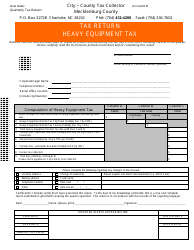

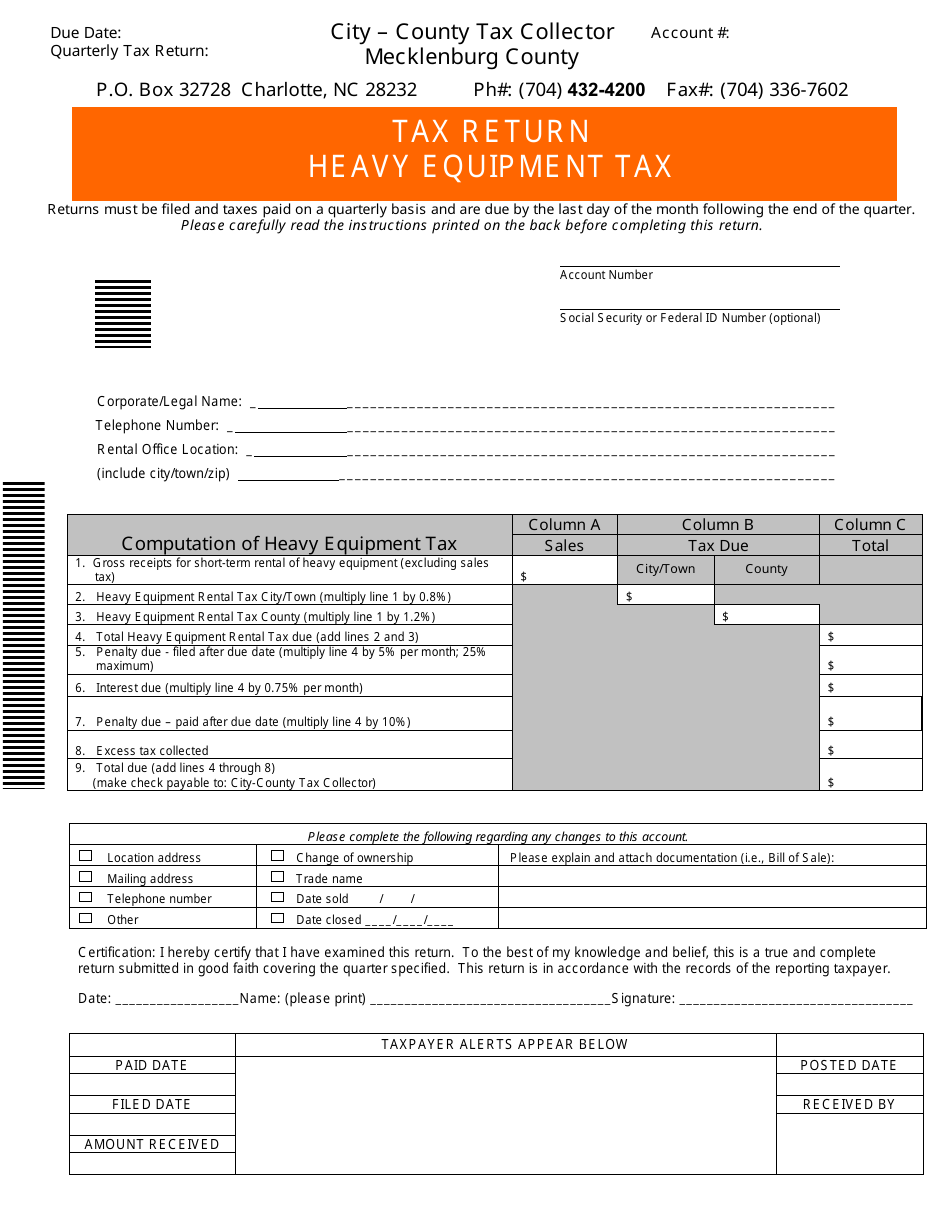

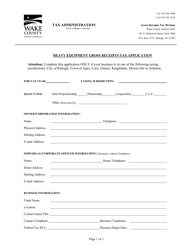

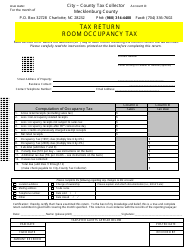

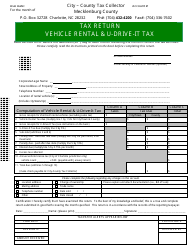

Heavy Equipment Tax Return - Mecklenburg County, North Carolina

Heavy Equipment Tax Return is a legal document that was released by the Office of the Tax Collector - Mecklenburg County, North Carolina - a government authority operating within North Carolina. The form may be used strictly within Mecklenburg County.

FAQ

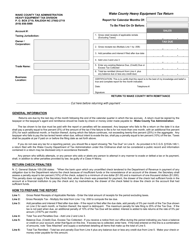

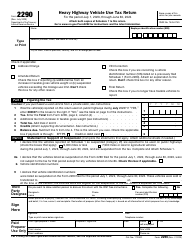

Q: What is the heavy equipment tax return?

A: The heavy equipment tax return is a form to report and pay taxes on heavy equipment owned or operated in Mecklenburg County, North Carolina.

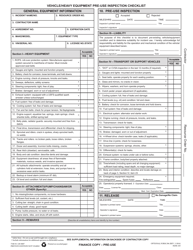

Q: Who needs to file the heavy equipment tax return?

A: Any individual or business that owns or operates heavy equipment in Mecklenburg County, North Carolina, is required to file the heavy equipment tax return.

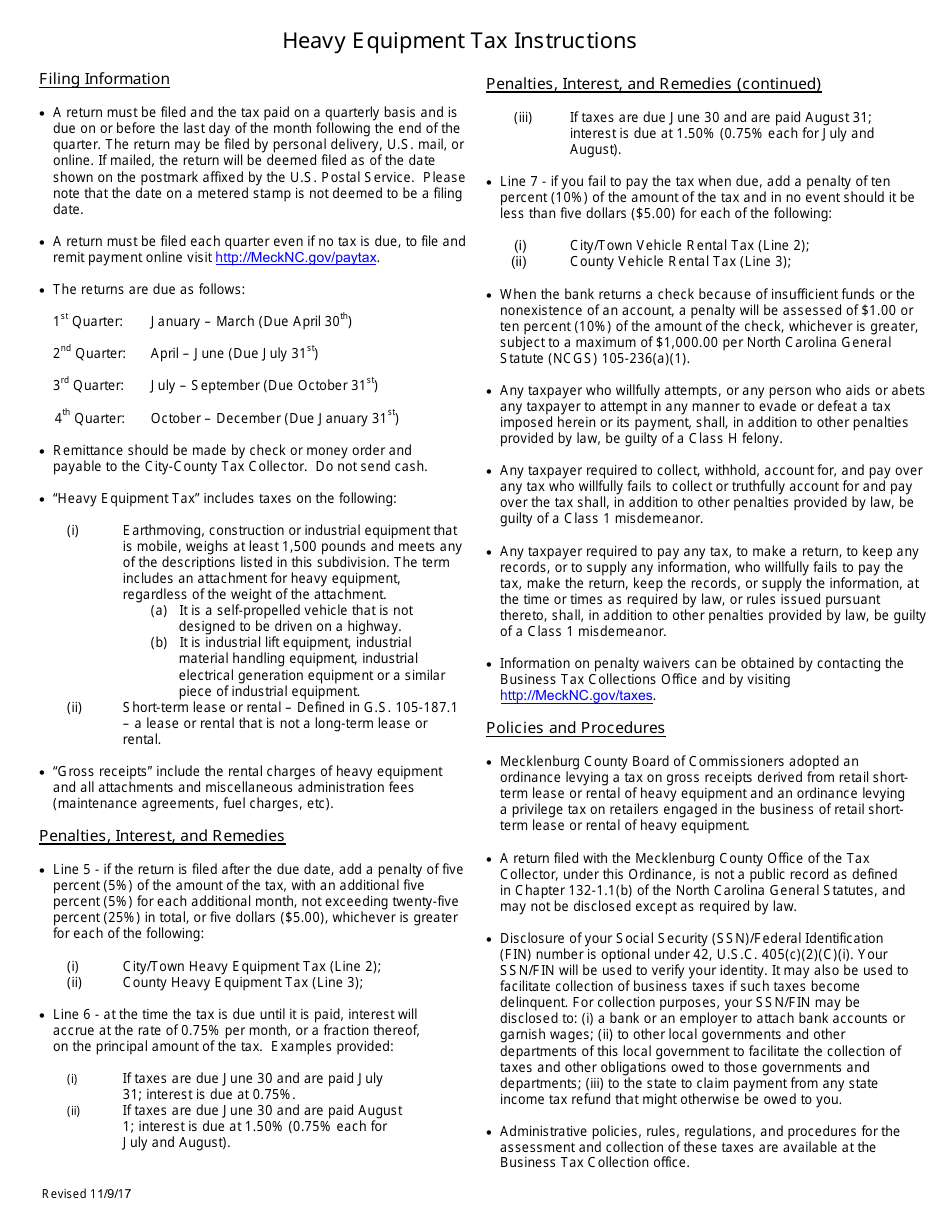

Q: When is the deadline to file the heavy equipment tax return?

A: The deadline to file the heavy equipment tax return in Mecklenburg County, North Carolina, is typically January 31st of each year.

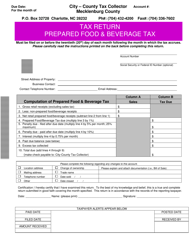

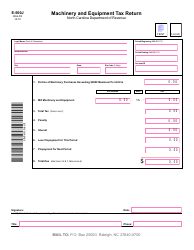

Q: What information do I need to file the heavy equipment tax return?

A: You will need information about the heavy equipment you own or operate, including the make, model, year, and value of each piece of equipment.

Q: How is the heavy equipment tax calculated?

A: The heavy equipment tax is calculated based on the appraised value of the equipment and the tax rate set by Mecklenburg County.

Q: Are there any penalties for late filing or non-payment of the heavy equipment tax?

A: Yes, there may be penalties for late filing or non-payment of the heavy equipment tax, including interest charges and possible legal consequences.

Form Details:

- Released on November 9, 2017;

- The latest edition currently provided by the Office of the Tax Collector - Mecklenburg County, North Carolina;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Office of the Tax Collector - Mecklenburg County, North Carolina.