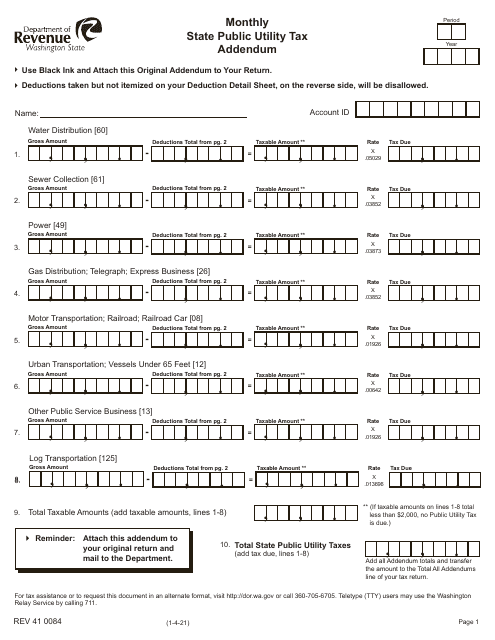

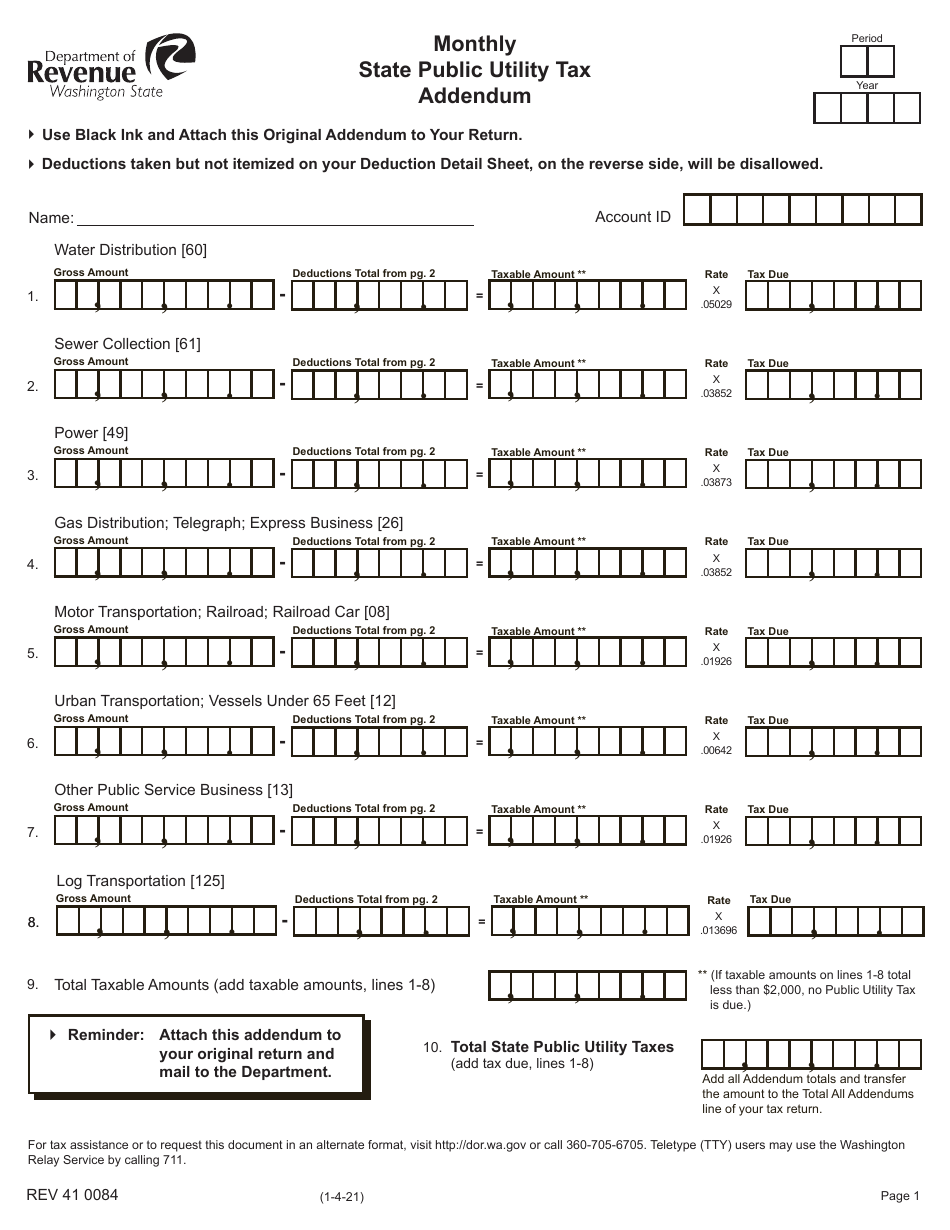

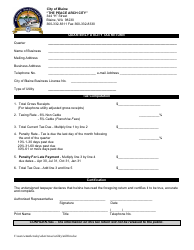

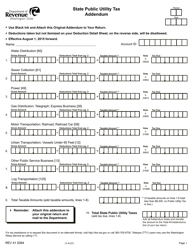

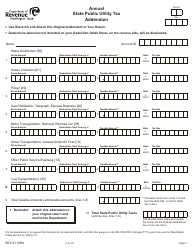

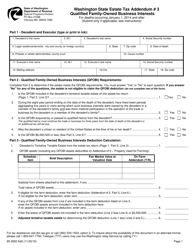

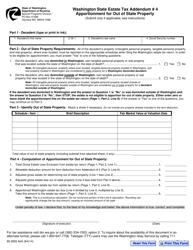

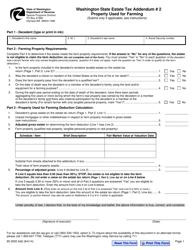

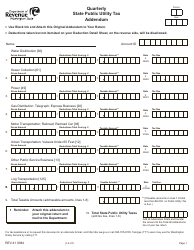

Form REV41 0084 Monthly State Public Utility Tax Addendum - Washington

What Is Form REV41 0084?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV41 0084?

A: Form REV41 0084 is the Monthly State Public Utility Tax Addendum for Washington.

Q: What is the purpose of Form REV41 0084?

A: The purpose of Form REV41 0084 is to report and pay the monthly state public utility tax in Washington.

Q: Who needs to file Form REV41 0084?

A: Public utility companies operating in Washington need to file Form REV41 0084.

Q: Is Form REV41 0084 specific to Washington?

A: Yes, Form REV41 0084 is specific to Washington state public utility tax.

Q: When is Form REV41 0084 due?

A: Form REV41 0084 is due on a monthly basis, typically by the 25th day of the following month.

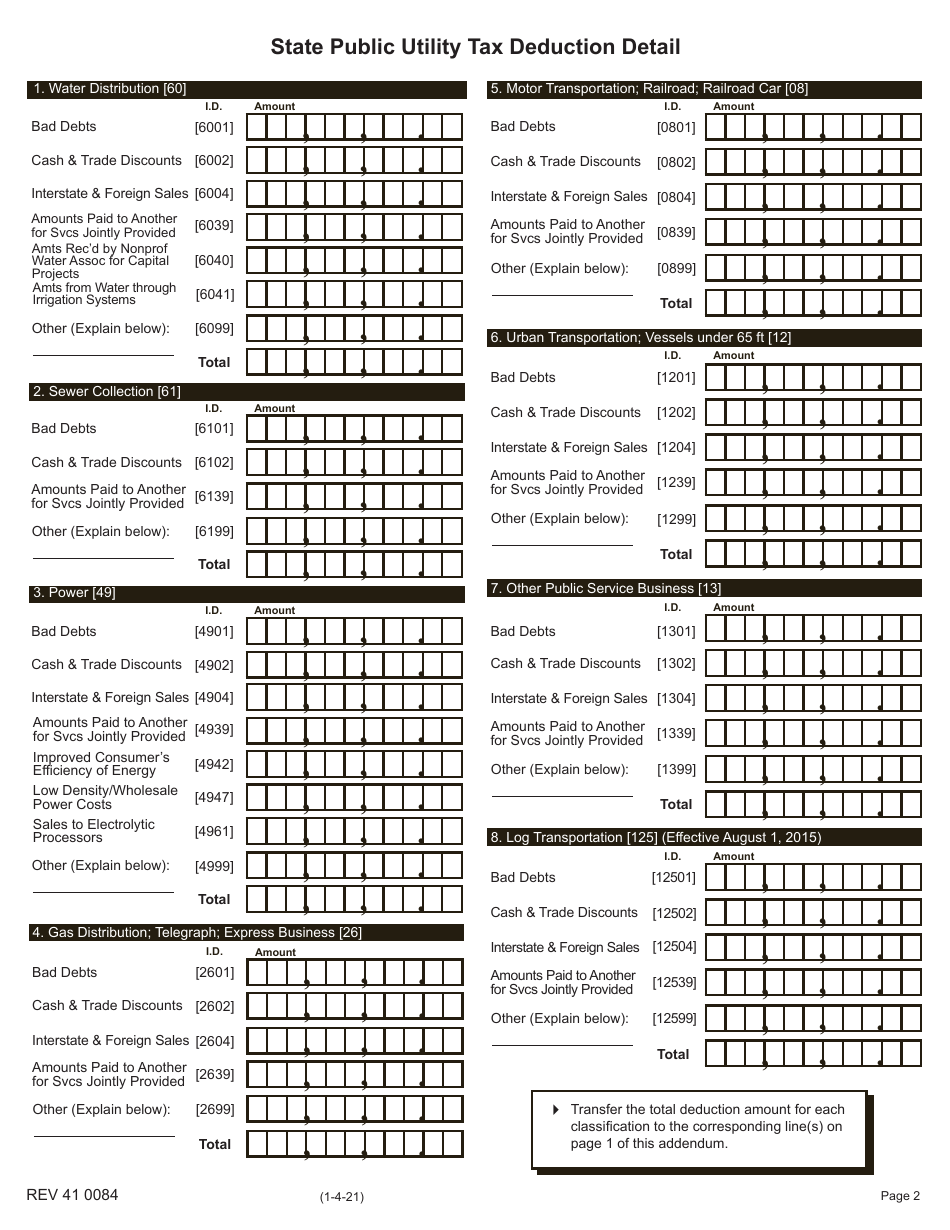

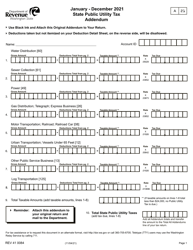

Q: What information is required on Form REV41 0084?

A: Form REV41 0084 requires information such as gross operating revenue, deductions, exemptions, and the calculation of the tax owed.

Q: Are there any penalties for not filing Form REV41 0084?

A: Yes, there may be penalties for not filing Form REV41 0084 or for late or incomplete filings. It is important to file the form accurately and on time.

Q: Is Form REV41 0084 confidential?

A: The information provided on Form REV41 0084 is subject to public disclosure under Washington state law.

Form Details:

- Released on January 4, 2021;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV41 0084 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.