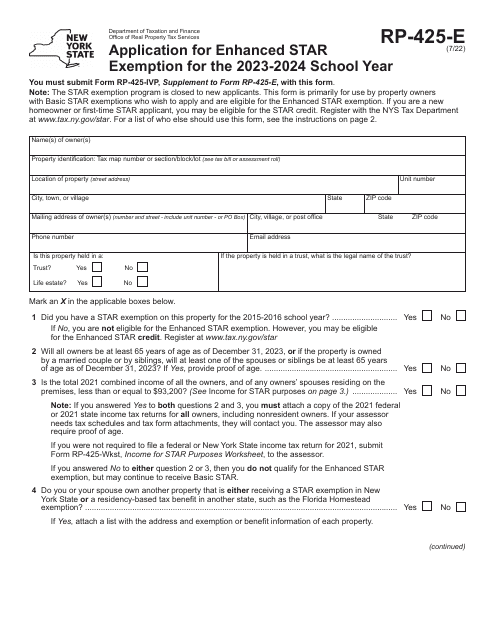

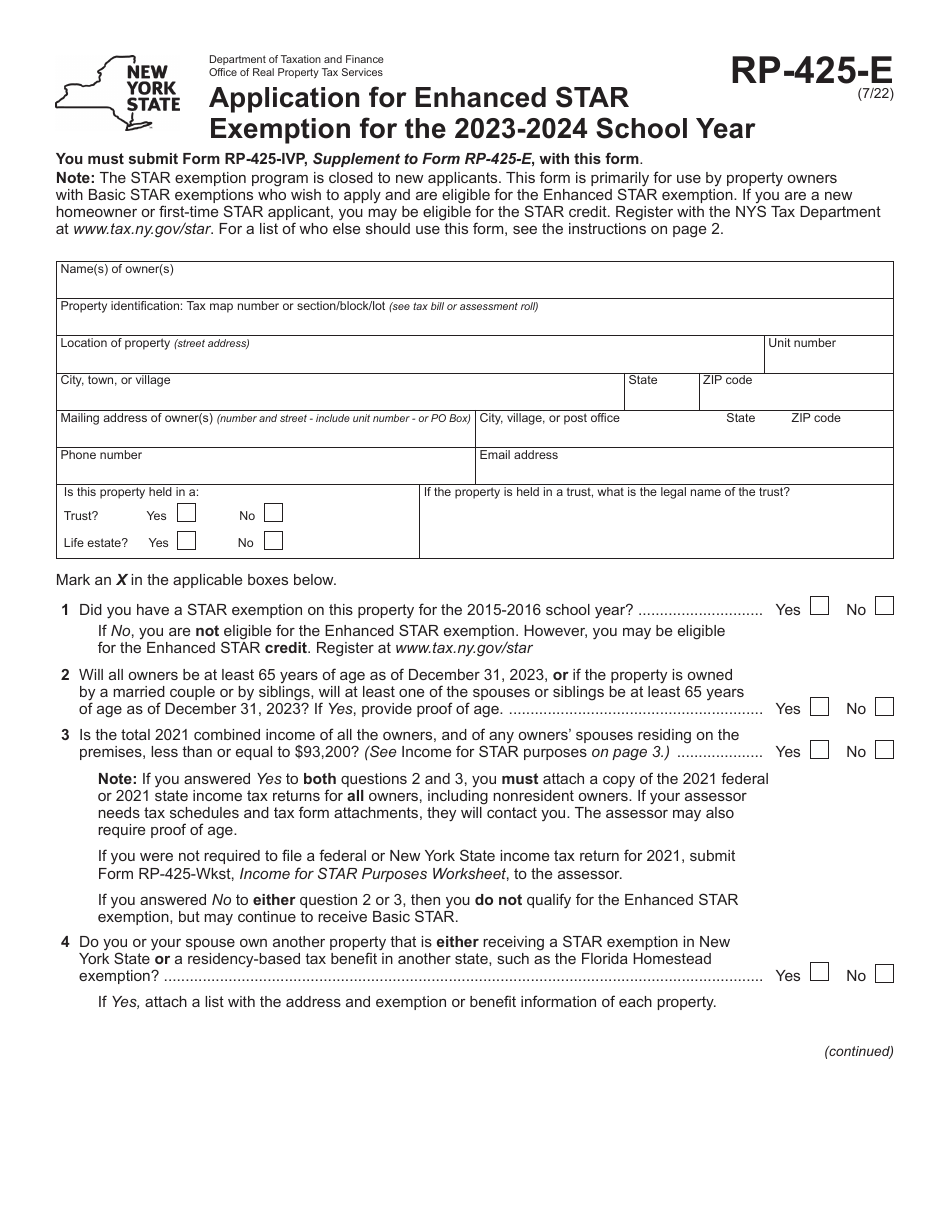

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RP-425-E

for the current year.

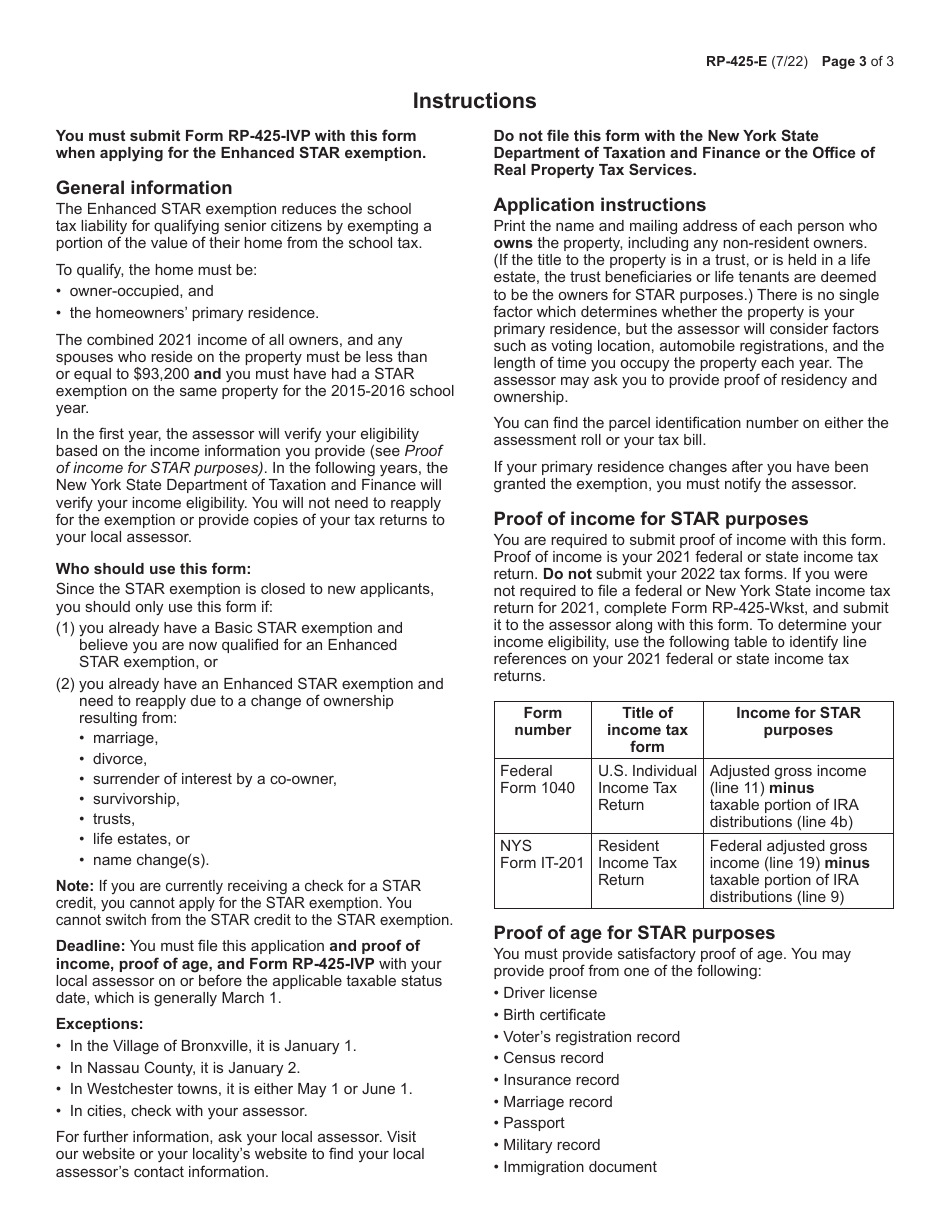

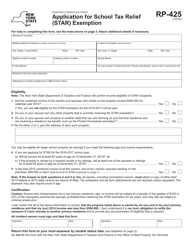

Form RP-425-E Application for Enhanced Star Exemption - New York

What Is Form RP-425-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-425-E?

A: Form RP-425-E is the application form for the Enhanced Star Exemption in New York.

Q: What is the Enhanced Star Exemption?

A: The Enhanced Star Exemption is a property tax exemption in New York that provides additional savings for senior citizens.

Q: Who is eligible for the Enhanced Star Exemption?

A: To be eligible for the Enhanced Star Exemption, you must be at least 65 years old and have a maximum annual income as defined by the state.

Q: What information is required on Form RP-425-E?

A: Form RP-425-E requires information such as your name, address, Social Security number, and income details.

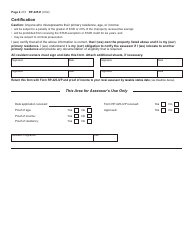

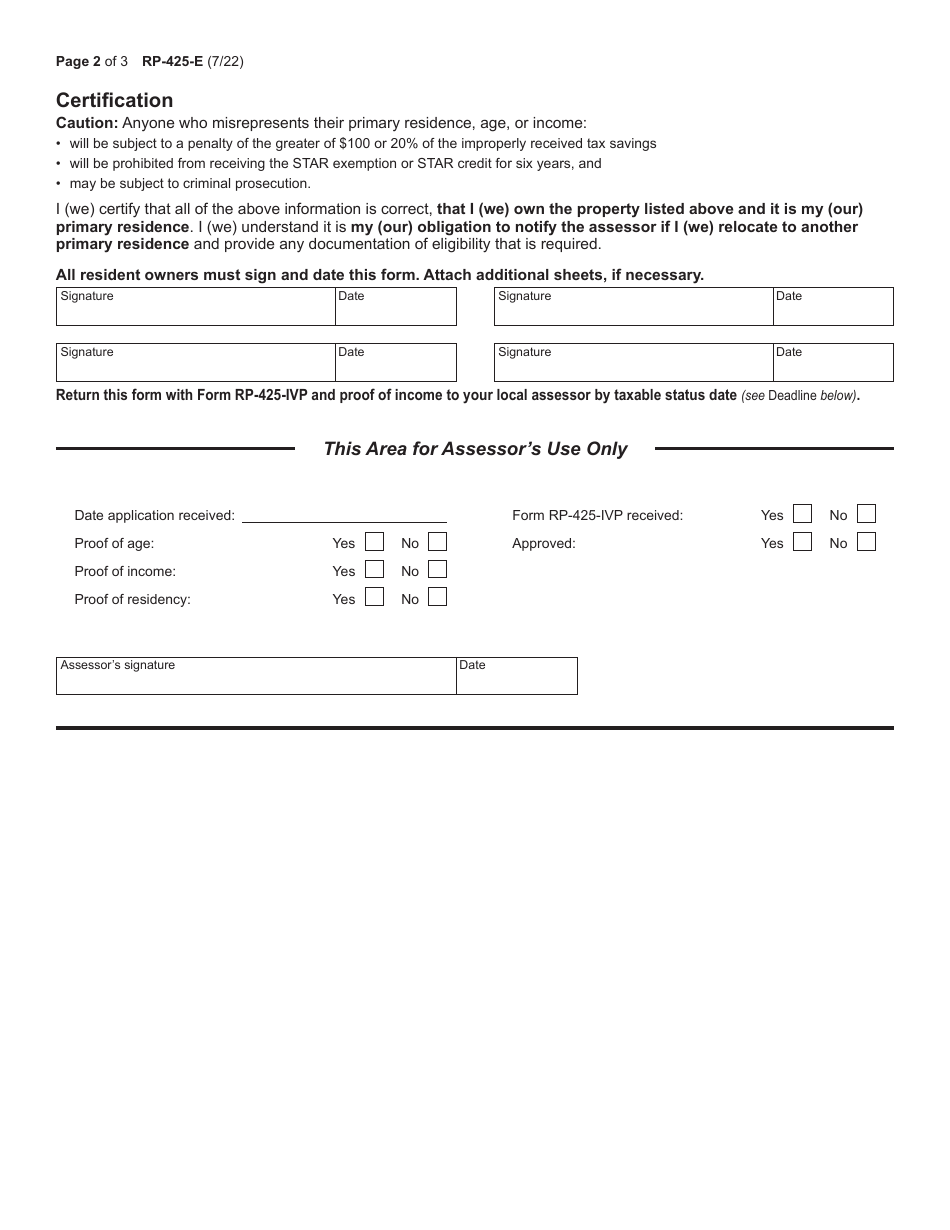

Q: How do I submit Form RP-425-E?

A: You can submit Form RP-425-E either by mail or in person to your local assessor's office.

Q: When is the deadline for submitting Form RP-425-E?

A: The deadline for submitting Form RP-425-E is usually March 1st of each year, but it may vary depending on your local assessor's office.

Q: What happens after I submit Form RP-425-E?

A: After you submit Form RP-425-E, your application will be reviewed, and if approved, you will receive the Enhanced Star Exemption on your property tax bill.

Q: Can I get assistance in completing Form RP-425-E?

A: Yes, you can seek assistance from your local assessor's office or a tax professional to help you complete Form RP-425-E.

Q: Is the Enhanced Star Exemption available in all counties in New York?

A: Yes, the Enhanced Star Exemption is available in all counties in New York.

Q: Can I apply for the Enhanced Star Exemption if I already receive another property tax exemption?

A: Yes, you can still apply for the Enhanced Star Exemption even if you already receive another property tax exemption.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-425-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.