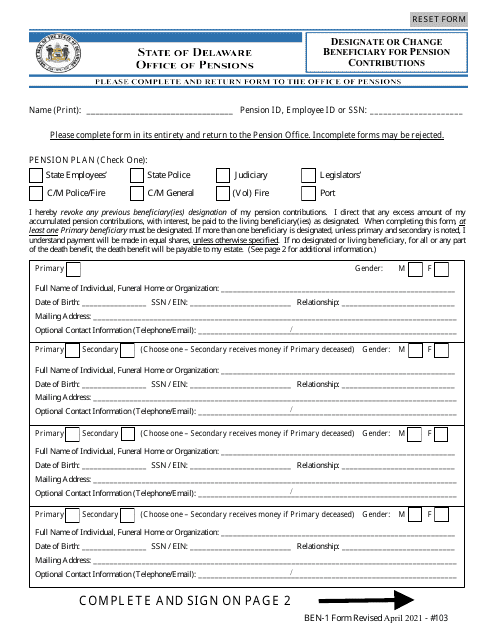

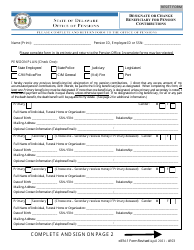

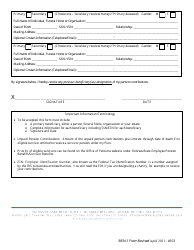

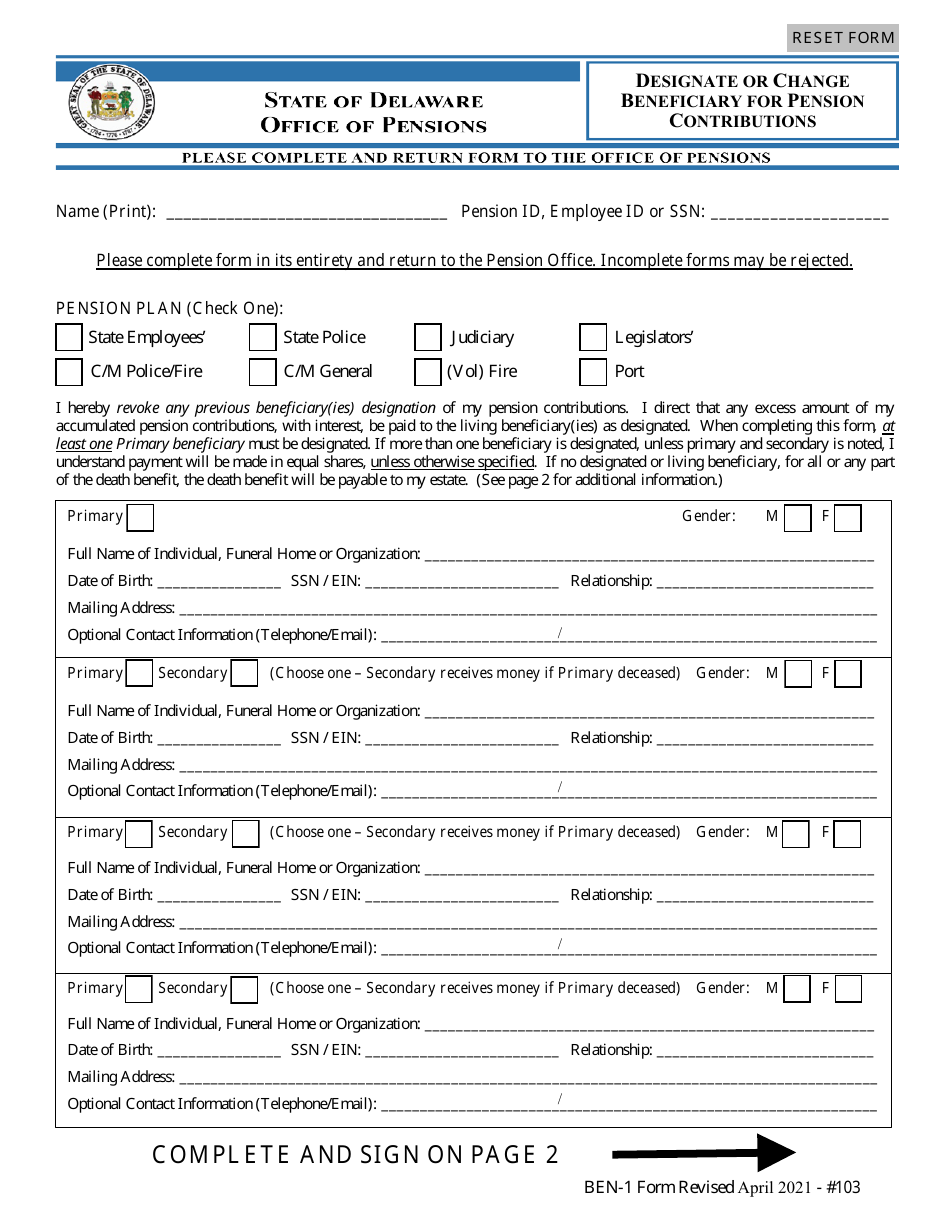

Form BEN-1 Designate or Change Beneficiary for Pension Contributions - Delaware

What Is Form BEN-1?

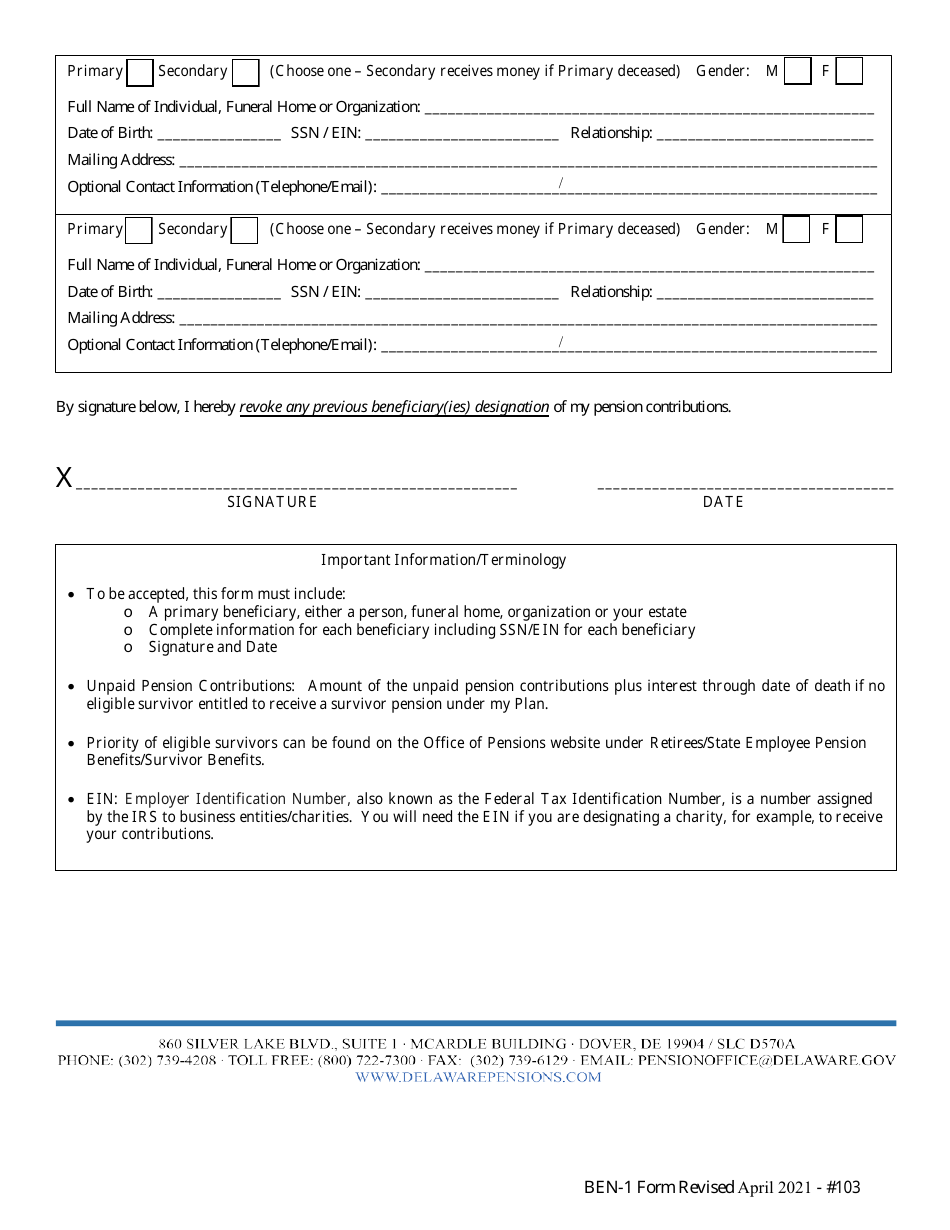

This is a legal form that was released by the Delaware Office of Pensions - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BEN-1?

A: Form BEN-1 is a form used to designate or change the beneficiary for pension contributions in Delaware.

Q: Who can use Form BEN-1?

A: Form BEN-1 can be used by individuals who have pension contributions in Delaware and want to designate or change their beneficiary.

Q: What is the purpose of Form BEN-1?

A: The purpose of Form BEN-1 is to specify who will receive the pension contributions in the event of the individual's death.

Q: Can I designate more than one beneficiary on Form BEN-1?

A: Yes, you can designate multiple beneficiaries and specify the percentage or share allocated to each beneficiary.

Q: Do I need to notify the beneficiary of my designation?

A: It is recommended to inform your designated beneficiaries about their designation, but it is not required.

Q: Can I change my beneficiary after submitting Form BEN-1?

A: Yes, you can change your beneficiary at any time by submitting a new Form BEN-1.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Delaware Office of Pensions;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BEN-1 by clicking the link below or browse more documents and templates provided by the Delaware Office of Pensions.