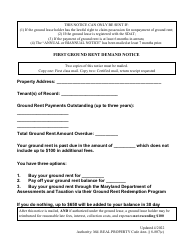

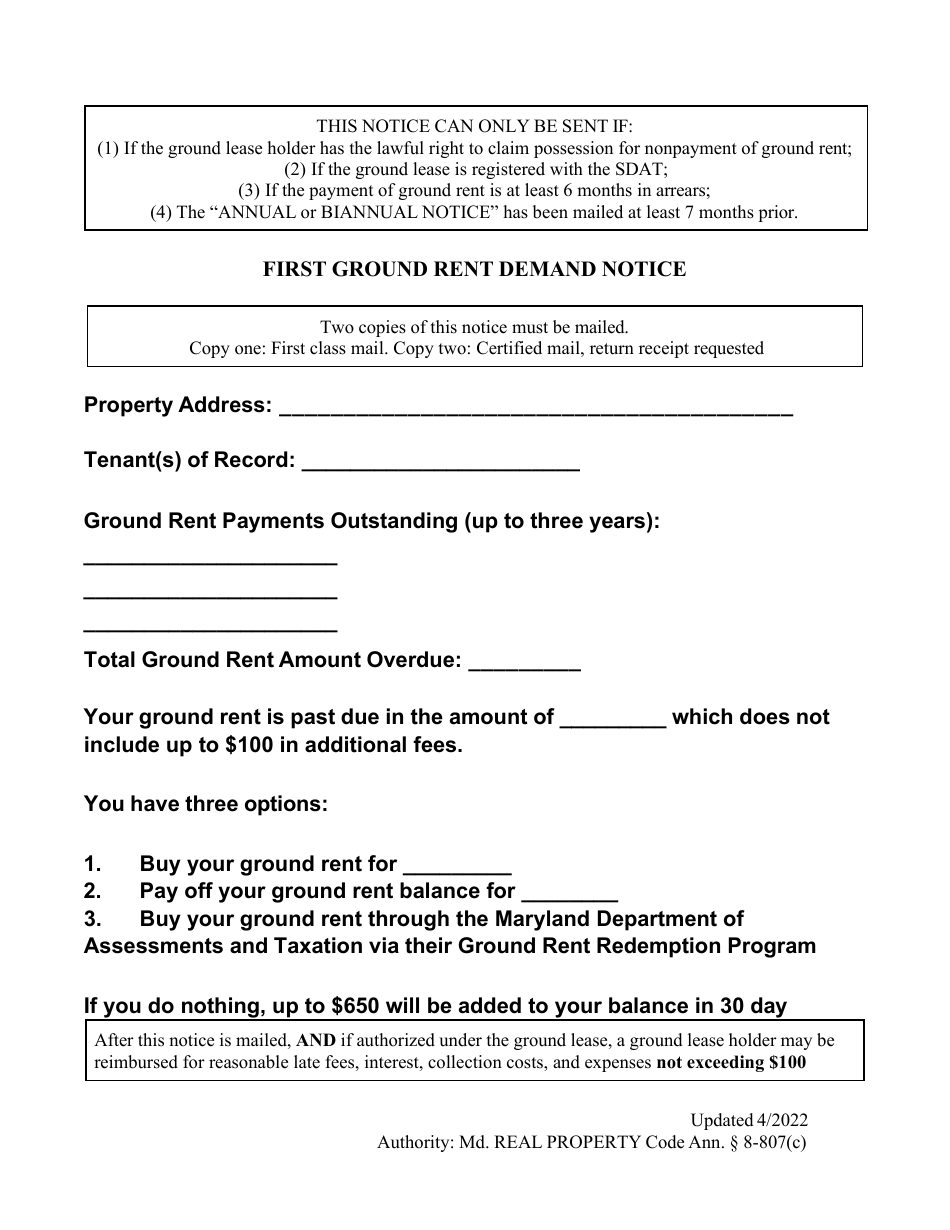

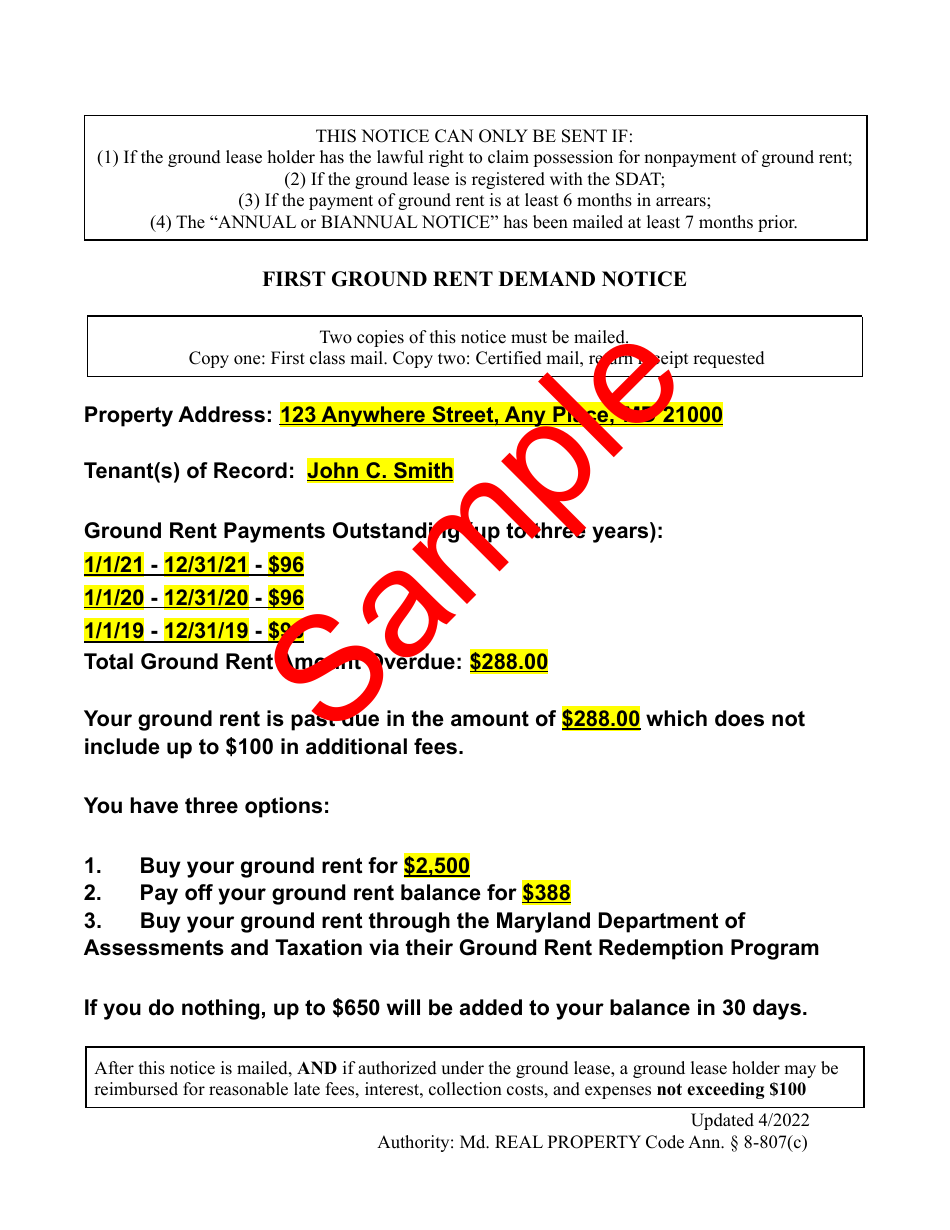

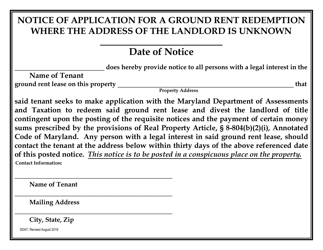

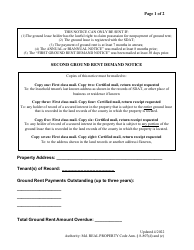

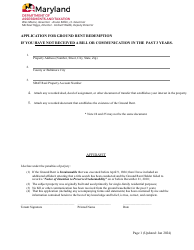

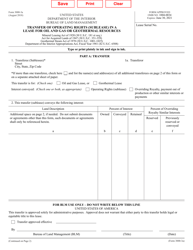

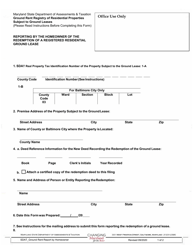

First Ground Rent Demand Notice - Maryland

First Ground Rent Demand Notice is a legal document that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland.

FAQ

Q: What is a First Ground Rent Demand Notice?

A: A First Ground Rent Demand Notice is a formal request for payment of ground rent in the state of Maryland.

Q: What is ground rent?

A: Ground rent is an annual payment made by the leaseholder of a property to the owner of the land on which the property is built.

Q: Why do I receive a First Ground Rent Demand Notice?

A: You receive a First Ground Rent Demand Notice because you are the leaseholder of a property subject to ground rent in Maryland.

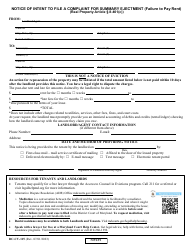

Q: What should I do upon receiving a First Ground Rent Demand Notice?

A: Upon receiving a First Ground Rent Demand Notice, you should review the notice carefully and ensure that the information is correct. If there are any discrepancies, you should contact the issuing party.

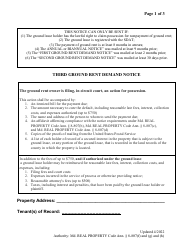

Q: What happens if I do not pay the ground rent?

A: If you do not pay the ground rent, the owner of the land may take legal action to collect the unpaid amount, which could include filing a lawsuit or initiating foreclosure proceedings.

Q: Can the ground rent amount change over time?

A: Yes, the ground rent amount can change over time. The terms of the ground rent are typically established in the original ground lease, and may include provisions for periodic increases.

Q: How can I determine the amount of ground rent I owe?

A: To determine the amount of ground rent you owe, you can refer to your ground lease agreement or contact the owner of the land.

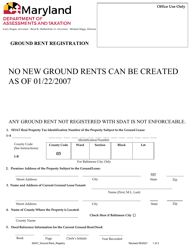

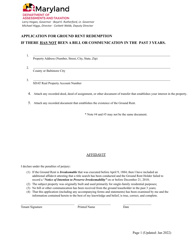

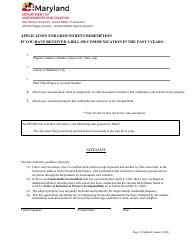

Q: Can I buy out the ground rent?

A: Yes, it is possible to buy out the ground rent. This typically involves negotiating a lump sum payment to the owner of the land in exchange for the elimination of the ground rent obligation.

Q: Can I sell a property subject to ground rent?

A: Yes, you can sell a property subject to ground rent. However, it is important to disclose the ground rent obligation to potential buyers.

Q: Are there any exemptions to paying ground rent?

A: There may be certain exemptions to paying ground rent, such as exemptions for properties owned by religious institutions or government entities. It is advisable to consult with an attorney to determine if any exemptions apply to your situation.

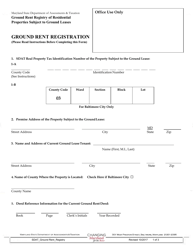

Form Details:

- Released on April 1, 2022;

- The latest edition currently provided by the Maryland Department of Assessments and Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.