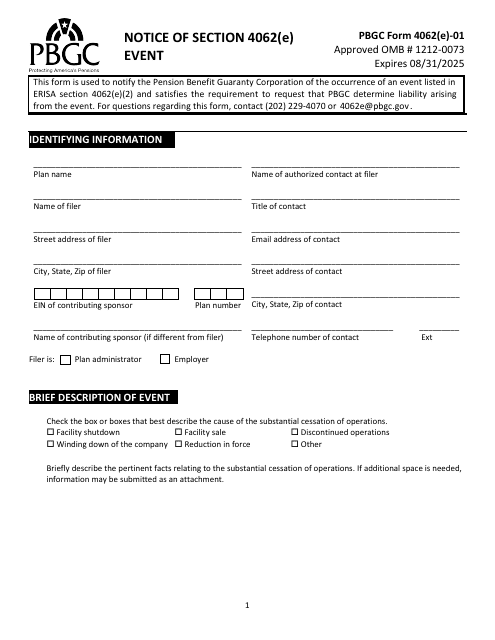

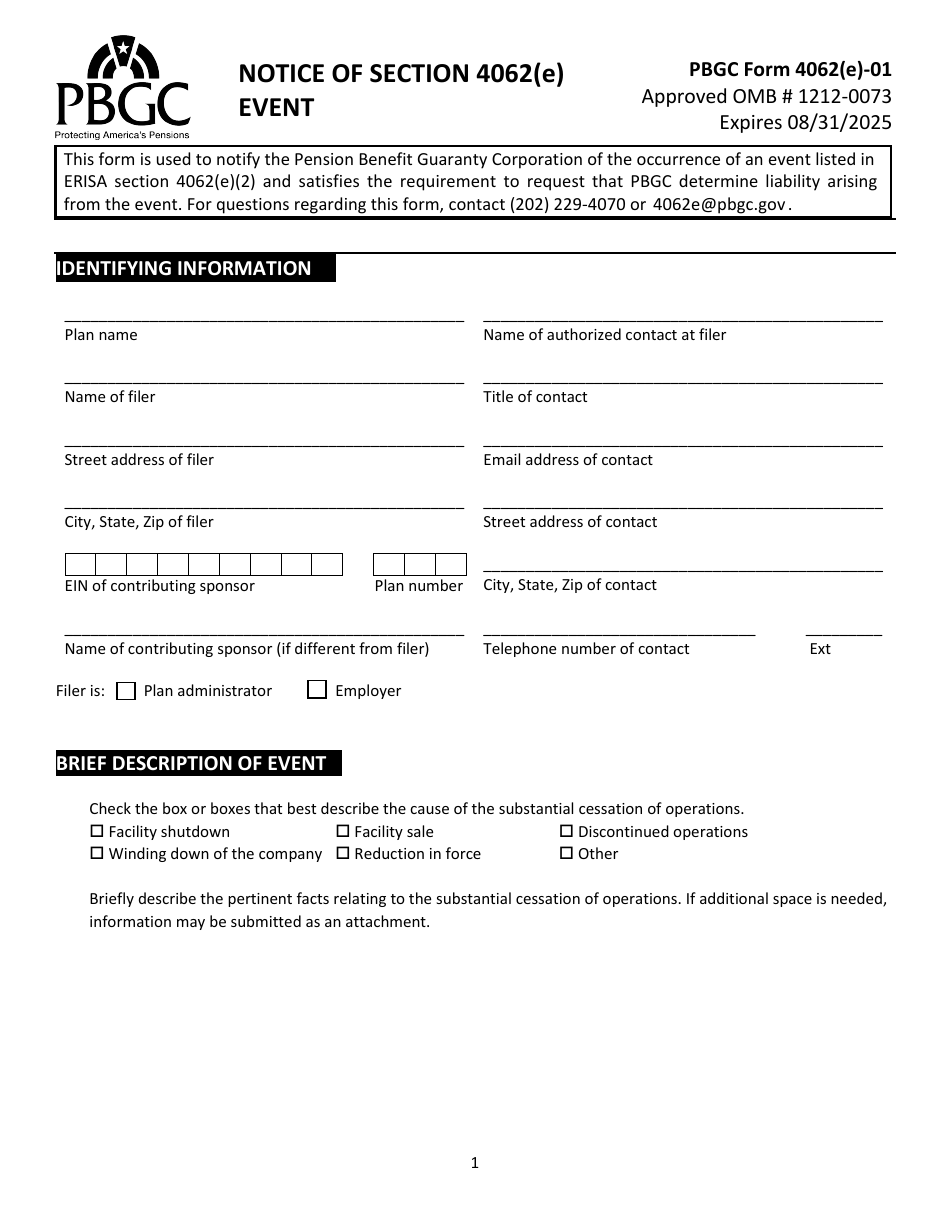

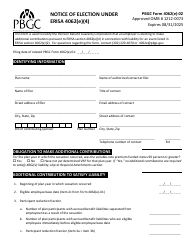

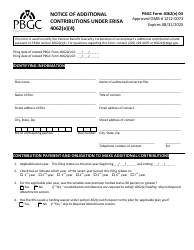

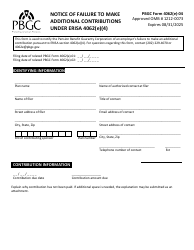

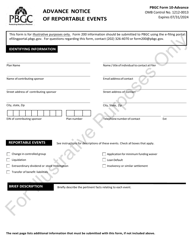

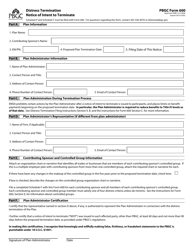

PBGC Form 4062(E)-01 Notice of Section 4062(E) Event

What Is PBGC Form 4062(E)-01?

This is a legal form that was released by the U.S. Pension Benefit Guaranty Corporation and used country-wide. Check the official instructions before completing and submitting the form.

FAQ

Q: What is PBGC Form 4062(E)-01?

A: PBGC Form 4062(E)-01 is a notice form used to report a Section 4062(e) event to the Pension Benefit Guaranty Corporation (PBGC).

Q: What is a Section 4062(e) event?

A: A Section 4062(e) event occurs when an employer ceases operations at a facility or location and, as a result, more than 20% of the total number of employees participating in a defined benefitpension plan are separated from employment.

Q: Why is PBGC Form 4062(E)-01 important?

A: PBGC Form 4062(E)-01 is important because it provides the PBGC with information about the Section 4062(e) event, which helps the PBGC assess the financial impact on the pension plan and take appropriate action.

Q: Who needs to file PBGC Form 4062(E)-01?

A: Employers who experience a Section 4062(e) event need to file PBGC Form 4062(E)-01 with the PBGC.

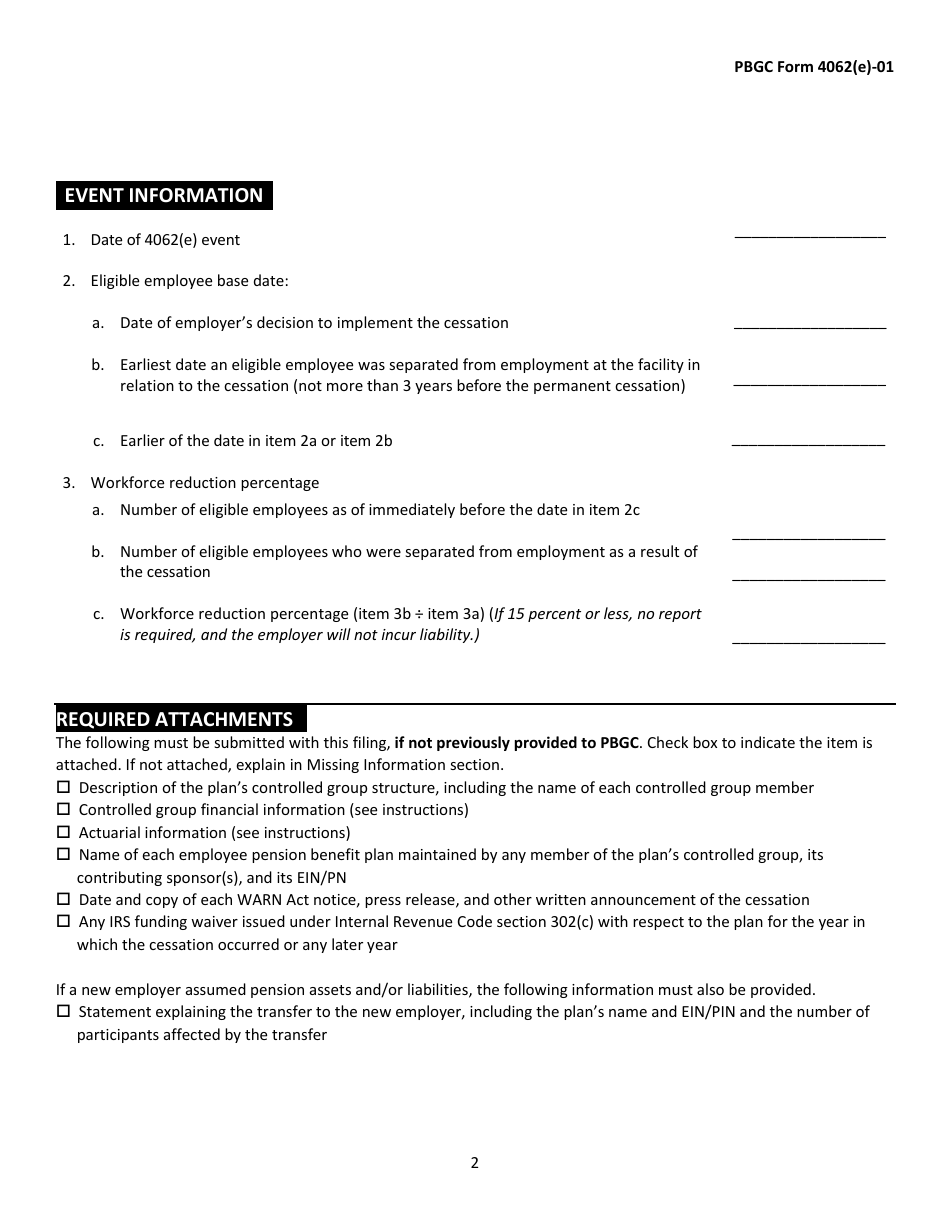

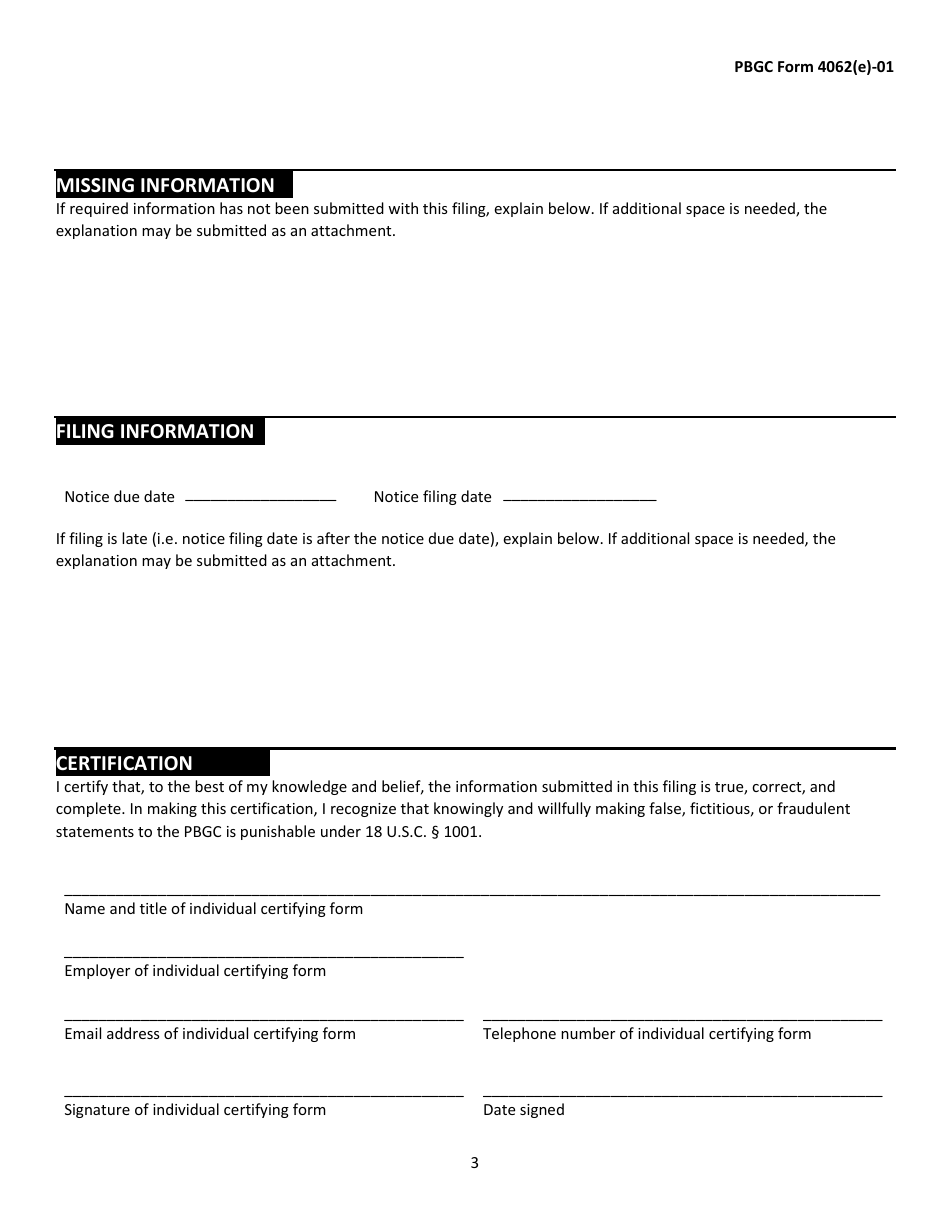

Q: What information is required in PBGC Form 4062(E)-01?

A: PBGC Form 4062(E)-01 requires information such as employer identification, plan information, details of the Section 4062(e) event, and relevant financial information.

Q: When should PBGC Form 4062(E)-01 be submitted?

A: PBGC Form 4062(E)-01 should be submitted to the PBGC within 60 days after the employer realizes that a Section 4062(e) event has occurred.

Q: Is there a penalty for not filing PBGC Form 4062(E)-01?

A: Yes, there may be penalties for not filing PBGC Form 4062(E)-01, including monetary fines and legal consequences.

Form Details:

- The latest available edition released by the U.S. Pension Benefit Guaranty Corporation;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of PBGC Form 4062(E)-01 by clicking the link below or browse more documents and templates provided by the U.S. Pension Benefit Guaranty Corporation.