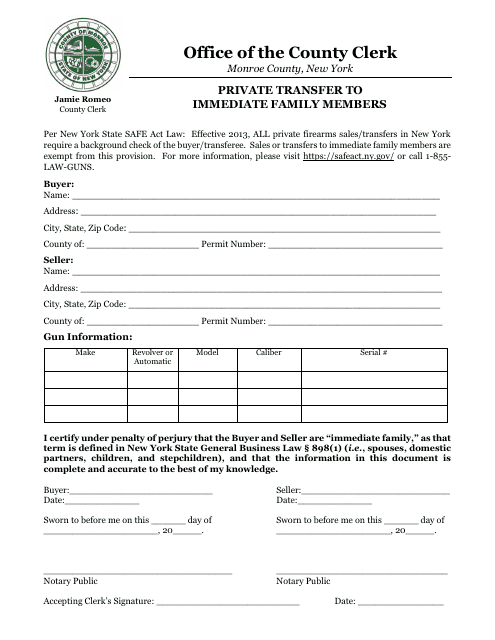

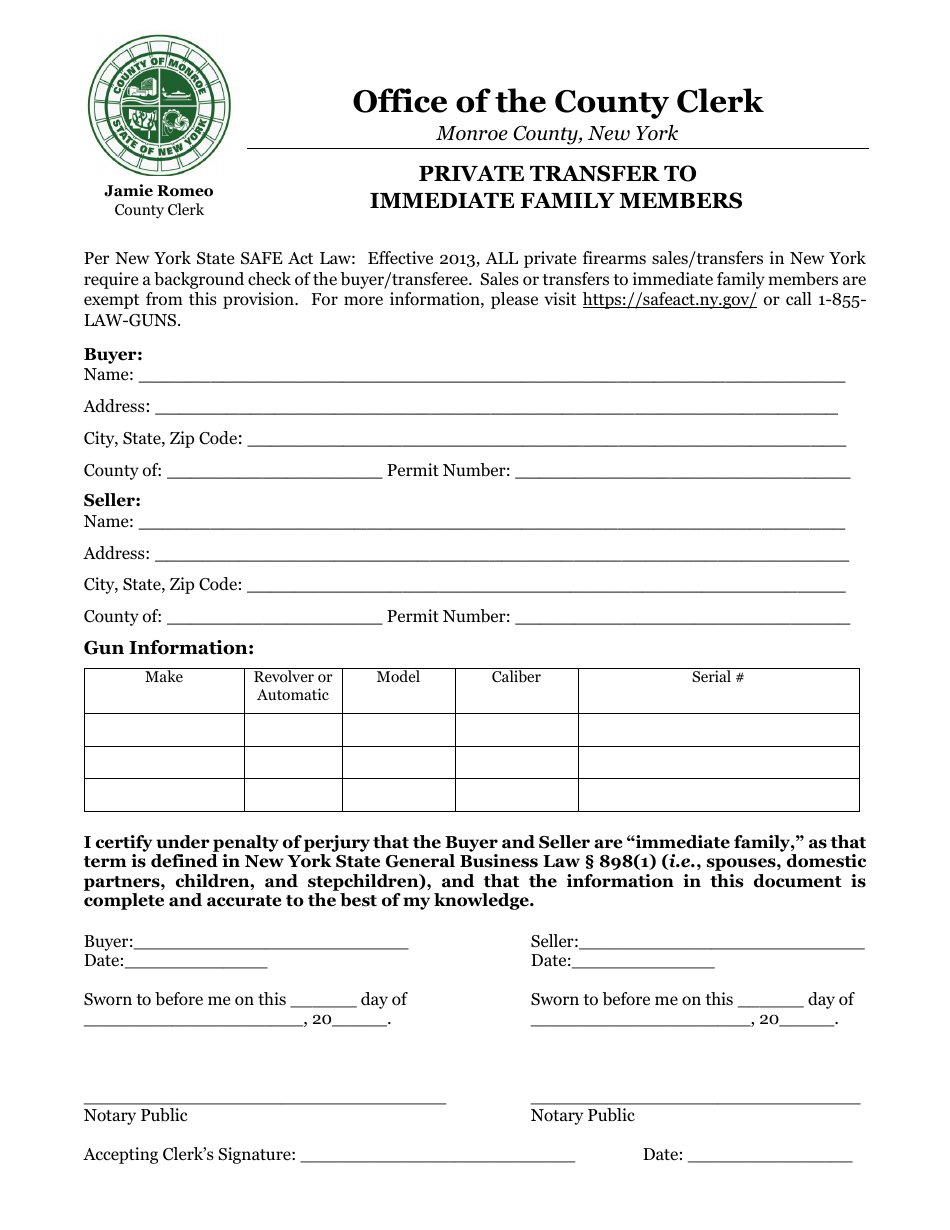

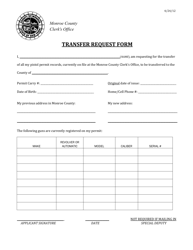

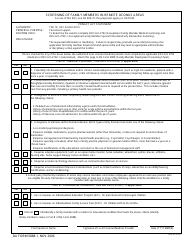

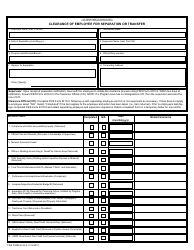

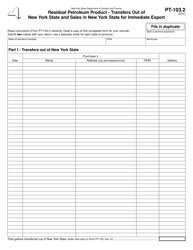

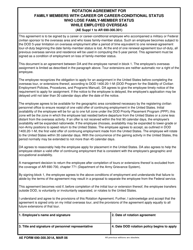

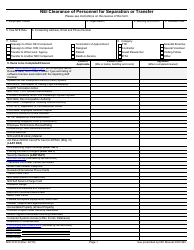

Private Transfer to Immediate Family Members - Monroe County, New York

Private Transfer to Immediate Family Members is a legal document that was released by the Clerk's Office - Monroe County, New York - a government authority operating within New York. The form may be used strictly within Monroe County.

FAQ

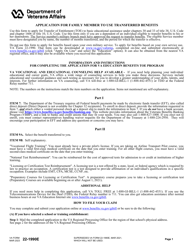

Q: What is a private transfer to immediate family members?

A: A private transfer to immediate family members refers to the transfer of property or assets from one family member to another without involving a third party or a sale transaction.

Q: Who is considered an immediate family member?

A: Immediate family members generally include spouses, children, parents, and siblings.

Q: What is Monroe County in New York?

A: Monroe County is a county located in the state of New York, specifically in the western part of the state.

Q: Are there any specific requirements or regulations for private transfers to immediate family members in Monroe County, New York?

A: Specific requirements or regulations for private transfers to immediate family members in Monroe County, New York may vary. It is advisable to consult with legal professionals or local authorities to understand any relevant laws or guidelines.

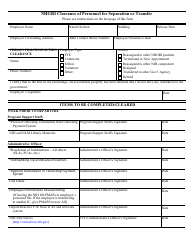

Q: Do private transfers to immediate family members involve any taxes or fees?

A: Private transfers to immediate family members may be subject to certain taxes or fees, such as inheritance taxes or gift taxes. It is recommended to consult with tax professionals or local authorities for accurate information on the applicable taxes or fees.

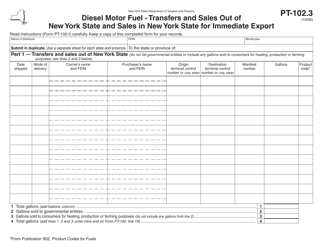

Form Details:

- The latest edition currently provided by the Clerk's Office - Monroe County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Clerk's Office - Monroe County, New York.