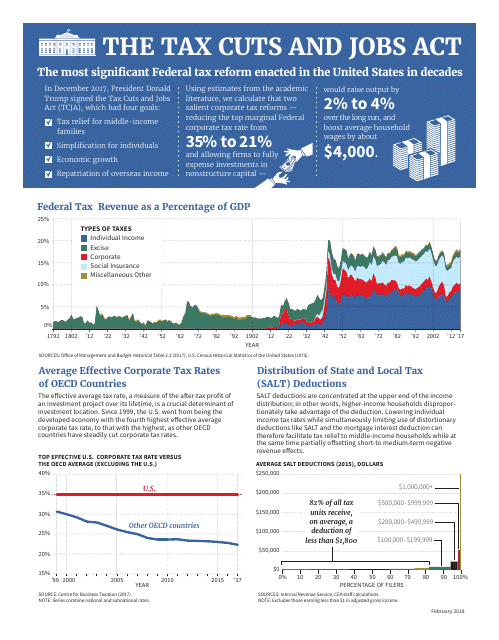

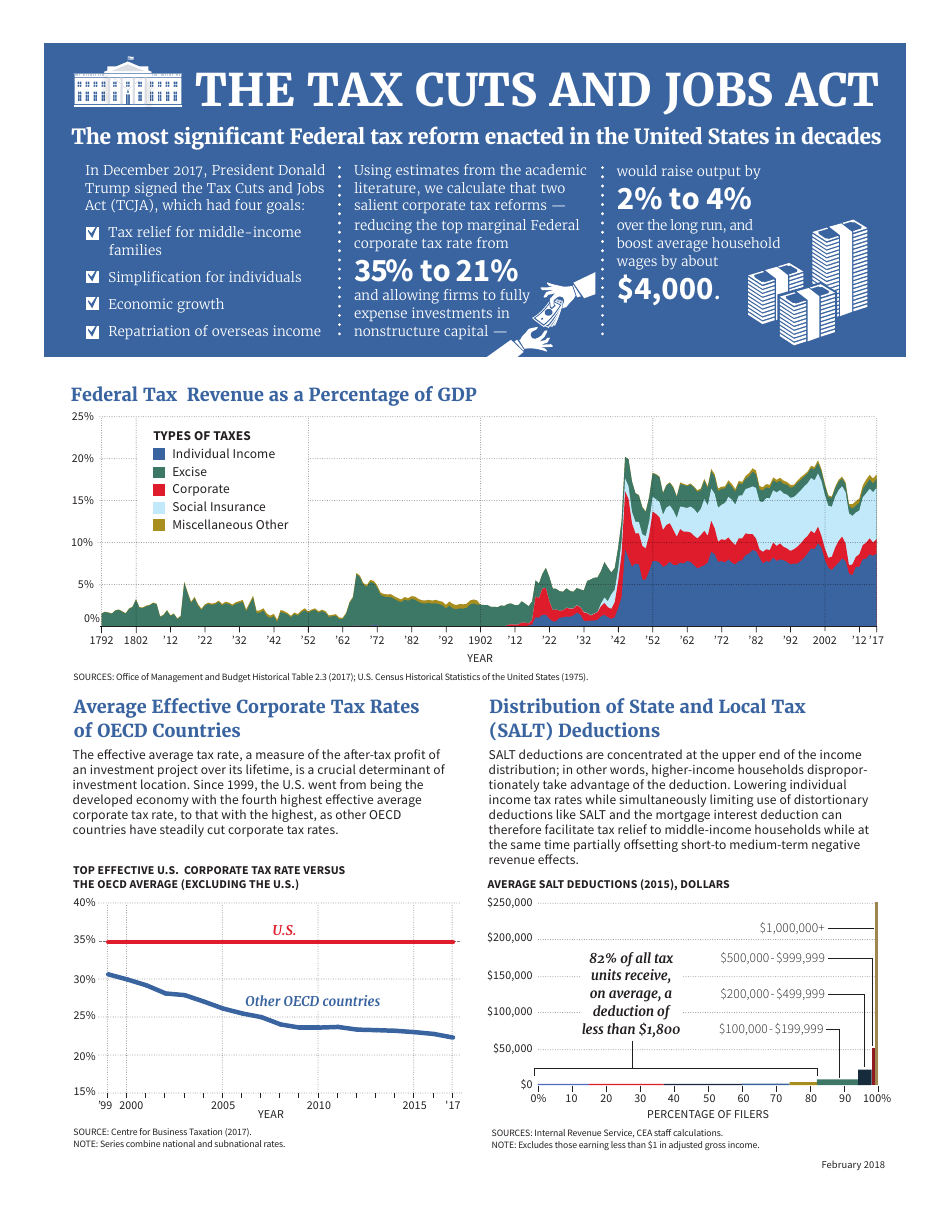

The Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act is a 1-page legal document that was released by the U.S. Office of Management and Budget on February 1, 2018 and used nation-wide.

FAQ

Q: What is the Tax Cuts and Jobs Act?

A: The Tax Cuts and Jobs Act is a tax reform legislation passed in 2017 that made significant changes to the US tax code.

Q: What were the main goals of the Tax Cuts and Jobs Act?

A: The main goals of the Tax Cuts and Jobs Act were to stimulate economic growth, simplify the tax code, and provide tax relief to individuals and businesses.

Q: How did the Tax Cuts and Jobs Act affect individual taxpayers?

A: The Tax Cuts and Jobs Act lowered tax rates for most individual taxpayers. It also increased the standard deduction and child tax credit.

Q: What were the changes for businesses under the Tax Cuts and Jobs Act?

A: The Tax Cuts and Jobs Act reduced the corporate tax rate and introduced a new deduction for certain pass-through businesses.

Q: Did the Tax Cuts and Jobs Act eliminate any deductions?

A: Yes, the Tax Cuts and Jobs Act eliminated or limited various deductions, including the deduction for state and local taxes and the personal exemption.

Q: How did the Tax Cuts and Jobs Act impact the economy?

A: The impact of the Tax Cuts and Jobs Act on the economy is a subject of debate. Proponents argue that it has stimulated economic growth, while critics argue that it has primarily benefited the wealthy.

Form Details:

- The latest edition currently provided by the U.S. Office of Management and Budget;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.