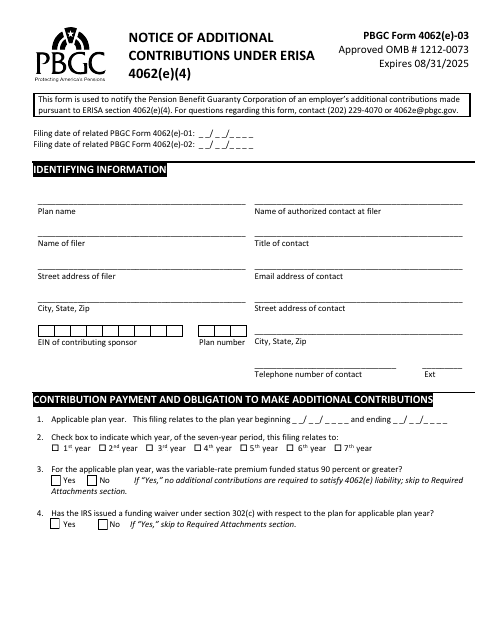

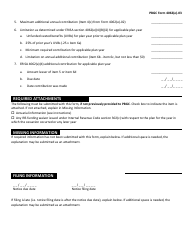

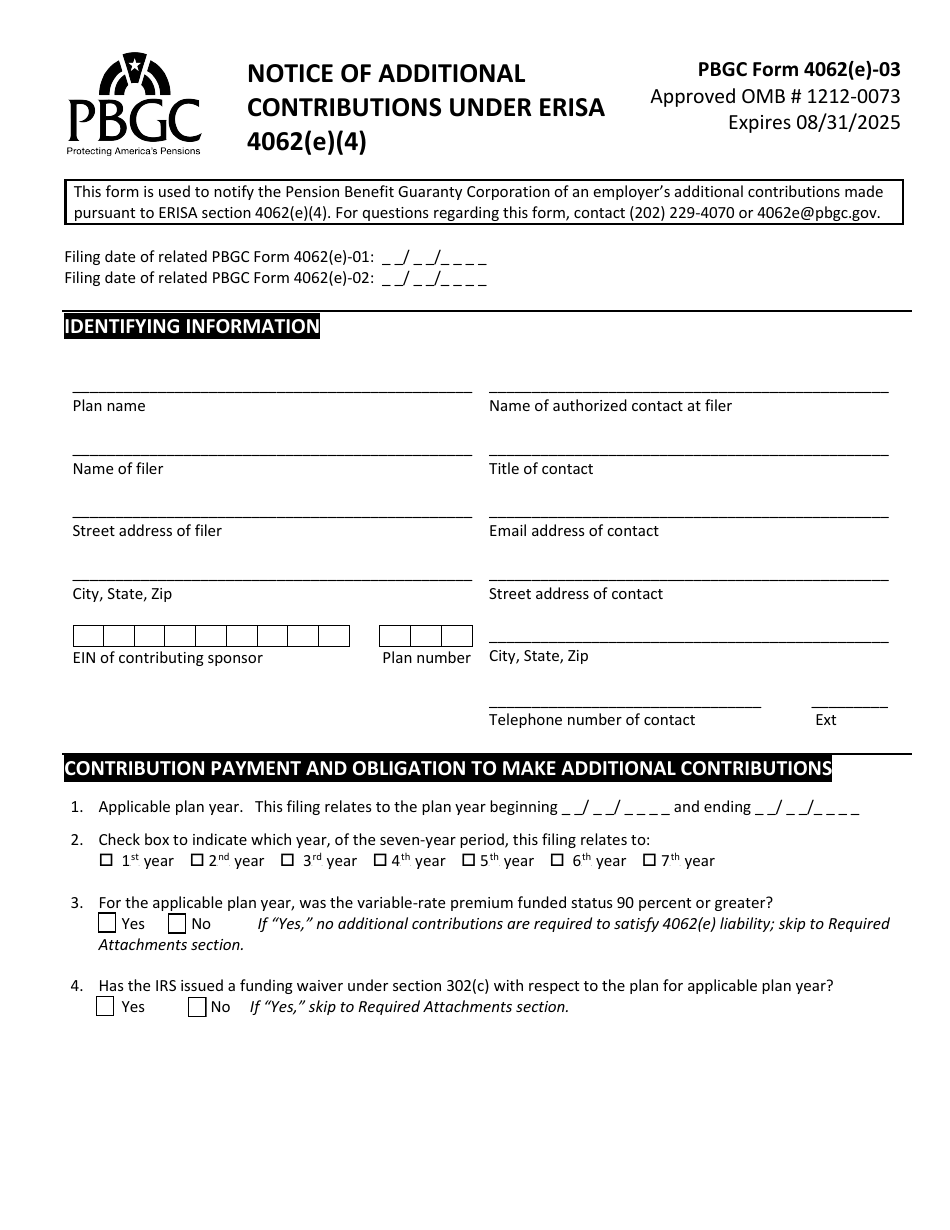

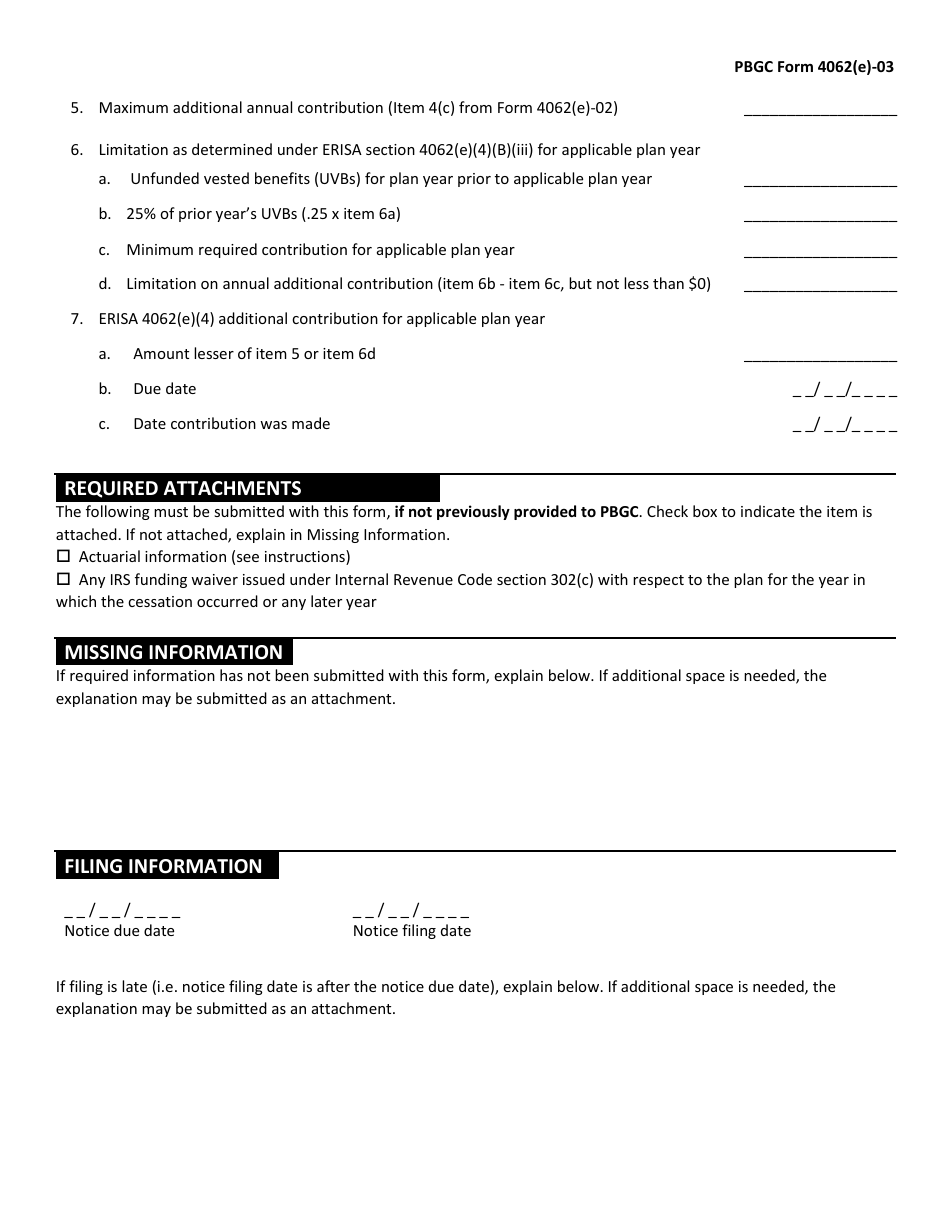

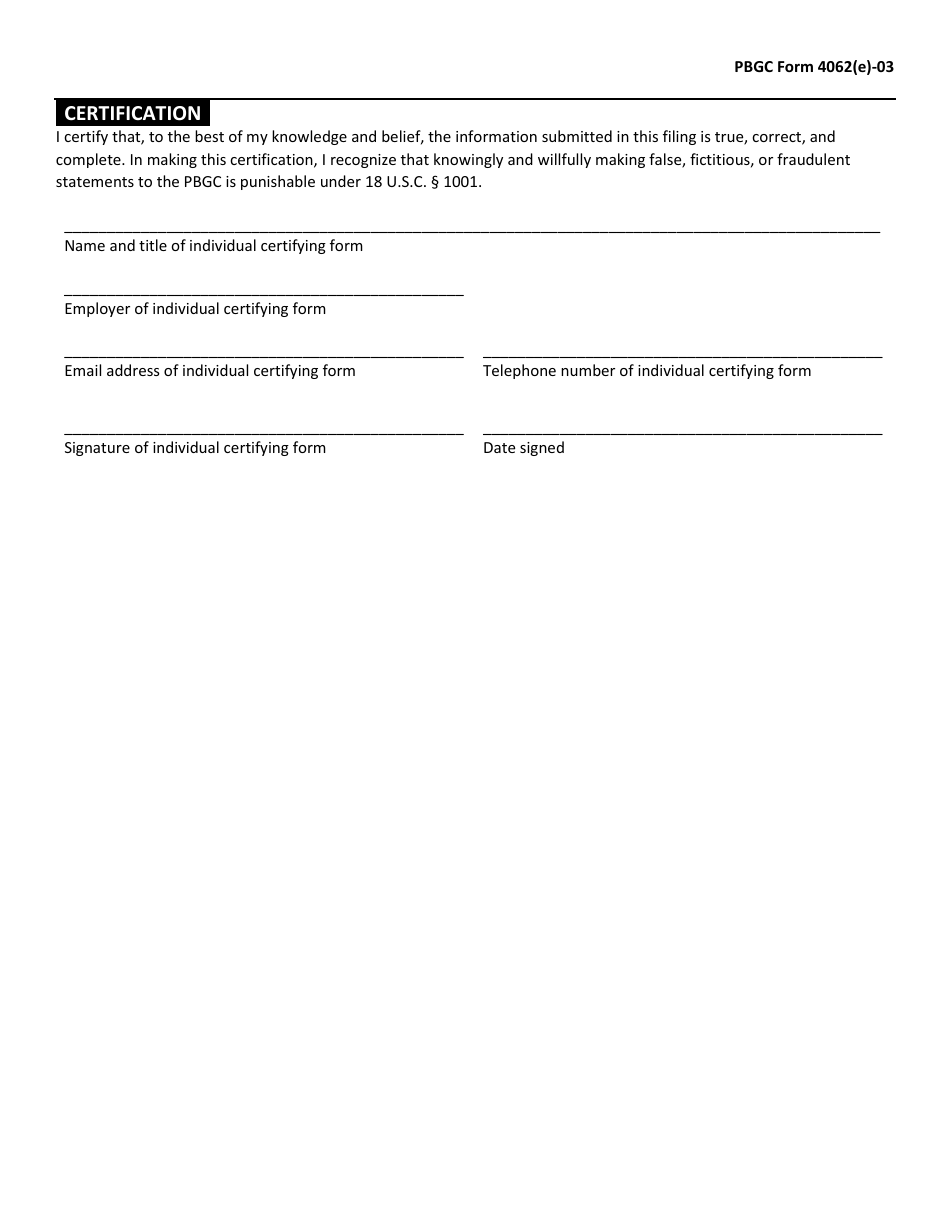

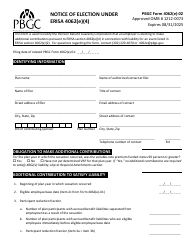

PBGC Form 4062(E)-03 Notice of Additional Contributions Under Erisa 4062(E)(4)

What Is PBGC Form 4062(E)-03?

This is a legal form that was released by the U.S. Pension Benefit Guaranty Corporation and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is PBGC Form 4062(E)-03?

A: PBGC Form 4062(E)-03 is a notice of additional contributions under ERISA 4062(e)(4).

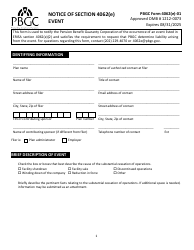

Q: What is ERISA 4062(e)(4)?

A: ERISA 4062(e)(4) is a provision in the Employee Retirement Income Security Act that requires employers to make additional contributions to their pension plans if certain events occur.

Q: Who is required to file PBGC Form 4062(E)-03?

A: Employers who are subject to ERISA 4062(e)(4) are required to file PBGC Form 4062(E)-03.

Q: What is the purpose of PBGC Form 4062(E)-03?

A: The purpose of PBGC Form 4062(E)-03 is to notify the Pension Benefit Guaranty Corporation (PBGC) of additional contributions that an employer is required to make under ERISA 4062(e)(4).

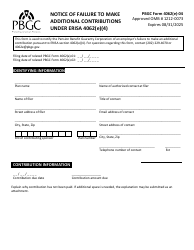

Q: What happens if an employer fails to file PBGC Form 4062(E)-03?

A: Failure to file PBGC Form 4062(E)-03 can result in penalties and other enforcement actions by the PBGC.

Q: Who should I contact if I have questions about PBGC Form 4062(E)-03?

A: If you have questions about PBGC Form 4062(E)-03, you can contact the PBGC directly for assistance.

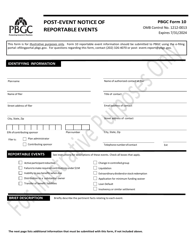

Form Details:

- The latest available edition released by the U.S. Pension Benefit Guaranty Corporation;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of PBGC Form 4062(E)-03 by clicking the link below or browse more documents and templates provided by the U.S. Pension Benefit Guaranty Corporation.