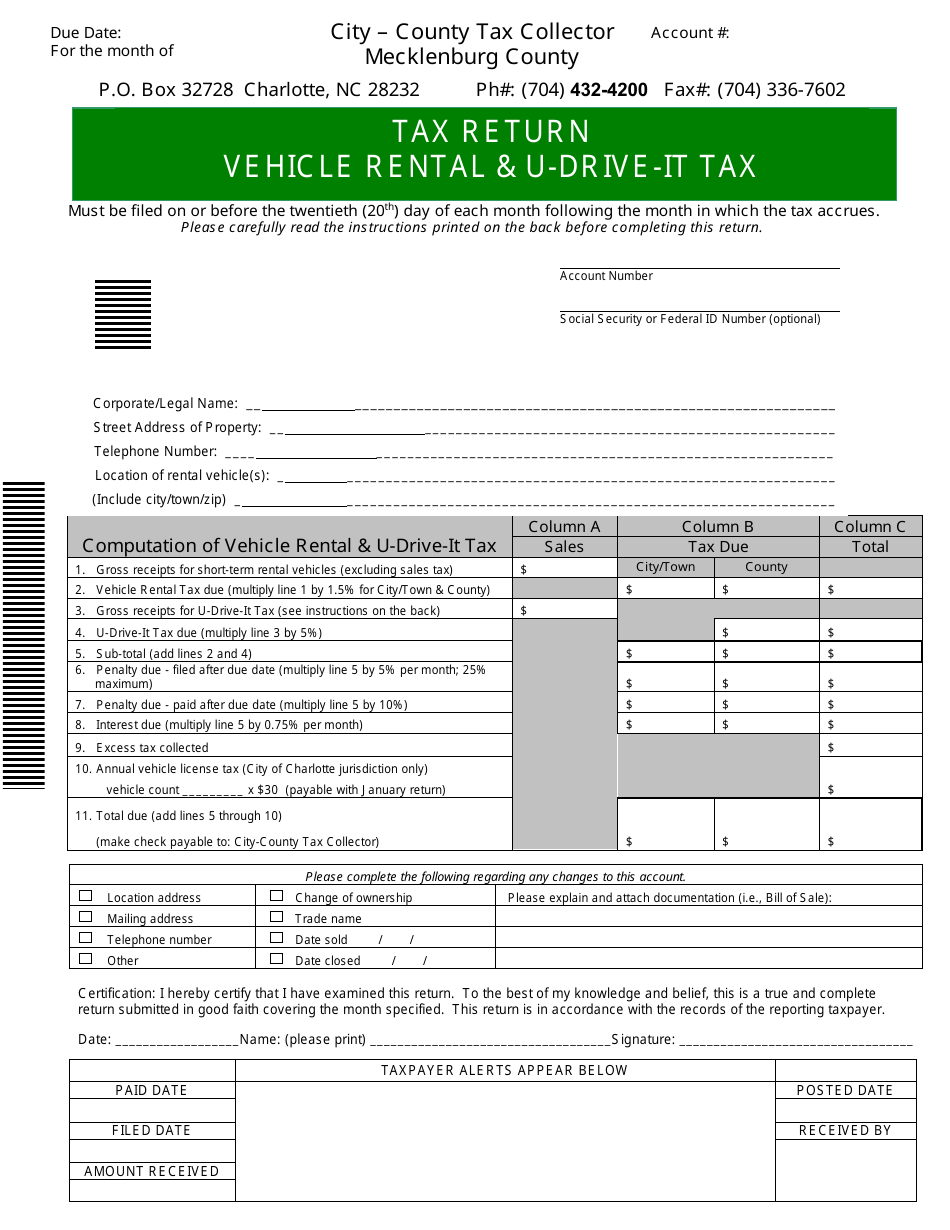

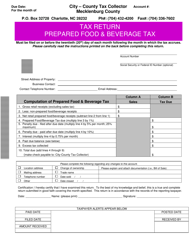

Vehicle Rental & U-Drive-It Tax Return - Mecklenburg County, North Carolina

Vehicle Rental & U-Drive-It Tax Return is a legal document that was released by the Office of the Tax Collector - Mecklenburg County, North Carolina - a government authority operating within North Carolina. The form may be used strictly within Mecklenburg County.

FAQ

Q: What is a Vehicle Rental & U-Drive-It Tax Return?

A: A Vehicle Rental & U-Drive-It Tax Return is a tax return specifically for businesses that engage in vehicle renting or U-Drive-It operations.

Q: Who needs to file a Vehicle Rental & U-Drive-It Tax Return in Mecklenburg County, North Carolina?

A: Businesses that are involved in vehicle renting or U-Drive-It operations in Mecklenburg County, North Carolina need to file this tax return.

Q: What is the purpose of the Vehicle Rental & U-Drive-It Tax Return?

A: The purpose of this tax return is to report and pay the tax on vehicle renting or U-Drive-It operations conducted in Mecklenburg County.

Q: How often do businesses need to file the Vehicle Rental & U-Drive-It Tax Return?

A: Businesses that engage in vehicle renting or U-Drive-It operations need to file this tax return on a monthly basis.

Q: What information is required to complete the Vehicle Rental & U-Drive-It Tax Return?

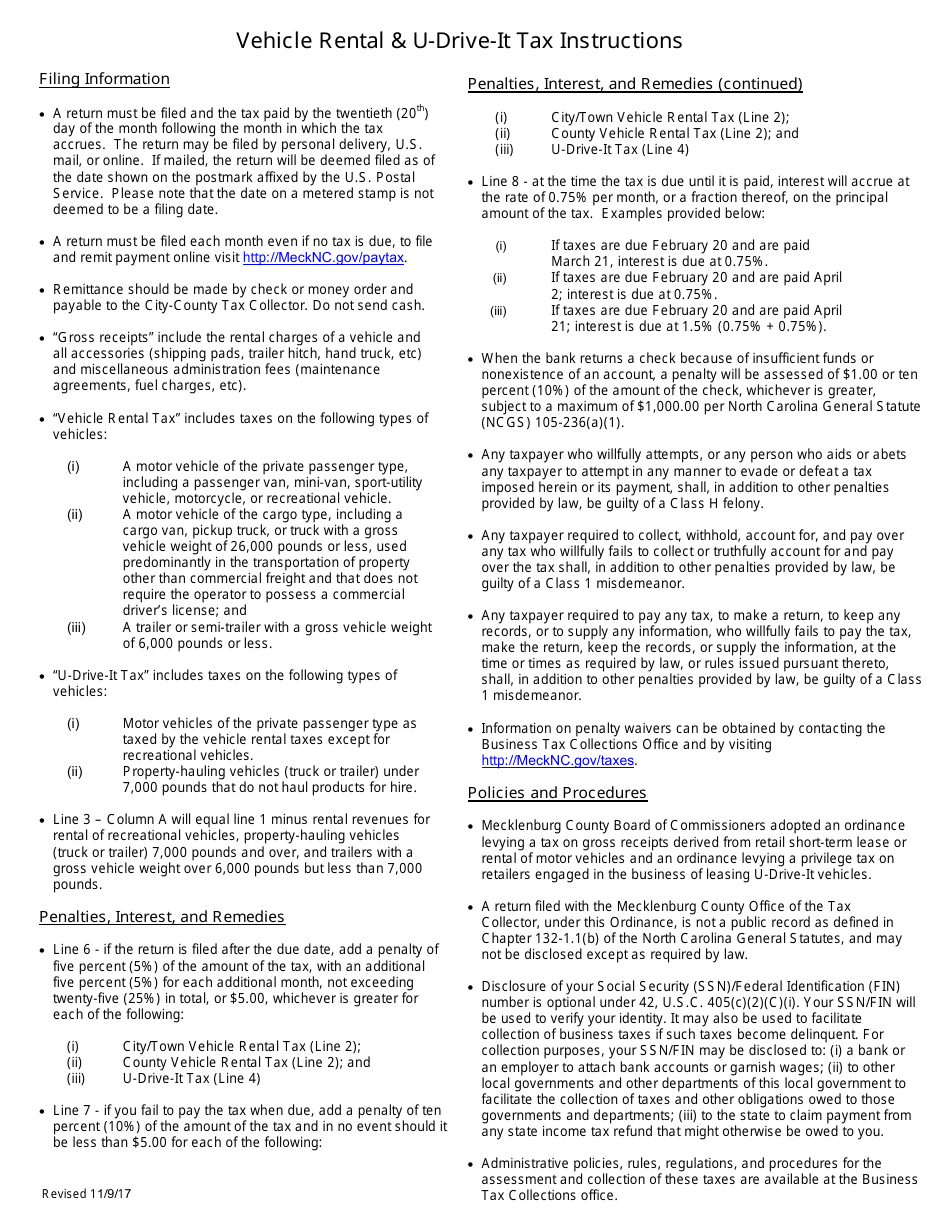

A: Businesses need to provide information such as the number of vehicles rented or used, rental charges, and the amount of tax due.

Q: What are the consequences of not filing or paying the Vehicle Rental & U-Drive-It tax?

A: Failure to file or pay the Vehicle Rental & U-Drive-It tax can result in penalties, interest, and legal actions by the county.

Q: Are there any exemptions or deductions available for the Vehicle Rental & U-Drive-It tax?

A: Yes, certain exemptions and deductions may apply. It's best to consult the official guidelines or a tax professional for specific details.

Form Details:

- Released on November 9, 2017;

- The latest edition currently provided by the Office of the Tax Collector - Mecklenburg County, North Carolina;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Tax Collector - Mecklenburg County, North Carolina.