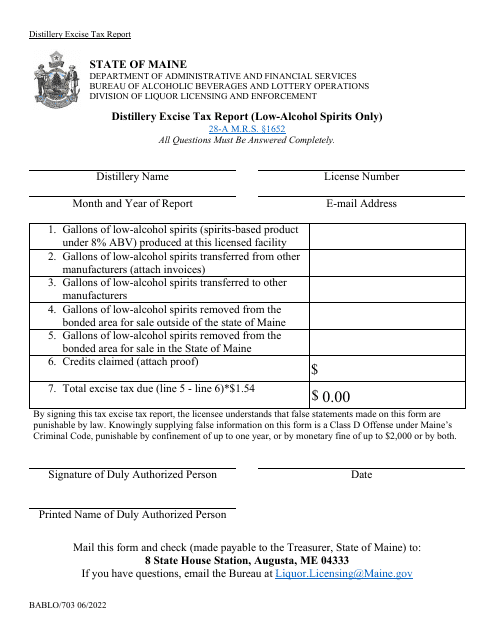

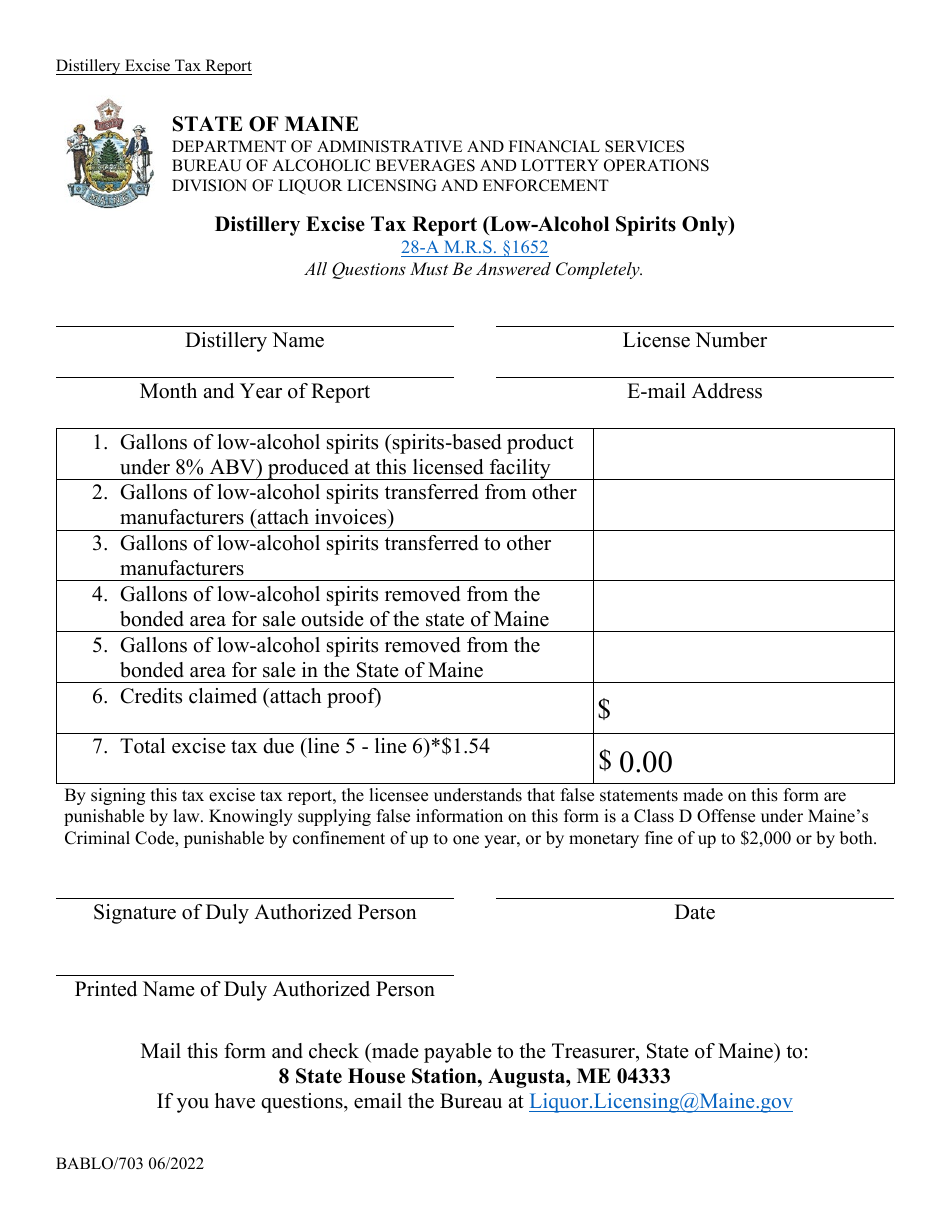

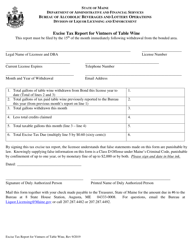

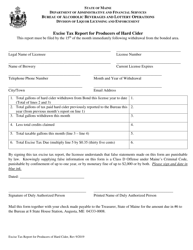

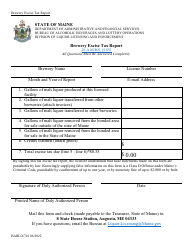

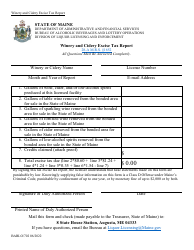

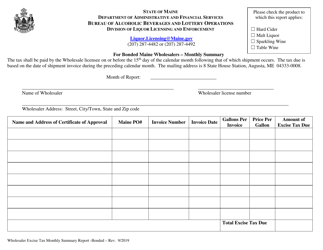

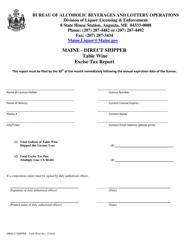

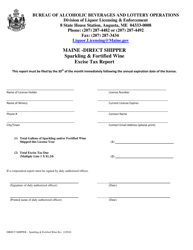

Form BABLO / 703 Distillery Excise Tax Report (Low-Alcohol Spirits Only) - Maine

What Is Form BABLO/703?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the BABLO/703 Distillery Excise Tax Report?

A: The BABLO/703 Distillery Excise Tax Report is a tax report specifically for low-alcohol spirits in the state of Maine.

Q: Who needs to file the BABLO/703 Distillery Excise Tax Report?

A: Distilleries producing low-alcohol spirits in Maine need to file the BABLO/703 Distillery Excise Tax Report.

Q: What is considered low-alcohol spirits?

A: Low-alcohol spirits are spirits with an alcohol content of less than 2.5% ABV (alcohol by volume).

Q: How often do distilleries need to file the BABLO/703 Distillery Excise Tax Report?

A: Distilleries in Maine need to file the report monthly.

Q: What information is required in the BABLO/703 Distillery Excise Tax Report?

A: The report requires information on the quantity of low-alcohol spirits produced and sold, as well as the applicable excise tax rates.

Form Details:

- Released on June 1, 2022;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BABLO/703 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.